Bill’s Commentary:

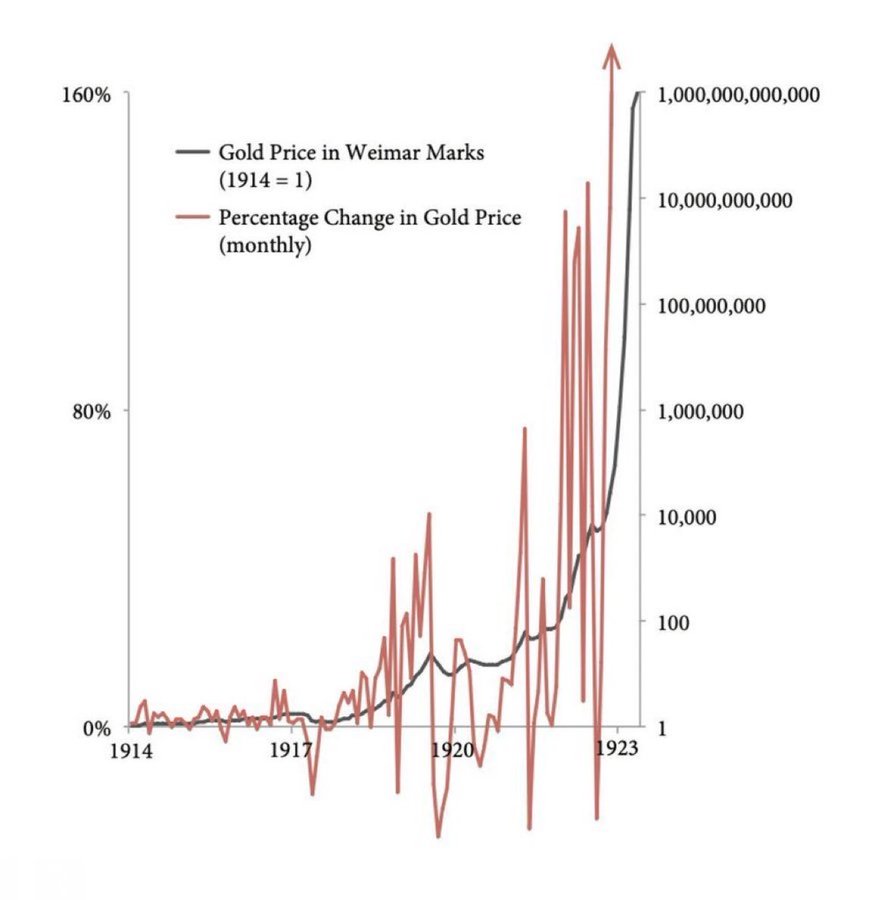

“I have posted a couple of the AI “Asian Guy” videos in the past but cautioned there were some numbers and dates that were off and said I believed his logic is correct. AG released a video which I am mentioned in several times. I believe this video is an AI sweep of much of what I have personally said or written publicly. Some of the dates and numbers are a little off, but I agree with everything in this particular video because I have publicly said these exact words. I believe this video is 100% spot on and thank whoever created it!”

Asian Guy does a Bill Holter video

Bill is interviewed by Liberty and Finance (Also posted under Interviews)

Bill’s Commentary:

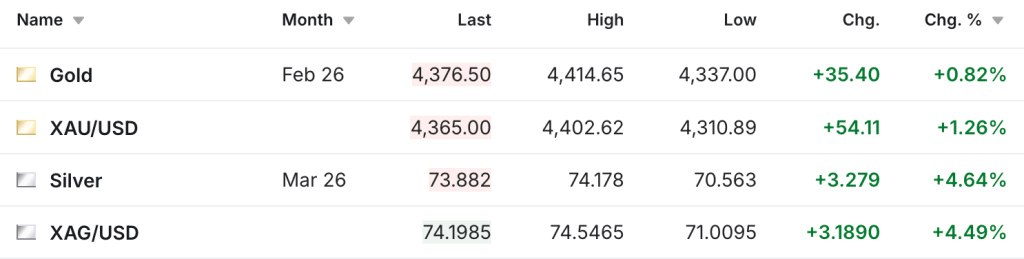

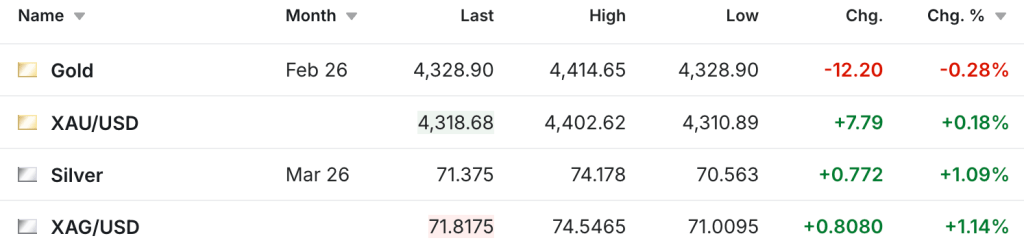

“January looks to be sticky for deliveries of silver!”

@DavidLe76335983

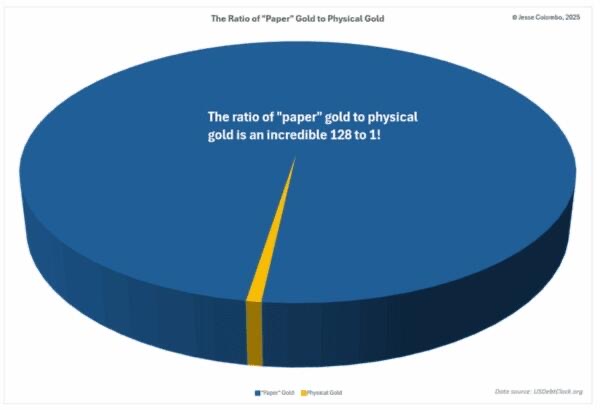

Shorts are stuck with emptying their vault or covering their shorts. They have run out of room to play the paper market

@silvertrade

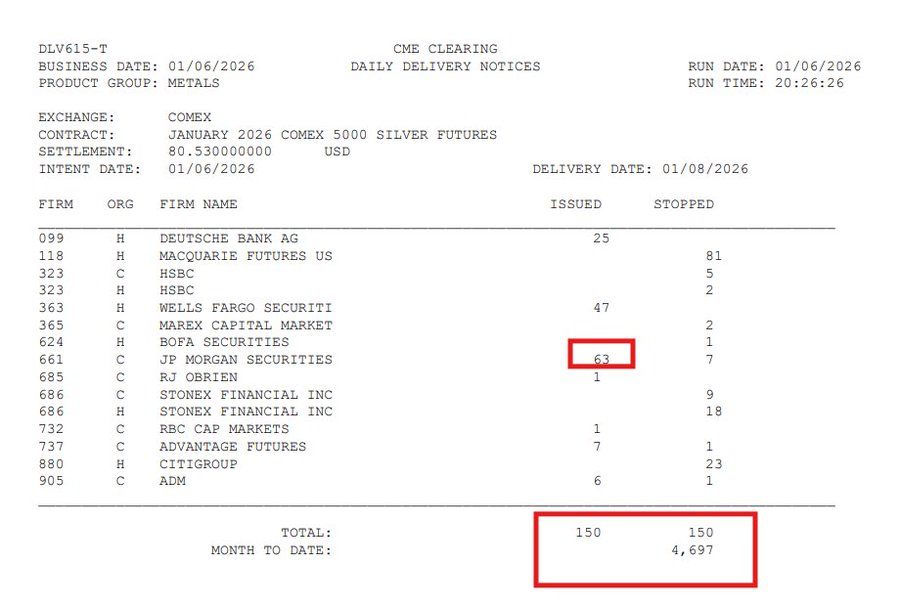

🏦COMEX SILVER DELIVERIES UPDATE 🏦

🔥150 Jan Silver Delivery Notices Issued Tuesday!

➡️JPM Issued 63/150 of the Notices

➡️Macquarie Stopped 81 Notices

🔥TOTAL JAN SILVER DELIVERY NOTICES RISE TO 4,697 CONTRACTS – 23,485,000oz!

🚨January is NOT a Primary Delivery Month for COMEX Silver! The silver shortage is so severe that nearly 23.5 MILLION OZ have issued delivery notices OVER THE FIRST 3 TRADING DAYS OF A NON-PRIMARY DELIVERY MONTH!

⚡️HISTORIC PHYSICAL DEMAND.

The Bullion Banks May be in SERIOUS TROUBLE Come March… 🚨

Bill’s Commentary:

“So much for the rule of law…!”

The latest from Erik –