-

Bill’s Commentary:

“I guess the question at this point is WHY?”

Good Morning and welcome to part 2 of the September Silver $200 Calls of confusion.

Yesterday, I had witnessed a large scale purchase of this said option, within a 40 minute time period before the S&P close, within a trading range between .001 and .002, going from a Volume of 134 all the way up to a total of 1,080 swaps at the ICE close (International Commodity Exchange). By all measure, one would have expected to see a change in the Open Interest which was recorded at 4,812 (buyers/sellers combined). The option value closed at 0.001 cent = $5. As of this morning, even after shutting down my trading platform and restarting, the Open Interest has not changed. It remains at 4,812. To add, the is an “ask” price of 1.5 cents and no bids up on the board so far this morning.

Since this trade was done after the Comex close, 1:25 PM Est, it may be that the Open Interest won’t change until the next trading day (Monday).

Admittedly I have no idea what this means. I do see $125/$150/$175/$200 Calls spread out till March 2025 (excluding the Jan/Feb serial months, for now). It could be a form of what is called a Calendar Spread, but is way super overweighted in Sept.

If anything else noteworthy happens on Monday, I’ll send out another note. Have a great weekend and as always

Stay Long!

Jeremiah Johnson

-

Bill’s Commentary:

“Drugged up athletes and drag queens, I think I will totally pass on this Olympics …”

Bill’s Commentary:

“Did he really say “after the GOVERNMENT tried to kill former President Trump?”

Bill’s Commentary:

“Our pal J. Johnson checks in with something quite interesting! Who in the world would pay money for October silver $200 calls? And for those who wrote these calls, could they end up being similar to the counterparties of “The Big Short”?”

To all; I saw something absolutely crazy today and have to tell you. Today is options expiration for August Options in Silver and Gold. I only watch Silver at present and have noticed someone had become a market maker in the $100/$125/$150/$200 Calls going out to March 2025 (maybe about a week ago). Today, about ½ hour before the S&P close I watch the Volume in the $200 Calls (September) go from 134 to now 861, and climbing, paying $5 each for them plus the commissions. Not sure what I am seeing here. Brokering for over 30 years and have never seen anything like before.

Hope it means something. Have a nice day, and as always ..

Stay Strong!

Jeremiah Johnson

An addendum from J. Johnson –

For the $200 Calls in September at 1,080. No other months have this kind of Volume that high at all. Truly an odd purchase.

-

Bill’s Commentary:

”Homeschooling is the answer to this!”

California teachers were right to severely punish girl, 7, for writing these words under Black Lives Matter drawing she gave to friend, judge rules

A California judge has ruled that teachers were right to punish a seven-year-old girl over a Black Lives Matter drawing because ‘she’s too young to have First Amendment rights.’

The first grader was banned from recess and drawing pictures at Viejo Elementary in Orange County after she added the words ‘any life’ below Black Lives Matter on a picture she drew and and gave to a black friend.

The picture showed the words ‘Black Lives Matter’ with four round shapes in various different tones of brown, beige and yellow, which was intended to ‘represent her friends’ who were ‘racially-mixed’.

Bill’s Commentary:

“Filed under the category of complete bullshit!”

Monday was the world’s hottest day ever recorded — breaking Sunday’s short-lived record

Sunday’s record as the hottest day ever recorded on Earth lasted only one day.

According to preliminary data from the European Union’s Copernicus Climate Change Service, the global average temperature reached 17.15 degrees Celsius (62.87 degrees Fahrenheit) on Monday, toppling the prior day’s record of 17.09 C.

In other words, the planet had its two warmest days back-to-back this week. “For those of you who are bent out of shape that silver stopped at $32, here is Michael Oliver to help your weak knees!”

Bill’s Commentary:

“For those of you who are bent out of shape that silver stopped at $32, here is Michael Oliver to help your weak knees!“

Michael Oliver: $50 Silver? No Problem.

This is an excellent interview conducted by Chris in which he and Michael discuss price and momentum as indicators of future price using historical context.

-

Bill’s Commentary:

“Truth, justice, and the American way?”

Trial in Bombing of U.S. Warship Set to Start 25 Years After Attack

The death-penalty trial of a prisoner accused of plotting the bombing of the U.S.S. Cole warship has been set to begin in October 2025. If the plan holds, the trial would coincide with the 25th anniversary of the Qaeda attack, which killed 17 U.S. sailors off the coast of Yemen.

Col. Matthew S. Fitzgerald, an Army judge, reserved a courtroom at Guantánamo Bay for the trial from Oct. 6, 2025, until Dec. 19 of that year, according to an order released by the court on Friday. Based on the court calendar, it would reach trial before the Sept. 11 case, whose judge has set 23 weeks of pretrial hearings for next year.

Bill’s Commentary:

”Don’t ever forget, when all is said and done, price ALWAYS follows volume…”

US Existing Home Sales Puked (Again) In July…

US existing home sales slumped for the fourth straight month in June, plunging a worse than expected 5.4% MoM (the worst MoM drop since Nov 2022) and dragging sales down 5.4% YoY…

Notably, existing home sales have not risen on a YoY basis since July 2021, with the SAAR total back below 4mm, near COVID lockdown lows…

-

Bill’s Commentary:

”A good history and explanation of silver price manipulation.”

Suppressing silver prices has been official U.S. policy since 1965

In the July 18 edition of Gold Newsletter, editor and publisher Brien Lundin wrote about the failure of silver prices to keep up with gold prices. “I’m not the kind of conspiracy buff that many of my friends in the industry are,” Lundin wrote, “but it’s hard to look at silver and not see some hidden hands at work (especially considering who holds so much of the metal in both physical and paper forms while acting as custodian for the biggest silver exchange-traded fund).”

Of course Lundin meant investment bank JPMorganChase and silver ETF SLV.

Bill’s Commentary:

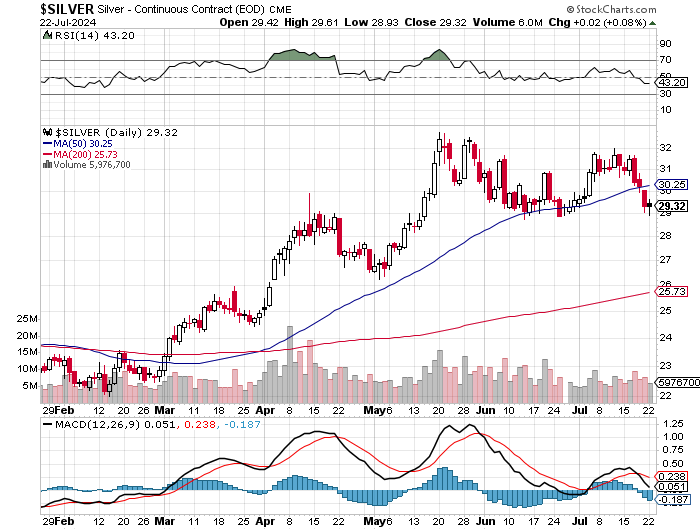

”Update on Silver;

We posted this chart a little over 3 weeks ago. Silver did break higher but was contained at $32. Was it real selling or paper? I believe it was vastly paper but for now it does not matter, price is price. It will certainly matter when failure to deliver finally arrives. So here we are, right back at $29 support. This should hold, if not there is strong support at $25.50-26. If it does hold, it will require a week or two to stabilize but $32.50 should fall. This is all short term technical stuff, the reality is fundamental, not technical. The Western world has gone hyperbolic in its issuance of debt, $2-3 trillion per year just from the US alone, then add the other sovereign treasuries. Silver supply/demand has been in deficit for 3+ years and continues today. Between the supply deficit, Western central banks shortly being forced to ease due to financial stress and the fact that they have reached “debt saturation” levels, once this pullback is done, silver looks to me like we will see a spectacular 2nd half of the year after performing as the best asset in the 1st half. Hold tight and do not be shaken out. The biggest outlying gains always come in compressed timeframes! A great change in “global currency” is about to occur, you must be in place while it happens. You will either be IN, or you will be OUT, likely for the remainder of your financial life!”

-

Bill’s Commentary:

“The Babylon Bee is more honest than nearly any mainstream media source …”

Jill Biden Drops Out Of Presidential Race

WASHINGTON, D.C. — Jill Biden has formally dropped out of the 2024 presidential race, she announced today at a press conference that was supposed to be for her husband.

“I cannot in good conscience continue,” the acting president said as her husband wandered around somewhere backstage.

Bill’s Commentary:

”How is it possible that Joe got dumped on National Ice Cream day?”

National Ice Cream Day is on Sunday. Here’s where to get free ice cream this weekend.

WASHINGTON — Looking to score a sundae on Sunday? National Ice Cream Day 2024 is this weekend, meaning there’s plenty of offers and deals for a sweet treat.

The national holiday takes place every third Sunday in July, which is also known as National Ice Cream Month. It’s all thanks to President Ronald Reagan who signed a proclamation 40 years ago, partly due to his love of the frozen delight, designating the national month and holiday.

Bill’s Commentary:

”Weekend Erik for you”

The latest from Erik –

-

Bill’s Commentary:

”They lied?”

Bill’s Commentary:

”Weekend comedy/tragedy”

Bill’s Commentary:

”Is this the pot calling the kettle black?”

Treasury warns that anti-woke banking laws like Florida’s are a national security risk

WASHINGTON — WASHINGTON (AP) — The Treasury Department is warning that state laws that restrict banks from considering environmental, social and governance factors could harm efforts to address money laundering and terrorism financing.

The Associated Press obtained a copy of the letter sent Thursday to lawmakers. The letter singled out a law signed by Florida Gov. Ron DeSantisin May that says it would be an “unsafe and unsound practice” for banks to consider non-financial factors when doing business. The letter concludes that “such laws create uncertainty and may inhibit” national security efforts.

-

Bill’s Commentary:

“How is this, any of this, possible?”

Trump Gunman Flew Drone Over Rally Site Hours Before Attempted Assassination

A gunman who tried to kill Donald Trump was able to fly a drone and get aerial footage of the western Pennsylvania fairgrounds shortly before the former president was set to speak there, law-enforcement officials briefed on the matter said, further underscoring the stunning security lapses ahead of Trump’s near assassination.

Thomas Matthew Crooks flew the drone on a programmed flight path earlier in the day on July 13 to scour the Butler Farm Show grounds ahead of Trump’s ill-fated rally, the officials said. The predetermined path, the officials added, suggests Crooks flew the drone more than once as he researched and scoped out the event site.

-

Bill’s Commentary:

”An irritated Erik on the Trump assassination attempt”

The latest from Erik –

-

Bill’s Commentary:

”Since when does a CEO not attend an earnings call?”

Jamie Dimon Goes Missing from Earnings Call, After Dumping $183 Million of His JPMorgan Chase Stock Earlier this Year

We can’t remember a time when the Chairman and CEO of the largest, most complex and scandal-ridden bank in the United States, Jamie Dimon of JPMorgan Chase, was too busy to squeeze in an appearance at the company’s heavily-scrutinized quarterly earnings call with analysts. That happened last Friday.

When something happens for the first time at a bank that has racked up five felony counts, has been doled out non-prosecution and deferred-prosecution agreements by the U.S. Department of Justice in a steady drumbeat since 2014, and spent most of last year in the headlines for a decade of sluicing tens of thousands of dollars per month in hard cash to the international sex trafficker of children, Jeffrey Epstein, it pays to sit up and pay attention.

Bill’s Commentary:

”Where is this found in the Western news media?”

Bloomberg: Saudi Arabia threatens G7 to “dump” European securities if Russia’s frozen assets are confiscated

Ukraine risks being left without the Russian frozen assets promised to it by the West; the G7 countries received a corresponding warning from Saudi Arabia. Bloomberg reports this.

According to the agency, at the beginning of the year, Saudi Arabia hinted to the G300 countries that it could get rid of European debt obligations if they touched frozen Russian assets in the amount of $XNUMX billion. Although Riyadh did not directly say which countries’ securities were at risk, France would presumably suffer the most.

Bill is interviewed by Dave Janda at Operation Freedom

(Also posted under Interviews)

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.