-

Bill’s Commentary:

“Welcome to your future!”

Looters EMPTY 63 LA Stores… Mayor PANICS as “Sanctuary” DEVOURS ITSELF

Bill’s Commentary:

“What’s good for the goose is good for the gander… and as they say, payback’s a bitch!”

Democrats Exhibit Amnesia About Biden-Era Lawfare

Democrats who denounce federal indictments of former FBI Director James Comey and New York Attorney General Letitia James as unprecedented weaponization of the Justice Department exhibit amnesia about the norm-eviscerating, undemocratic lawfare they launched during the Biden administration.

A federal grand jury in Virginia indicted Comey last month for lying to Congress and obstructing a congressional proceeding by “willfully and knowingly” lying to the Senate Judiciary Committee when he testified that he had not “authorized someone else at the FBI to be an anonymous source in news reports” concerning the FBI’s 2016 investigation of Hillary Clinton’s use of private email for confidential information.

-

Bill’s Commentary:

“On today’s silver price action. Do not be fooled and sell your lifeboat!”

COMEX Silver Vaults Raided: LBMA Runs Bone Dry as 3 Million Ounces Exit in One Day—

Buyers Face Reality Check on Physical Bars. BUY THE DIP. Hold the Line. LFG!

Bill’s Commentary:

“They never should have been allowed to trade on inside information in the first place!”

‘We’re going to have a vote’ on member stock trading, key GOP hard-liner says

A raft of internal GOP fights are awaiting Speaker Mike Johnson when he brings the House back from its shutdown recess — including a major brawl over legislation banning congressional stock trading.

Rep. Chip Roy of Texas said in an interview Monday he and fellow Republicans are ready to push GOP leaders to put their bipartisan stock trading ban bill on the floor whenever the House returns — or possibly use a discharge petition to do an end-run around Johnson.

Roy, a member of the House Rules Committee, said Republicans need to figure out the timing going into November and December for when the legislation could go to the floor. He said GOP leaders, who have been skeptical of the effort, are “having conversations” about the legislation.

The latest from USA Watchdog –

Bill’s Commentary:

“Silver no longer shunned as a monetary metal… it is moving INTO the system, not out of it!”

India Unleashes Silver as Banking Collateral with 10-to-1 Gold-Silver Ratio—Declares Silver as Global Monetary Metal.

India’s bold financial reforms, effective April 2026, are set to propel silver into a powerful new era—not just as an industrial workhorse, but as a formalized monetary metal anchoring the banking sector. The Reserve Bank of India’s unified gold and silver loan rules mark a paradigm shift and intensify the global rush toward silver-backed banking, with bullish implications for investors and industrial users alike.

For decades, India’s vast middle class and rural population relied on physical gold as the foundation for household credit and emergency loans. Now, silver is officially joining the ranks. Under RBI’s new regulations, up to 10 kilograms of silver jewelry can be pledged per person as collateral—versus just 1 kilogram for gold—for personal or business loans from banks and Non-Banking Financial Companies (NBFCs). Loans of up to ₹2.5 lakh (about $3,000 USD) can be granted with minimal credit history, making precious metal-backed credit more accessible than ever.

Bill’s Commentary:

“They just figured this out?”

Bill’s Commentary:

“Erik tells us about the lies, lies, and more lies we are told daily..”

The latest from Erik –

-

Bill’s Commentary:

“And they told us there was plenty of silver around?”

India’s Largest Metals Refinery Ran Out of Silver for the First Time in History

Shortages hit London too. The silver market is broken.

For months, Vipin Raina had been bracing for a stampede of buying from Indian customers loading up on silver to honor the Hindu goddess of wealth.

But when it came, he was still blown away. At the start of last week, his company, India’s largest precious metals refinery, ran out of silver stock for the first time in its history.

-

Bill’s Commentary:

“Always follow the money!”

“Coup d’Flat”: Billionaire-Funded ‘No Kings’ Color-Revolution Turns Into White Liberal Boomer Parade As Dems Become National Laughingstock

The Democratic Party’s dark-money NGO network, bankrolled by left-wing billionaires, unleashed a highly coordinated, color-revolution-style mobilization nationwide on Saturday; the same tactics U.S. intelligence agencies have used overseas for years in regime-change operations. Yet the turnout wasn’t dominated by unhinged young leftists or gender-confused woke warriors, but rather by white baby-boomer liberals, a mobilization effort that NGO expert Mike Benz described as a “Coup d’f́lat.”

The nation is waking up to the fact that dark-money NGO networks, including the Arabella Network, Soros Network, Gates Foundation, Ford Foundation, Tides Foundation, Rockefeller Network, Singham Network, and many others, are funneling millions of dollars into what investigative researchers Peter Schweizer and Seamus Bruner of the Government Accountability Institute call “Riot, Inc.” – the permanent protest industrial complex and the engine behind “No Kings 2.0” partners and organizers. These protests are far from organic; this movement is manufactured, coordinated, and entirely artificial.

Bill’s Commentary:

“JP Morgan tells India “no silver for you”?”

Sold out in India, panic in London: How the silver market broke – The Economic TimesFor months, Vipin Raina had been bracing for a stampede of buying from Indian customers loading up on silver to honor the Hindu goddess of wealth.

But when it came, he was still blown away. At the start of last week, his company, India’s largest precious metals refinery, ran out of silver stock for the first time in its history.

The latest from USA Watchdog –

https://usawatchdog.com/gold-fights-financial-control-grid-catherine-austin-fitts/

-

Bill’s Commentary:

“This is way beyond BAD!”

Bondi DOJ Backs Warrantless Invasion Of Gun Owners’ Homes

The Department of Justice under Attorney General Pam Bondi is advancing an argument that threatens to hollow out the Fourth Amendment’s core protection: that Americans may be secure in their homes against warrantless searches.

The lawsuit is Case v. Montana. After a difficult breakup, William Trevor Case was at home alone when police arrived for a so-called “welfare check.” They spent nearly an hour outside his house. Officers walked around the property, shined flashlights through windows, and even discussed calling his relatives or reaching him directly. They never did. Instead, they retrieved rifles and a ballistic shield, broke down his door without a warrant, and shot him.

Bill’s Commentary:

“Exactly… how much does it pay!!!”

Bill’s Commentary:

“This quote sent in from a reader; “THE WORLD IS CLAMORING FOR SILVER AND GOLD, AND AMERICANS ARE SELLING IT. WHO IS THE THIRD WORLD COUNTRY NOW”?

This is so true! I can tell you as a precious metals broker, I have never seen retail selling like this ever before in my entire career. People are selling because they need the money, Main St. is failing…”

Bill’s Commentary:

“Welcome to the Matrix!”

-

Bill’s Commentary:

“Science has always mattered… even when these leftard asshats abandoned it during the Covid scam…”

15 Democratic Governors Announce Health Alliance to Counter RFK Jr.

The Democratic governors of 14 states and the territory of Guam on Oct. 15 announced a new coalition they said will provide scientific information to counter Health Secretary Robert F. Kennedy Jr.

The Governors Public Health Alliance is aiming to boost coordination between states on public health guidance, preparing for emergencies, and detecting health threats. It plans to issue recommendations to the public on vaccines and other health topics, as the governors say guidance from the federal government can no longer be trusted.

Bill’s Commentary:

“$300 trillion won’t raise any eyebrows in the world we are headed into!”

PayPal’s crypto partner mints a whopping $300 trillion worth of stablecoins in ‘technical error’

Paxos, the blockchain partner of PayPal, mistakenly minted $300 trillion worth of the online payment giant’s stablecoin on Wednesday in what the company called a “technical error.”

Market watchers had spotted the enormous injection of the PayPal PYUSD stablecoin on Etherscan — a block explorer and analytics platform for the Ethereum blockchain.

Paxos had mistakenly minted the stablecoins as part of an internal transfer, before it “immediately identified the error and burned the excess PYUSD,” the company said in a social media statement.

Bill’s Commentary:

“What comes will be a “credit event” of epic proportions!”

Regional Banks Crash As More Credit “Cockroaches” Emerge

Just when the market was starting to finally freak out – with a one month delay – about the Tricolor and First Brands bankruptcy following yesterday’s fingerpointing session between JPM’s Jamie Dimon and various private credit firms in which both accused each other of harboring more credit “cockroaches“, this morning the credit freak out went to 11 as two regional US banks crashed after they both disclosed problems with loans involving allegations of fraud (completely unrelated to Tricolor or First Brands), adding to concern that more cockroaches are indeed emerging in borrowers’ creditworthiness.

Bill’s Commentary:

“And this all happened while gold never had (nor will have) any DEFAILT RISK!”

13 Reasons Why Gold Has Outperformed Stocks Since 2000

The recent increase in gold prices in the United States and around the world has been driven by a confluence of economic, financial, and political factors. This environment, where gold has outperformed U.S. GDP and the four major U.S. stock markets, began in 2000 and has continued to date (see Exhibits 1, 2, 3). We outline 13 reasons why gold has outperformed most major investments and why it is likely to continue attracting individual and institutional investors.

Bill’s Commentary:

“It will be silver as the blasting cap…”

Breaking: Global Silver Shock — LBMA Crisis Forces 88% Draw on COMEX Inventories

Silver’s physical market has just crossed a historic threshold. The CME’s latest report confirms only 173 million troy ounces of registered silver remain in COMEX vaults—metal actually available for delivery. Yet according to ex‑JP Morgan Bullion Bank executive Robert Gottlieb, the London Bullion Market Association (LBMA) must import roughly 150 million ounces to avert systemic failure. In other words, London now needs 88 percent of all COMEX deliverable silver to survive the current liquidity crisis.

The latest from USA Watchdog –

-

Bill’s Commentary:

“Curious why Elon Musk posted this 2 months ago?”

Bill’s Commentary:

“Not so foolish to own gold after all?”

Screenshot Bill’s Commentary:

“Erik on The Constitution”

The latest from Erik –

-

Bill’s Commentary:

“The chart on lease rates is a day old… they closed out on Friday at 200% to borrow silver. Also, you will notice the futures in NY are now $3 below spot in London. Jim used to always ask the question; ‘what is the value of a contract that cannot perform’. Are futures just now beginning to display what they are actually worth? Think about that…!”

Silver Traders Rush Bars to London as Historic Squeeze Rocks Market

(Bloomberg) — The London silver market has been thrown into turmoil by a massive short squeeze, driving prices above $50 an ounce for only the second time in history and stirring memories of the billionaire Hunt brothers’ notorious attempt to corner the market in 1980.

Benchmark prices in London have soared to near-unprecedented levels over New York. Traders described a market where liquidity has almost entirely dried up, leaving anyone short spot silver struggling to source metal and forced to pay crippling borrowing costs to roll their positions to a later date.

The latest from USA Watchdog –

-

Bill’s Commentary:

“This is SO BAD… failure to deliver from here is a very real possibility! “

Physical Panic: Lease Rate Hits 39%–London in Crisis

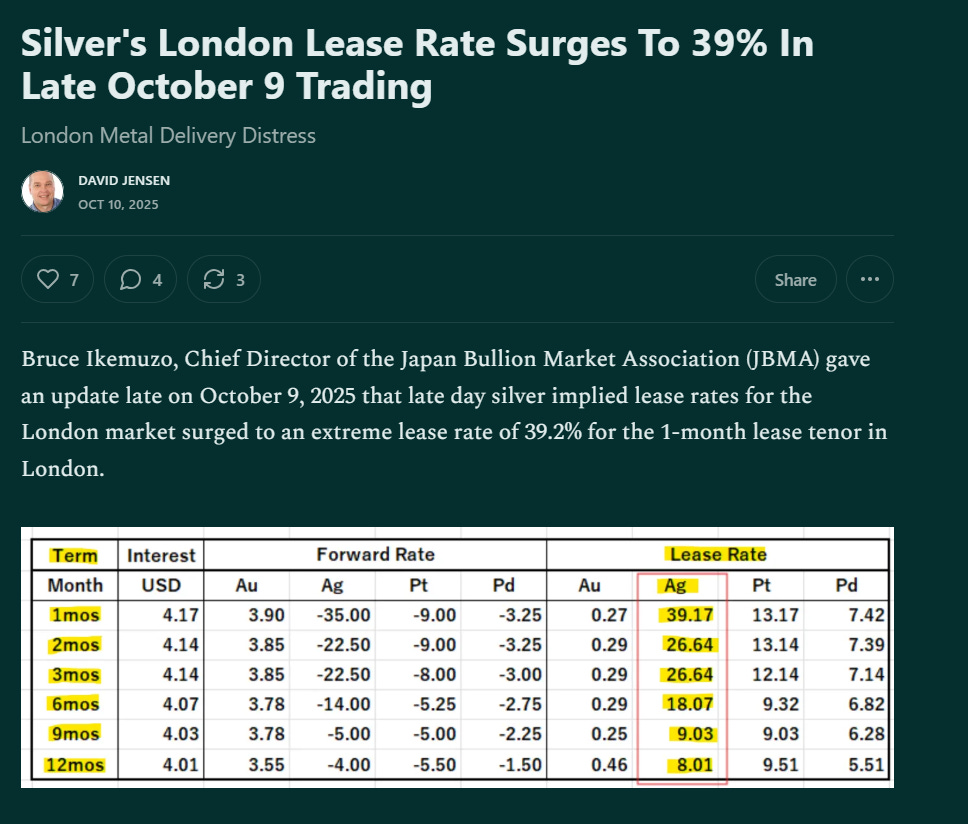

The silver market just witnessed a seismic event: On the evening of October 9, Bruce Ikemizu, Chief Director of the Japan Bullion Market Association (JBMA), confirmed that the 1-month implied lease rate for physical silver in London erupted to a jaw-dropping 39.2%. This extraordinary spike, captured in recent market data, signals acute physical supply distress—metal in the vaults is running out, and lenders are demanding a premium for any silver that remains.

Bill’s Commentary:

“For those who say Trump has not done one single good thing…”

Putin Praises Trump’s ‘Real Efforts’ Toward Peace, Blasts Nobel Committee

President Vladimir Putin on Friday praised U.S. President Donald Trump’s efforts to broker a ceasefire in the Middle East and criticized the Nobel Committee for awarding its peace prize to people he claimed did nothing to deserve it, remarks that appeared aimed at currying favor with Trump, who has grown increasingly cool toward Moscow amid stalled efforts to end the war in Ukraine.

Putin told reporters at a press conference in Tajikistan that Trump “is definitely making an effort and working on these issues — on achieving peace and resolving complex international affairs,” noting that the “clearest example” of those efforts is the recent ceasefire in Gaza.

-

Bill’s Commentary:

“Gold $4,000 and Silver $50… be careful what you wish for!”

Gold and silver finally had explosive runs and have become extremely overbought. They are both due a correction while the dollar gets a relief rally… this would be normal. But, we live in anything but normal times…!

I have said for 10 years now that gold/silver would ultimately fail to deliver and take the global derivative edifice down. I believe we are very close. If you bought gold or silver for asset protection, even if they pull back so what? This, I believe, is “the rally you never sell” as described by my late partner, Jim Sinclair. We are currently living through the biggest global financial change in over 50 years. During every financial upheaval in man’s history, holding gold prior to, and through the tumult turned out to be THE BEST HOLDING.

If the metals do pull back, who cares? The collapse will mathematically come. “Trading” and trying to pick a top and hoping for re-entry is a fool’s game at the end of an empire. The only thing that will financially matter once markets break will be how many ounces you own versus how many assets you have being gobbled up by the system, period! Expect a pullback, even hope for one. Because if the metals fail to deliver and price goes parabolic, it means immediate societal breakdown. I have always cautioned when people talked about gold and silver to the moon, BE CAREFUL WHAT YOU WISH FOR!

Bill is interviewed by Metals and Miners (Also posted under Interviews)

Bill’s Commentary:

“Hi Ho Silver!”

Bill’s Commentary:

“Is silver (and gold) due a pullback? Of course they are and in normal times the pullback could be 10% or even more. The state of the silver market today does not resemble normal under any definition. If lease rates are 19% in London, that tells you the market is thoroughly broken, price will ultimately reflect this… “

East Meets West: Silver Spike Shatters Records—$59 on JD.com, London Lease Rate Explodes to 19%

JD.com has silver listed at $59 per ounce. With 1 kilogram equaling 32.1507 troy ounces, that works out to about $1,900 per kilogram. This highlights soaring premiums in China and the desperate scramble for physical metal.

Now we interrupt this news article to pivot to the WestThe 19% Lease Rate Shock: China’s Secret Silver Empire and a Global Market on the Brink

This is not just another price spike. The world is witnessing an unprecedented unraveling of the silver market—one that pundits, economists, and policymakers everywhere will remember as the point at which physical reality overwhelmed financial illusion.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.