-

Bill’s Commentary:

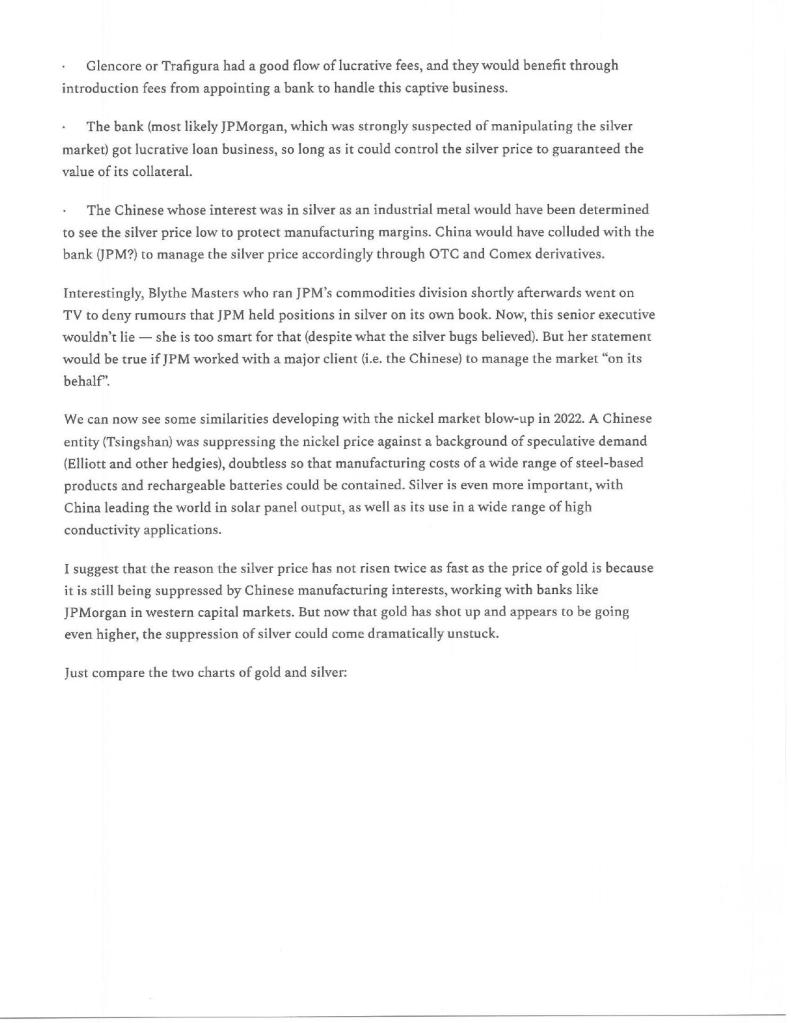

“From Alasdair Macleod. The answer to the title is ‘Yes, and on anabolic steroids’. The crackup two years ago in the Nickel market will pale in comparison to the upcoming silver fiasco!”

Bill’s Commentary:

“Don’t worry, the CRASH will be “transitory”!”

“According to data released by the Federal Home Loan Banks for the quarter ending December 31, 2023, it is not just small or medium size banks that are tapping advances from the FHLBs. As of that date, the top three borrowers were the following: JPMorgan Chase, the largest bank in the U.S., had outstanding FHLB advances of $41.7 billion. Wells Fargo and PNC Bank each took second place with advances of $38 billion each.”

During Spring Bank Panic of 2023, Liquidity Advances From FHLBs Topped Those of Q4 2008, When Wall Street was in Collapse

According to data from the Federal Deposit Insurance Corporation, and using a graph from the St. Louis Fed above, the liquidity crisis among banks in the spring of last year was far more dramatic than has been acknowledged by banking regulators.

According to the data, during the worst financial crisis since the Great Depression (at the end of the fourth quarter of 2008 when Wall Street was in a state of collapse), banks had borrowed a total of $790 billion in advances from Federal Home Loan Banks (FHLBs). But during the bank panic in the spring of last year, those FHLB advances topped the Q4 2008 number, registering $804 billion as of March 31, 2023.

-

Bill’s Commentary:

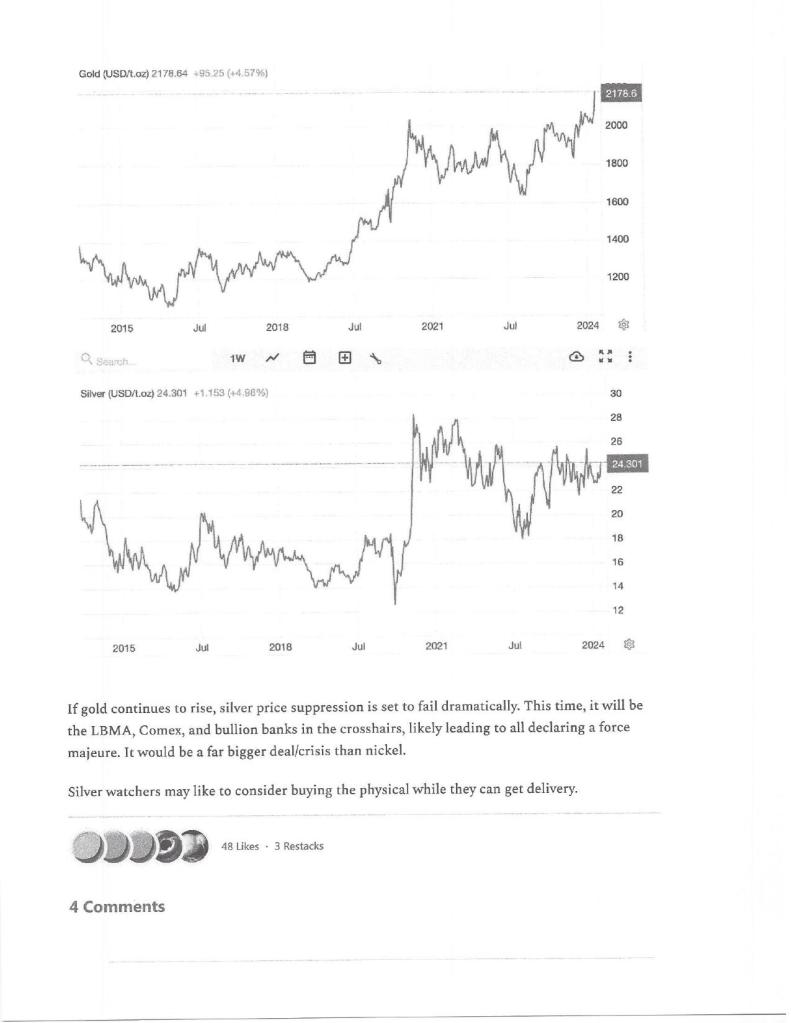

“Here is another very scary chart for those with eyes to see and brains to decipher!”

Bill’s Commentary:

“Nowhere did I see the number 320 million ounces of demand for solar production. At least they did admit to a supply deficit for the 4th year running. It’s OK though, when “paper” silver gets busted, it will only make the upside explosion that much more of an epic event!”GLOBAL SILVER DEMAND FORECASTED TO RISE TO 1.2 BILLION OUNCES IN 2024

If Achieved, It Would Be Second Highest Level on Record

(Washington, D.C. – January 30, 2024) Global silver demand is forecast to reach 1.2 billion ounces in 2024, which, if achieved would be the second-highest level recorded. Stronger industrial offtake is a principal catalyst for the rising global demand for the white metal, and the sector should hit a new annual high this year.

Bill’s Commentary:

“This is the stuff that Banana Republics are made of!”

Michigan Lawyer Stefanie Lambert Arrested by US Marshals in DC Following Court Appearance — After Submitting “Evidence of Numerous Crimes” Including Internal Emails from Dominion Voting Systems to Law Enforcement

Michigan attorney Stefanie Lambert Junttila was arrested in Washington, D.C., on Monday following a court hearing after she gave the “evidence of numerous crimes” to law enforcement containing internal emails from Dominion Voting Systems, AP reported.

Lambert attended a court hearing in Washington, D.C., for a defamation case involving Patrick Byrne, whom she represents. Byrne, the former CEO of Overstock, is being sued by Dominion Voting Systems over his claims of election fraud.

Lambert’s arrest occurred after it was revealed that she had leaked confidential documents from Dominion to Barry County Sheriff Dar Leaf, who has been actively investigating claims of voter fraud from the 2020 election, according to CNN.

-

Addendum to yesterday’s post:

Bill’s Commentary: “It turns out that his comments were taken out of context. Here is the full speech https://www.youtube.com/watch?v=YrMMiDXspYo His comments were at the 28:33 mark. I could only listen to 5 minutes or less as my blood pressure gets out of control whenever I hear complete bullshit. In my Constitutionally guaranteed personal opinion, the man sits on the throne of completely evil and divisive bullshit.”

-

Bill’s Commentary:

“Obama says the quiet part out loud. Is this real, or a deepfake? Either way, the sick joke is on us …!”

-

Bill’s Commentary:

“Will the US invade “the rest of the world” for not using dollars for trade?”

Many Countries Want to Start Rupee Trade with India in “Game-changing” De-dollarisation Step

On Monday, Union Commerce and Industry Minister Piyush Goyal said that many large and small economies around the world have expressed willingness to start trading in rupee terms with India, which could be a “game-changing” development for India’s trade. This is another important step taken towards de-dollarisation and would better protect India’s economy in case of any future US-led sanctions.

India’s Union Minister said some of the countries that have expressed willingness to start trading in rupees include neighbouring Bangladesh and Sri Lanka, as well as Gulf countries.

Bill’s Commentary:

“Real comedy, and the way politics were before everything was an outright lie. Please watch and allow your blood pressure to come down a few notches!”

-

Bill’s Commentary:

“Erik brings up some very serious questions for you to digest.”

-

Bill’s Commentary:

“If You Can’t See It, I Can’t Help You” | Bill Holter

(Also posted under Interviews)

Financial System Unraveling Right Now

The US debt crisis is coming to a head, says Bill Holter (https://billholter.com). The only solution is to print more currency and paper over the problem. “The currency is collapsing,” he says, and foreigners recognize it. “It is the end of empire. You’re watching it in real time,” he argues. “If you can’t see that, I can’t help you.” He discusses preparedness and what kinds of gold and silver products would be ideal in a collapse scenario.

-

Bill’s Commentary:

“This should be no surprise, the game is rigged from top to bottom …period!”

Wall Street Mega Banks Have Drawn a Law-Free Zone Around Themselves – The Media Is Complicit

From revoking the American people’s right to a jury trial in matters involving Wall Street; to brazenly thumbing their nose at anti-trust law; to trading the stock of their own bank in the darkness of their own dark pools; to forming their own stock exchange; to committing serial felonies without being criminally prosecuted or having their bank charters revoked – Wall Street mega banks have drawn a law-free zone around themselves and are more dangerous today than they have ever been in U.S. history.

Bill’s Commentary:

“As long as they are going off the rails, they might as well go all the way and include “thought crimes”?”

We have previously discussed the unrelenting attacks by Canadian Prime Minister Justin Trudeau and his allies on free speech. There has been a steady criminalization of speech, including even jokes and religious speech, in Canada. Now, the Canadian parliament is moving toward a new change that would allow the imposition of life imprisonment on those who post views deemed supportive of genocide. With a growing movement calling Israel’s war in Gaza “genocide,” the potential scope of such a law is readily apparent. That appears to be its very draw for anti-free speech advocates in the country.

-

Bill’s Commentary:

“This seems pretty “inclusive”!”

Miss. Official: DOJ Pushes for Illegals, Felons to Vote

Mississippi Secretary of State Michael Watson claimed the Justice Department is using the U.S. Marshals Service and jails to encourage illegal immigrants and imprisoned felons to register to vote.

Watson, a Republican, sent a letter to Attorney General Merrick Garland last week, asking him to stop enforcing Biden Executive Order 14019, which was promoted as an attempt to combat racial discrimination and instructed government agencies to “consider ways to expand citizens’ opportunities to register to vote and to obtain information about, and participate in, the electoral process.”

-

Bill’s Commentary:

“The “evil empire”?”

Bill’s Commentary:

“What happens when you raise interest rates on the most overly indebted system in all of history?”

US Spent More Than Double What It Collected In February, As 2024 Deficit Is Second Highest Ever… And Debt Explodes

Earlier today, CNBC’s Brian Sullivan took a horse dose of Red Pills when, about six months after our readers, he learned that the US is issuing $1 trillion in debt every 100 days, which prompted him to rage tweet, (or rageX, not sure what the proper term is here) the following:

We’ve added 60% to national debt since 2018. Germany – a country with major economic woes – added ‘just’ 32%.

Maybe it will never matter. Maybe MMT is real. Maybe we just cancel or inflate it out. Maybe career real estate borrowers or career politicians aren’t the answer.

I have no idea. Only time will tell. But it’s going to be fascinating to watch it play out.

Read more here…

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.