Bill’s Commentary:

“A couple of observations; first, the silver futures market is far larger than the physical market. The true financial “leverage” has been to the short side which means whenever the real short squeeze arrives, it will make cocoa look like a calm day! Additionally, it looks like a billion+ paper ounces were needed yesterday to cap the price, or roughly a year’s worth of global production traded in one day.”

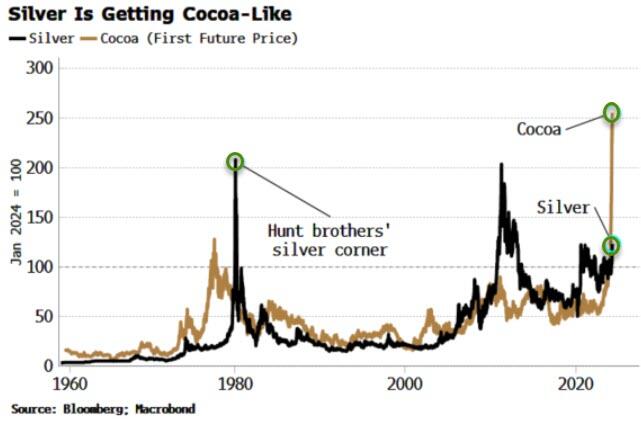

Is Silver About To Do A Cocoa?

Silver prices have rocketed higher in recent days, and they have been surging today (with great volatility). As a futures market, more of it trades on exchange relative to its annual physical supply compared to cocoa. Therefore it’s not inconceivable silver could deliver a similar sort of move to cocoa’s recent mega-rally.

Thank you pamelamoves@gmail.com

LikeLike