Bill’s Commentary:

“I have posted a couple of the AI “Asian Guy” videos in the past but cautioned there were some numbers and dates that were off and said I believed his logic is correct. AG released a video which I am mentioned in several times. I believe this video is an AI sweep of much of what I have personally said or written publicly. Some of the dates and numbers are a little off, but I agree with everything in this particular video because I have publicly said these exact words. I believe this video is 100% spot on and thank whoever created it!”

Asian Guy does a Bill Holter video

See video here…

Bill’s Commentary:

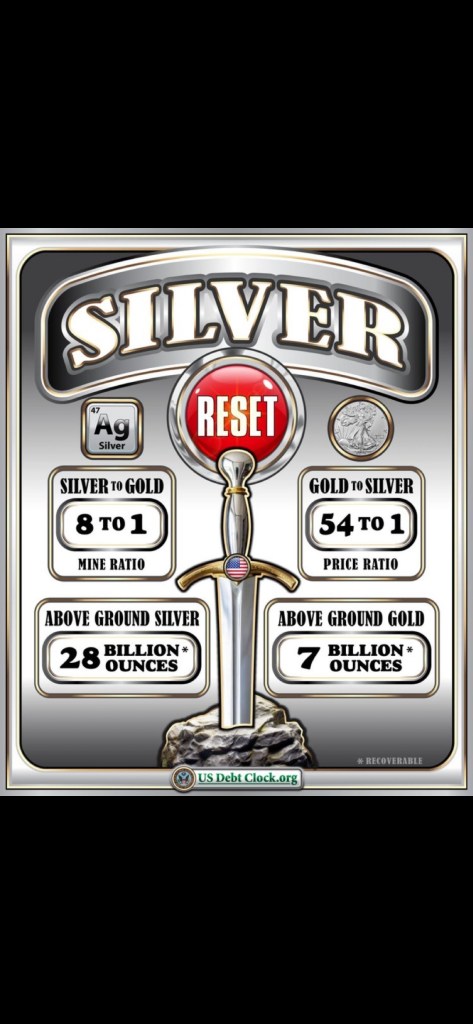

“More on silver”

Silver Will Remind Us: We Are Deeply Dependent On The Earth

We live in a world that has engineered distance between us and the physical limits our ancestors once lived inside of. The constraints that shaped generations before us—weather, harvest, transport, salt, fuel, season, strength, distance, labor, time—have been replaced by one dominant modern restraint: money.

Money has become our proxy for limits, the translation layer between desire and reality. But somewhere along the way, we started believing the translation was the terrain. Constraints didn’t disappear—we outsourced them to systems so efficient we stopped noticing their fragility at all.

My husband grew up in a town with no road connecting it to the outside world. When his family wanted to slaughter a pig, they didn’t reach for salt in a pantry. They first rode horses to the salt flats, mined the salt by hand, carried it home, and then began curing the meat. Their survival depended on terrain, season, muscle, and community. Nothing was guaranteed. Everything required presence.

Read more here…

Bill’s Commentary:

“Dedollarizing…”

Gold overtakes US bonds as largest foreign reserve asset

Gold has surpassed US Treasuries as the world’s largest reserve asset globally for the first time in 30 years amid rising prices and aggressive buying by central banks.

According to new data from the World Gold Council, the value of gold held by foreign central banks is now approaching the $4 trillion mark, more than their approximate $3.9 trillion holding in US Treasuries. The last time that foreign institutions held more gold than US bonds was 1996.

Read more here…

Bill’s Commentary:

“Why, I thought gold was a barbarous relic?”

Bill,

This is getting interesting. The crypto world's eyes have opened to accepting Gold as the only real money.

Wolfgang

Stablecoin Titan Tether Wants Gold to Be Used for Everyday Payments—Here's How

Tether moved to establish a new unit of account for gold, arguing that transactions denominated in "Scudo" could simplify digital payments.

Tether’s XAUT may be worth $2.3 billion, but the stablecoin issuer says it owns much more gold than that. The firm said it held 116 tonnes of gold as of the end of Q3 2025, with that tally valued at nearly $17 billion as of Tuesday.

Read more here...

Bill’s Commentary:

“Some things never change…”

Janet Yellen warns the $38 trillion national debt is testing a red line economists have feared for decades

Two thousand years before the U.S. federal government’s debt crossed the $38 trillion threshold, the Roman Empire faced a similar-looking calculus: a state with increasingly expensive obligations and a very limited appetite for taxes. To pay for this discrepancy, emperors pursued a policy known as “debasement”: gradually shaving off the silver from the coins until the value of the metal became more about its symbol than the metal itself.

In practical terms, it was a way to pay bills without fully admitting the cost. The long-run risk wasn’t just hyperinflation, it was that once people stopped trusting the coin, everything else in the economy became harder to coordinate.

Read more here…

Bill’s Commentary:

“Full speed ahead for the Great Taking!”

Mass Tokenization of Assets In 2026: Is This a Set Up For The Great Taking?

In the latest episode of the show, we examine the DTCC’s recent announcement that it has received approval from the SEC to tokenize vast amounts of assets in 2026. Whilst this initiative is being framed as a modernization effort, it actually represents a significant consolidation of control when it comes to stocks and bonds, and a further erosion of our property rights.

SEC White Paper: https://www.sec.gov/files/tm/no-action/dtc-nal-121125.pdf

Whilst we were told digital ledgers and blockchain technology were a move toward decentralized finance, the reality is the exact opposite. That was merely the bait and hook, with Bitcoin being used to keep the masses from asking any difficult questions.

Read more here…