Bills Commentary:

SURPRISE!!!

Please click the link to view the quick video !

Bills Commentary:

SURPRISE!!!

Please click the link to view the quick video !

Bills Commentary :

Pretty amazing what can happen in “72 hours”?

https://www.timesofisrael.com/liveblog_entry/home-front-command-advice-sparks-run-on-supermarkets/

“The panic-buying spree comes despite attempts by the IDF to assure Israelis that the advice is standard and simply a reminder, not a prediction of what a looming war will bring…”

Bills Commentary :

In memory of Jim Sinclair, Mr. Gold.

It is with a sad heart to announce that my friend, business partner and mentor Jim Sinclair passed away last Friday. He was a font of knowledge and gladly gave this knowledge away to anyone willing to listen and connect the dots. Jim had a storied career in global finance, and always knew that in the end, all monetary roads led right back to gold. I am especially sad that he left us just as his final deal, TRX, became solid and into commercial production. He believed this would be his largest by orders of magnitude and devoted his final years to its success. “Mr.Gold” will be missed by more people than he knew. RIP James E. Sinclair (Seligman).

| TRX Gold Announces Passing of Founder and Chairman James E. Sinclair |

TORONTO, Ontario, October 9, 2023 – TRX Gold Corporation (TSX: TNX) (NYSE American: TRX) (the “Company” or “TRX Gold”) is deeply saddened to announce the passing of its founder and Chairman James E. Sinclair on October 6, 2023, at the age 82. James passed away peacefully at home in Connecticut, U.S.A. TORONTO, Ontario, October 9, 2023 – TRX Gold Corporation (TSX: TNX) (NYSE American: TRX) (the “Company” or “TRX Gold”) is deeply saddened to announce the passing of its founder and Chairman James E. Sinclair on October 6, 2023, at the age 82. James passed away peacefully at home in Connecticut, U.S.A.James founded TRX Gold and acted as Chairman and Director since 2000. His belief in Tanzania as a gold-rich landscape, in the ability and talent of the region’s people, and the openness of Tanzanian government to foreign investors, formed the basis for his perseverance in unlocking the Buckreef Gold Project’s potential. Until his final moments, James acted as a supporter, mentor and point of reference. “This is a great loss and moment of sadness for all of us at TRX Gold and the Buckreef Gold Project. On behalf of the Company and its Board of Directors, we wish to offer Mr. Sinclair’s family our sincerest condolences. James was always positive and forward-looking and was excited by the trajectory of the Company. He was a tenacious, hard driving individual who challenged everyone around him to move forward and be better. We will continue to build on our current successes and his substantial legacy,” explains Stephen Mullowney, TRX Gold Chief Executive Officer. To those outside of the Company, James was perhaps best known as “Mr. Gold”, being a true believer in the value of gold and its ability to generate and preserve wealth. He is remembered for boldly and accurately predicting that the price of gold would rise from $150 per troy ounce to $900 per troy ounce, between 1977 and 1980. He led a successful career as a precious metals specialist, market maker, and commodities and foreign currency trader. He was the original founder and explorer of the Bulyanhulu mine through Sutton Resources, which is one of the most productive gold mines in Tanzania to this day. He was a notable author and commentator on topics such as precious metals, trading strategies, geopolitical events and global markets. Incredibly, through the ups and downs of the financial markets, his audience has remained faithful over the last two decades and more. His memory lives on with more than 500 TRX Gold and Buckreef Gold employees and contractors on two continents, as well as the countless individuals he touched through his work around the world. |

Bills Commentary :

I believe a crash of Biblical proportions is now imminent. When I say “crash”, I am speaking of stocks, bonds, and real estate, and thus it will lead to breakdown of society. Stocks averages have been held up by only a handful of stocks, very similar to the Nifty Fifty, 1987, the Dot-com bubble, and 2008-09. The averages themselves are now rolling over. Credit markets (bonds) have already been destroyed. Treasury-Bond Collapse Ranks Among the Worst Market Crashes in History (businessinsider.com)

The reality is that credit has already crashed and it is the ONLY market that really matters. The credit markets have been in the worst bear market bonds have ever experienced in all of history. The simple reason is that rates started upward from zero, “zero coupon bonds” are THE most volatile of all. Essentially, the entire world became a financial “zero coupon bond”, the resulting rate rise is absolute death for the entire system. Everything is levered and this time around the “debt saturation trap” includes nearly all central banks and sovereign treasuries. Central banks and sovereign treasuries still had room to expand credit in 2008-09, balance sheets today are blown out everywhere! If you know nothing about macro finance, please understand that credit (bonds) are the “foundation” to EVERYTHING in today’s world… the foundation has cracked! Everything “financial” is based on credit, and more importantly, the “real world” ( production, distribution etc.) is entirely based on credit. Any stoppage of credit anywhere in the world will begin to snowball and engulf ALL credit. Nothing, NOTHING that you now do in your everyday life will be the same, or maybe not even function at all when credit is no longer available. Credit is entirely based on confidence and this con game is over!

This is it folks, it is the end of our “credit based” society. You think crime is bad now? Think “everyone for themselves”, this is what is unfortunately coming. How do I know this? Because once credit is no longer advanced, NO ONE WILL BE PAID! Workers, vendors, suppliers, first responders …NO ONE! Mathematically, the amount of debt currently outstanding worldwide can never be repaid in current terms. It is either print to oblivion or outright default, either way the result is total financial collapse. The amount of “unrealized losses” systemwide is staggering. The Federal Reserve itself already has far more unrealized losses than the paltry $65billion of equity they used to claim. They are upside down but now hiding their balance sheet within the US Treasury since they were merged a couple of years ago. The Treasury itself is in a debt service death spiral as it must pay $1.5 trillion per year in interest going forward, up from $400billion just two or three years ago.

If you have been paying any attention at all, you know that almost everything you are being fed and told has been a lie. I hate to be the bearer of bad news but, your “lifestyle” has been a lie. We are told that one can change their gender if they wish? Financial and economic numbers used to be massaged, now they are outright fantasy. Climate change, racism, sexism, or whatever “isms” are put forth as fact and parroted by a captured media. Speech is severely censored and throttled if you don’t go along with the bullshit du jour. Elections are a complete farce. Government at all levels is pitted and pointed against citizens who for the most part just want to live their lives and be left alone. If you cannot see how abnormal your world has become, you are part of the problem.

The “lies” could never have passed as “truth” were it not for asset prices. Sky high stock, bond, and real estate prices masked what was really happening. As long as 401k balances and homestead prices were good, the masses were placated. Asset prices could never have come close to where they are, were it not for the easy money available at interest rates resembling “free”. If the Dow jones and housing were trading at 50 cents on the dollar, people would be pissed and then ask some tough questions with some very disturbing answers. These questions, and thus answers are just around the corner, spiking interest rates assure this!

Now that rates have spiked, buyers have been drastically culled due to the debt service required. If your income level two years ago allowed you to bid on a $1 million house, today you are only able to look at half of that. Credit is a double edged sword, wonderful when rates are low and easy application, disastrous when rising …especially when rising against the largest pile of debt the world has ever seen. We are living in and watching THE biggest credit bubble of all time deflate, the result will be disaster in so many ways, most importantly to “society” itself. I was laughed at six or seven years ago when I used the term “Mad Max” as the end result to the credit bubble. I have only one question for you, CAN YOU HEAR ME NOW?

Standing a terrified watch,

Bill Holter

Bills Commentary :

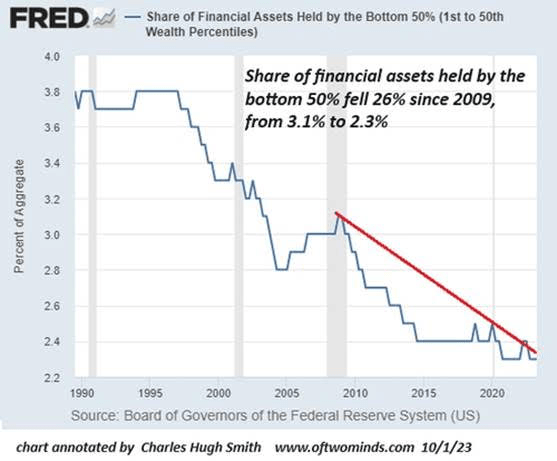

Inflation of the things we need and deflation of the things we have …

Bills Commentary :

Putin knows full well the underbelly of the West…

The theme of Valdai 2023 was, most appropriately, ‘Fair Multipolarity’. The key axes of discussion were presented in this provocative, detailed report. It’s as if the report had prepared the stage for Putin’s address and his carefully crafted answers to the questions from the plenary.

The concept of multipolarity in the Russian space was first articulated by the late, great Yevgeny Primakov in the mid-Nineties. Now, the road to multipolarity is based on Foreign Minister Sergey Lavrov’s concept of “strategic patience”.

https://www.unz.com/pescobar/putin-and-the-magic-multipolar-mountain/

Bills Commentary :

These are all good charts from Dismal Dave. Please try to understand what each one means and how they are all interrelated?

Bills Commentary :

As I have said for many years, “watch the credit markets”, as credit makes the financial and real-life world turn. The average person watches stock markets, but THE most important “market” has already crashed. Put your helmets on, stock averages are next and will be followed by many global markets seizing up into closures!!!

“The bond-market sell-off that’s sending yields soaring is starting to eclipse some of the most extreme market meltdowns of past eras. Bloomberg reported losses on Treasury bond with maturities of 10 years or more had notched 46% since March 2020, while the 30-year bond had plunged …“

Bills Commentary:

This is a VERY REAL 1 min 50 seconds. I have 1 minor correction for Congressman Gaetz, he used the word “if” rather when… but I am sure he already knows this!

“Congressman Matt Gaetz (R-FL) speaking about the growing BRICS nations engaging in “de-dollarization,” Gaetz told reporters “. . . if we’re going to lose the dollar . . ..” Does Gaetz already KNOW the Dollar is doomed?…”

Bills Commentary:

You can’t make this stuff up!

“The development has renewed speculation over whether the billions of dollars in aid provided to Ukraine is being laundered and returned to individuals within the U.S. Earlier this year, James “Jim” Moran, who served as a Virginia congressman for 24 years before retiring in 2015, launched Moran Global Strategies (MGS), a lobbying firm with a growing number of international clients…”