-

Bill’s Commentary:

“Yes it is illegal, but we who own mining shares know all too well that it is done every day!”

Trump Media Stock Spikes After CEO Pens “Naked” Short Letter

Shares of Trump Media spiked on Friday after the company alerted the Nasdaq to ‘potential market manipulation’ from ‘naked’ short selling of its stock.

The warning came as the company, which trades under the symbol $DJT, offered shareholders detailed instructions on how to prevent someone from loaning out their shares to short sellers.

In a Friday morning letter to Nasdaq CEO Adrena Friedman, CEO Devin Nunes noted that as of Wednesday, “DJT appears on Nasdaq’s ‘Reg SHO threshold list,’ which is indicative of unlawful trading activity.”

-

Bill’s Commentary:

“Imagine that? The best (scariest) part is the outperformance yet to come!”

Gold Vs. S&P 500: Which Has Grown More Over Five Years?

Gold is considered a unique asset due to its enduring value, historical significance, and application in various technologies like computers, spacecraft, and communications equipment.

Commonly regarded as a “safe haven asset”, gold is something investors typically buy to protect themselves during periods of global uncertainty and economic decline.

It is for this reason that gold has performed rather strongly in recent years, and especially in 2024. Persistent inflation combined with multiple wars has driven up demand for gold, helping it set a new all-time high of over $2,400 per ounce.

Part IV with Texas Silver (Also posted under Interviews)

-

Bill’s Commentary:

“Is it possible that the unprecedented losses at the Fed – the central bank of the United States – are also creating a flight to safety into gold?”

Gold Has Set Historic Highs this Year as the Federal Reserve Has Reported Historic Losses

According to Federal Reserve data, for the first time in its history, the Fed has been losing money on a consistent basis since September 28, 2022. As of the last reporting date of April 10, those losses came to a cumulative $162.9 billion. As the chart above from the Fed indicates, the monthly losses thus far in 2024 have ranged from a high of $13.4 billion in January to $5.5 billion in March.

Bill’s Commentary:

Recently I have fielded several e-mails asking about selling gold and silver to wait for a pullback. While a pullback seems surely warranted, there is huge risk in trying to trade at this juncture. We are in the end game already, what is happening is multigenerational and global. We are witnessing the end of Dollar dominance with a fiat “competitive” devaluation across the board. We are witnessing end of empire! The danger of being cute and trying to time a trade here is enormous. You must be “:in place” when the music stops, which it mathematically will. If you have taken profit and intend to trade, what happens if (when) the system breaks and gold nor silver are even available for purchase? Your “profit” will be sitting in a bank/broker, and will be bailed in. So you lose your cash and sold someone else your ounces? THIS is the rally you cannot afford to sell. You presumably bought metal to get your capital out of the system, if you purchased to make “dollars” as profit, then this brief article is not for you. Please remember this, in a very short time, you will be counting your net worth in ounces, not dollars. Be your own Central Bank!

Standing watch,

Bill Holter

Bill’s Commentary:

“Paul Craig Roberts on the Great Taking, part 1 of 3. He asks an interesting question; were these laws changed to create collateral for derivatives, or were derivatives created to blow up and allow your collateral to be taken? I believe the most evil answer is the correct one. These people are not stupid, and bad policy is not a mistake. You must remove your capital from their crosshairs immediately!”

The Great Dispossession Part 1

Some definitions: an “account holder” is you, your IRA, your pension plan, your stock and bond investments held at an “account provider” or “intermediary” or “depository institution” such as Merrill Lynch, Schwab, Wells Fargo. An “entitlement holder” is the definition of you whose ownership claim to your financial assets has been subordinated to the claims of “secured creditors” of the institution where you have your accounts. Please do understand that the dispossession of which I write is your dispossession.

Klaus Schwab tells us that in the Great Reset that the World Economic Forum is preparing for us “you will own nothing and you will be happy.” Well, we already own nothing. Our bank deposits and stocks and bonds, in the event the depository institution gets into trouble, belong to the depository institution’s creditors, not to us. All assets are pooled and serve as collateral whether or not labeled “segregated.”

Bill is interviewed by USA Watchdog. THIS is the rally in gold and silver you do not sell! (Also posted under Interviews)

-

Bills’ Commentary:

“Happy Birthday to Erik! His first article as an octogenarian.”

Texas Silver interview part 3 (Also posted under Interviews)

-

Bill’s Commentary:

“SHOWTIME has finally arrived folks!”

China’s Media Recommends Buying Silver and Silver Starts to Surge on Open of Shanghai’s SGE Exchange

This innocuous tweet, if correct, gives an interesting insight into a potential sea-change in the Chinese silver market.

The Chinese media (i.e. the Chinese Communist government) encouraging its 1.5 billion citizens to buy silver in lieu of gold can have a potentially very material impact on the global silver market.

Bill part 2 interview with Texas Silver (Also posted under Interviews)

-

Bill’s Commentary:

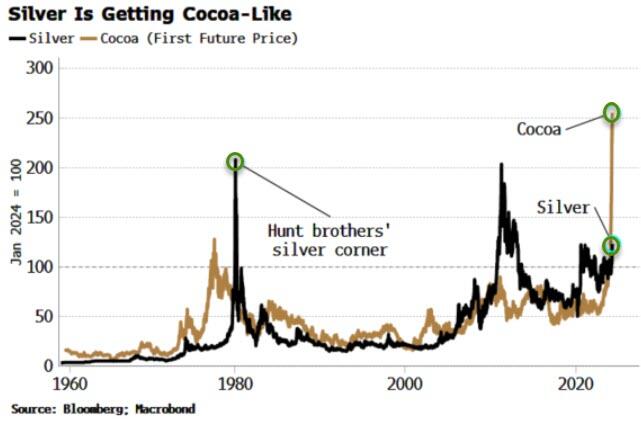

“A couple of observations; first, the silver futures market is far larger than the physical market. The true financial “leverage” has been to the short side which means whenever the real short squeeze arrives, it will make cocoa look like a calm day! Additionally, it looks like a billion+ paper ounces were needed yesterday to cap the price, or roughly a year’s worth of global production traded in one day.”

Is Silver About To Do A Cocoa?

Silver prices have rocketed higher in recent days, and they have been surging today (with great volatility). As a futures market, more of it trades on exchange relative to its annual physical supply compared to cocoa. Therefore it’s not inconceivable silver could deliver a similar sort of move to cocoa’s recent mega-rally.

-

Bill’s Commentary:

“The Dollar is losing reserve currency status. Have you thought thru thoroughly what this will mean to your monthly budget? Hint; your Starbucks coffee might soon cost you s “C note” in dollars but a mere silver dime in real money!”

IMF Prepares Financial Revolution – Say GOODBYE to the Dollar

Global reserve currency status allows for amazing latitude in terms of monetary policy.

The Treasury Department understands that there is constant demand for dollars overseas as a means to more easily import and export goods. The petrodollar monopoly made the U.S. dollar essential for trading oil globally for decades.

This means that the central bank of the U.S. has been able to create fiat currency from thin air to a far higher degree than any other central bank on the planet while avoiding the immediate effects of hyperinflation.

Bill’s Commentary:

“Rocket scientists driving the bus!”

Labor group demands California’s $20 minimum wage for fast food workers extend to all sectors | Fox Business

A fair wage advocacy group is demanding that California’s new $20 minimum wage law for fast food workers be extended to all sectors to help working-class people who are struggling with the state’s high cost of living.

FOX Business spoke with Saru Jayaraman, president of One Fair Wage to discuss what she described as the skyrocketing levels of home insecurity and food insecurity post-pandemic.

Fast food workers winning a $20 minimum wage, she said, “was just the beginning.”

Jayaraman pointed to the exorbitantly high cost of living in the Golden State where, in some counties, an individual would need a $40 an hour salary to live comfortably.

-

Bill is interviewed by Texas Silver (Also posted under Interviews)

-

Bill’s Commentary:

“As I posted yesterday, the Fed is both woke AND BROKE!”

The Black Swan Rears Its Head: The Fed Has Negative Capital Using GAAP Accounting

The Fed’s unprecedented experiments with years of ZIRP (Zero Interest Rate Policy) and QE (Quantitative Easing), where it bought up trillions of dollars of low-yielding U.S. Treasuries and agency Mortgage-Backed Securities (MBS) and quietly parked them on its balance sheet, are now posing a threat to the Fed’s flexibility in conducting monetary policy. (Since 2008, the Fed’s concept of conducting monetary policy has come to enshrine serial Wall Street mega bank bailouts as a regular part of its monetary policy. Large and growing cash losses at the Fed may seriously crimp such future bailouts.)

Read more here…https://wallstreetonparade.com/2024/04/the-black-swan-rears-its-head-the-fed-has-negative-capital-using-gaap-accounting/

Bill’s Commentary:

“So basically they just make this shit up? Like pretty much everything else?”

Hidden Behind Climate Policies, Data From Nonexistent Temperature Stations

The National Oceanic and Atmospheric Administration (NOAA) predicts July, August, and September will be hotter than usual. And for those who view warmer temperatures as problematic, that’s a significant cause for concern.

“Earth’s issuing a distress call,” said United Nations secretary-general António Guterres on March 19. “The latest State of the Global Climate report shows a planet on the brink.

“Fossil fuel pollution is sending climate chaos off the charts. Sirens are blaring across all major indicators: Last year saw record heat, record sea levels, and record ocean surface temperatures. … Some records aren’t just chart-topping, they’re chart-busting.”

-

Bill’s Commentary:

“So, I guess this makes The Fed both woke and broke? Remember, they are the ones who “issue” the currency. How often are you willing to do business with someone who has these two traits? Got gold?”

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.