-

Bill’s Commentary:

“Erik is spot on!”

Bill’s Commentary:

“10 years? Are you kidding me? And by the way, “supply side” economics only worked back then because the West still had the ability to lever up. That ability is now gone…”

Former British PM Liz Truss Warns About Global Threat of the Left

Former British Prime Minister Liz Truss spoke Monday at The Heritage Foundation about how the United States and the United Kingdom are facing very challenging forces in the global Left, not just in terms of their extremist activists, but also in the power they hold in our institutions. (Heritage founded The Daily Signal in 2014.)

She warned that conservatives must create a stronger infrastructure to take on the Left—which is well-funded, activist, and has many friends in high places—by recruiting more conservative activists and candidates who can fight in the trenches in the ideological war that we now face.

Bill’s Commentary:

“A mental disorder, end of story.”

Scientific American Claims It Is “Misinformation” That There Are Just Two Sexes

Scientific American has published a piece claiming that “misinformation,” such as the notion that there are only two sexes, is “being used against transgender people” and in order to target “gender-affirming medical care.”

The article states that there are three types of “misinformation,” and they are “oversimplifying scientific knowledge, fabricating and misinterpreting research, and promoting false equivalences.”

-

Bill’s Commentary:

“For those of you with weak knees today because of the selloff. Supply does not meet the surging demand which will only increase. Silver will be gold on steroids! Time to crawl into a hole and pull a rock over you, when you come up for air, current prices will not even be recognizable!”

Why a Powerful Silver Bull Market May Be Ahead

Since early-March, precious metals have launched one of their sharpest rallies in decades. Gold surged by 16% and silver by 26%, which are significant moves for safe-haven assets — especially considering that it played out over such a short time period. During this rally, gold has received the lion’s share of the attention because it has been hitting all-time highs, while silver has yet to exceed its 2021 high of $30.13 — let alone its all-time high of $49.81 that was reached all the way back in 2011. Though silver has been languishing for the past several years, there are numerous reasons why it may be on the verge of one of its most powerful bull markets in history.

Bill is interviewed by Jon Dowling (Also posted under Interviews)

-

Bill’s Commentary:

“And not one dollar for the border?”

House passes critical aid to Ukraine, Israel and Taiwan along with a TikTok ban

WASHINGTON — The House on Saturday passed a $95 billion package that includes two long-awaited bills with $60.8 billion of aid for Ukraine and $26 billion in aid for Israel.

The Ukraine bill, which passed 311- 112 with one present, will head to the Senate alongside the Israel aid bill and two others — one with aid for Taiwan and another that would force TikTok’s parent company to sell the platform.

Lawmakers waved Ukrainian flags and cheered upon the Ukraine bill’s passage. Voting in favor were 101 Republicans and 210 Democrats, while Rep. Dan Meuser, R-Pa., voted present. All 112 votes against it came from Republicans.

Bill’s Commentary:

“Filed under the categories UNConstitutional and treasonous!”

Senate Passes Spying Bill, Rejecting Privacy Concerns

WASHINGTON—The Senate passed legislation early Saturday renewing a controversial foreign spying power, prevailing over objections from privacy advocates who warned the measure could lead to a dramatic expansion of government surveillance on Americans.

In a 60-34 vote senators approved a bill to renew Section 702 of the Foreign Intelligence Surveillance Act for two years just as it was due to expire, after several amendments failed. The legislation passed the House last week and was signed on Saturday by President Biden, whose administration views the law as vital to protecting national security.

-

Bill’s Commentary:

“Erik on what happens after fiat’s collapse. I think a percentage ratio backing with gold would be a good start?”

Bill’s Commentary:

“Both agencies are weaponized against the population they were created to protect, so one investigating the other qualifies as the comedic bullshit of the day!”

Anti-Catholic FBI memo’s origin revealed as bureau absolved of ‘malicious intent’

The Federal Bureau of Investigation has been exonerated by a Department of Justice review that found investigators did not intend to target traditional Catholics as potential “racially or ethnically motivated violent extremists.”

The Justice Department Inspector General review noted, however, that analysts “incorrectly conflated” an investigative subject’s religious views with his alleged domestic terrorism activities.

Findings from the 120-day review, which was handled by Justice Department Inspector General Michael E. Horowitz and ordered by Congress, were outlined in a letter sent to members of Congress on Thursday.

-

Bill’s Commentary:

“Yes it is illegal, but we who own mining shares know all too well that it is done every day!”

Trump Media Stock Spikes After CEO Pens “Naked” Short Letter

Shares of Trump Media spiked on Friday after the company alerted the Nasdaq to ‘potential market manipulation’ from ‘naked’ short selling of its stock.

The warning came as the company, which trades under the symbol $DJT, offered shareholders detailed instructions on how to prevent someone from loaning out their shares to short sellers.

In a Friday morning letter to Nasdaq CEO Adrena Friedman, CEO Devin Nunes noted that as of Wednesday, “DJT appears on Nasdaq’s ‘Reg SHO threshold list,’ which is indicative of unlawful trading activity.”

-

Bill’s Commentary:

“Imagine that? The best (scariest) part is the outperformance yet to come!”

Gold Vs. S&P 500: Which Has Grown More Over Five Years?

Gold is considered a unique asset due to its enduring value, historical significance, and application in various technologies like computers, spacecraft, and communications equipment.

Commonly regarded as a “safe haven asset”, gold is something investors typically buy to protect themselves during periods of global uncertainty and economic decline.

It is for this reason that gold has performed rather strongly in recent years, and especially in 2024. Persistent inflation combined with multiple wars has driven up demand for gold, helping it set a new all-time high of over $2,400 per ounce.

Part IV with Texas Silver (Also posted under Interviews)

-

Bill’s Commentary:

“Is it possible that the unprecedented losses at the Fed – the central bank of the United States – are also creating a flight to safety into gold?”

Gold Has Set Historic Highs this Year as the Federal Reserve Has Reported Historic Losses

According to Federal Reserve data, for the first time in its history, the Fed has been losing money on a consistent basis since September 28, 2022. As of the last reporting date of April 10, those losses came to a cumulative $162.9 billion. As the chart above from the Fed indicates, the monthly losses thus far in 2024 have ranged from a high of $13.4 billion in January to $5.5 billion in March.

Bill’s Commentary:

Recently I have fielded several e-mails asking about selling gold and silver to wait for a pullback. While a pullback seems surely warranted, there is huge risk in trying to trade at this juncture. We are in the end game already, what is happening is multigenerational and global. We are witnessing the end of Dollar dominance with a fiat “competitive” devaluation across the board. We are witnessing end of empire! The danger of being cute and trying to time a trade here is enormous. You must be “:in place” when the music stops, which it mathematically will. If you have taken profit and intend to trade, what happens if (when) the system breaks and gold nor silver are even available for purchase? Your “profit” will be sitting in a bank/broker, and will be bailed in. So you lose your cash and sold someone else your ounces? THIS is the rally you cannot afford to sell. You presumably bought metal to get your capital out of the system, if you purchased to make “dollars” as profit, then this brief article is not for you. Please remember this, in a very short time, you will be counting your net worth in ounces, not dollars. Be your own Central Bank!

Standing watch,

Bill Holter

Bill’s Commentary:

“Paul Craig Roberts on the Great Taking, part 1 of 3. He asks an interesting question; were these laws changed to create collateral for derivatives, or were derivatives created to blow up and allow your collateral to be taken? I believe the most evil answer is the correct one. These people are not stupid, and bad policy is not a mistake. You must remove your capital from their crosshairs immediately!”

The Great Dispossession Part 1

Some definitions: an “account holder” is you, your IRA, your pension plan, your stock and bond investments held at an “account provider” or “intermediary” or “depository institution” such as Merrill Lynch, Schwab, Wells Fargo. An “entitlement holder” is the definition of you whose ownership claim to your financial assets has been subordinated to the claims of “secured creditors” of the institution where you have your accounts. Please do understand that the dispossession of which I write is your dispossession.

Klaus Schwab tells us that in the Great Reset that the World Economic Forum is preparing for us “you will own nothing and you will be happy.” Well, we already own nothing. Our bank deposits and stocks and bonds, in the event the depository institution gets into trouble, belong to the depository institution’s creditors, not to us. All assets are pooled and serve as collateral whether or not labeled “segregated.”

Bill is interviewed by USA Watchdog. THIS is the rally in gold and silver you do not sell! (Also posted under Interviews)

-

Bills’ Commentary:

“Happy Birthday to Erik! His first article as an octogenarian.”

Texas Silver interview part 3 (Also posted under Interviews)

-

Bill’s Commentary:

“SHOWTIME has finally arrived folks!”

China’s Media Recommends Buying Silver and Silver Starts to Surge on Open of Shanghai’s SGE Exchange

This innocuous tweet, if correct, gives an interesting insight into a potential sea-change in the Chinese silver market.

The Chinese media (i.e. the Chinese Communist government) encouraging its 1.5 billion citizens to buy silver in lieu of gold can have a potentially very material impact on the global silver market.

Bill part 2 interview with Texas Silver (Also posted under Interviews)

-

Bill’s Commentary:

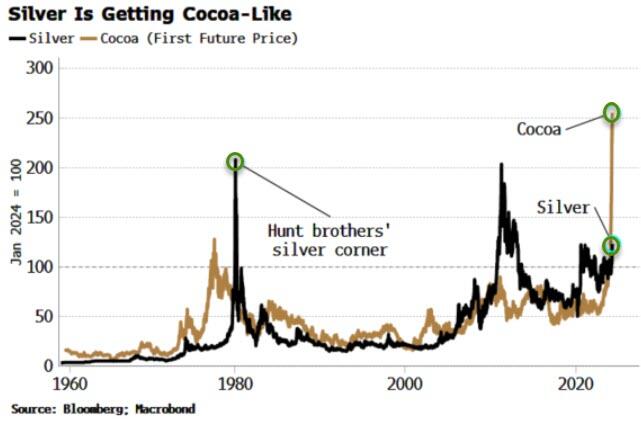

“A couple of observations; first, the silver futures market is far larger than the physical market. The true financial “leverage” has been to the short side which means whenever the real short squeeze arrives, it will make cocoa look like a calm day! Additionally, it looks like a billion+ paper ounces were needed yesterday to cap the price, or roughly a year’s worth of global production traded in one day.”

Is Silver About To Do A Cocoa?

Silver prices have rocketed higher in recent days, and they have been surging today (with great volatility). As a futures market, more of it trades on exchange relative to its annual physical supply compared to cocoa. Therefore it’s not inconceivable silver could deliver a similar sort of move to cocoa’s recent mega-rally.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.