Bill’s Commentary:

“I have told you for many years that the “end” would be a credit event. I have also told you to keep a sharp eye on Japanese yields coming off the “0%” bottom. JGB’s are cratering, your credit event is arriving right before your own eyes! Got gold? Got silver?”

JGBs Implode, Gold Soars: The Trade CNBC Ridiculed Is Crushing Everything

As I first noted back in 2023, my disdain, distrust and general disgust for financial media reached a peak in 2016 when CNBC’s Fast Money invited Bill Fleckenstein on the air to offer up his take on the economy and why the Fed-fueled market was “un-shortable”.

Bill is a well-known advocate for the Austrian school of economics and has been highly critical of the Fed and central banking policies for decades.

In this interview, he made two key points: 1) he thought Japan would probably be the first bond market to blow up and 2) he was buying gold and miners and thought the broader market was “un-shortable”.

Bill’s Commentary:

“Doing publicly what other nations are doing quietly…”

Danish pension fund to sell $100 million in Treasurys, citing ‘poor’ U.S. government finances

Danish pension operator AkademikerPension said it is exiting U.S. Treasurys because of finance concerns as Denmark spars with President Donald Trump over his threats to take over Greenland.

Anders Schelde, AkademikerPension’s investing chief, said the decision was driven by what it sees as “poor [U.S.] government finances” amid America’s debt crisis. But it also comes as tensions escalate between the U.S. and Denmark after Trump’s latest threats to tariff European countries if Greenland, an arctic territory of Denmark, isn’t sold to the U.S.

“It is not directly related to the ongoing rift between the [U.S.] and Europe, but of course that didn’t make it more difficult to take the decision,” Schelde said in a statement to CNBC.

Bill’s Commentary:

“Here it is, the unwinding of the yen carry trade… this is bad beyond words!”

Sudden Japan Bond Crash Unleashes Turmoil Across Trading Floors

The selling in Japan’s $7.6 trillion bond market began slowly, then seemed to hit all at once.

What started as an unremarkable day on Tokyo trading desks quickly morphed into what several market participants described as the most chaotic session in recent memory. While concerns about Japan‘s fiscal position had been simmering for weeks, they suddenly boiled over on Tuesday afternoon with little warning — sending yields on some bonds to all-time highs.

The rout left some hedge funds rushing to unwind losing trades, pushed life insurers to dump bonds and caused at least one corporate bond investor to pull out of a multi-million dollar trade. Even as traders struggled to pinpoint an immediate catalyst for the selloff, the overriding worry was clear: Prime Minister Sanae Takaichi’s plans to cut taxes and boost spending are raising doubts about the financial health of one of the world’s most indebted governments.

Bill’s Commentary:

“Idiots, and they don’t even know they are idiots. These things have consequences; the state will empty out!”

Bill’s Commentary:

“Look at the date on this article. Spot on in the rear view mirror. Oh, and a 40 year bull market will not unwind in an orderly fashion because cheap credit brought forth abundant credit that now needs to be paid back or rolled… but cannot. The biggest bubble in human history is bursting now!”

A 40-year bull run in the bond market is under pressure as Treasury yields touch the ‘most important trend line of all time’

The 40-year trend of declining interest rates could be on its last legs as the 10-year US Treasury yield tests resistance against “the most important trend line of all time,” according to technical analyst Carter Worth of Worth Charting.

Bond prices rise as interest rates fall, but amid a period of record inflation and an expanding economy, the Federal Reserve is raising interest rates to help cool down demand and tame inflation.

Now the widely-followed 10-year US Treasury yield is pushing against its 40-year downtrend line that starts with the 1981 peak in interest rates of 15.81%.

Bill’s Commentary:

“Good question!”

Bill’s Commentary:

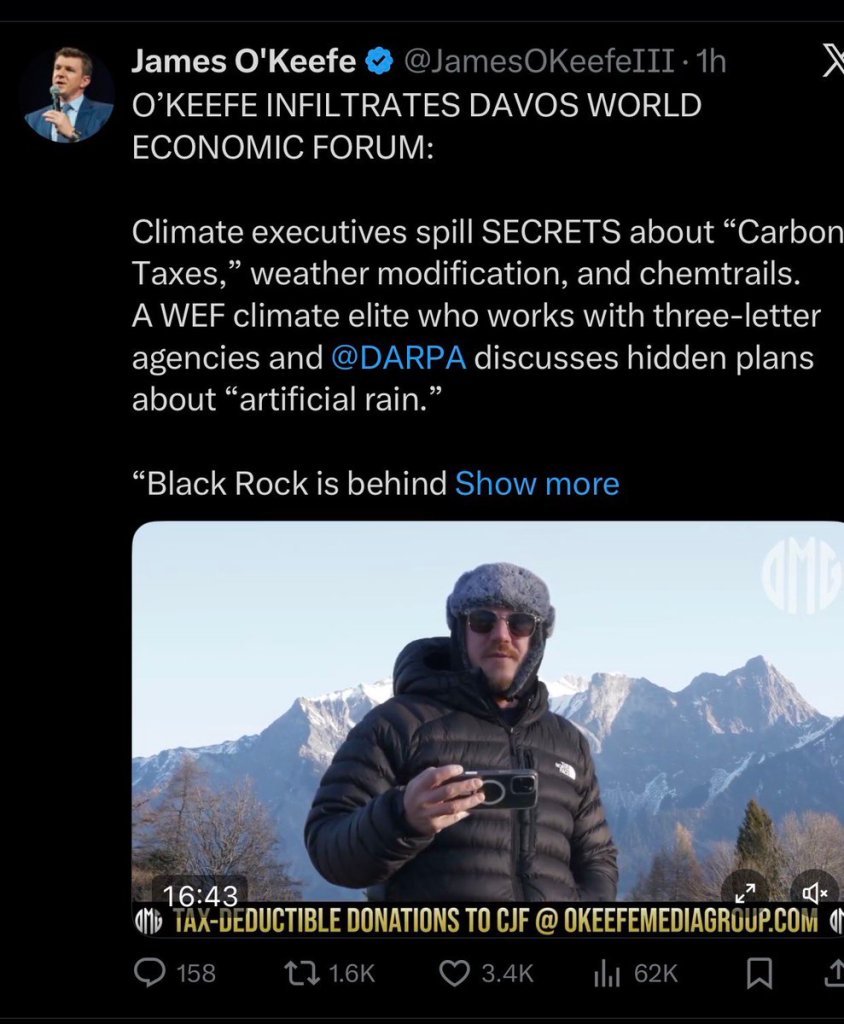

“This is going to be some good stuff. If there still is a financial system and a real economy, get ya some popcorn!”

@BGatesIsaPyscho

6h

🚨🌎 James O’Keefe @JamesOKeefeIII

just infiltrated The WEF in Davos & proved that Blackrock are also behind the Global Weather Manipulation we all see each & every day‼️

RFK Jnr was also right – it is DARPA!

Multiple Conspiracies Confirmed ✅

May most money managers end up selling pencils in the street…..for putting their clients in soup lines

LikeLike

Thank you pamelamoves@gmail.com

LikeLike