-

The latest from USA Watchdog –

Bill’s Commentary:

“Filed under the category of “no shit Sherlock”, you didn’t see this coming prior to now?”

Goldman CEO Issues Warning as Interest Costs on America’s Ballooning Debt Exceed Spending on Defense, Medicare

Goldman Sachs CEO David M. Solomon is the latest business leader to sound the alarm on the Biden administration’s deficit spending, which comes as the cost of making interest payments on the United States’ ballooning government debt has exceeded spending in both the critical sectors of defense and Medicare.

“I think the level of debt in the United States [and] the level of spending is something that we need a sharper focus on and more dialogue around than what we’ve seen,” the investment banking chief told Bloomberg Television on May 13, adding that if something isn’t done to rein it the spending, it could create problems.

Bill’s Commentary:

“Michael Burry, “the Big Short” has just taken a position in gold. Welcome to the party, but what took you so long? Imagine had he put all of his 2008-09 profits into gold (which cannot bankrupt) back then when gold was sub $1,000?”

-

Bill is interviewed by Jean Claude – (Also posted under Interviews)

-

Bill’s Commentary:

“Credit turns negative on top of the most over levered global financial system and real economy in all of history? This truly means something big, we will shortly see the fallout. On a separate note, maybe China (and the world) is buying gold, not as a hedge against Dollar inflation but versus Chinese deflation? Naw, it’s both!”

China’s Broadest Credit Metric Just Turned Negative For The First Time Since 2005

China has lots of economic problems (even if the market has been surprisingly generous in the past 4 months and allowed Chinese stocks to surge despite any actual economic rebound or recovery), but this is a new one.

It is hardly a secret that for much of the past 15 years, and certainly in the aftermath of the Lehman collapse, it was China’s unstoppable credit creation that lifted the world out of a deflationary shock time and again, and indeed it is a fact that as long as we can remember, China’s broadest credit aggregate, Total Social Financing, was always positive, come rain, blizzard, or shina.

Bill’s Commentary:

“WOW, a double whammy! Their money supply is contracting as well as new credit. How do you think this will end? And certainly, it won’t affect global financial markets nor the real economy, right?”

Pressure On China Heightens As Capital Outflow Chokes Liquidity

The latest money data from China shows its capital-outflow problem is worsening, pressuring policymakers to allow a further weakening in the currency.

China released money and inflation data over the weekend. CPI and PPI were not great reading, but money supply data was even more downbeat: M2’s growth disappointed, while M1 growth is moldering, falling 1.4% year-on-year versus +1.2% expected.

Bill’s Commentary:

“Deflation of the things you have …”

Delinquencies on Office Property Loans at Banks Are at 8 Percent While Office Loans the Banks Sold to Investors Show 31 Percent in Trouble

Just how much pain is being felt in the CMBS market related to office properties was further quantified on May 3 when Scott Carpenter reported the following at Bloomberg Law:

“About $52 billion, or 31%, of all office loans in commercial mortgage bonds were in trouble in March, according to KBRA Analytics.

“That share is up from 16% a year ago, according to the firm. Some cities have bigger headaches than others, with Chicago and Denver offices having 75% and 65% in jeopardy, respectively.”

Bill’s Commentary:

“More real estate death”

Iconic Trump Hotel DC Struggles Under New Owners, Foreclosure Auction Next Month.

One of Washington D.C.’s most iconic buildings, located just blocks from the White House, is set to be sold at a foreclosure auction next month. The Waldorf Astoria, formerly the Trump International Hotel at the Old Post Office, is at the center of financial turmoil with its new owners struggling to turn a profit like Trump did.

-

Bill’s Commentary:

“Filed under the category “DEFLATION of BAD CREDIT”!”

Fort Worth’s tallest building sells for just $12.3M at auction in stunning price drop

Burnett Plaza, the tallest building in Fort Worth, Texas, has been purchased via foreclosure auction for $12.3 million just three years after it was sold for more than $137.5 million, according to the Dallas Business Journal.

The 40-story behemoth was bought back by Pinnacle Bank Texas in the auction held on the steps of the Tarrant County courthouse on Tuesday.

Pinnacle had claimed in public filings that the tower’s former owner, Burnett Cherry Street LLC, an affiliate of New York-based Opal Holdings LLC, defaulted on a $13 million loan used to purchase the building in 2021.

-

Bill’s Commentary:

“ZeroHedge posted this with the comment; “Fresh out of Unicorn farts?” How do you top that commentary? Seriously, these are chickens on their way home to roost!”

Newsom Forced To Slash California Budget, Blames Crippling Deficit On “Rain Bombs” And Tax Shortfalls

In the course of two years, California has turned a $100 billion surplus into a $73 billion deficit, forcing governor Gavin Newson (D) to propose painful (token) spending cuts on Friday while announcing his revised state budget.

Bill’s Commentary:

“Does this include backdated Blackface?”

Blame Canada? Justin Trudeau Creates Blueprint for Dystopia in Horrific Speech Bill

On February 21st, Canadian Prime Minister Justin Trudeau gave a press conference in Edmonton, announcing his government’s decision to introduce the Online Harms Act, or Bill C-63. It was described in Canadian media as a “bill to protect kids” that would stop the “exploitation of children,” and Trudeau’s curt speech focused solely on minors. The scarf-clad PM angrily dismissed criticisms the bill might have a broader focus.

-

The latest from USA Watchdog –

Huge Financial Shock Inevitable & Hitting Now – Ed Dowd

Former Wall Street money manager Ed Dowd is a skillful financial analyst. Even though he has a wildly popular book on CV19 vax deaths and injuries called “Cause Unknown,” he is now turning his attention back to the economy. Dowd warns the economy can fall out of bed at any time. Dowd explains, “What’s coming up next is a credit cycle. We are going to see commercial real estate go into problem mode. There are a lot of loans that need to be rolled over in 2024 and 25. A lot of these properties are down 80% . . . . There is huge credit risk coming. The prediction of bank failures is accurate. We are going to see, over the next 12 to 24 months, banks go belly-up. Then, they will have to get merged with bigger banks.”

-

Bill’s Commentary:

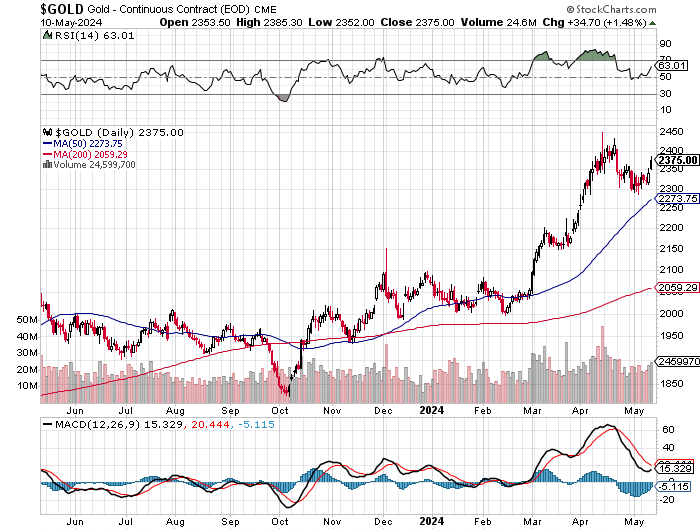

The precious metals complex had a pretty good run since early March. Gold, silver, and the miners got quite overbought and deserved to relax and digest those gains, which is what we’ve seen the past 2-3 weeks. For many years now, metals bulls have repeatedly asked “when”? It looks to me like “when” is NOW! I believe this coming week may be the most interesting week we have seen in many many years. I have pasted 3 charts, gold, silver and the HUI mining index. Before you tell me that because the metals complex is so rigged that charts are meaningless, please be patient. Something has definitely changed. That change is what we believed all along, that the physical markets would overwhelm the paper markets. This is, and has, been happening with China a huge buyer of physical gold and India the same with silver. There are now premiums on the SGE over and above COMEX and LBMA which has led to arbitrage moving physical metal from West to East and definitely tightening available supply for the paper traders to use to satisfy deliveries.

This first chart is gold which moved to all time highs. You will see a roughly 33% move up since last October, and close to a 20% move since late February. The move since February saw some serious overbought readings which you would expect to see with a move of this magnitude. If you look at the bottom of the chart, you will see the MACD (moving average convergence/divergence). This indicator can be quite useful leading up to a breakout or a breakdown. In this case, it looks to me like another push higher to further new highs is imminent. You will see a “hook” turning up, it has not crossed over yet but very close indeed!

Here we have silver. Silver has been JP Morgan’s beaten up and battered red headed stepchild. The silver market is maybe only 1/10th the size of gold, so obviously it is much easier to “manage” or manipulate. Since late February it’s had a nearly 40% move. Just as gold, it is no longer overbought but a little further advanced on the MACD “hook”. In fact, it closed Friday minutely crossing over to positive. The setup tells me that the coming week (maybe two) will be extremely telling of the future direction and do so in a huge way. “They” (the cabal) must either slam the metals complex here and now to abort the chart patterns, or suffer the consequence of a full on (and more importantly GLOBAL) “bank run” out of dollars/US Treasuries and into gold/silver/miners. $30+ silver looks like it could be only a day or a few days away. This will green light a very quick move to the $50 level where another battle will be fought …unless of course if a failure to deliver occurs, then all bets are off and the sky (floor for fiats) is the limit. I have been on the record for years that the entire fiat experiment would end in a failure to deliver physical metal. We may see this in very short order!

Lastly we have the beaten up HUI index. Same as silver, no longer overbought and the MACD infinitesimally crossed over higher on Friday. A picture perfect set up if you ask me, not severely overbought and within spitting distance of a breakout!

In conclusion, it looks like this week could be super exciting for those who have held “real money” for so many arduous years. Please remember, gold and silver do not “go up or down”, they are merely a mirror image of fiat. The real way to say the above is, this may be the week where the collapse of fiat is seen in its full nakedness! Though there are some who buy gold and silver because they believe they will “go up”, the REALLY BIG money buys metal to get out of fiat and the system as a whole. A bank run away from the system if you will? Whether or not they can find and kill Bin Laden for a 9th time remains to be seen, but they had better pull some sort of rabbit out of the hat immediately. Otherwise, we will see gold, silver, and the miners breaking out to new ground and the train fully pulled out of the station within a week or two.

There is no bull market like a gold bull market the saying goes. This is because “fear is a far greater emotion than greed”. A stampede into the metals will ultimately create a failure to deliver. When you tell a human that something is not available at any price, they only want it that much more! You are watching the canary in the coal mine, how much life is left in the empire? Stay tuned!

Standing watch,

Bill Holter

-

Bill’s Commentary:

“Our pal Praemonitus praemunitus! (look it up) wrote this. I can only say, I wish I was the author. It is so simple and so correct! Only gold (silver) is money, everything else is credit…”

-

Bill’s Commentary:

“Filed under the category “deflation of the things you have.””

Bad-Loans Hit Record-High As Used-Car Prices Suffer Worst Bear-Market Ever

A bear market in the used car market was confirmed in November and has since worsened through April. At the same time, negative equity values are hitting new record highs while auto insurance rates have soared the most since the mid-1970s. While gas prices at the pump are elevated, the environment to operate a vehicle is probably one of the worst ever. Just listen to Gen-Z and millennial users on X bitch and moan about $1,000 monthly car payments and other absurd costs associated with driving.

Bill’s Commentary:

“Socking gold away today …in order to buy hotcakes at a later date?”

Gold bars are selling like hot cakes in Korea’s convenience stores and vending machines

Aside from ramen and sausages, South Korea’s convenience stores have a new popular item on the menu — gold bars.

The country’s largest convenience store chain, CU, has been collaborating with the Korea Minting and Security Printing Corporation (KOMSCO) to offer customers mini gold bars — and they’re selling like hot cakes.

Bill’s Commentary:

“Is he also in favor of a CBDC?”

Bill’s Commentary:

“We have told you for many years it was all about “credit”, you will fully understand this over the next 12 months. $1 trillion of commercial loans need to be rolled over, not happening …unless of course Treasury would like to provide the funding? But who will fund the Treasury?”

Office Tower Turmoil in NYC Worsens Ahead of Trillion Dollar Maturity Wall

A combination of factors, including remote work, an exodus of progressive cities, higher interest rates for longer, and diminished credit availability, continues to pressure the office tower market nationwide. The latest example of challenges facing the $20 trillion commercial real estate market comes from New York City.

Bloomberg reports that the $400 million loan backing 1440 Broadway, a 25-story tower at the corner of Broadway and 40th Street in Midtown Manhattan, has fallen into delinquent status.

Bill’s Commentary:

“These people are insane! Can you imagine someone sequestering your savings, and then paying the interest to your enemy? Is there any rule of law left? Is the West prepared to start WWIII that by every computer model ends in nuclear war? Are $3 billion pieces of paper worth it? Is $200 billion? What would any businessman in the world do …if he was backed by the most powerful military in the world and was blatantly and publicly stolen from?”

EU Policy. Brussels agrees to send €3bn from frozen Russian assets to aid Ukraine

EU diplomats agreed Wednesday to use income from frozen Russian state assets to aid Ukraine – paving the way for the war-torn country to get around €3 bn for arms purchases and reconstruction before the summer.

Since the full-scale invasion of 2022, €210 billion in assets of the Moscow central bank have sat frozen within the bloc – chiefly at the Euroclear depositary in Belgium.

-

Bill’s Commentary:

“Erik’s Constitutional “lunacy” today would not have even raised an eyebrow 50 years ago!”

The latest from Erik –

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.