-

Bill’s commentary:

“I guess it can be summed up this way; those who are vaxxed, absolutely do NOT want to know the answer!”

It’s been four months since I sent out a warning on Twitter about the hidden iceberg that America has hit — the iceberg that’s called Operation Warp Speed.

Bill’s commentary:

“What could possibly go wrong? Everything!”

Today, the U.S. Senate Banking Committee will call federal banking regulators before it to testify at a hearing at 10 a.m. The underlying theme will be why these regulators were caught napping when the second, third, and fourth largest bank failures in U.S. history occurred in a span of seven weeks this past Spring and hear about the new plans of action to restore confidence in the U.S. banking system.

Bill’s commentary:

“Very sad that sanity has been trashed. I guess the question is this, can the world find the mind it lost …in time, or do we go down the drain in demented fashion? “

It’s been a continuing mystery for three years, at least to me but many others too. In October 2020, in the midst of a genuine crisis, three scientists made a very short statement of highly public health wisdom, a summary of what everyone in the profession, apart from a few oddballs, believed only a year earlier. The astonishing frenzy of denunciation following that document’s release was on a level I’ve never seen before, reaching to the highest levels of government and flowing through the whole of media and tech. It was mind-boggling.

Bill’s commentary:

“Guns don’t kill people, people kill people! Next time your Liberal ‘acquaintance’ starts spouting bullshit regarding guns, you might want to show them these statistics?”

Where does your state rank in gun ownership? We analyzed all 50 states, gun ownership rates, and ownership percentages to bring you this article. Of course, we’ve also included the answers to some of your most burning questions about gun control, ownership, and crime.

Bill’s commentary:

“I believe he is saying what many of us feel deep down in our guts!”

I am 94 years old and like many of you, I am exhausted by politics and saddened by what I see happening to America. I had hoped it was time for me to move to the sidelines and let younger generations continue the fight to preserve America’s founding freedoms and values. But, like so many of us, I realized that I could not let myself walk away; the stakes are just too high.

-

Bill’s commentary:

“An excellent interview re the situation in Israel. This is not “opinion” on who is right and who is wrong, it is about ramifications and potential outcomes. Well worth your time to watch!”

Bill’s commentary:

“Have you ever wondered what your ‘net worth’ and more importantly your ability to survive will be should an aircraft carrier get smoked? As the late Jim Sinclair always said, if you can’t catch it you can’t kill it. I would simply ask, who has hypersonic weapons and who does not …?”

Powerful Russian anti-ship missiles acquired by Hezbollah give it the means to deliver on its leader’s veiled threat against U.S. warships and underline the grave risks of any regional war, sources familiar with the group’s arsenal say.

Bill’s commentary:

“This would be Friday humor but it is not, and a reason not to send your kids to college. Does this asshole suggest hiring a legion of Dr. Doolittles to make sure it is ‘consensual’?”

On Wednesday, a professor at Princeton University tweeted that he considered the idea of humans having sex with animals to be “thought-provoking.”

According to the Daily Caller, Peter Singer is a bioethics professor at Princeton’s University Center for Human Values. He also describes himself as an animal rights activist, having written such books as “Why Vegan? Eating Ethically,” and “Animal Liberation Now.”

Bill’s commentary:

“Gee, what could possibly explain this?”

Executives at the largest insurance companies in the United States are alarmed that teenagers, young and white-collar Americans in the prime of life are inexplicably dying at a record pace, causing a “monumental outflow” of death claims and drag on profits that is shaking the industry and causing some to take a fresh look at the problem.

According to an Oct. 26 report in InsuranceNewsNet, U.S. insurance companies expected higher-than-normal payouts from excess deaths during the COVID-19 pandemic.

Read more…

Bill’s commentary:

“Is this what happens when your “credit card” is cancelled?”

With war funding for both Ukraine and Israel now seemingly snarled up beyond repair in Congress, on Thursday the Pentagon said that funding delays have forced the US to begin restricting the flow of military assistance to Ukraine, and the Pentagon has only $1 billion left to replenish stocks of weapons that were sent to the country, according to a spokeswoman.

“We have had to meter out our support for Ukraine,” Deputy Pentagon spokeswoman Sabrina Singh told reporters. “We’re going to continue to roll out packages but they are getting smaller.”

Bill’s commentary:

“Say it isn’t so? I am crushed, Grandpa was front running trades? Why? Did he not already make enough money in his lifetime? If I was not already totally disappointed in humanity, this is icing on that cake… maybe it’s only fake news?”

Bill’s commentary:

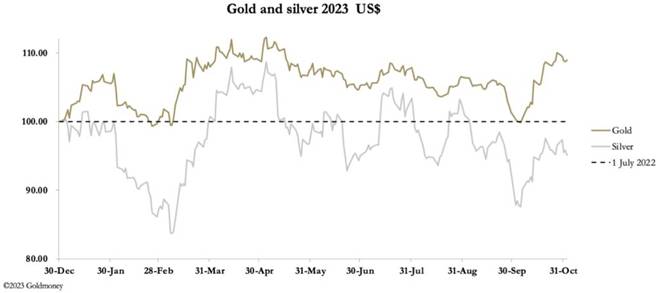

“The answer to this is very simple. When the common man (globally) understands that dollars are issued by an insolvent entity, untold trillion$ will be lost worldwide. The end.”

Financial statements of the US Federal Reserve, which consists of the board of governors in Washington and twelve district reserve banks across the country, indicate that the consolidated system has generated both capital and operating losses for the past couple of years. The Fed was created in 1913 to issue and circulate an “elastic currency” that could respond to consumers’ demand for cash, end bank runs known then as “money panics,” and serve as a “lender of last resort” to the nation’s commercial banks. How is it possible that the Fed could be losing money after one hundred years of operation?

Bill’s commentary:

“Already worse than 2008 …and no tools to fix anything this time around? Make sure your seatbelts are securely fastened!”

Yesterday, the regulator of the Federal Home Loan Bank system, the Federal Housing Finance Agency (FHFA), released a report on its recommended changes going forward. The report was in response to the questionable conduct of the Federal Home Loan Banks in the leadup to the banking crisis this past spring.

Bill’s commentary:

“As I have written several times, Israel/Hamas is another divisive subject just as left/right, gay/straight, black/white etc. Everyone has their own opinion on each and every topic which means the odds of meeting your own “mental clone” on all topics is nearly impossible. I feel Erik’s frustration in losing subscribers. We lost 30% of our subscribers after the 2016 election because we believed Trump was a better choice than Hillary from every perspective we looked at. We, I, learned a valuable lesson back then. When a topic is so divisive (as is Israel/Hamas), it is better to lay out possible financial outcomes to the variable circumstances. Everyone has an “opinion” …but they are just that, OPINIONS. What matters in my opinion, is how various outcomes affect readers personally (and financially). For example, what happens to the global financial system should Israel win or lose? How about the dollar and reputation of the US? Yes it is a shame that innocents are being killed, but no one can save them by choosing sides and offering opinion. Innocent (and naive) investors however can be saved with ideas on how to protect assets/livelihoods based on different or probable outcomes of divisive topics. All I can offer to Erik is welcome to my world! Rather than choose a side, offer ideas/opinions after connecting some dots as to what may take place? Choosing sides without solutions or actionable plans to protect oneself is just that, choosing sides. Loosing subscribers is unfortunately the only outcome when choosing sides, more so in today’s polarized world than ever before…”

-

Bill’s commentary:

“This is no different than what the US has done. Please read the book ‘Confessions of an economic hitman’ to fully understand the model of plunder.”

A report released on Monday by AidData noted that China finds itself in the unfamiliar role of being the world’s largest official debt collector, with a total outstanding debt (including principal but excluding interest) of at least USD 1.1 trillion owed by borrowers in the developing world to China.

Bill’s commentary:

“Just a ‘little’ more supply in an already crushed market?”

Office-sharing company WeWork filed for Chapter 11 bankruptcy protection in New Jersey federal court Monday, saying that it had entered into agreements with the vast majority of its secured note holders and that it intended to trim “non-operational” leases.

The bankruptcy filing is limited to WeWork’s locations in the U.S. and Canada, the company said in a press release. WeWork reported total debts of $18.65 billion against total assets of $15.06 billion in an initial filing.

Bill’s commentary:

“Yes, ‘safe and effective’!”

Executives at the largest insurance companies in the United States are alarmed that teenagers, young and white-collar Americans in the prime of life are inexplicably dying at a record pace, causing a “monumental outflow” of death claims and drag on profits that is shaking the industry and causing some to take a fresh look at the problem.

Bill’s commentary:

“Amongst many other reasons …”

By the summer of 1812, Napoleon still thought of himself as nearly invincible. He had conquered nearly all of Europe with relative ease and brought the continent’s remaining rulers under his control. He had personally lost just a single battle.

And his chief nemesis, Great Britain, had just been dragged into a new war with its former colony, the United States.

-

Bill’s commentary:

“‘Discovered’? You mean someone actually looked? Imagine what they would find in the US?”

“Amidst market turmoil, we’ve discovered massive illegal naked short-selling by global investment banks and circumstances of additional illegal activities,” Financial Services Commission Chairman Kim Joo-hyun told a briefing. “It’s a grave situation where illegal short-selling undermines fair price formation and hurts market confidence.”

Bill’s commentary:

“Must be some of real substance to have a ‘news blackout’?”

There are extremely strange things happening in a very high-profile federal court case in Manhattan where the largest bank in the United States, JPMorgan Chase, stands accused by victims of facilitating Jeffrey Epstein’s sex-trafficking ring that sexually abused minors as the bank doled out $40,000 to $80,000 a month in hard cash for more than a decade without filing the legally required Suspicious Activity Reports.

Bill’s commentary:

“It’s what they do …and why you have them!”

Bill’s commentary:

“It is only a matter of time …”

By Joe Sullivan, a senior advisor at the Lindsey Group and a former special advisor and staff economist at the White House Council of Economic Advisers during the Trump administration.

The wake of the BRICS summit splashes into a world much riper for de-dollarization now than it was even six months ago. BRICS, now BRICS+ due to the admission of new members, deserves only partial credit. In the last six months, tectonic shifts in China’s economy and in Washington have cleared the path for de-dollarization—an open route that BRICS+ can now step into.

Bill’s commentary:

“Some more ugliness from our pal Dismal Dave.”

“How does a recession happen?” “Slowly, and then all at once.”

“Bill, who could have seen this coming? I only said every Saturday it was going to go bust.

The firm signed office leases for 10 to 20 years, freshened up the space and generated buzz with perks such as free beer on tap to attract younger workers. As of June, WeWork was paying over $2.7 billion a year in rent and interest—more than 80% of its entire revenue, according to company filings. Its total losses since founding topped $16 billion as of June, as it churned through all the money it raised from top investors and lenders over the past decade.

So what does this say about how stupid these top investors are, very stupid?

Wall street is a ponzi!”

– Dave

Bill’s commentary:

“David, you have been spot on since we met in 1999, you will soon get paid very handsomely for being the quintessential ‘My cousin Vinny’. People who have never listened to you do not know what they missed!”

WeWork rode the wave of the venture-capital frenzy, building a global real-estate empire worth more than any other U.S. startup before buckling and laying off thousands when funding ran dry under its turbulent co-founder and former chief executive Adam Neumann.

Ultimately, though, it was a historic office market bust that doomed the desk-rental giant.

-

Bill’s commentary:

“Silver lining? China’s property market, and by extension the debt carried by this sector, could be exactly what sparks the wildfire of debt implosion worldwide…”

China’s housing market is still struggling. Outstanding loans to the property sector fell on a yearly basis for the first time on record as consumers opt against buying homes.

The all-important sector clearly needs more support. But Beijing’s strategy is to shift resources from speculative sectors to more productive industries. In that sense, the difficult rebalancing is going according to the plan.

Bill’s commentary:

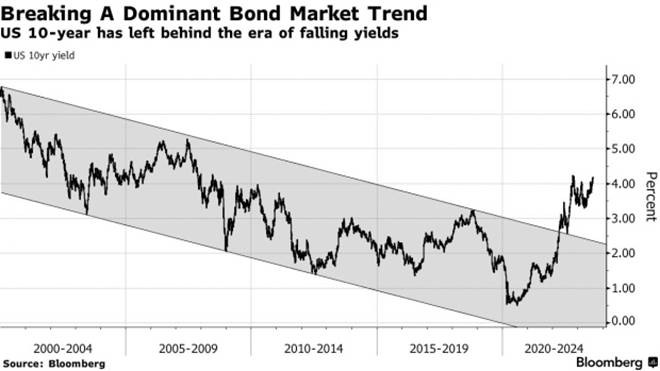

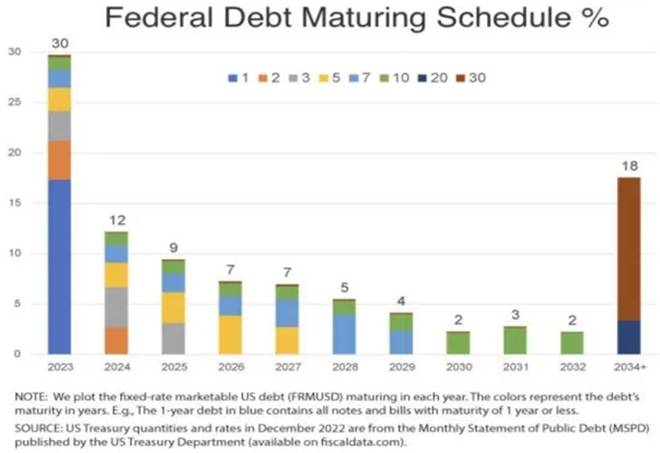

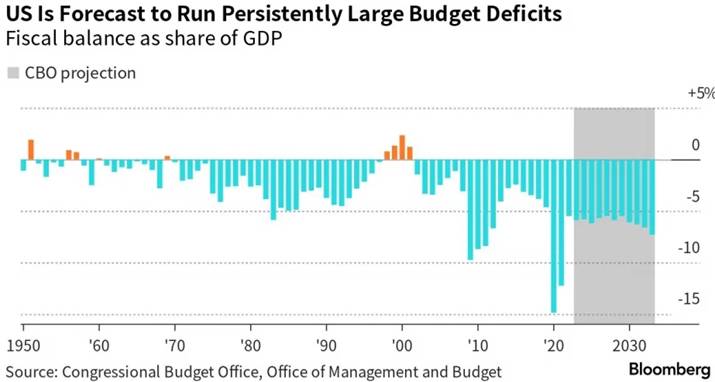

“”Debt service” kills!”

‘If ever again our nation stumbles upon unfunded paper, it shall surely be like death to our body politic. This country will crash.’ George Washington. (1732-1799).

Bill’s commentary:

“Is it possible there can actually be a cold day in hell? It doesn’t matter, the world already knows that Western central banks are insolvent. This is fact as interest rates have destroyed their balance sheets…”

-

Bill’s commentary:

“Why? Do they know something we don’t?”

Alright, before we get into why this shit is surprising to me, I wanna lay the groundwork for the responsibilities of the US Central Command. From the government website:

Mission: USCENTCOM directs and enables military operations and activities with allies and partners to increase regional security and stability in support of enduring U.S. interests.

Command Priorities:

1. Deter Iran

2. Counter Violent Extremist Organizations

3. Compete Strategically

– Regional Constructs

– Integrated Air and Missile Defense/ Counter Unmanned Aerial systems

All those things sound relevant given the disasters that are dominating the news and the globe.

The area that CENTCOM polices is one that is at high alert right now and well, kinda always. Check out some of the countries listed here.

Bill’s commentary:

“How funny, I just recently decided to name my new dog ‘Karma’?”

Alameda County District Attorney Pamela Price is no stranger to controversy. She raised eyebrows after she received at least $130,000 from George Soros during her failed 2018 election bid, then won in 2022 on a campaign of radical criminal reforms for the Oakland area. Her primary position? That minorities are disproportionately targeted by law enforcement and the criminal court system and that “equity” policies would stop the rising crime rate.

-

Bill’s commentary:

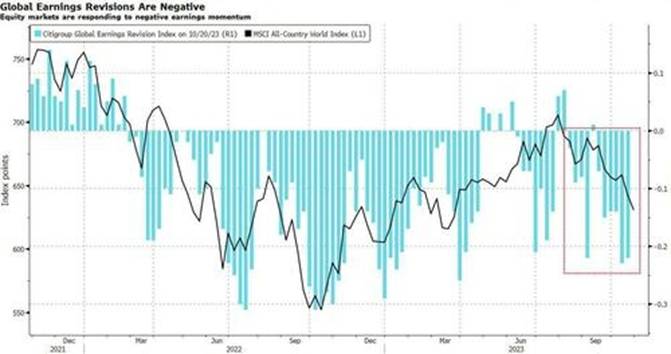

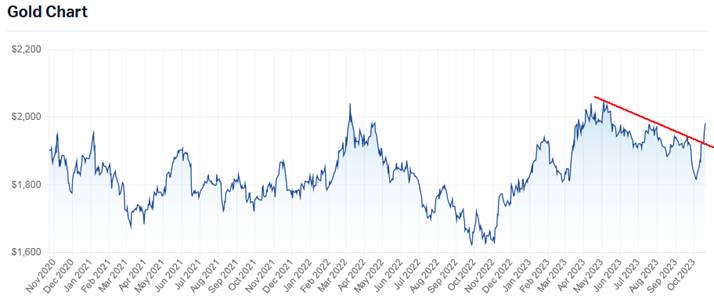

“That last picture truly puts the shitter to good use! The charts are pretty good too…”

‘Experience is simply the name we give our mistakes.’ Oscar Wilde. (1854-1900).

Bill’s commentary:

“A well done article and worth your time to read and understand.”

Our classics teacher at Groton reminded us daily that every μεν has its δε. The first

of these ancient Greek words means “on one hand” and the latter “on the other hand.”

Especially in later, philosophical texts, quite a number of words could pass between

those two words, but there could never be one without the other. The instruction was

both a linguistic law and life lesson, one that the Greeks knew well.Bill’s commentary:

“Whether they do care or don’t, it doesn’t matter …because they WILL!”

How many of you out there have experienced this? You are having a conversation with a normie friend (if any of you have any of those left, friends who are normies) and you are doing really well with all the evidence you have gathered about the New World Order, the WEF, the bent on transhumanism from the global-wannabe-world-leader-technocrats, and all of the other things that are clearly obvious. And then whomever you are talking too really can’t come up with any sort of viable counterpoints and they just shake their head and say, “So what?”

“The latest is called ‘CV19 mRNA Vaccines Were Meant to Harm & Kill People’ – Dr. Michael Palmer.”

Dr. Michael Palmer MD was a biochemistry professor at University of Waterloo, Ontario, Canada, and was fired from his job in 2022 when he refused the CV19 so-called “vaccine.” He now helps run Doctors4CovidEthics.org.

Bill’s commentary:

“Unfortunately, Erik is not far off the mark…”

-

Bill’s commentary:

“Do you remember 2 years ago when you pushed back against the jab …and all you could hear was ‘just do the right thing’? Guess what …YOU DID! “

New Zealand is a small country yet it often serves as a useful microcosm of events in other parts of the world.

At present men and women are being slaughtered.

Within the last few days Liz Gunn, head of NZ Loyal, one of the few political parties willing to speak out revealed leaked documents indicating that tens of thousands of the population have died from the experimental gene therapy. If you appreciate that the population of New Zealand is just 5 million it gives some idea of the scale of the slaughter. In one clinic in one day 30 people were given the jab. All 30 are now dead.

Bill’s commentary:

“HAPPY BIRTHDAY Dismal Dave, you earned it!”

‘I can see now that my main trouble was my failure to grasp the vital difference between stock gambling and stock speculation.’ Jesse Livermore.

– note:

Bit of a heads-up, folks. Whilst my pale, undernourished body continues to heal gradually, a certain significant event looms large; my birthday! Y’see, on Wed. week, I will attain a significant personal milestone; on that day, I will reach a perfect cricket score…80 not out! (fingers crossed!)

Starting tomorrow, the family begins to assemble and the celebrations will begin. Woo Hoo!

I mention all this because it will probably have a detrimental affect on my dismal output! Sorry.

However, feel free to raise a glass, or two, in acknowledgement of the event.

Sooo envious, given my alcohol-free restrictions at the moment @#$%.

FYI…

Quite right!

Bill’s commentary:

“Erik with today’s ‘normal’ reality that would have been total science fiction just a few short years ago.”

Bill’s commentary:

“In today’s world, anywhere that credit does not flow freely will fail with real world ramifications …”

Access to financing has become more complicated for oil refiners as banks are increasingly looking to reduce their exposure to fossil fuel projects, according to refining executives.

“If you have the word ‘refinery’ anywhere in your title, you’re not going to get finance,” Alwyn Bowden, chief executive officer of Malaysia’s Pengerang Energy Complex, said at an industry conference, as quoted by Bloomberg.

Banks are also increasingly demanding emission-cutting targets from the oil refiners seeking financing, Bowden noted.

Bill’s commentary:

“The real question is, “who” bails out the central banks? Then of course, who bails out the ‘bailers’?”

Two weeks ago we reminded the world that thanks to soaring interest rates, which will only keep rising until the Fed figures out what “big-enough” crisis it uses to trigger QEx+1, the staggering losses on global fixed income securities which according to the IIF amount to $307 trillion – as calculated by DB’s Jim Reid – have risen to a staggering $107 trillion. And while thanks to such facilities as the BTFP much of the MTM risk has been transferred (if only for the time being) away from commercial banks and to the Fed, the cumulative losses at central banks are now absolutely staggering, starting with the biggest and baddest one of all, where the Fed operating loss is now $111 billion and rising with every day that the Fed pays out more in interest to banks (excess reserves) and money markets (reverse repos) than it collects on its bond portfolio…

-

Bill’s commentary:

“No problem, Janet Yellen can cover it!”

Last Friday, the Federal Reserve published its Financial Stability Report, which takes a detailed look at U.S. financial stability through the second quarter of this year. Although the Fed does its best to put a rosy glow on the outlook, it’s not a pretty picture.

-

Bill’s commentary:

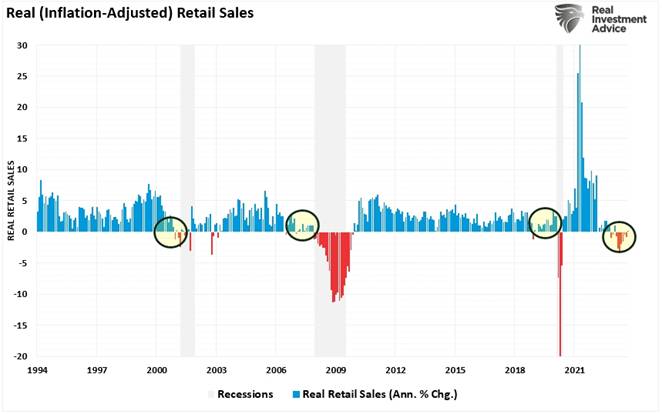

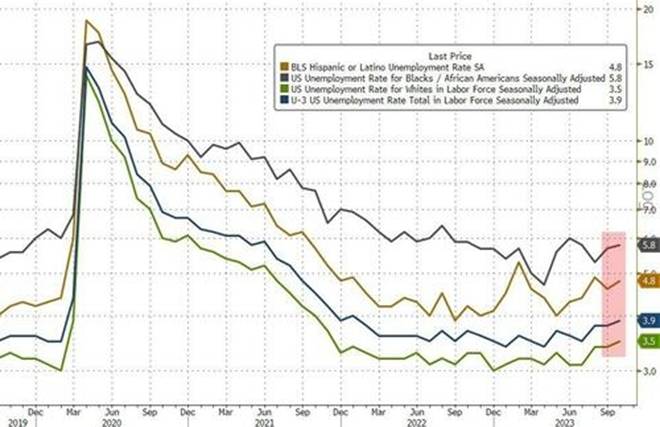

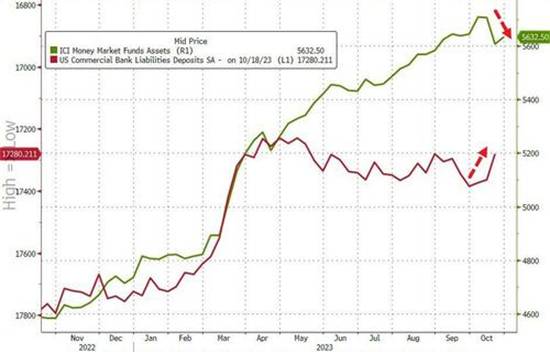

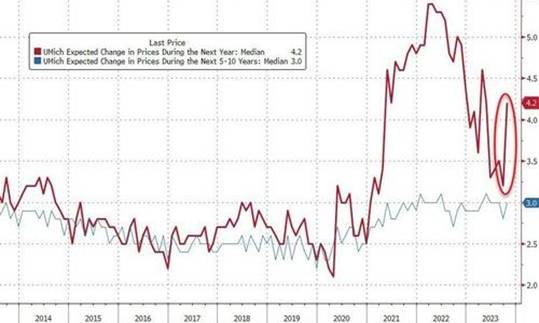

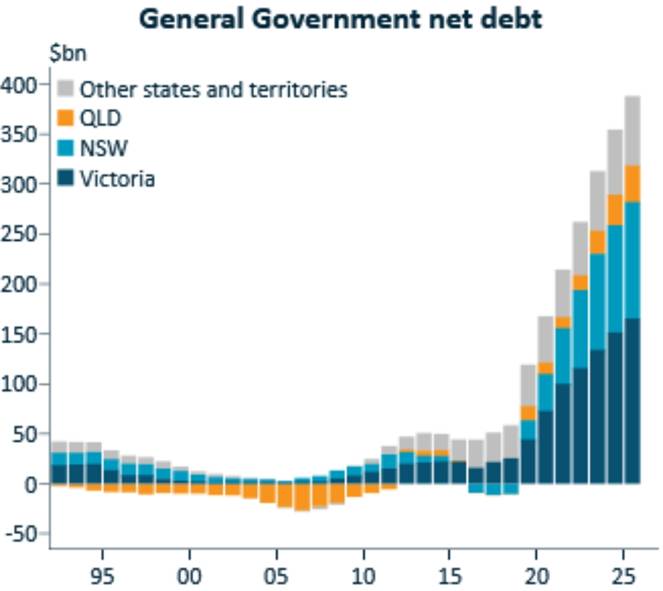

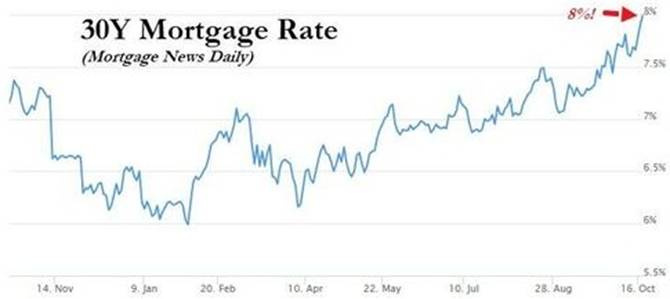

“Charts from our pal down under.”

‘Most successful investors, in fact, do nothing most of the time.’ Jim Rogers. (read much, Jim?)

Bill’s commentary:

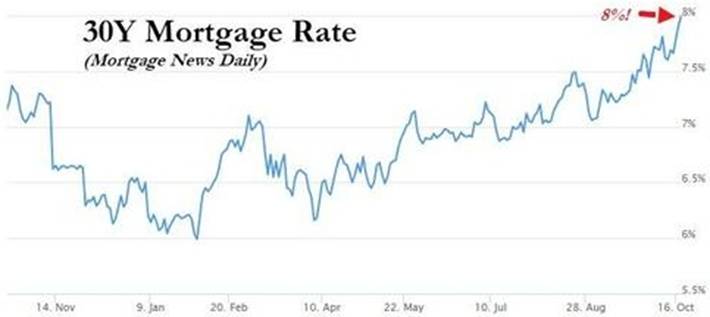

“The commercial real estate market has already crashed and the housing market has frozen solid. Your 401k/brokerage statements don’t show this …yet, just wait a short time!”

Soaring interest rates and a slide in bank lending following March’s regional banking meltdown have pressured the commercial real estate sector, especially office towers nationwide. But the stress might be spreading as a new report warns one of San Francisco’s largest apartment buildings has sustained a near 50% collapse in valuation in just five years, with risks of imminent default.

Bill’s commentary:

“And you thought banking problems were over? Naw, just temporarily swept under the rug…”

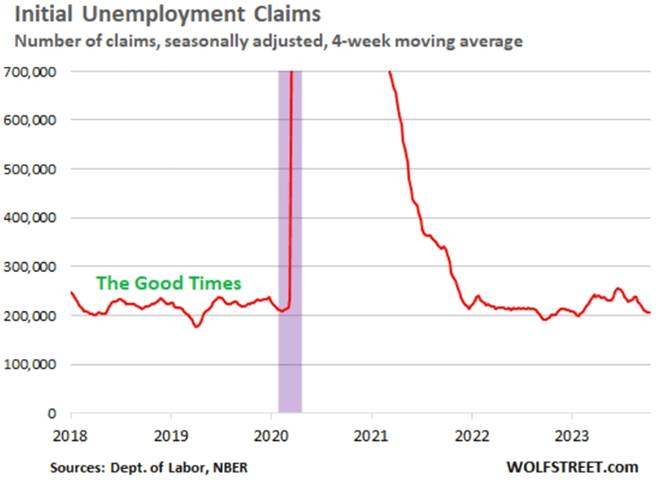

As the chart above indicates, Friday was not a good day to own regional bank stocks. The percentage declines are just for the one day of trading on Friday — not the year-to-date percentage losses. After the bank runs this past spring at regional banks brought on the second, third and fourth largest bank failures in U.S. history, things had quieted down in recent months. Then, along came earnings announcements last week, showing renewed struggles among the regional banks.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.