Bill’s Commentary:

“As I have been saying all along, somebody, somewhere, is swallowing all of these losses. The banking system does not have enough capital to eat what is coming, neither does the US Treasury without its capacity to borrow more. Imagine, the solution is to borrow money to sustain the losses of borrowed money. We do live in the most interesting of times!”

“Absolutely Stunning”: CRE Analyst Lists Latest Office Tower & Mall Valuation Collapses

The commercial real estate downturn is still underway, posing significant risks for investors across financial markets. CRE-linked equities, corporate credit, structured credit, and private markets all feel the impacts of major unwinds as property prices plunge.

While headwinds from high interest rates may diminish in the coming quarters, with rate traders pricing in the possibility of the first 25bps cut as early as the mid-September FOMC meeting, the critical question is whether these projected rate cuts will be adequate to cushion the landing.

Office tower valuations remain sloped in a downward trend, plummeting in many cases, as vacancy rates soar as remote work trends keep white-collar workers out of the office and at home. These imploding values remain a massive threat to regional banks, with the CRE crisis likely to persist through 2025.

Bill’s Commentary:

“As well they should. Which government is next?”

Japan Apologizes to the Unvaccinated for the Millions of Deaths Caused by the Deadly COVID Shot (Video)

Japan demands justice for the crimes against humanity perpetrated by those who knew that the shots were ineffective and extremely dangerous.

Most people have no idea of the level of corruption of Fauci and the world news media who are responsible for the millions and perhaps soon billions of deaths around the world.

FDA has now approved the same deadly vaccine which will now be called the Bird Flu Vaccine. Expect millions and millions more to die if they believe this lie.

Bill’s Commentary:

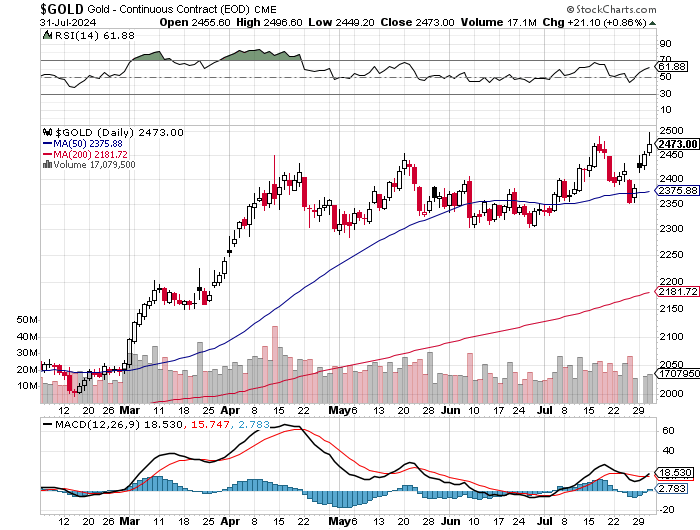

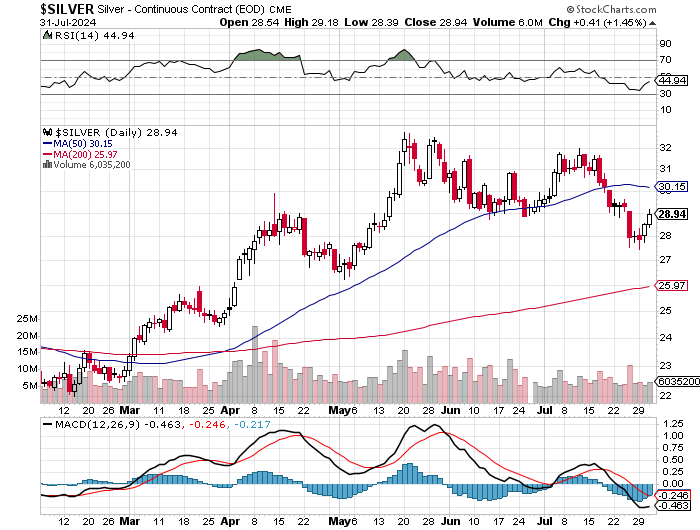

“Another push higher?

Here we go again, with another try! I posted these 3 charts back on May 11, I suggested we were about to move sharply higher in all 3 markets. We did, silver moved better than 20% in roughly 3 weeks. I posted them again at the beginning of July suggesting another move higher. Gold and the HUI index made new highs (the HUI is a new high since 2016, Gold is all time high). Silver got whacked at $32, so did not quite make a new high for this move. After a healthy pullback, here we are again! Gold and the HUI have MACD’s (bottom and right on each chart) in the process of crossing over again to the upside, silver is working on it and needs another 2-5 days to resolve. We got as low as a 74-1 gold to silver ratio at one point, we are now back up to 84-1. Silver is only 10 times more plentiful than gold, to see this ratio come down to 40-1 or lower should be expected. From here, a 40-1 ratio would mean that silver outperforms gold in purchasing power by better than 2-1. Be careful what you wish for however. Exploding metals, especially silver will create huge margin calls for the shorts, this will coincide with customers demanding delivery. At some point, a failure to deliver will occur. Does it happen in the immediate future? I do not know, I do know that the current global geopolitical scene is a disaster …with a backdrop of insolvent and bankrupt central banks and treasuries. Be shocked at nothing, anything can happen at any time to pull this curtain down. The financial situation is pure math, we know it, and they know it. They will kick this table over because the collapse must be to their timing, stay alert and skeptical!”

Standing watch,

Bill Holter

Thank you pamelamoves@gmail.com

LikeLike