-

Bill’s commentary:

“Great idea but precious little time left to act!”

North Carolina House Republicans want the state to use some of its savings to buy gold bullion and bury it in Texas.

A group of House Republicans filed a bill in mid-April that would have the state use $2 billion from its savings reserve to buy gold bullion. The bill sat idle in the House Appropriations Committee until Thursday, when it was sent to the Committee on State Government. It’s set for a committee hearing Wednesday.

Bill’s commentary:

“Good stuff from our pal Dismal Dave!”

That government is best, which governs least.’ attr. Henry David Thoreau. (1872-1962).

Bill’s commentary:

“More to come?”

Yesterday, at 9:33 a.m. ET, JPMorgan Chase and the law firm Boies Schiller Flexner, issued a terse joint statement indicating that they had informed Judge Jed Rakoff’s federal court in Manhattan that claims against the bank for aiding and abetting Jeffrey Epstein’s sex-trafficking of underage girls had been settled by the two sides. The settlement will require court approval. -

Bill’s commentary:

“Isn’t this so in almost all professions …except these days it is present in almost none …”

Bill’s commentary:

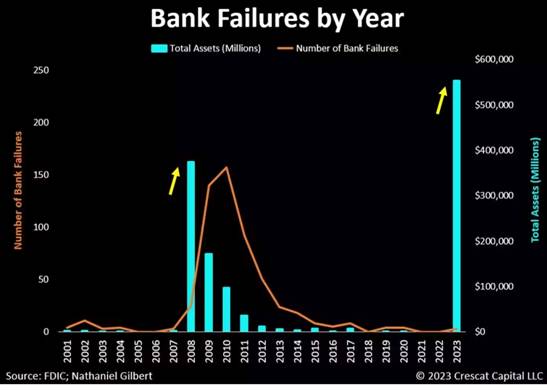

“$359 billion in one day and just few bank failures? No worries and party on dudes!”

‘By the time a man is wise enough to watch his step, he’s too old to go anywhere.’ Billy Crystal. (1948-)

-

Bill’s commentary:

“Do you like Sushi? I wonder what kind of ‘ESG’ score this will get since it is only radiation and not nasty fossil fuels?”

Bill’s commentary:

“Here comes the yuan!”

‘We are here on earth to do good unto others. What the others are here for, I have no idea.’ W.H. Auden. (1907-1973).

Bill’s commentary:

“For those who wonder, there is such a thing as a ‘silent majority’!”

Despite the best efforts of the media and the White House to promote a liberal agenda on issues from abortion to gender change, America has turned back to being more conservative.

Gallup’s latest Values and Beliefs Survey said that conservatives top liberals on social policies and the economy, the two biggest topics America is grappling with.

Bill’s commentary:

“Nearly 100 million views and counting! About the only thing he did not say, was we have turned into one giant shithole. Maybe in episode 2? I fear for this man’s life because the masses cannot be fed truth.”

Bill’s commentary:

“Or, they could just wait until the West is publicly bankrupted?”

Bill’s commentary:

“Cryptocurrency? In my opinion are nothing but digital air, but then again, some accuse me of being a dinosaur because I believe gold and silver are the only real ‘monies’ on the planet.”

It’s only June 7, but the liquidating, federally-insured, crypto-loving Silvergate Bank is having one helluva month. On June 1, the Federal Reserve released an enforcement action (called a Cease and Desist Consent Order) that it and a California banking regulator had filed against Silvergate Bank and its parent, Silvergate Capital Corporation. (See our report: Disgraced Silvergate Bank Hints It May Not Be Able to Cover All of Its Deposits; Fed Slaps It with a Cease and Desist Consent Order.)

-

Bill’s commentary:

“They sold it at a discount to 2005 prices? So the last 18 years was nothing but a mirage?”

Virginia-based REIT Park Hotels & Resorts has opted to cease payments on a $725 million loan, as the SF Business Times reports today, essentially surrendering over 2,900 hotel rooms and hospitality facilities to its lender. This includes the 1,921-room Hilton San Francisco Union Square, which is San Francisco’s largest hotel, occupying an entire city block, and one of the country’s largest hotels outside of Las Vegas.

Bill’s commentary:

“Target supports shutting down Mt. Rushmore? I support shutting down Target! It seems they have doubled, tripled, and now quadrupled down on STUPID!”

Since the George Floyd protests and riots of 2020, Target Corporation said it ramped up its diversity, equity and inclusion work. This agenda extended far beyond enhancing representation and support of historically marginalized groups externally and in its stores, and dipped into funding organizations with far-left and blatantly political agendas.

Bill’s commentary:

“Do you understand what this really means? You better become your own central bank pronto!”

As we reported yesterday, Silicon Valley Bank was not even on the “Problem Bank List” maintained by the Federal Deposit Insurance Corporation (FDIC) when it imploded in a span of 48 hours in March. According to testimony by the Federal Reserve’s Vice Chairman for Supervision, Michael Barr, on March 28 before the Senate Banking Committee, depositors had yanked $42 billion of their deposits from the bank on March 9 and had queued up to grab another $100 billion on March 10 when it was abruptly put into FDIC receivership. Had the FDIC not stepped in, Silicon Valley Bank would have lost 85 percent of its deposits in a two-day stretch.

Bill’s commentary:

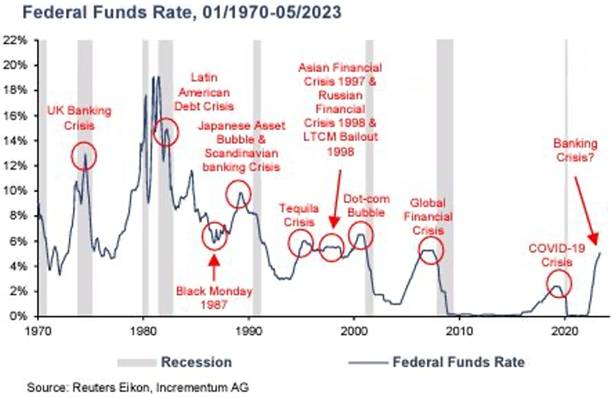

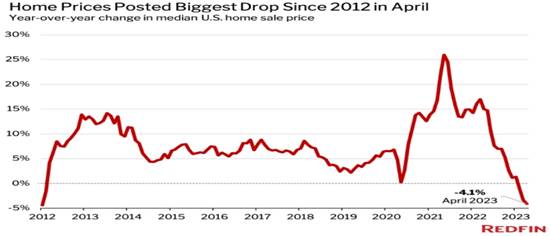

“The ability to refinance anything has come to end. What comes next is extremely predictable!”

As the federal government strives to contain financial market turmoil, the next risk looming over the nation’s banks is in plain sight: the $20 trillion commercial real estate market.

Some $1.5 trillion in mortgages will come due in the next two years, a potential time bomb as higher interest rates and spiraling office vacancies push down property values.

Bill’s commentary:

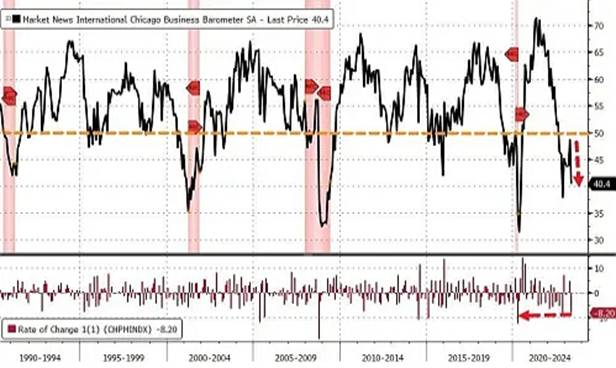

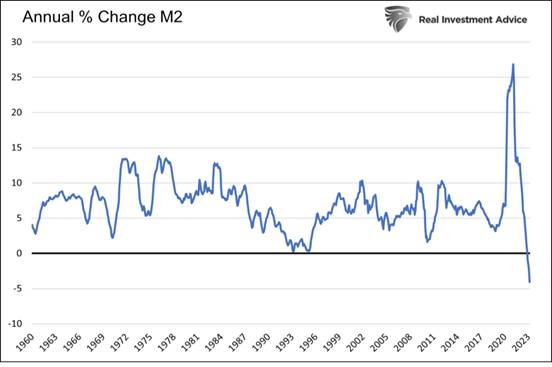

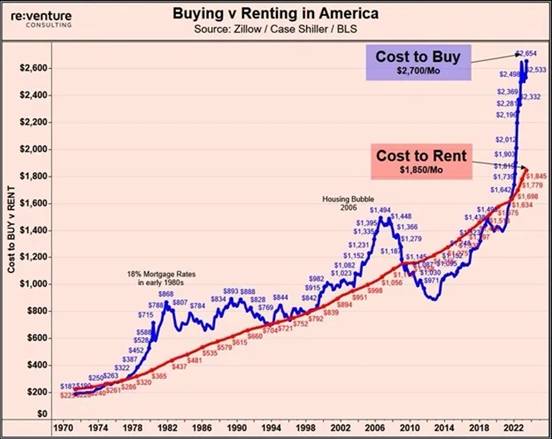

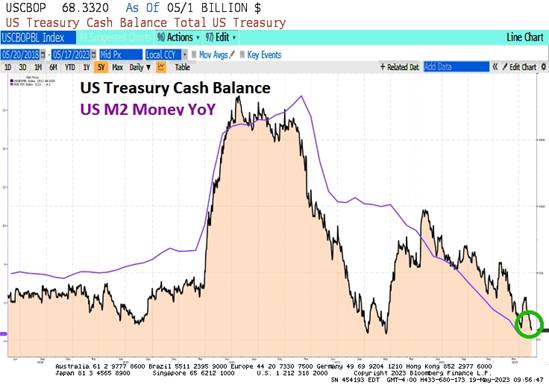

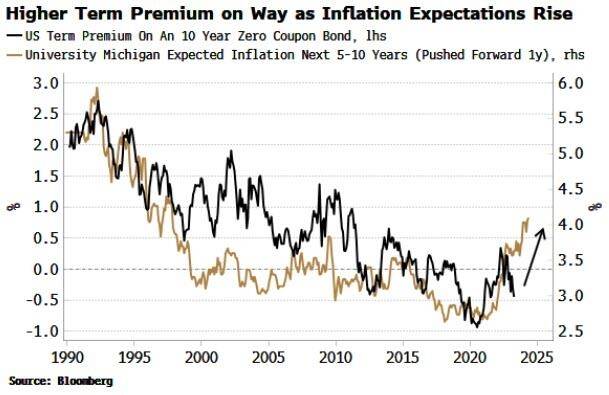

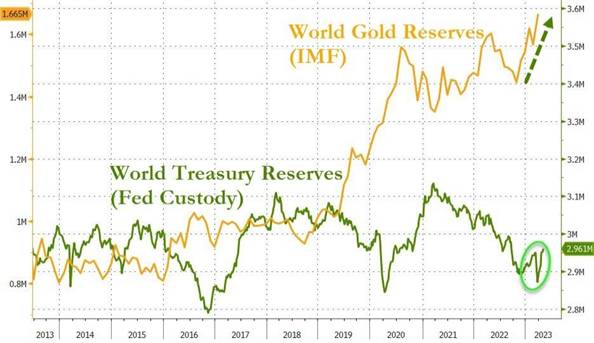

“More charts from our pal Dismal Dave.”

‘Capitalism without financial failure is not capitalism at all, but a kind of socialism for the rich.’ James Grant. (1946).

Bill’s commentary:

“Maybe little green men can take the focus off of “math” that just doesn’t add up?”

A former intelligence official turned whistleblower has given Congress and the Intelligence Community Inspector General extensive classified information about deeply covert programs that he says possess retrieved intact and partially intact craft of non-human origin.

Read more…

Bill’s commentary:

“More detective work from Wall Street on Parade!”

The second, third, and fourth largest bank failures in U.S. history occurred this year. And yet, none of the banks that blew up were on the “Problem Bank List” that is prepared quarterly by the federal bank regulator that is supposed to be on top of these things – the Federal Deposit Insurance Corporation (FDIC).

-

Bill’s commentary:

“Erik with an interesting read.”

Bill’s commentary:

“Dismal Dave with some ugly math.”

‘A bus station is where a bus stops. A train station is where a train stops. My desk is a work station.’ Dismal Dave. (Mind Your Own Business.)

Bill’s commentary:

“More bank problems…”

Last week, on Tuesday, May 23, the Federal Reserve and California Department of Financial Protection and Innovation (the state banking regulator) hit the collapsed federally-insured bank, Silvergate Bank, and its parent, Silvergate Capital Corporation, with an enforcement action called a “Cease and Desist Consent Order.” The action was not announced to the public until yesterday.

Bill’s commentary:

“Our pal Stanley on overnight rates and derivatives.”

On June 30, 2023 the financial world changes. On that date all contracts that were based on the LIBOR (London Interbank Offer Rate) that have not already switched, will begin using the SOFR (Secured Overnight Financing Rate) as the new standard rate on which to base financial contracts upon.

Bill’s commentary:

“Ooops!!!”

After much delay and legal protests by JPMorgan Chase, its Chairman and CEO, Jamie Dimon, was forced by a Manhattan federal court to testify under oath in a deposition about what he personally knew about the bank’s long-term customer relationship with child sex trafficker Jeffrey Epstein. (Epstein died in a Manhattan jail on August 10, 2019. His death was ruled a suicide by the medical examiner.)

-

Bill’s commentary:

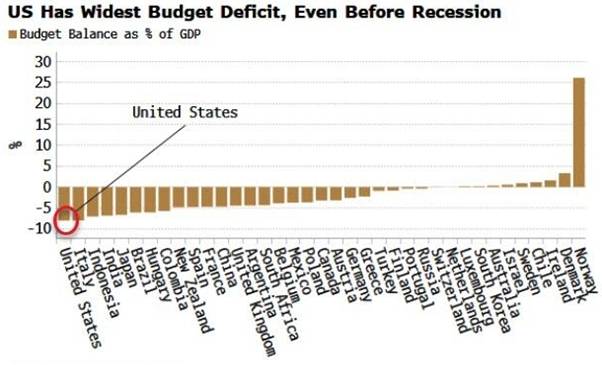

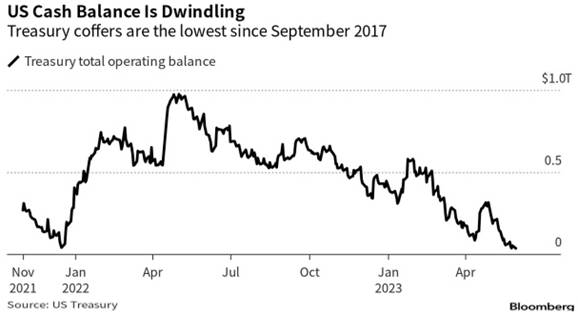

“Deficits never mattered …until here and now!”

Back in 2002, then-Vice President Dick Cheney claimed “Reagan proved deficits don’t matter” and went on to push for tax cuts combined with more federal spending. Indeed, the Bush administration would go on to push immense amounts of new spending, supporting a huge Medicare expansion and blowing hundreds of millions of dollars on costly and pointless occupations in Iraq and Afghanistan.

Bill’s commentary:

“Bravo Dave from Down Under! You killed it with this one. “Annual mortgage cost as a percentage of household income” and “Why rates can’t rise that much”. Debt service is exploding across the board and will expose the extreme nature of leverage up to and including The U.S. Treasury. The end of the road is here and now!”

Bill’s commentary:

Bill’s commentary:

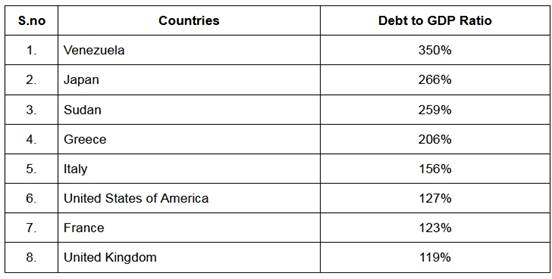

“Debt to GDP over 100% …can you say unpayable debt and Banana Republic?”

‘Remember ‘I’ before ‘E,’ except in Budweiser.’ Professor Irwin Corey. (1914-2017).

-

Bill’s commentary:

“Investigators investigating themselves? Surely we will get some real answers ..when hell freezes over?”

Unlike his three immediate predecessors who chaired the Federal Reserve (Janet Yellen, Ben Bernanke and Alan Greenspan), who all had doctoral degrees in economics, the current Fed Chairman, Jerome Powell, has a law degree from Georgetown University.

Bill’s commentary:

” OK, but who lent the money? This question will soon be asked in many parts of the world!”

Recent statistics from China’s central bank show that home buyers’ enthusiasm has fallen drastically. Despite price cuts and incentives, the world’s largest housing market continues to slump, and China’s banking sector is taking a hit on two fronts, as both defaults and prepayments rise. Meanwhile, China’s developers are starting to show the strain, with real estate giant Wanda Group making headlines this week as the value of its dollar bonds plunged.

-

Bill’s commentary:

“And you thought it was “your” money?”

A reader sent me this graphic which is circulating on social media. Whenever I see an unattributed image like this going around I want to verify it, lest it be photoshopped, a deep-fake or some derivation of “urban legend”.

Sure enough, if you go to NatWest bank’s website, right here – you see this cash withdrawal policy spelled out for all to see:

Bill’s commentary:

“Broke is broke!”

‘Society deserves equal protection from both the burglar and the banker.’ George Bernard Shaw. (1856-1950).

-

Bill’s commentary:

“They’re Taking America and System Down.”

Precious metals expert and financial writer Bill Holter is looking at what is going on with the financial system and says there is not really an effort to save it. Holter thinks the moves they are making are designed to take the financial system down, and along with it, they want America destroyed too.

Bill’s commentary:

“And again, how exactly do you starve a Ponzi scheme?”

The U.S. banking crisis, which has claimed a few victims since March, is the direct result of the Fed’s fight against high Inflation. Uncertainty about the health of regional banks and rising yields in the money market led to a steady outflow of deposits, bringing banks’ balance sheets to their knees.

Bill’s commentary:

“The new rocket science?”

The recent spate of bank failures is upending a long-held theory among banking executives and regulators—that the value of a lender’s deposit business goes up when interest rates move higher.

The theory rests on an assumption: That banks don’t have to pay depositors much to keep their money around, even as rates rise. The deposits would be a stable source of low-cost funding while the bank earned more money lending at higher rates.

-

Bill’s commentary:

“And a Fed dancing between 2 crocodiles: something gets eaten—the system or the dollar?”

Bill’s commentary:

“China wants to de-risk from the dollar. The G-7 wants to de-risk their supply chain with China. How is this going to work? Do you have any idea how destroyed the standard of living will be?”

Economic security was a major focus on the second day of the G-7 summit of leading industrial nations in Hiroshima, with leaders outlining actions to counter Beijing’s “economic coercion” and non-market practices.

The G-7 countries—the United States, the UK, Japan, Canada, Germany, France, and Italy—announced on May 20 their plan to address the “disturbing rise in incidents of economic coercion.”

Bill’s commentary:

“One must wonder what economic growth would look like if there were no ‘government interventions’?”

‘There is no more dangerous menace to civilization than a government of incompetent, corrupt, or vile men.’ Ludwig von Mises. (1881-1973).

Bill’s commentary:

“Wow, what a shocker! Now the question is, will WHO connect the obvious dots?”

UK authorities are investigating an “unusual” surge in severe myocarditis which has hit 15 babies in Wales and England and has killed at least one, the World Health Organization has announced.

On Tuesday, the WHO issued an alert that there had been a rise in “severe myocarditis” in newborns and infants between June 2022 and March 2023 in Wales and England.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.