Bill’s commentary:

“Something old, something new”, yet still correct…

As many of you know, I began writing back in late 2006 and wrote steadily until about 2 years ago. To be honest, I got burned out from writing over the years as it seemed I was “re” covering ground I had already spoken about. While the end of the road has taken much more time than I or anyone else could imagine, that “end” is here and now. I can say here and now as the math of overleverage, coupled with crippling interest rates has arrived. In the past, central banks and sovereign treasuries could always bail out the system. Now, THEY are a huge part of the problem and in no way can they save anything, much less themselves…

With that said, I came across an article I wrote a few years back and will publish it here. I plan to dig up a few older articles that I believe are still “correct” and will update them with a few current notes. Hopefully it will be a refresher for long term readers or eye openers for new readers?

April, 2017

$5,000 silver?

A catchy title this “$5,000 Silver?” don’t you think? Am I crazy? Is this even possible? In who’s lifetime? Ours or our great, great grandchildren long after we are dead and buried? The best way to look at this I believe is to briefly look at silver’s big brother gold and then postulate whether it’s possible or not.

To begin, let’s look at what happened in 1980 and why gold traded up to $875 in the first place. As Jim Sinclair has said many times, gold “moved in a manner to cover the value of foreign held debt of the U.S.”. He has also said “$50,000 gold is possible and it may turn out that this figure is far too low”. Before you laugh and start firing spitballs at me or Mr. Sinclair, I remind you of his call of “gold at $1,650 per ounce by Jan. 2011”. He said this when gold was $350 per ounce or so and the year was around 2004 if memory serves me correctly. He was called a nutjob and far worse …he was correct in retrospect and off in his timing by about eight months …SEVEN YEARS AHEAD OF TIME!

To refresh your memory, let’s do some basic mathematics. The U.S. purportedly has 262 million ounces of gold. (As a side note, if you understand how much gold China has imported just over the last six years and compare that to global production, then you understand the U.S. has in all likelihood “dishoarded” much of this gold). We can compare this 262 million ounces to our national debt rounded off at $18 trillion. Doing the math, if we had to back our debt with the gold we supposedly have, the number currently comes up to $68,700 per ounce!

Before you call me nuts, I have one question for you. Were foreigners to decide that “dollars” for any (many!) reason was no longer acceptable, what would we “pay” with? Remember, since the dollar is the reserve currency, the U.S. holds almost NOTHING in foreign reserves. Why should we have to hold foreign reserves, we issue THE reserve currency?! And yes, I understand the debt is “contracted” in dollars so all we have to do is print more to make the payment. All I am saying is this, if the U.S. was forced somehow to actually settle the debt …in gold, our gold would need to be valued at $68,700 per ounce “now”. I say “now” because our debt burden will only grow larger, our gold holdings (IF they truly still exist) will not grow or “breed” making our stash larger with new little goldlings. My point is this, $68,700 is a credible number only assuming we do have the gold we claim to have.

Now let’s look at silver. Silver is taken out of the ground at roughly a 10-1 ratio to gold production. This number includes “by-product” silver. The current price ratio is 70-1 or thereabouts, nonsensical when you factor in the price to produce silver is higher than the market price. This situation argues for severe supply cutbacks in the future unless the price goes higher to allow for a mining profit. Silver is also a very miniscule market when looked at from a dollar standpoint. There are roughly 800 million ounces produced globally which in dollar terms is less than $15 billion. In today’s world, $15 billion is nothing! Individual companies are bought and sold for more every day.

Another aspect to silver is the “low hanging fruit” has already been found and mined. Many companies have high graded production just to stay in business. New silver deposit exploration has found very little over the last 5-10 years, current new exploration today is almost non existent because the funds from operations have turned into losses. The capital to look for new silver deposits simply does not exist.

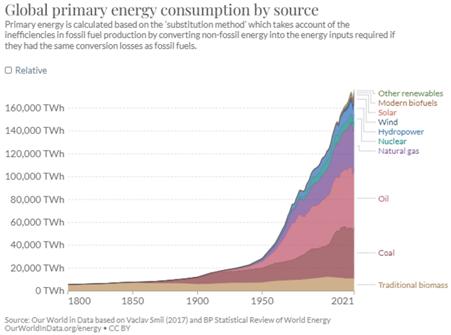

New “uses” for silver, be they electrical, industrial, solar, medical or other seem to be popping up regularly. Demand will increase over time. And speaking of time, it is estimated that silver may become the next “extinct element” in about 20 years. Does this mean there will be no silver left on the planet? No, new silver will be found and dug up but probably not enough to satisfy the fledging demand of 100’s of years ago unless new mining technology becomes available.

What comes our way is a once in hundred’s of years currency event. Never before has the world not had a single currency backed by silver or gold. There is no place to hide from the currency derivatives/debt/currency meltdown except in the actual metals themselves, “receipts” will not do this time!

To finish, I would like to paraphrase something from the Bible. In Matthew 25, verses 14-30, the “Parable of talents” is written. It speaks of a master going on a trip and leaving three of his servants’ bags of gold to care for while he is away. To one he gave 10, another he gave two and the third servant just one bag. He did so based upon his judgment of their abilities to handle money. When the master returned, the servant who was given 10 bags, returned 20 and the servant given two bags returned four. The last servant, who dug a hole in the ground and buried his bag of gold, dug it up and returned it intact. The last servant was scorned and called lazy for doing nothing with his “talent”. Please understand in those days, “talent” was considered weight or coinage but can be looked at today as one’s talent or ability, it should not be wasted.

In my opinion, because the “moneychangers” have so rigged and fraudulently ruined the global monetary system, now is not the time to “earn interest”. Now is not the time to try to “make money”. The system is on the verge of a mathematically certain collapse where institutions and governments themselves stand to perish. Believe this or not, mathematics don’t lie. Now is the time for you to be the third servant and bury you bag of whatever you have accumulated. Get it out of the system and thus out of the way of the financial carnage coming. You will have something to “start over” with and give you a head start. As Richard Russell has said, right now is NOT about making money, it is all about not losing everything.

Will silver go to $5,000 per ounce? Who knows, we may have a completely different currency in short order, and nothing will be quoted in “dollars” anymore. All I can tell you is that when gold and silver are remonetized back into the system, their purchasing powers will be at least equal to if not many times higher than these depressed levels. In “dollar terms” they may approach infinity!

Standing watch,

Bill Holter

Please note that current on books US Treasury debt is now over $33 trillion rather than 18 when this was written and the silver to gold ratio is 85 to 1 versus 70-1 at the time of writing. Were US “held” gold (no audit has been done since 1956? Why not?) to be required to extinguish current debt, the price of gold would need to be well north of $125,000 per ounce. The silver to gold ratio held at 16-1 for hundred’s of years. Silver would be roughly $8,000 per ounce in this instance…