-

Bill’s Commentary:

“WOW!

@KingKong9888

The biggest precious metals recycler in China, Rongtong Gold, is now offering Chinese consumers a buy-back price for #Silver at the USD equivalent of $128.52 per troy ounce (VAT-exempt), well above prevailing international #Silver spot price levels.

#Gold #Silver”

-

Bill’s Commentary:

“Gold is the measuring stick…”

The latest from USA Watchdog – (also posted under Interviews)

Bill’s Commentary:

“Lies, lies, and more lies!”

The latest from Erik –

-

The latest from USA Watchdog –

-

Bill’s Commentary:

“This is an unintended consequence of running around the geopolitical world like a bull in a china shop…”

Repatriate the gold’: German economists advise withdrawal from US vaults

Shift in relations and unpredictability of Donald Trump make it ‘risky to store so much gold in the US’, say experts

‘Repatriate the gold’: German economists advise withdrawal from US vaultsGermany is facing calls to withdraw its billions of euros’ worth of gold from US vaults, spurred on by the shift in transatlantic relations and the unpredictability of Donald Trump.

Germany holds the world’s second biggest national gold reserves after the US, of which approximately €164bn (£122bn) worth – 1,236 tonnes – is stored in New York.

Emanuel Mönch, a leading economist and former head of research at Germany’s federal bank, the Bundesbank, called for the gold to be brought home, saying it was too “risky” for it to be kept in the US under the current administration.

Bill’s Commentary:

“This is pretty much correct, the “plumbing” in markets all over the world is beginning to plug…”

Bill’s Commentary:

“Can I get sued for calling a Canadian a faggot?”

Davos 2026: Special address by Mark Carney, Prime Minister of Canada

- This blog contains the full transcript of a special address by Mark Carney, Prime Minister of Canada, delivered at the World Economic Forum’s Annual Meeting 2026 in Davos.

- Carney emphasized the end of the rules-based international order and outlined how Canada was adapting by building strategic autonomy while maintaining values like human rights and sovereignty.

- The Canadian PM called for middle powers, such as his own, to work together to counter the rise of hard power and the great power rivalry, in order to build a more cooperative, resilient world.

This transcript was produced using AI and subsequently edited for style and clarity. The edits do not alter the substance of the speaker’s remarks.

Thank you very much, Larry. I’m going to start in French, and then I’ll switch back to English.

[The following is translated from French]

Thank you, Larry. It is both a pleasure, and a duty, to be with you tonight in this pivotal moment that Canada and the world going through.

Today I will talk about a rupture in the world order, the end of a pleasant fiction and the beginning of a harsh reality, where geopolitics, where the large, main power, geopolitics, is submitted to no limits, no constraints.

-

Bill’s Commentary:

“Any number is plausible, any “final” number you hear or read will almost certainly be WAY TO LOW!”

Gold revalued to $73,500 is plausible according to US Treasury statements.

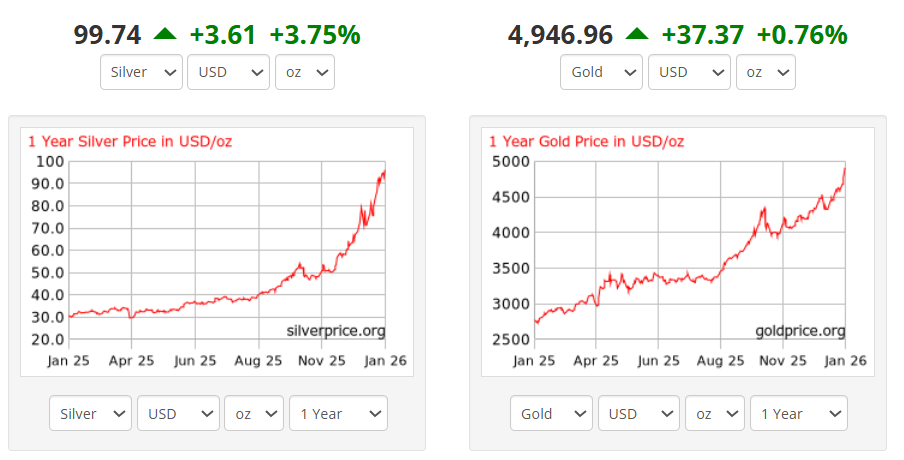

SILVER is about to BUST THROUGH 100 DOLLARS AN OUNCE.

That is not a price; it is a verdict. Years of gaslighting by Wall Street, years of paper games in London and New York, just collided with the physical reality of the most strategically necessary metal on Earth.

In the real world, silver is the wiring, skin, and nervous system of modern power.

Military and aerospace systems rely on silver in guidance electronics, satellite communications, heat sinks, night-vision optics, and laser platforms because nothing carries current or sheds heat as efficiently under extreme stress.

Bill’s Commentary:

“For those of you who believe Trump has not done a single “good thing”… here is something fantastic!”

US Officially Exits World Health Organization

“Today, the United States withdrew from the World Health Organization, freeing itself from its constraints, as President [Donald] Trump promised on his first day in office,” Secretary of State Marco Rubio and Health and Human Services Secretary Robert Kennedy, Jr., declared in a Jan. 22 joint statement.

“This action responds to the WHO’s failures during the COVID-19 pandemic and seeks to rectify the harm from those failures inflicted on the American people.”

This is the latest move by an administration that has been highly skeptical of membership in a number of global organizations that, in Trump’s view, and that of many conservatives, compromise the sovereignty of the United States and operate counter to America’s interests. In January 2025, Trump withdrew the United States from the Paris Accord, which aims to limit global warming, and on Jan. 7, he withdrew en masse from 66 U.N.-sponsored climate and social justice organizations, among them the U.N. Framework Convention on Climate Change.

Bill’s Commentary:

“Welcome to my world Erik! I wrote for years and would piss off one side or the other with anything I wrote. What I don’t get is how you live where you live? I would have lost it many years ago…!”

The latest from Erik –

-

Bill’s Commentary:

“Bye bye carry trade…”

Japan Bond Meltdown Sends Yields to Record High on Fiscal Fears

(Bloomberg) — The slump in Japanese bonds deepened Tuesday, sending yields soaring to records as investors gave a thumbs down to Prime Minister Sanae Takaichi’s election pitch to cut taxes on food.

The 40-year rate rocketed past 4% to a fresh high since its debut in 2007 and a first for any maturity of the nation’s sovereign debt in more than three decades. The jump in 30- and 40-year yields of more than 25 basis points was the most since the aftermath of President Donald Trump’s Liberation Day tariffs onslaught in April last year.

A lackluster auction of 20-year earlier underscored broader worries over government spending and inflation. Treasuries, already under pressure on concern that tariffs may dim the allure of US assets, extended declines as the selloff in Japanese debt accelerated.

-

The latest from USA Watchdog –

Bill’s Commentary:

“More from our pal Stanley on Nat Gas”

Natural Gas Futures up BIG again; now +60% in 2 days

Natural gas prices have skyrocketed again today bringing the two day increase in the February futures to UP 60% IN 2 DAYS!

Yes, there is a big storm coming this weekend with a pretty severe cold snap in temperatures. This rise in price is only eclipsed by the one day increase of 72% on January 27, 2022 which has been credited mainly to the expiration of the Feb 2022 futures contract. In addition to the cold snap in January 2026 we are also on the cusp of world war and inflation in almost all things but gas prices (which may change soon).

If natural gas prices remain elevated that would increase heating costs for much of the United States. That creates one more nail in the coffin of an affordable American lifestyle for the middle class.

Bill’s Commentary:

“I am not a Trumptard, nor do I have TDS. I believe this is a little too harsh…”

The latest from Erik –

-

Bill’s Commentary:

“I have told you for many years that the “end” would be a credit event. I have also told you to keep a sharp eye on Japanese yields coming off the “0%” bottom. JGB’s are cratering, your credit event is arriving right before your own eyes! Got gold? Got silver?”

JGBs Implode, Gold Soars: The Trade CNBC Ridiculed Is Crushing Everything

As I first noted back in 2023, my disdain, distrust and general disgust for financial media reached a peak in 2016 when CNBC’s Fast Money invited Bill Fleckenstein on the air to offer up his take on the economy and why the Fed-fueled market was “un-shortable”.

Bill is a well-known advocate for the Austrian school of economics and has been highly critical of the Fed and central banking policies for decades.

In this interview, he made two key points: 1) he thought Japan would probably be the first bond market to blow up and 2) he was buying gold and miners and thought the broader market was “un-shortable”.

Bill’s Commentary:

“Doing publicly what other nations are doing quietly…”

Danish pension fund to sell $100 million in Treasurys, citing ‘poor’ U.S. government finances

Danish pension operator AkademikerPension said it is exiting U.S. Treasurys because of finance concerns as Denmark spars with President Donald Trump over his threats to take over Greenland.

Anders Schelde, AkademikerPension’s investing chief, said the decision was driven by what it sees as “poor [U.S.] government finances” amid America’s debt crisis. But it also comes as tensions escalate between the U.S. and Denmark after Trump’s latest threats to tariff European countries if Greenland, an arctic territory of Denmark, isn’t sold to the U.S.

“It is not directly related to the ongoing rift between the [U.S.] and Europe, but of course that didn’t make it more difficult to take the decision,” Schelde said in a statement to CNBC.

Bill’s Commentary:

“Here it is, the unwinding of the yen carry trade… this is bad beyond words!”

Sudden Japan Bond Crash Unleashes Turmoil Across Trading Floors

The selling in Japan’s $7.6 trillion bond market began slowly, then seemed to hit all at once.

What started as an unremarkable day on Tokyo trading desks quickly morphed into what several market participants described as the most chaotic session in recent memory. While concerns about Japan‘s fiscal position had been simmering for weeks, they suddenly boiled over on Tuesday afternoon with little warning — sending yields on some bonds to all-time highs.

The rout left some hedge funds rushing to unwind losing trades, pushed life insurers to dump bonds and caused at least one corporate bond investor to pull out of a multi-million dollar trade. Even as traders struggled to pinpoint an immediate catalyst for the selloff, the overriding worry was clear: Prime Minister Sanae Takaichi’s plans to cut taxes and boost spending are raising doubts about the financial health of one of the world’s most indebted governments.

Bill’s Commentary:

“Idiots, and they don’t even know they are idiots. These things have consequences; the state will empty out!”

Bill’s Commentary:

“Look at the date on this article. Spot on in the rear view mirror. Oh, and a 40 year bull market will not unwind in an orderly fashion because cheap credit brought forth abundant credit that now needs to be paid back or rolled… but cannot. The biggest bubble in human history is bursting now!”

A 40-year bull run in the bond market is under pressure as Treasury yields touch the ‘most important trend line of all time’

The 40-year trend of declining interest rates could be on its last legs as the 10-year US Treasury yield tests resistance against “the most important trend line of all time,” according to technical analyst Carter Worth of Worth Charting.

Bond prices rise as interest rates fall, but amid a period of record inflation and an expanding economy, the Federal Reserve is raising interest rates to help cool down demand and tame inflation.

Now the widely-followed 10-year US Treasury yield is pushing against its 40-year downtrend line that starts with the 1981 peak in interest rates of 15.81%.

Bill’s Commentary:

“Good question!”

Bill’s Commentary:

“This is going to be some good stuff. If there still is a financial system and a real economy, get ya some popcorn!”

@BGatesIsaPyscho

6h

🚨🌎 James O’Keefe @JamesOKeefeIII

just infiltrated The WEF in Davos & proved that Blackrock are also behind the Global Weather Manipulation we all see each & every day‼️

RFK Jnr was also right – it is DARPA!

Multiple Conspiracies Confirmed ✅

-

Bill’s Commentary:

“Pastor Stanley checks in with natural gas.”

Bill:

I put together a small article on this for your consideration: US Natural Gas Prices Extend Gains to +19% on the Day https://www.encouragingangels.org/new-blog/2026/1/19/us-natural-gas-prices-extend-gains-to-19-on-the-day

Thank you,

Stan Szymanski

encouragingangels@icloud.com

Bill’s Commentary:

“It is a disease of the mind…!”

-

Bill’s Commentary:

“Whitney Webb never ever says anything she hasn’t vetted 100%. She has an earful for you here!”

The latest from USA Watchdog –

Bill’s Commentary:

“And you wonder whether or not you should at least have some mining shares?”

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.