-

Bill’s Commentary:

“Any questions?”

Bill’s Commentary:

“I for one am shocked! Didn’t Dick Cheney tell us that deficits don’t matter?”

Bill’s Commentary:

“It’s OK, they are saving Democracy!”

Biden Regime Operatives Stalk Journalist, Block Interviews With Voters at Campaign Stop

The Most Transparent Administration in History™, as the marketing slogan goes, is now, right out in the open, in broad daylight, hounding journalists — even state-sanctioned journalists from the beloved New York Times — so as to prevent them from discovering and reporting that voters have eyes and ears, who were none too impressed with the Brandon entity’s on-stage total apocalyptic meltdown last Thursday night.

Bill’s Commentary:

“And then one day, it just appeared in your backyard!”

Satellite Images Show Expansion of Suspected Chinese Spy Bases in Cuba

WASHINGTON—Images captured from space show the growth of Cuba’s electronic eavesdropping stations that are believed to be linked to China, including new construction at a previously unreported site about 70 miles from the U.S. naval base at Guantanamo Bay, according to a new report.

The study from the Center for Strategic and International Studies, a Washington-based think tank, follows reporting last year by The Wall Street Journal that China and Cuba were negotiating closer defense and intelligence ties, including establishing a new joint military training facility on the island and an eavesdropping facility.

At the time, the Journal reported that Cuba and China were already jointly operating eavesdropping stations on the island, according to U.S. officials, who didn’t disclose their locations. It couldn’t be determined which, if any, of those are included in the sites covered by the CSIS report.

Bill’s Commentary:

“Ooops!”

How thousands of Americans got caught in fintech’s false promise and lost access to bank accounts

When Natasha Craft first got a Yotta banking account in 2021, she loved using it so much she told her friends to sign up.

The app made saving money fun and easy, and Craft, a now 25-year-old FedEx driver from Mishawaka, Indiana, was busy getting her financial life in order and planning a wedding. Craft had her wages deposited directly into a Yotta account and used the startup’s debit card to pay for all her expenses.

The app — which gamifies personal finance with weekly sweepstakes and other flashy features — even occasionally covered some of her transactions.

-

Bill’s Commentary:

“I would say the flood gates just opened?”

Jury fines BlueCross for firing worker over COVID-19 vaccine mandate

A Tennessee jury has awarded a former research scientist at BlueCross BlueShield of Tennessee $687,000 in back pay and damages after she was fired in 2021 for refusing to take the COVID-19 vaccine.

Following a three-day jury trial in Chattanooga last week, a federal jury decided BlueCross failed to provide reasonable accommodation for Tanja Benton, who did most of her work from home and claimed a religious exemption to the company’s vaccine mandate.

Chattanooga Attorney Doug S. Hamill, who represents Benton, said the biostatistical research scientist was fired in November 2021 in violation of her religious beliefs after working for the Chattanooga-based health insurer for nearly six and a half years. Benton said she believed the COVID-19 vaccines are derived from aborted fetus cell lines.

Bill’s Commentary:

“Another country repatriates their gold from the West …hmmm?”

Even Nigeria Plans to Bring Gold Reserves Home to Minimize Risk

Even Nigeria is now bringing its gold reserves home to keep it safe from the West.

According to a report by The Star, Nigerian officials decided to repatriate the country’s gold in April “to mitigate risks associated with the weakening U.S. economy.”

“Economic indicators such as rising inflation, escalating debt levels, and geopolitical tensions have raised apprehensions among Nigerian policymakers about the stability of the U.S. financial system.”

Nigeria holds about 21 tons of gold in its reserves.

-

Bill’s Commentary:

“I did not know this had happened, but I have thought for years that current history could be digitally erased similar to a “book burning”. It looks like that thought process was not far off the mark?”

LIBBY EMMONS: The encroaching digital dark age begins with the erasure of MTV News

When I was a kid I really wanted to know things. I would ride my ten-speed to the library in our little suburban Massachusetts town, say “hi” to Mrs. Johnson the librarian, and scour the card catalog to find things I didn’t know. I liked maps and old history. I liked fiction and stories about girls my age. I liked tales of adventure told by great American men. As I grew up, my obsession with libraries was unceasing and I discovered that if you looked deep enough, there were records of everything. In college, I poured over microfilm of old issues of The New York Times or defunct old news outlets like the Philadelphia Tribune that were kept in storage but hadn’t been publishing for years, sometimes decades. Kids who are hungry for knowledge of the past will find gaping holes in those records: all beginning with the erasure of MTV News.Bill’s Commentary:

“Pretty much spot on!”

Surprise, Surprise!

“Joe Biden is the walking embodiment of the exhausted American Establishment. More and more people have simply lost their faith in our Ruling Class. You could scarcely have a more potent symbol of its impotence.” — Rod Dreher

Just before the weekend, a political prairie fire raced across a nation buffaloed, blind-sided, and buried deeply in bullshit, and the little critters who inhabit the landscape are still running around with their fur smoldering. What a surprise that “Joe Biden,” the mentally-disabled pretend-president, fell apart in the debate spotlight for all to see, like Captain Queeg in his fateful witness chair, or William Jennings Bryan at the Scopes trial (1925), or the Wizard of Oz when little Toto drew the curtain back — a brutal revelation of stark truth about how things actually are.

Bill’s Commentary:

“As we approach July 4th, I don’t think this is exactly what our founding fathers had in mind? But, if AOC is “butthurt”, it might make the BBQ taste a little better?”

AOC threatens to IMPEACH all six conservative Supreme Court Justices after Trump immunity ruling

Squad leader Rep. Alexandria Ocasio-Cortez said that she plans on impeaching the six conservative Justices on the Supreme Court for their ruling in Donald Trump‘s presidential immunity case.

The conservative 6-3 majority on the Supreme Court ruled Monday a president does have immunity from criminal prosecution for official acts in a monumental decision.

The ruling kicks the decision on whether Trump intentionally tried to subvert the 2020 election results back to a Washington, D.C., judge – and will likely delay the trial until after the November election in a ‘big win’ for the former president.

-

Bill’s Commentary:

“Mark my words, this will be used to tell you after the crash “but we warned you”!”

The Fed and FDIC Wake Up Suddenly to the Threat of Derivatives, Flunking the Four Largest Derivative Banks on their Wind-Down Plans

Since the financial crash of 2008 and the Fed’s multi-trillion dollar bank bailouts that followed, the Office of the Comptroller of the Currency (OCC) has been waving a giant red flag every quarter in its “Bank Trading and Derivatives Activities” reports. For sixteen years the OCC has been reporting that just four megabanks are responsible for more than 80 percent of the trillions of dollars in bank derivatives.

Bill’s Commentary:

“Weekend comedy!”

CDC Recommends New COVID-19 Vaccines for Nearly All Americans

The U.S. Centers for Disease Control and Prevention (CDC) on June 27 recommended forthcoming COVID-19 vaccines for virtually all Americans.

“CDC recommends everyone ages 6 months and older receive an updated 2024-2025 COVID-19 vaccine to protect against the potentially serious outcomes of COVID-19 this fall and winter whether or not they have ever previously been vaccinated with a COVID-19 vaccine,” the agency said in a statement.

The COVID-19 vaccines now available, which are also broadly recommended, target the XBB.1.5 strain. But observational data indicate they provide short-lived protection against COVID-19 infection and hospitalization.

Bill’s Commentary:

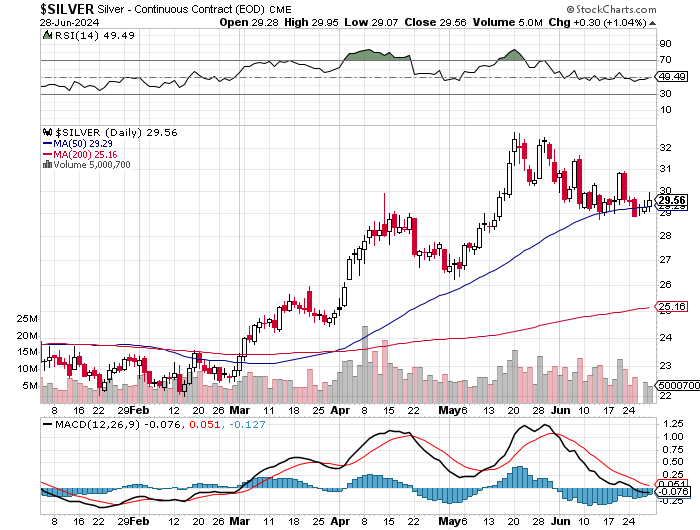

“Update; I posted the below commentary and chart last weekend regarding silver, it is still valid. We are a week out from this writing and things still look similar if not better as we have another week of building the base. I believe within a week to 10 days, the MACD at the bottom of the chart will form another hook, and then crossover to the upside. With all of the surrounding financial, political, and geopolitical catastrophes building, my target of $34-37 in the medium term may end up being modest?”

”Is silver bouncing exactly where it is supposed to? $29 is support from the previous highs back in April and also support from the 50 day moving average. Given a week or so, this looks like we may see another “hook” in the MACD turning upwards and crossing over. I think we could see at $34-37 on this next leg but we need to see more work done here digging off support. In any case, a very big move either up, or down is in the cards as we have spent nearly 3 weeks chopping in the $29-31 zone, not overbought nor oversold on the daily’s and coiled for a move one way or the other. Add the fundamentals where silver is in a structural deficit and a snorting bull market/major short squeeze looks likely. Stay tuned!”

Bill’s Commentary:

“Erik on Socialism vs Capitalism”

The latest from Erik –

-

Bill’s Commentary:

“”Someone” holds the debt on these to be empty towers, the losses will be eaten by “someone”…”

Moody’s Predicts 24% Of Office Towers Will Be Vacant By 2026

A new report from Moody’s offers yet another grim outlook that the commercial real estate downturn is nowhere near the bottom. Elevated interest rates and persistent remote and hybrid working trends could result in around 24% of all office towers standing vacant within the next two years. The office tower apocalypse will result in more depressed values that will only pressure landlords.

“Combining these insights, with our more than 40 years of historic office performance data, as well as future employment projections, our model indicates that the impact on office demand from work from home will be around 14% on average across a 63- month period, resulting in vacancy rates that peak in early 2026 at approximately 24% nationally,” Moody’s analysts Todd Metcalfe, Anthony Spinelli, and Thomas LaSalvia wrote in the report.

Bill’s Commentary:

“The election process certainly got much more interesting last night! I see no possible way that Joe Biden is on the ballot in November. James Howard Kunstler has an interesting take linked below. In my opinion, if anything, last night’s trainwreck upped the odds in my opinion that we actually do have an election, but not by much… The reason being, I am not sure that Joe Biden can even finish the current term, there will be (already are) calls from the left for him to step down and be replaced by another candidate. I do not believe there are any candidates out there that can whip up enough excitement or support in 130 days to get within “the margin of cheating” to be believable …with one exception, Michelle Obama. In my opinion, this debate was scheduled as the earliest debate ever, and before both conventions, to leave time for a replacement candidate. I still believe that the occurrence of an election is at best a 50/50 or slightly higher proposition. My fear is this, there has been so much crime behind the scenes that they will have to kick the table completely over, so that no “investigations” can be made. One thing I am sure of, the potential for armed conflict and WWIII rose greatly last night. Whether it be that foreign adversaries now see the US as a rudderless entity (and a greatly diminished power) or as I said, an internal kick of the table via false flag, the entire world just got more risky in the first 2 minutes of that debate. I believe markets, ALL markets, will reflect this higher risk over the next 4 months. Time will tell!”

Joe Biden Catches Cold

Maybe ninety-seconds into last night’s long-awaited debate spectacle, the consensus must have jelled among the woke-and-broken news media mavens that their champion, “Joe Biden,” was not quite killing it out there at the podium. CNN moderators Jake Tapper and Dana Bash acted like witnesses at a ritual sacrifice. And afterward, the CNN post-mortem panel seemed genuinely shocked that months of playing pretend had skidded to such an ignominious finish.

Which raises a great many questions, starting with: why on earth did the Democratic Party and its media handmaidens persist in pretending month-after-month that “Joe Biden” was a fit candidate for another four-year term? Last night, he didn’t appear capable of even finishing the current term. Why did they usher him so jauntily into the nomination? And what are they going to do about that now? And what were their motives for all that pretending? “Joe Biden” circulates among scores of astute officials every day. Did they all fail to notice his incapacity? Or has the whole thing been a sham and a lie all along? Was this just the culminating hoax by the Party of Hoaxes of a long string of hoaxes against the nation going back to 2015?

Bill’s Commentary:

“This is pretty scary!”

DATA ANALYSIS: MORE BANKS AT RISK OF FAILURE AS CRE LOANS REPRICE

More than 60 of the largest banks in the country are at increased risk of failure due to their commercial real estate (CRE) exposures, according to a data analysis from a finance expert at Florida Atlantic University.

Sixty-seven banks have exposure to commercial real estate greater than 300% of their total equity, as reported in their first quarter 2024 regulatory data and shown by the U.S. Banks’ Exposure to Risk from Commercial Real Estate screener.

“This is a very serious development for our banking system as commercial real estate loans are repricing in a high interest-rate environment,” said Rebel Cole, Ph.D., Lynn Eminent Scholar Chaired Professor of Finance in FAU’s College of Business. “With commercial properties selling at serious discounts in the current market, banks eventually are going to be forced by regulators to write down those exposures.”

-

Bill is interviewed by Liberty and Finance (Also posted under Interviews)

-

Bill’s Commentary:

“In case you were wondering, this is why Julian Assange was jailed.”

10 most controversial exposé by WikiLeaks founded by Julian Assange.

-

Bill is interviewed at Coffee and a Mike (also posted under Interviews)

Bill’s Commentary:

“So not only is The Fed sitting on huge unrealized losses, they also have a cash operating loss since 2022? And this is the entity that issues the world’s reserve currency? At least now you know why the world has formed a competitive bloc called the “BRICS”!”

The Fed Posts Historic Operating Losses As It Pays Out 5.40 Percent Interest to Banks

According to Federal Reserve data, for the first time in its history, the Fed has been losing money on a consistent monthly basis since September 28, 2022. As of the last reporting date of June 19, 2024, those losses add up to a cumulative $176 billion. As the chart above using Fed data shows, the losses thus far in 2024 have ranged from a monthly high of $11.076 billion in February to a low of $5.674 billion in May.

These losses are separate and distinct from the unrealized losses the Fed is experiencing on the debt securities it holds on its balance sheet. It does not mark those losses to market since it intends to hold the securities to maturity and their principal is guaranteed at maturity by the U.S. government.

Bill’s Commentary:

“Price always follows volume! Are you paying attention?”

US Pending Home Sales Unexpectedly Plunged In May To A New Record Low

After crashing in April, analysts expected a small rebound in pending home sales in May, but they didn’t.

That dragged the YoY change down 6.6% to a new record low…

“The market is at an interesting point with rising inventory and lower demand,” NAR Chief Economist Lawrence Yun said in a statement.

“Supply and demand movements suggest easing home price appreciation in upcoming months. Inevitably, more inventory in a job-creating economy will lead to greater home buying, especially when mortgage rates descend.”

Bill’s Commentary:

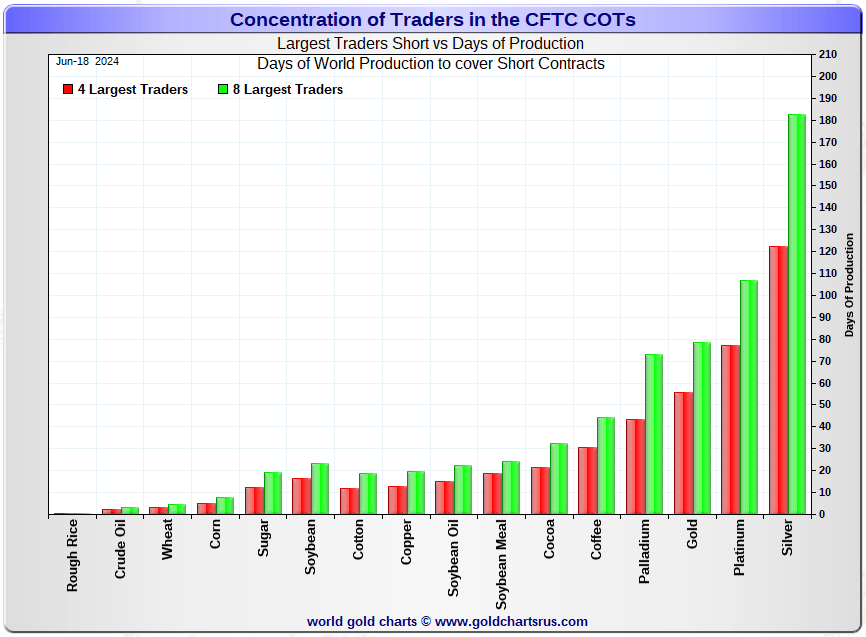

“Based on this chart, which asset will have THE greatest short squeeze rallies when the financial system goes south? To put this in easy terms to understand, based on current volume levels, the shorts would need to purchase (cover) an amount equal to 6 months worth of normal daily volume. This of course does not include “normal buying” which will be anything but normal …have you ever seen sharks in bloodied water before?! I promise you, the “cover” and resulting explosion will be unlike anything you have ever seen in any asset class in ALL OF HISTORY!”

Bill’s Commentary:

“Well, at least they have now given a timeline of 3 years. Do you really believe there will be no frontrunning?”

Brics Announces Plans to Completely Abandon the US Dollar

The Brics is a group of countries interested in the prevalence of international justice, while the West seeks in all ways to stop the multilateralization of the international community to prolong its hegemony.

The new development bank of the economic alliance Brics announced on Wednesday its plans to abandon completely the US dollar in the next 3 years.

-

Bill’s Commentary:

“So, this qualifies as a school?”

No 8th Grader at LeBron James’ Ohio School Has Passed State Math Test Since 2019

Not a single 8th grade student at left-wing activist and basketball legend LeBron James’ I Promise School in Ohio has passed the state’s math proficiency exam since 2019, according to a review by the local Akron Beacon Journal.

“Seeing himself in the faces of Akron’s youth, he’s dedicated his time and resources to eliminating many of the barriers most inner-city students and families face. He’s rolled all of his philanthropic efforts into the I Promise School, which he considers one of the greatest achievements of his lifetime,” says the school’s website.

Bill’s Commentary:

“OF COURSE all the banks passed this test, did you think otherwise?”

As Usual All US Banks Pass the Fed’s “Stress” Test; Goldman Unexpectedly Has 2nd Ugliest Credit Card Portfolio

In the latest annual farce meant to boost confidence in the banking sector, moments ago the Fed announced that all the biggest US banks passed annual stress test with flying colors, paving the way for higher shareholder payouts as the industry awaits a watered-down version of a separate proposal for stricter capital requirements. Of course, all the banks that collapsed last March passed the “stress test” too, so there’s that.

Bill’s Commentary:

“On silver…”

Acceleration of the Silver Price Rise in the Short Term

China is the world’s factory and largely dominates the photovoltaic panels market, an industry that consumes a lot of silver. From January to May 2024, 1,663 tonnes of silver were delivered to the Shanghai markets (SGE and SFE), and analysts expect 3,992 tonnes to be delivered during this year.

While SFE stocks stood at 3,200 tonnes in January 2021, they fell to 684 tonnes on June 20, 2024.

Bill is interviewed by CapitalCosm. (also posted under Interviews)

Bill’s Commentary:

“A good one from Erik!”

The latest from Erik –

-

Bill’s Commentary:

“Are they planning to show the debate on the Comedy Channel?”

“This Proved Our Point”: CNN Anchor Slammed Over Mic-Cut Exposing Jake Tapper Lies

In case you needed a preview of what to expect during this week’s presidential election debate – hosted by CNN – we present the following…

Just seconds after Trump 2024 National Press Secretary Karoline Leavitt began to discuss CNN’s historical bias against her candidate – most specifically that of debate moderator Jake Tapper’s history of anti-Trump lies – CNN anchor Kasie Hunt “ma’am’d” her and immediately cut her mic and ended the interview…

Bill’s Commentary:

“Further proof that government statistics are pure bullshit!”

Newest Early Jobs Revision Shows No Net Job Growth During 2023

Monthly State Jobs Estimates Are Revised Annually. Each month our office publishes the most recent state employment figures from the the Current Employment Statistics (CES) survey. State employment figures come from this monthly survey, which is based on a small sample of businesses in the state. As a result, once per year the U.S. Bureau of Labor Statistics (BLS) does a benchmark revision, updating the monthly CES estimates to match more reliable administrative data from states’ Unemployment Insurance programs.

Federal Researchers Now Publishing Quarterly Revisions. Although the BLS only revises the state-level CES once per year, the underlying data used to revise the CES survey is collected quarterly. Taking advantage of this asynchrony, in 2021, researchers at the Federal Reserve Bank of Philadelphia began publishing state-level “early revisions” based on the same underlying data but revised more frequently.

Bill’s Commentary:

“He should never have been arrested in the first place, and Trump should have pardoned him…”

WikiLeaks founder Julian Assange strikes plea deal with the U.S.

WikiLeaks founder Julian Assange has entered into a plea deal with the U.S. government, bringing an end to a years-long international saga over his handling of national security secrets.

Assange is preparing to plead guilty to a single count of conspiring to obtain and disclose information related to the national defense in a U.S. federal court in Saipan, in the Northern Mariana Islands, a U.S. commonwealth in the Pacific, this week, according to newly filed court papers.

Bill’s Commentary:

“Your tax dollars (and government borrowing) at work!”

U.S. Airbase Authorizes Troops To Wear LGBT ‘Pride Patch’ Alongside Real Badges Of Honor

The latest example of the politicization of the military under the Biden administration (and there are many) has been revealed by Stars and Stripes. It reports that the commander of the Osan Air Force base in South Korea has authorized troops on the base to wear a “pride morale patch” on their military uniforms, in public and while on duty.

Insignia and patches on a soldier’s uniform used to serve the purpose of telling you something about the military qualifications and experience of the soldier. They now can also signal whether a soldier ascribes to the Democrat Party’s current political trends.

Bill’s Commentary:

“…AND Mike Pompeo”

Bill’s Commentary:

“This should tell you all you need to know about Mike Pence…”

Bill’s Commentary:

“Suddenly? There has been a banking problem since the turn of the century, now it’s “suddenly”?”

The Fed and FDIC Wake Up Suddenly to the Threat of Derivatives, Flunking the Four Largest Derivative Banks on their Wind-Down Plans

Since the financial crash of 2008 and the Fed’s multi-trillion dollar bank bailouts that followed, the Office of the Comptroller of the Currency (OCC) has been waving a giant red flag every quarter in its “Bank Trading and Derivatives Activities” reports. For sixteen years the OCC has been reporting that just four megabanks are responsible for more than 80 percent of the trillions of dollars in bank derivatives.

Bill’s Commentary:

“Can you say Banana republic land?”

The National Debt Crisis Is Coming

During the Obama administration, many economists and political commentators became worried that the U.S. faced endless budget deficits that could cause higher interest rates, depress investment, and slow economic growth. Some elected officials pressed for a so-called grand bargain in 2011 between the parties that would both reduce spending and increase revenue, and a bipartisan commission was appointed to address the issue.

Although the commission failed to reach an agreement, the negative consequences that budget hawks predicted didn’t come to pass. Instead of rising, inflation rates slowed after 2011 and remained low for years. The economy entered a period of growth until the pandemic disrupted everything.

Bill’s Commentary:

“This from the CDC presented by NBC, both with stellar reputations for “truth”. Will this be SO BAD that we cannot hold an election because everyone knows that mosquitos swarm polling stations in November?”

CDC issues dengue fever alert in the U.S.

The Centers for Disease Control and Prevention issued a health advisory Tuesday alerting authorities, health care providers and the public of the increased risk of dengue fever infections in the United States.

The alert comes as an unexpectedly higher number of dengue fever cases have been reported across the nation, according to the CDC.

A total of 2,241 cases have been reported so far this year in the U.S., including 1,498 cases in the U.S. territory of Puerto Rico, where a public health emergency was declared in March after cases exceeded historical figures. Most of the cases reported in states are travel related, according to the CDC.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.