-

Bill’s commentary:

“A stark choice, tyranny versus revolution…”

Bill’s commentary:

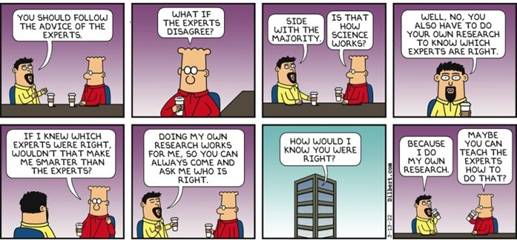

“Ah yes, the ‘science!’”

Which came first, the chicken or the egg? One potential answer is that the chicken was first, and the egg was in it. So it is with our current dilemma: which came first, the corruption of science or the censoring of speech?

It appears they’ve walked hand-in-hand for quite some time, becoming all the more apparent with the consolidation of social media power and the collective efforts of federal bureaucrats who wish to control not only what you think but especially what you say. During no time in human history was this more obvious than during the COVID-19 crisis where social engineering tactics were used against the American public, not to limit your exposure to a virus, but to limit your exposure to information that did not fit within a government sanctioned narrative.

-

Bill’s commentary:

“More visuals from Dave down under.”

‘You are a den of vipers and thieves.’ Andrew Jackson (1767-1845). Seventh US President, when forcing the closure of the Second Bank of the US in 1836 by revoking its charter.

Bill’s commentary:

“Food for thought? Or do you just use common sense and decide which side is evil?”

Billionaire Elon Musk and World Economic Forum (WEF) Chairman Klaus Schwab faced off this week, presenting competing visions for the future at this year’s World Government Summit (WGS).

Convened from Feb. 13-15 in Dubai under the slogan “Shaping Future Governments,” the WGS brought together prominent figures in politics, business and global governance in a format akin to that of the recent WEF annual meeting.

The WGS bills itself as “a global knowledge exchange platform dedicated to shaping the future of government worldwide.”

Participants comprised over 300 speakers and 10,000 attendees, including 250 government ministers and representatives from 80 international, regional and governmental organizations, including the U.N., WEF, World Health Organization (WHO), World Bank and International Monetary Fund.

These projections foresee a dystopian future of catastrophic climate change, mass migration, mass layoffs due to automation, ensuing social unrest and the merging of humans and technology as the “best-case scenario” for 2071.

Musk, Schwab and other leaders debated conflicting hopes and concerns for the future. The WGS itself also predicted what the world will look like by 2071, released as part of the WGS’ “Government in 2071” initiative.

-

Bill’s commentary:

“So as I understand it, ‘AI’ has to be programmed initially before it starts ‘thinking’ for itself. What does this say for the actual programmer? I guess I can understand it, just look around and see what and how the woke actually think in today’s world. Can you say ‘woke programmer’?”

Microsoft’s Bing AI chatbot has gone full HAL, minus the murder (so far).

While MSM journalists initially gushed over the artificial intelligence technology (created by OpenAI, which makes ChatGPT), it soon became clear that it’s not ready for prime time.

Bill’s commentary:

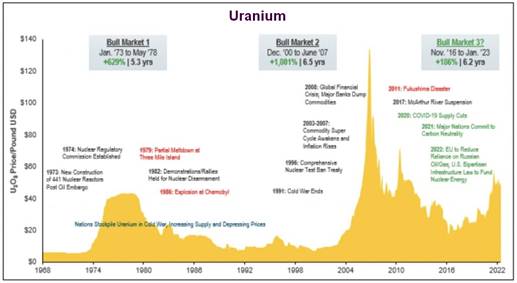

“I wish I knew a stockbroker with this much foresight!!!”

On February 3, a Norfolk Southern Railroad train derailed in East Palestine, Ohio, emitting toxic clouds into the air and water supplies. Officials issued an emergency evacuation shortly after, but residents have since returned home. The catastrophe has been downplayed by the media, and the Environmental Protection Agency has deemed the water “safe to drink” – despite the existing reports of wildlife dying in the affected area.

Now it seems even the CDC is minimizing the effects of the chemicals involved in the crash, one of them being vinyl chloride, a gas used to produce a plastic known as polyvinyl chloride (PVC). According to the National Cancer Institute, vinyl chloride is a carcinogen that has links to different kinds of cancers, including liver, brain, and lung cancers, as well as lymphoma and leukemia.

-

Bill’s commentary:

“Higher mortgage rates=lower affordability, do you really believe rates can move substantially lower from here?”

‘Our government has kept us in a perpetual state of fear, kept us in a continuous stampede of patriotic fervour, with the cry of grave national emergency.’

‘Always there has been some terrible evil at home, or some monstrous foreign power that was going to gobble us up if we did not blindly rally behind it.’ General Douglas MacArthur, 1957.

Bill’s commentary:

“Test after test after test? Why? All you need to know is, masks do not pass the “smell test”. If you have a mask on and can smell cigarette smoke or even someone passing gas …YOUR MASK DOES NOT WORK!”

A new scientific review raises additional questions over the science behind the mask mandates imposed on the population for years. The new scientific review by 12 researchers from leading universities found little support for the claims that masks reduced Covid exposures. My interest in the story, as usual, focuses on free speech. Numerous experts were suspended or banned for challenging these very claims and the media labeled any such critics as dangerous or fringe figures. Regardless of your ultimate conclusions on the efficacy of masks, there was clearly a scientific basis to challenge the mask policies. Yet, many people were routinely censored on Twitter and other platforms for daring to challenge the official position on masks.

-

Bill’s commentary:

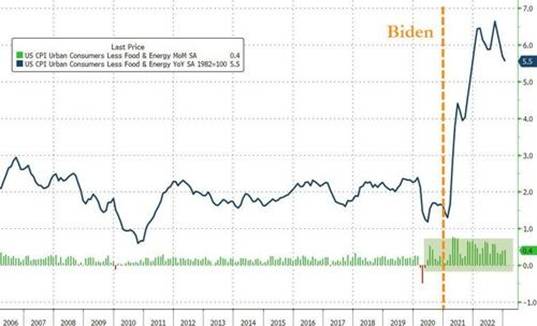

“Don’t worry, they told us inflation was only “transitory”?

‘If Tyranny and Oppression come to this land, it will be in the guise of fighting a foreign enemy.’ James Madison. (1751-1836).

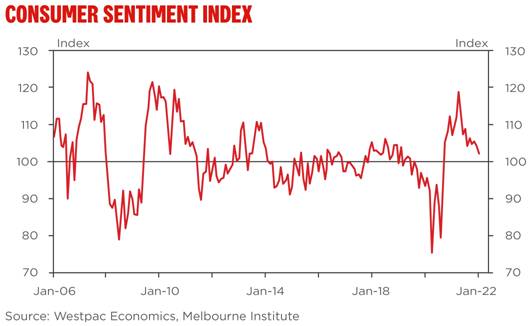

Intensifying War, Enormous Upside for Gold – Charles Nenner

Renowned geopolitical and financial cycle expert Charles Nenner said back in late November, interest rates were on the way down but “for the very short term.” Nenner also predicted that inflation might come down to around 6.5%. The latest CPI number clocked in this week at 6.4%. Nenner was right on both counts. Now, Nenner says inflation bottomed, and his cycle says prices for everything will go up from here. So, is the Fed going to do the so-called pivot and start lowering interest rates? Nenner says, “We are going up, not right away, but we are going up. You don’t hear the talk anymore that the Fed is going to lower rates because it is so ridiculous. If you are an insider, the Fed Funds Rate in the futures just made a new high. So, now everybody is expecting a much higher Fed Funds Rate than a few months ago. We are not out of trouble yet, and the bounce in stocks is almost over.“

-

Bill’s commentary:

“I believe this to be true!”

If they can get the masses to believe that God does not exist, then they can also take away our rights since there would be no rights-giver. I don’t care what issue we are facing here in this country, this is what it all boils down to: If we want Constitutional Rights, we must believe in the rights-giver. If we want to save this country, we’ve got to get the masses to believe in the one, true Creator of this world.

Bill’s commentary:

“Edward Snowden says ‘the pipeline’. I say yes, but how many other things does it provide cover for?”

Over the past week, there have been at least four instances of U.S. fighter jets destroying unidentified flying objects, in one case over Alaska, an object that had no means of propulsion but was spotted flying at 40,000 feet and pilots said interfered with the sensors of their aircraft.

Yesterday, the White House denied that the objects were extraterrestrial in nature, although the glib dismissal if anything only continued to feed into speculation online that ET had paid a flying visit.

In reality, as most people have pointed out, the shootdowns are likely a show of force to save the Biden administration’s blushes from questions as to why the Chinese spy balloon was allowed to monitor America in the first place.

-

Bill’s commentary:

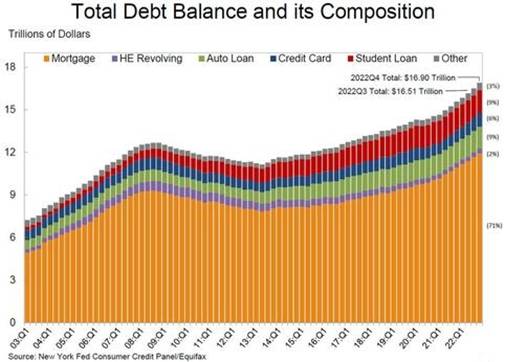

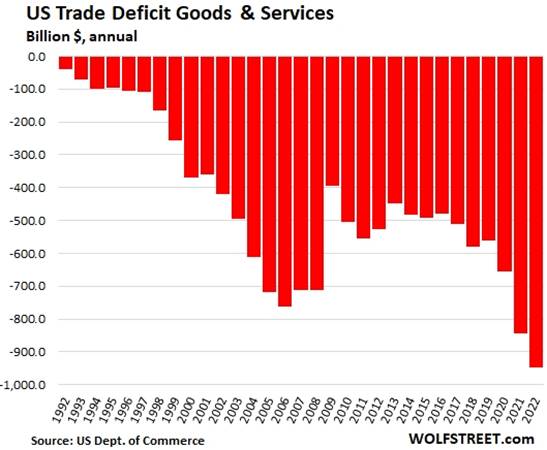

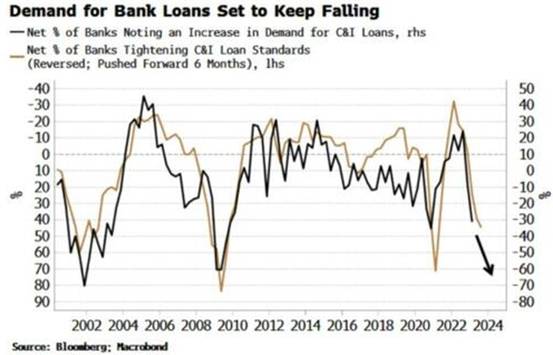

“Demand for bank loans is cratering and we know that Bretton Woods II has died. Will the Fed finally end up with the sum of all their fears, pushing on a string?”

‘A good politician is quite as unthinkable as an honest burglar.’ H. L. Mencken. (1880-1956).

Global Debt & Death Spiral

Analyst and financial writer John Rubino says we’re are in a “debt and death spiral” that will force dramatic changes on the world. Rubino explains, “The debt spiral part of this means things from here continue to get worse and worse for the big currencies of the world until they die. In other words, until people lose faith in them, refuse to use them and hold them anymore until their value falls to their intrinsic value, which is zero. That manifests to hyperinflation. The value of the currency falls as opposed to the things you buy with it. . . . Things feel basically okay for a long time as long as governments could force interest rates down to really low levels. The side effects of that are massive money creation and, eventually, inflation. That’s what we are dealing with now. So, here we go. Welcome to the end game for the world’s big currencies.

Bill’s commentary:

“The way I see it, school board meetings, city council meetings etc. have for the most part remained peaceful to this point. But what happens once the population looses vast swaths of wealth? Still peaceful?”

These videos now seem to be appearing every week. The footage shows the school board members of Pittsford Schools in New York attempting to prevent the mother from reading out the graphic material as she asks them what they are going to do about it.

-

‘If ‘con’ is the opposite of ‘pro,’ then what is the opposite of progress?’ Steven Wright. (1955- )

PS. Sorry about the delay; a paucity of good data! (like NYC!)

Bill’s commentary:

“What a shocker?”

Employees of Levi Strauss & Co repeatedly pummeled me with these questions during 2020-2022, when I was the company’s brand president. Why? I advocated in defense of children: against the masking of toddlers, against closed playgrounds and youth sports, for open public schools.

I’m not exactly sure what an anti-science person is. But that’s not me. I’m pro-science. And that’s why I’m anti-mask.

Given the findings from the recent Cochrane study, a meta-analysis summarizing seventy-eight studies including a million people, the science is now clear: “Face coverings make little to no difference” in Covid infection and fatality rates. Even when the hallowed N95 is worn.

Bill’s commentary:

“God blessed Texas!”

Banks and corporations should stay out of politics, just like government should stay out of business. But when one or the other crosses the line, the other side has to push back or roll over.

Texas Attorney General Ken Paxton and crew are pushing back.

Paxton’s office has deemed that Citigroup Inc. “discriminated against the firearms sector,” according to Reuters. Because of this, the banking giant was barred from underwriting most municipal bond offerings in the state.

-

Bill’s commentary:

“Another way of saying it is ‘all roads lead to gold.’”

Below we look at the interplay of embarrassing debt, dying currencies and failed monetary fantasies masquerading as policies to confirm that no matter how one turns or spins the inflation/deflation, QT/QE or recession/no-recession narratives, the global financial system is already doomed.

As I’ve been arguing in report after report, my view has been that the US, with its 125% debt-to-GDP and 7% deficit-to-GDP ratios, was, and already is, in a recession heading into 2023, despite official efforts in DC to re-define the very definition of a recession.

But a recession is still a recession, and an elephant is still an elephant, and both are fairly easy to see at a distance.

As of now, however, the recession has officially been avoided.

How comforting.

Bill’s commentary:

“Will this pushback around the world turn into blowback?”

Dr Masanori Fukushima, Professor Emeritus at Kyoto University, along with fellow scientists announces his lawsuit against the Japanese government.

-

Bill’s commentary:

“My money is on a Big BANG!”

Almost five years ago I wrote a blog post titled, “BANG: Why The Gold Miners Could Soon Make FANG Look Tame.” A reader recently reached out to ask if I would post an update so here it is. The chart below plots two custom indexes: FANG (META, AMZN, NFLX, GOOG) versus BANG (GOLD, AEM, NEM). Clearly, there has been some back and forth between the two with the BANG stocks taking the lead and holding it over the past year or so. Frankly, I’m surprised they haven’t done better but more on that in a bit. As for the FANG stocks, it’s pretty remarkable to see them generate essentially zero return as a group since mid-2018, even after their strong run-up to start the year.

Bill’s commentary:

“Seymour Hersh is well known for doing his homework before publishing. This is so, so bad on many levels!”

The U.S. Navy’s Diving and Salvage Center can be found in a location as obscure as its name—down what was once a country lane in rural Panama City, a now-booming resort city in the southwestern panhandle of Florida, 70 miles south of the Alabama border. The center’s complex is as nondescript as its location—a drab concrete post-World War II structure that has the look of a vocational high school on the west side of Chicago. A coin-operated laundromat and a dance school are across what is now a four-lane road.

Bill’s commentary:

“I wonder what their derivatives book looks like? …and who their counter parties are?”

Back in late 2022, when Credit Suisse stock cratered to never before seen levels after a series of dismal earnings reports and regulatory “missteps” sparked a staggering bank run, amounting to some $88 billion forcing the bank to seek emergency liquidity from the Fed via SNB swap lines, and which also led to a historic corporate restructuring which included the de facto closure of the bank’s investment bank coupled with mass layoffs and bonus cuts, many thought that would be as bad as it gets as the (rapidly changing) management had finally thrown out the kitchen sink.

Boy, were they wrong.

Bills’ commentary:

“It is far easier to fool someone than to convince them they have been fooled?”

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.