-

Bill’s Commentary:

“The gates are closing!”

Has the Great Taking Begun?

If you (like me) keep mixing up Blackstone and BlackRock, you can relax now. They’re both in serious financial trouble, so you can assert that either is “imploding” and be more-or-less right:

BlackRock fund limits withdrawals as redemptions rattle private credit

(Reuters) – BlackRock (BLK.N) said on Friday it has limited withdrawals from a flagship debt fund after a surge in redemption requests, as investor worries mount around the $2 trillion private credit industry.

Shares of the world’s largest asset manager fell 6.7% on the New York Stock Exchange, amid a broader market selloff after worse-than-expected U.S. jobs data and escalating U.S.-Israeli war against Iran.

The latest from USA Watchdog –

-

Bill’s Commentary:

“A history of monetary collapse.”

-

Bill is interviewed by Andrew Maguire (Also posted under Interviews)

Silver Strain Rocks Global Markets Ft. Bill Holter

In this week’s Live from the Vault, Andrew Maguire and Bill Holter explain why silver has become the critical pressure point in the global derivatives system, as surging physical delivery demands collide with rapidly tightening exchange inventories.

With futures contracts representing far more silver than exchanges can deliver and physical markets in Asia trading at persistent premiums, the experts highlight how mounting stress in Western futures markets could spark a historic breakdown.

Bill’s Commentary:

“The BRICS want to make sure that physical trumps paper as they want real and fair “settlement.” They will prevail. Something no one has even whispered yet is that Iran is absolutely critical to a functioning “Silk Road”. Does anyone really believe when push comes to shove, that China/BRICS will not attack the Achilles tendon of Western finance directly? Frank Giustra is correct. Your standard of living is about to drop… I ask, got gold? Got silver?”

‘Paper gold is over’ as BRICS nations build dollar-free payments

Beaver Creek, Colorado – Canadian dealmaker Frank Giustra says the age of paper gold is ending as BRICS nations stand up a parallel financial system that routes around the US dollar and prizes deliverable metal.

“We’re now, believe it or not, in the era of hard money,” Giustra said Tuesday in a conversation with Alex Deluce of the Ontario-based bulletin Gold Telegraph at the Precious Metals Summit. “If you own paper gold, you do not own gold. When the crunch comes, it will not be there.”

China and partners among the BRICS (Brazil, Russia, India, China and South Africa) nations are building a system to mirror Western finance. It spans payments, settlement, depositories, ratings and swap lines – all outside the dollar. It downplays paper gold, products like gold exchange-traded funds, sovereign gold bonds and gold futures that represent a stake in gold’s value without physically possessing the metal.

Bill’s Commentary:

“…it is ALL about credit!”

Big Lenders’ Risky Loans Are Rattling Wall Street

Blue Owl Capital, a giant Wall Street lender, used to do just about anything for attention. It hosted investment advisers at five-star resorts, advertised on digital billboards, slapped its logo on professional tennis players and hosted a pickleball tournament in Central Park.

But for the past few weeks, Blue Owl has been the talk of Wall Street for an altogether different reason. It has been trying to convince investors that its $300 billion portfolio of investments and loans is actually worth what Blue Owl says.

Despite a blitz of conference calls, media interviews and news releases, Blue Owl appears not to have resolved the miasma surrounding the firm. Rather, its efforts to calm many investor jitters may have contributed to worries that Wall Street is on the precipice of a broad, new credit crisis. On Tuesday, Blue Owl stock was down as much as 9 percent, nearing its lowest point as a public company. The share prices of other large lenders also fell.

Bill’s Commentary:

“Our pal Grizzly checks in with a response to Erik”

Mornin.

Now we’re talkin!

My opinion on your opinion does not matter as I believe you are free to write what you want and would never want that freedom denied. As I’ve stated, I often grow weary of the constant complaining but that’s your right as well.

I think about this topic nearly daily and I believe you’ve hit on the crux of the issue as I see it. The federal government, really all levels of government in this two party charade have grown to be fat, bloated ticks off our blood , our time, our treasure and our talents.

The pendulum swings. I put up with so many years of the pendulum stuck in the left as if defying gravity. Now it’s swung somewhat back towards the right but never gets even to the middle and definitely not far enough to the right for me who wants the most limited of limited (read barely existent) federal government. I’m not stuck in the middle. I’m stuck in the far right (bad connotation nowadays) merely wanting to be left alone – which is, I believe, an “ancient” attitude of this nations explorers, pioneers and early settlers. But we always lose. We’re never allowed to be left in peace – someone always shows up to build a school, a church and then a government building from which soon are flowing a myriad of new regulations – under the guise of “progress” and the freedom to live as we want and as our Creator has allowed, is usurped little by little. The desire/responsibility to help family and neighbors is exchanged for wanting help from the government in some form – and thus the trap slams shut. So the few of us left with this gnawing, innate curse of freedom to the core, takes our pleasure from faith in God; living one with Him in His amazing creation; and trying to be as self-reliant as possible so as to truly be free to live the way we want and with whom we want and not slaves to the system in any form. Perhaps that’s why the late Jim Sinclair and my good friend Bill Holter’s G.O.T.S. teaching has resonated with me from the beginning with me as I’ve tried to live like this as much as possible with kids and businesses for most of my life. Getting out of the system entirely is difficult to do but the journey to get there is worth the effort. I don’t relate to clowns or jokers either. But we will see who is left standing, or at least breathing, when the dust settles on this once great idea of America.

Thanks for the articles – all of them, like them or not. Griz”

The latest from Erik –

-

The latest from USA Watchdog – (Also posted under Interviews)

-

Bill’s Commentary:

“Grok on the current month COMEX silver deliveries.”

Grok Conversation

What is the starting point in deliveries of Comex Silver Feb 27th?

The starting point for deliveries on Comex Silver as of February 27, 2026 (First Notice Day for the March 2026 contract) refers to the initial standing for delivery or the number of contracts/buyers intending to take physical delivery when notices begin.From CME reports and market analyses on that date:

- 10,526 contracts stood for delivery on First Notice Day for the March contract.

- Each Comex silver contract is 5,000 troy ounces, so this equates to 52.63 million ounces (10,526 × 5,000) of silver demand starting the delivery process.

This occurred against registered (deliverable) inventory of approximately 86.13 million ounces (some sources cited around 86-88 million oz, with minor variances in daily updates). For context:

- February 2026 (a minor delivery month) saw strong activity, with total deliveries around 5,036 contracts (~25.18 million oz), and some reports noting up to ~50 million oz outflow from vaults in the broader period.

- March is historically a major delivery month (often 3–5x higher than February), heightening focus on this starting figure amid low registered stocks and high open interest/paper claims (previously discussed ratios far exceeding physical availability, though no default occurred).

- Silver price on Feb 27 settled/closed around $90–$92/oz (e.g., ~$90.10–$92.68 in futures settlements), with spot near $89–$91, amid volatility and a rally on the day.

The official CME daily delivery notices report for business date 02/27/2026 (run on that day) details the issues and stops, confirming the initiation of March deliveries. No immediate default or force majeure was declared; many positions likely rolled or were managed, but the high initial standing highlighted ongoing physical tightness.Sources include direct CME delivery reports (e.g., MetalsIssuesAndStopsReport.pdf for 02/27/2026) and contemporaneous market commentary from analysts tracking inventory and notices. For the most precise historical breakdown, refer to CME’s archived delivery reports.

-

Bill’s Commentary:

“This is exactly what Jim talked about for years. When the big Kahuna comes, the “shorts” would already be LONG!”

The latest from USA Watchdog –

-

Bill’s Commentary:

“This should not be controversial. Any time I opened an overseas account, I always had to show a passport to verify citizenship.”

Is The Trump Admin Planning To Use Banks To Enforce Immigration Laws?

President Trump’s administration is ramping up its assault on illegal immigration by eyeing a bold new tactic: enlisting banks to verify the citizenship of every customer.

This potential executive order would mandate financial institutions to collect proof like passports from both new and existing account holders, effectively cutting off undocumented migrants from the banking system they’ve exploited under open-border policies.

It’s a commonsense step to safeguard American resources, but watch as Democrats and their corporate allies howl in protest – the same crowd that fights tooth and nail against voter ID requirements won’t back this either.

Bill’s Commentary:

“Michael Oliver has been spot on! With a breakdown of the dollar, his numbers may be very conservative? This is the rally you do not sell…”

-

Bill’s Commentary:

“Pastor Stanley checks in regarding Executive Orders”

Executive Order Now Lets Bankers Empty Their Private Equity Garbage Into the Retirement Accounts of Everyday Americans-The Problem With Blue Owl

Yesterday, Boaz Weinstein of Saba Capital Management, said the weight of the impact of Blue Owl Capital Inc.’s (OWL) private credit funds illiquidity may be an early indicator of vulnerability and weakness in the significant $1.8T market:

…’“All you need is the snowball to start going down the hill and it started. Blue Owl is right in the middle of that,” Weinstein said at an industry conference in Miami Beach, Florida, Bloomberg reported. “I think we are in the super-early innings of the wheels coming off the car.” (Seeking Alpha 2/24/26)

Weinsteins’ comments come after Blue Owl permanently blocked withdrawals from a $1.6 Billion private credit vehicle and sold $1.4B in loans to pension funds. Blue Owl also sold loans to its own insurance company, feeding new worries about risks concerning liquidity in this part of the ‘alternatives’ market.

Bill’s Commentary:

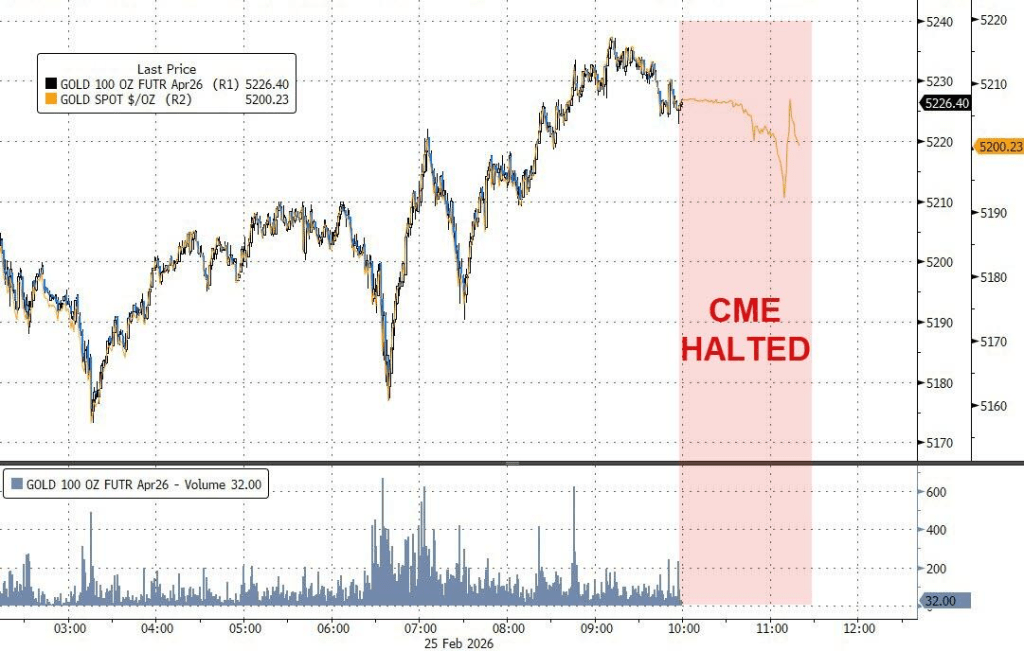

“So, when you lose control of pricing… pull the plug?”

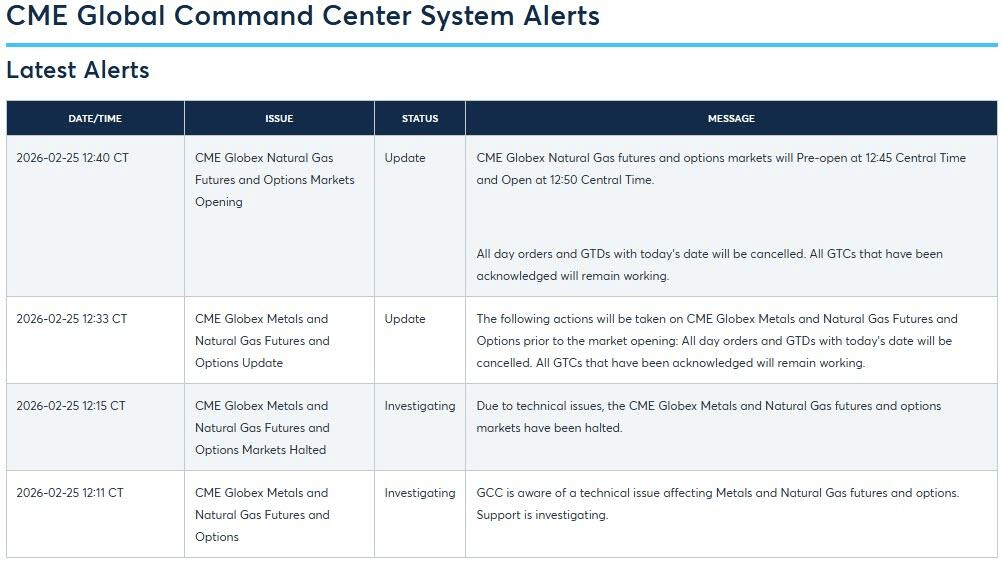

CME Halts All Metals, NatGas Markets Due To “Technical Issues”

At around 1300ET, the Chicago Mercantile Exchange (CME) halted trading of all metals and NatGas contracts (futures and options) due to ‘technical issues’.

Additionally, all day orders and GTDs with today’s date will be cancelled.

All GTCs that have been acknowledged will remain working.

Since the halt, spot prices for gold have declined…

Bill’s Commentary:

“These people don’t even know they don’t know…”

Watch: Dems DOUBLE DOWN On Refusing To Put AMERICANS FIRST After SOTU Meltdown

Democrats’ disdain for American priorities hit new lows during President Trump’s State of the Union, where many refused to stand for victims of illegal alien crime or even basic protections for citizens. Now, they’re doubling down with excuses that expose their true allegiances.

Building on their poe faced refusals to applaud pretty much any commons sense statement during the speech—as we detailed in our previous coverage—top Democrats are now openly trashing the address as ‘divisive’ while justifying their boycott.

According to reports, roughly half of House and Senate Democrats skipped the event altogether, opting for counter-rallies like this clown show:

Bill’s Commentary:

“A good piece on silver from Chris Marcus”

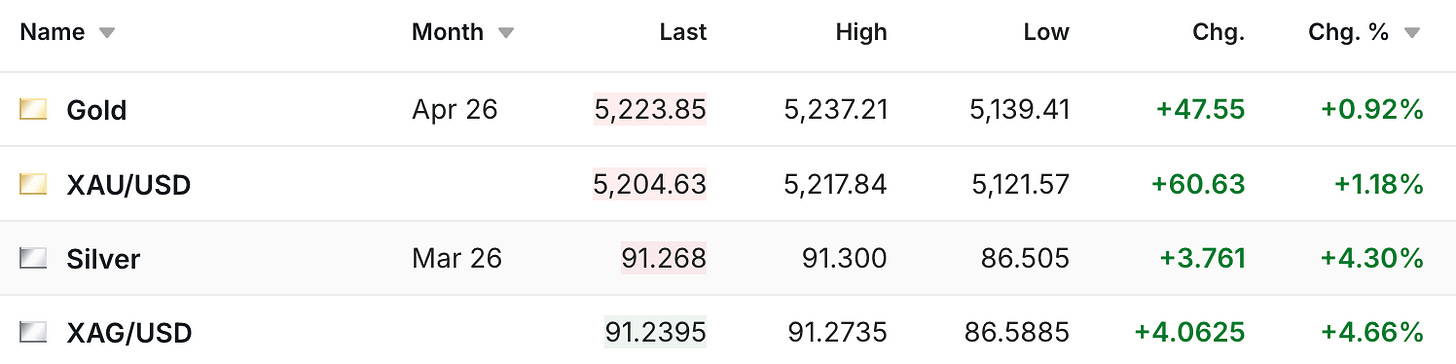

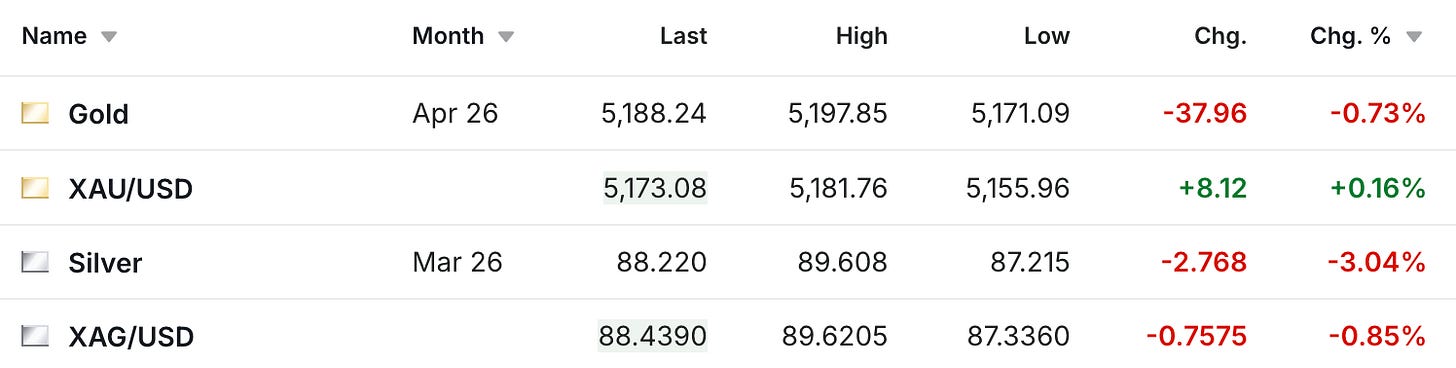

Silver Breaks Back Over $90 AS Metal Continues To Leave The Comex

The gold and silver prices continued their rally on Wednesday, with the gold futures at one point up another $47 to $5,224, while the silver futures were having a really big day, up $3.76 to $91.27.

Today’s column is coming out a little later than normal, and the prices are a little bit lower as of 7:15 p.m. Eastern, although still in very healthy rebound territory.

Bill’s Commentary:

“From Jeremiah Johnson…”

Bill,

Over the past few days, we’ve had some more than extraordinary events happen in Silver. Thousands of March Call Options expired Deep In The Money with no trading posted (they were exercised into long futures?) on expiration day. The very next day (yesterday) the COMEX OI dropped 8,367 contracts leading me to believe these Calls were covering short positions all the way down to the $65 mark.

Also, yesterday the ICE market in Nat Gas and Precious Metals ironically had another glitch in its service shutting down trading and virtually removing all newly placed orders in these very same markets.

Also, posted was a single purchase on the very last day for Fberuary Silver Deliveries (let’s just call this suspect).

Today the Open Interest in Silver is the lowest I can recall at 119,912 contracts in trade.

This is the lowest count I can recall since the very beginning of writing for Jim Sinclair. (Grok can’t find when it was lower either, data hidden??) It was and still is my belief that Silver’s prices would start moving sharply higher when the OI collapses. Will it go lower? Who knows, but at these prices, someone is making bank by arbitraging metals to Shanghai while keeping prices low here. With Silver as a critical metal for our nation’s security, someone or entity is going to have to explain why they’re doing what their doing right now. At this second Shanghai is $10.38 above Comex or a spread of $51,900 per contract.

Have a nice day

Jeremiah Johnson

None of this is trading advice

Bill and David Morgan discuss metals (Also posted under Interviews)

Bill’s Commentary:

“Man has always turned back toward God during bad times… so bad times are not always bad.”

The latest from Erik –

-

Bill’s Commentary:

“It comes to a head soon Wolfgang!”

Bill,

Sign of things to come.

Weak hands can take solace in massively dropping inventories in Shanghai. They nosedived 50% from Jan 1 to today...only 7 weeks.

Wolfgang

https://goldsilver.ai/metal-prices/shanghai-silver-price

Bill’s Commentary:

“Because America sucks?”

-

The latest from USA Watchdog –

Bill’s Commentary:

“I can still remember going to New York Yankee games for $6…”

The latest from Erik –

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.