-

Bill’s Commentary:

“People will soon find out the problem with gold and silver …is, they cannot be printed to meet relentless demand!”

India’s February silver imports hit record and set to rise 66% this year

-

Bill’s Commentary:

“The Fed in the red…”

For the First Time in History, the Fed is Reporting Billions in Losses Weekly; It’s Still Paying High Interest Income to the Mega Banks on Wall Street

As of April 3 of this year, the Federal Reserve (Fed) has racked up $161 billion in accumulated losses. We’re not talking about unrealized losses on the underwater debt securities the Fed holds on its balance sheet, which it does not mark to market. We’re talking about real cash losses it is experiencing from earning approximately 2 percent interest on the $6.97 trillion of debt securities it holds on its balance sheet from its Quantitative Easing (QE) operations while it continues to pay out 5.4 percent interest to the mega banks on Wall Street (and other Fed member banks) for the reserves they hold with the Fed; 5.3 percent interest it pays on reverse repo operations with the Fed; and a whopping 6 percent dividend to member shareholder banks with assets of $10 billion or less and the lesser of 6 percent or the yield on the 10-year Treasury note at the most recent auction prior to the dividend payment to banks with assets larger than $10 billion. (This morning the 10-year Treasury is yielding 4.41 percent.)

Bill’s Commentary:

“Trust is very easy to lose and nearly impossible to regain. But there is an upside, they do make it very easy to decipher what is true and what is false… by simply fading whatever position it is they are backing.”

I’ve Been at NPR for 25 Years. Here’s How We Lost America’s Trust.

You know the stereotype of the NPR listener: an EV-driving, Wordle-playing, tote bag–carrying coastal elite. It doesn’t precisely describe me, but it’s not far off. I’m Sarah Lawrence–educated, was raised by a lesbian peace activist mother, I drive a Subaru, and Spotify says my listening habits are most similar to people in Berkeley.

I fit the NPR mold. I’ll cop to that.

So when I got a job here 25 years ago, I never looked back. As a senior editor on the business desk where news is always breaking, we’ve covered upheavals in the workplace, supermarket prices, social media, and AI.

It’s true NPR has always had a liberal bent, but during most of my tenure here, an open-minded, curious culture prevailed. We were nerdy, but not knee-jerk, activist, or scolding.

In recent years, however, that has changed. Today, those who listen to NPR or read its coverage online find something different: the distilled worldview of a very small segment of the U.S. population.

-

Bill’s Commentary:

“I think Idaho needs a new governor?”

Idaho Governor Opposes Gold & Silver, Vetoes Bill to Enable Protective Holdings

(Boise, Idaho – April 8, 2024) – Idaho Gov. Brad Little today vetoed legislation that would have enabled the Idaho State Treasurer to protect state reserve funds with an allocation to physical gold and silver, sending an ominous message to the state’s mining industry and investors.

Senate Bill 1314 – sponsored by Sen. Phil Hart and Rep. Barbara Ehardt – passed overwhelmingly in the Idaho State Senate before being approved by the House in late March, only to be vetoed by Gov. Little.

Bill’s Commentary:

“Total spying and zero privacy. And you still think there is a left and a right? We are only bugs to be stepped on and eaten…”

A risky position – Live Updates – Politico

-

Bill’s Commentary:

“Ya’ think?”

Jamie Dimon Warns World Faces “Risks That Eclipse Anything Since World War II”

Perhaps the world’s most influential banker – JPMorgan Chase CEO Jamie Dimon – warned the world in his annual letter to shareholders that while he expects US economic resilience (and higher inflation and interest rates), and is optimistic about transformational opportunities from AI, he worries geopolitical events including the war in Ukraine and the Israel-Hamas war, as well as U.S. political polarization, might be creating an environment that “may very well be creating risks that could eclipse anything since World War II.”

Read more here…tps://www.zerohedge.com/geopolitical/jamie-dimon-warns-world-faces-risks-eclipse-anything-world-war-ii

Bill’s Commentary:

“As they say, “payback is a bitch”!”

Democrats Cry Foul as Anti-Free Speech Allies Turn Against Them

Below is my column in The Hill on the recent disruptions of events featuring leading Democrats from President Joe Biden to Rep. Jamie Raskin. After years of supporting the censoring and blacklisting of others, these politicians are now being targeted by the very anti-free speech movement that they once fostered. Hillary Clinton last week became the latest Democrat targeted by protesters in a visit to her alma mater, Wellesley College.

Bill’s Commentary:

“Under the bus you go!”

NATO Wants to Show Support for Ukraine, but Only So Much

When NATO’s leaders gather this summer to celebrate the 75th anniversary of their military alliance, the last thing they want to see is a resurgent Russian military marching across Ukraine because Europe was too weak to provide Kyiv with the support it needed.

What Ukraine wants, ultimately, is a formal invitation to join NATO. But alliance officials agree that is not going to happen at the festivities planned for Washington in July. NATO has no appetite for taking on a new member that, because of the alliance’s covenant of collective security, would draw it into the biggest land war in Europe since 1945.

Michael Oliver on Silver –

-

Bill’s Commentary:

“Some Erik in rare form!”

Bill’s Commentary:

“Finally a feminist group takes on the tranny clowns! As well they …and all other feminist groups should….”

Feminists accuse pro-trans activists of ‘intimidation’ on Scottish march

Feminists protesting against the new Scottish hate crime law have hit out at “abusive” placards displayed by pro-trans activists.

Women marching in Edinburgh against Humza Yousaf’s legislation, which critics including JK Rowling have warned could criminalise airing gender-critical beliefs, criticised the pro-trans protesters for “harassment and intimidation”.

JK Rowling’s victory over Humza Yousaf’s hate crime laws is a victory for all women

I was sitting in JK Rowling’s study, eating the biscuits her husband Neil brought us, when she told me about realising that she had to publicly fight for women’s rights. This was at the end of 2022.

Three years earlier, she had become involved in the “gender wars” by tweeting her support of Maya Forstater who was being forced out of a job for gender critical views. This was a landmark case because it established that gender critical beliefs are protected under the Equality Act of 2010.

Bill’s Commentary:

“Maybe we will find out who is paying them?”

Antifa Battered In Coolock, Their Phones Seized By Nationalists Apparently Revealing Seedy Links Between Media, NGOs, and Far Left

Earlier today, locals protesting against a refugee centre in Coolock, Dublin were confronted by leftist journalists and other antifa types. Here are the facts as we understand them from local first-hand sources in Coolock. We will be updating this article as more details are established:

The latest from USA Watchdog –

-

Stephen Mullowney, CEO of TRX gold sits down with Bill and our pal Denny to discuss past, present and future of TRX Gold.

-

The latest from USA Watchdog –

-

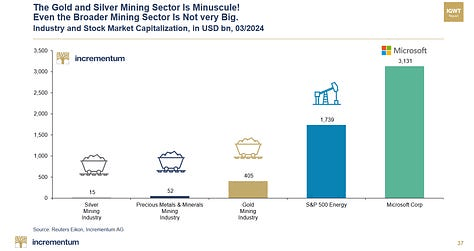

Our pal Kevin checks in with the severe undervalued status of miners. I would only add this, the pendulum ALWAYS swings too far in each direction. Mining shares have never been this undervalued to the underlying metal, you are about to get paid!

In 2020, more than 6,000 people became “ultras,” individuals whose financial wealth exceeds $100 million. The segment now makes up a total 60,000 people worldwide with a combined $32 trillion in investable wealth or 15 percent of the world’s total. With $5.8 trillion in 2020, the U.S. topped the list as the most concentrated market for investable wealth.”

Again today the entire value of global mining shares is only $430B – 2% of these 60,000 people could buy them all. If we do see a 10:1 Dow:Gold ratio or even lower, brought on by either higher gold prices or lower stock prices or both, these players will see trillions offset by a 10-15 fold increase in mining shares.

So 15% of global financial assets $250T is owned by 60,000 individuals. That amounts to $32T. Corp bonds already off 10% from 2021 and government bonds off 30% globally. Equities up 30% in G-7, up 15% MSCI, up 45% Nikkei since Sept. 2021.

If stocks stay stagnate as is likely for years let alone swoon and bond prices do same, mining shares and gold is both safe haven and profit center.

When JPM says we don’t like bitcoin or gold, you can count on them accumulating it. And they have been loading up truck for these 60,000 people already. Time to let it go up.

A 10-15 fold increase in mining shares equals a $4-5T increase in those shares. Absolutely necessary to hedge. Kevin

-

Bill’s Commentary:

“Is anyone surprised?”

Study Finds Wall Street Mega Banks Have Overstated Income for Years on Commercial Real Estate Loans They Sell to Investors

Last August, the Journal of Finance published a study by two finance professors that should have made bold headlines in every major business newspaper in America. It didn’t – suggesting that Americans will eventually learn about Wall Street’s chicanery in commercial real estate the same way they learned about Wall Street’s subprime residential mortgage scams after the 2008 financial collapse: from a movie like The Big Short or Inside Job.

A preview to Incrementum’s “In Gold We Trust 2024” report. Some fabulous charts and graphics here. Any time spent deciphering the story here is time well spent!

-

Bill’s Commentary:

“Transparent?”

Federal Reserve Refuses to Provide Records of Foreign Gold Holdings

Weeks after Federal Reserve Chairman Jerome Powell evaded a sitting congressman’s questions about the central bank’s foreign gold holdings, the Fed has also declined to comply with a Freedom of Information Act request for records about such holdings.

The Federal Reserve’s lack of transparency comes amidst reports that countries are removing their gold and other assets from the U.S. in the wake of the unprecedented Western sanctions imposed on Russia over its invasion of Ukraine. According to a 2023 Invesco survey, a “substantial percentage” of central banks expressed concern about how the U.S. and its allies froze nearly half of Russia’s $650 billion gold and forex reserves.

Bill’s Commentary:

“Again, this is Russian roulette with a full cylinder. Watch what happens shortly after any decision to cancel, or worse, use the funds to support Ukraine…”

Johnson eyes Russian assets in Ukraine funding fight

Congress is gearing up to give President Joe Biden a powerful new financial tool to strengthen Ukraine, in a move that could redefine modern economic diplomacy.

At issue is bipartisan legislation approved by House and Senate committees that would let the administration confiscate around $5 billion to $8 billion in Russian sovereign assets under U.S. jurisdiction and use the money to help finance Ukraine’s recovery. Discussions on the plans are expected to ramp up in the coming weeks as Congress hashes out a new Ukraine aid bill.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.