-

Bills Commentary

Is Friday the 13th an unlucky day? I’m not sure, but it surely was not so lucky for the Knights Templar in France!

https://www.history.com/news/why-friday-the-13th-spelled-doom-for-the-knights-templar

-

Bills Comments

What she describes is merely “QE to infinity” …and only makes the problem that much bigger!

https://realinvestmentadvice.com/janet-yellen-suggests-much-lower-for-much-longer/

-

Bill is interviewed by Andrew Maguire.

-

Bills Commentary:

An increase of almost 2% in 20 days? Oh my, the slippery slope!

“The White House has been pressing Congress to lift the limit. On June 3, President Joe Biden signed a bipartisan debt bill that allowed the limit to be lifted until January 2025, thus averting an economically disastrous default.…”

https://www.rt.com/business/584657-us-national-debt-surge-record/

-

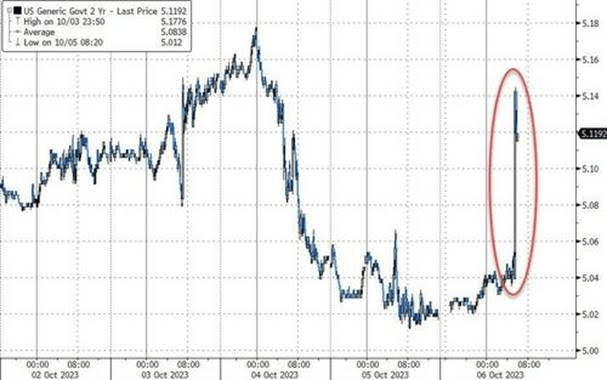

Bills Commentary :

The last time rates were this high, the amount of debt outstanding was less than 30% of what is outstanding today …what could possibly go wrong?

-

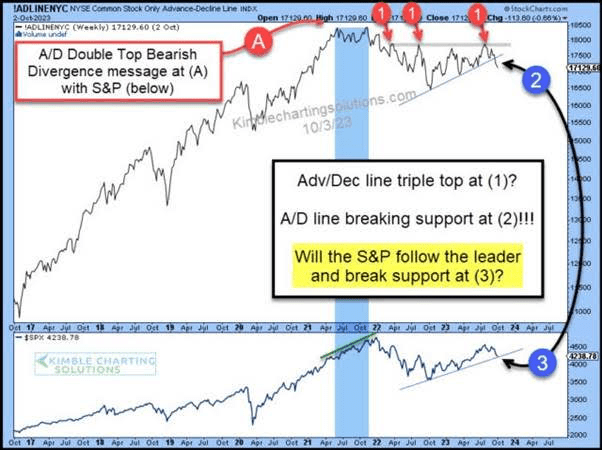

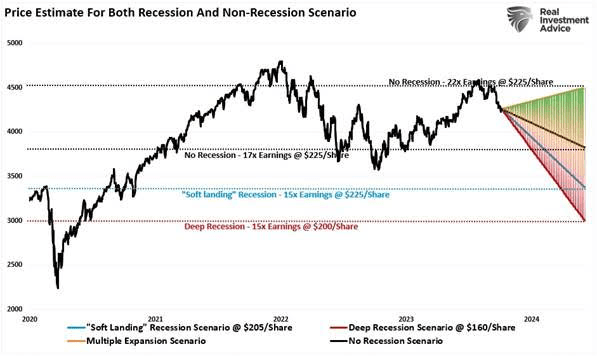

Bills Commentary :

About right?

-

Bills Commentary:

I think Erik was a little irritated while writing this?

-

Bills Commentary:

SURPRISE!!!

Please click the link to view the quick video !

-

Bills Commentary :

Pretty amazing what can happen in “72 hours”?

https://www.timesofisrael.com/liveblog_entry/home-front-command-advice-sparks-run-on-supermarkets/

“The panic-buying spree comes despite attempts by the IDF to assure Israelis that the advice is standard and simply a reminder, not a prediction of what a looming war will bring…”

-

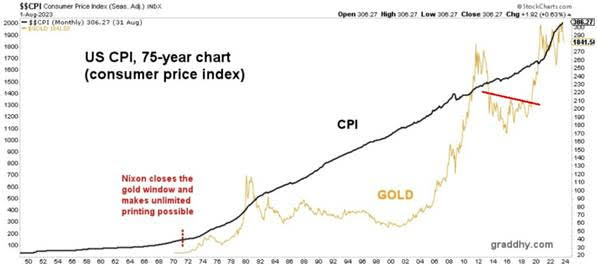

Bills Commentary :

In memory of Jim Sinclair, Mr. Gold.

It is with a sad heart to announce that my friend, business partner and mentor Jim Sinclair passed away last Friday. He was a font of knowledge and gladly gave this knowledge away to anyone willing to listen and connect the dots. Jim had a storied career in global finance, and always knew that in the end, all monetary roads led right back to gold. I am especially sad that he left us just as his final deal, TRX, became solid and into commercial production. He believed this would be his largest by orders of magnitude and devoted his final years to its success. “Mr.Gold” will be missed by more people than he knew. RIP James E. Sinclair (Seligman).

TRX Gold Announces Passing of Founder and Chairman James E. Sinclair  TORONTO, Ontario, October 9, 2023 – TRX Gold Corporation (TSX: TNX) (NYSE American: TRX) (the “Company” or “TRX Gold”) is deeply saddened to announce the passing of its founder and Chairman James E. Sinclair on October 6, 2023, at the age 82. James passed away peacefully at home in Connecticut, U.S.A.

TORONTO, Ontario, October 9, 2023 – TRX Gold Corporation (TSX: TNX) (NYSE American: TRX) (the “Company” or “TRX Gold”) is deeply saddened to announce the passing of its founder and Chairman James E. Sinclair on October 6, 2023, at the age 82. James passed away peacefully at home in Connecticut, U.S.A.

James founded TRX Gold and acted as Chairman and Director since 2000. His belief in Tanzania as a gold-rich landscape, in the ability and talent of the region’s people, and the openness of Tanzanian government to foreign investors, formed the basis for his perseverance in unlocking the Buckreef Gold Project’s potential. Until his final moments, James acted as a supporter, mentor and point of reference.

“This is a great loss and moment of sadness for all of us at TRX Gold and the Buckreef Gold Project. On behalf of the Company and its Board of Directors, we wish to offer Mr. Sinclair’s family our sincerest condolences. James was always positive and forward-looking and was excited by the trajectory of the Company. He was a tenacious, hard driving individual who challenged everyone around him to move forward and be better. We will continue to build on our current successes and his substantial legacy,” explains Stephen Mullowney, TRX Gold Chief Executive Officer.

To those outside of the Company, James was perhaps best known as “Mr. Gold”, being a true believer in the value of gold and its ability to generate and preserve wealth. He is remembered for boldly and accurately predicting that the price of gold would rise from $150 per troy ounce to $900 per troy ounce, between 1977 and 1980. He led a successful career as a precious metals specialist, market maker, and commodities and foreign currency trader. He was the original founder and explorer of the Bulyanhulu mine through Sutton Resources, which is one of the most productive gold mines in Tanzania to this day. He was a notable author and commentator on topics such as precious metals, trading strategies, geopolitical events and global markets. Incredibly, through the ups and downs of the financial markets, his audience has remained faithful over the last two decades and more.

His memory lives on with more than 500 TRX Gold and Buckreef Gold employees and contractors on two continents, as well as the countless individuals he touched through his work around the world.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.