-

Bill’s Commentary:

“Erik on the difference between currency and money …and only 250 million dead is a very optimistic view in my opinion.”

The latest from Erik –

Bill’s Commentary:

“DING DING DING! Did Warren Buffet ring the bell at THE top?”

Warren Buffett raises Berkshire cash level to record $277 billion after slashing stock holdings

Berkshire Hathaway’s cash pile swelled to a record $276.9 billion last quarter as Warren Buffett sold big chunks in stock holdings including Apple.

The Omaha-based conglomerate’s cash hoard jumped significantly higher from the previous record of $189 billion, set in the first quarter of 2024. The increase came after the Oracle of Omaha sold nearly half of his stake in Tim Cook-led tech giant in the second quarter.

Berkshire has been a seller of stocks for seven quarters straight, but that selling accelerated in the last period with Buffett shedding more than $75 billion in equities in the second quarter. That brings the total of stocks sold in the first half of 2024 to more than $90 billion. The selling by Buffett has continued in the third quarter in some areas with Berkshire trimming its second biggest stake, Bank of America, for 12 consecutive days, filing this week showed.

Bill’s Commentary:

“This resembles all Western financial markets …and society for that matter!”

Another Chinese Olympic swimming medalist linked to doping scandal denies any wrongdoing

Wang Shun vehemently denied that he ever cheated after winning a bronze medal in the men’s 200-meter individual medley at the Paris Olympics on Friday night.

Wang became the second swimmer linked to a Chinese doping scandal to claim a spot on the medal podium at these games, following Zhang Yufei.

Bill’s Commentary:

“Why? Because they might be crazy …but they’re not stupid?”

Central banks purchase gold to offset their own money destruction

Why is the price of gold rising if the global economy is not in recession and inflation is allegedly under control? This is a question often heard in investment circles, and I will try to answer it.

We must begin by clarifying the question. It is true that inflation is slowly decreasing, but we cannot say that it is under control. Let us remember that the latest CPI data in the United States was 3% annualized and that in the eurozone it is 2.6%, with eight countries publishing data above 3%, including Spain.

This is why central banks need to give the impression of hawkishness and maintain rates or lower them very cautiously. However, monetary policy is far from being restrictive. Money supply growth is picking up, the ECB maintains its “anti-fragmentation mechanism,” and the Federal Reserve continues to inject money through the liquidity window. We can say, without a doubt, that monetary policy is beyond accommodative.

-

Bill’s Commentary:

“Probably easier to get in as a refugee than passing customs as a true US citizen?”

The Latest Biden/Harris ‘Lawful Pathways’ Scheme: Declare Latin American Migrants to Be ‘Refugees’Almost sight unseen and scarcely noticed by the American public, the Biden/Harris administration’s Department of Homeland Security has super-charged yet another “Lawful Pathways” program to admit tens of thousands of people from Latin America who they claim would otherwise have crossed the border illegally.

It’s called the Safe Mobility Office Initiative (SMO), Movilidad Segura in Spanish, jump-started in May 2023 and its capacity expanded this spring. The SMO initiative uses the U.S. refugee resettlement system in a historically atypical way that some critics see as abusive to fly in tens of thousands of people from nationalities the United States has very rarely regarded as warranting refugee resettlement in recent decades — in record numbers and in record-fast time, a CIS examination and analysis of the new program shows.

Bill’s Commentary:

“No worries, it’s only a flesh wound!”

The sale price of 135 West 50th Street in Midtown, which is only 35 percent full, was a sign of how much the pandemic upended the market for office buildings in New York City.

In 2006, the hulking office building at 135 West 50th Street in Midtown Manhattan sold for $332 million. Tenants occupied nearly every floor; offices were in demand; real estate was booming.

On Wednesday, it changed hands again, in an unusual online auction — for $8.5 million.

The staggeringly low sale price of the 23-story glass behemoth that was once the headquarters of Sports Illustrated is the latest and perhaps most surprising sign of how the pandemic has upended the state of office buildings in New York City, home to the largest central business district in the United States.

-

Bill’s Commentary:

“The oddity continues!”

I’ve been watching these September Silver $200 Calls which has been stuck at 4,812 Open Interest for over a weeks’ time. Apparently yesterday, the open Interest went to 6,112. Not sure if they decided to add the trades from early in the week or “if” this was new? What would cause Silver to rise and put these options in the money? These options expire on August 28th

Stay Strong!

Jeremiah Johnson

Bill’s Commentary:

“J. Johnson checks in again…”

Ok, things are getting real interesting.

No trades in the Sept $200 Calls with its OI at 6,112

October $200 Calls has its Open Interest at 4 with a Volume of 30 at 0.004 ($20)

November $200 Calls OI is at 79 with a Volume of 55 up on the board between .006 and .009 ($30 to $45)

December $200 has its OI at 49 with no trades yet.

Also, Silver’s Futures Open Interest has dropped just over 10% since July 17th, the Wednesday after the assassination attempt (and the Crowdstrike event), down from 166,799 to today’s count (which is yesterday’s OI at the close) at 151,246, – 15,553 in long/short trades.

Is someone preparing for a major something? If so, the options, are now part of the play.

Stay Strong!

Jeremiah Johnson

From Wolfgang Rech –

Bill,My cousin was a bronze medal winner in gymnastics, so I was always interested in the Olympic games...summer and winter.

But no more. Not watching them ever again.

Now they allow professionals, as well as ignoring gender.

Shameful what it has become.

Wolfgang Rech

"W, not to mention the opening ceremonies?" Bill

-

Bill’s Commentary:

“As I have been saying all along, somebody, somewhere, is swallowing all of these losses. The banking system does not have enough capital to eat what is coming, neither does the US Treasury without its capacity to borrow more. Imagine, the solution is to borrow money to sustain the losses of borrowed money. We do live in the most interesting of times!”

“Absolutely Stunning”: CRE Analyst Lists Latest Office Tower & Mall Valuation Collapses

The commercial real estate downturn is still underway, posing significant risks for investors across financial markets. CRE-linked equities, corporate credit, structured credit, and private markets all feel the impacts of major unwinds as property prices plunge.

While headwinds from high interest rates may diminish in the coming quarters, with rate traders pricing in the possibility of the first 25bps cut as early as the mid-September FOMC meeting, the critical question is whether these projected rate cuts will be adequate to cushion the landing.

Office tower valuations remain sloped in a downward trend, plummeting in many cases, as vacancy rates soar as remote work trends keep white-collar workers out of the office and at home. These imploding values remain a massive threat to regional banks, with the CRE crisis likely to persist through 2025.

Bill’s Commentary:

“As well they should. Which government is next?”

Japan Apologizes to the Unvaccinated for the Millions of Deaths Caused by the Deadly COVID Shot (Video)

Japan demands justice for the crimes against humanity perpetrated by those who knew that the shots were ineffective and extremely dangerous.

Most people have no idea of the level of corruption of Fauci and the world news media who are responsible for the millions and perhaps soon billions of deaths around the world.

FDA has now approved the same deadly vaccine which will now be called the Bird Flu Vaccine. Expect millions and millions more to die if they believe this lie.

Bill’s Commentary:

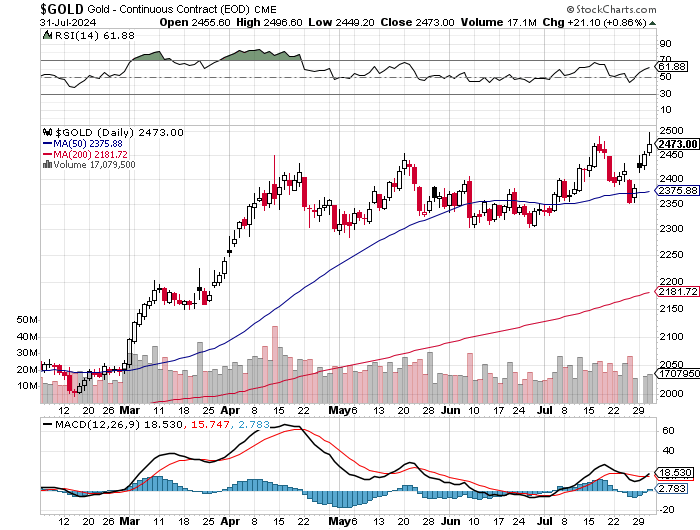

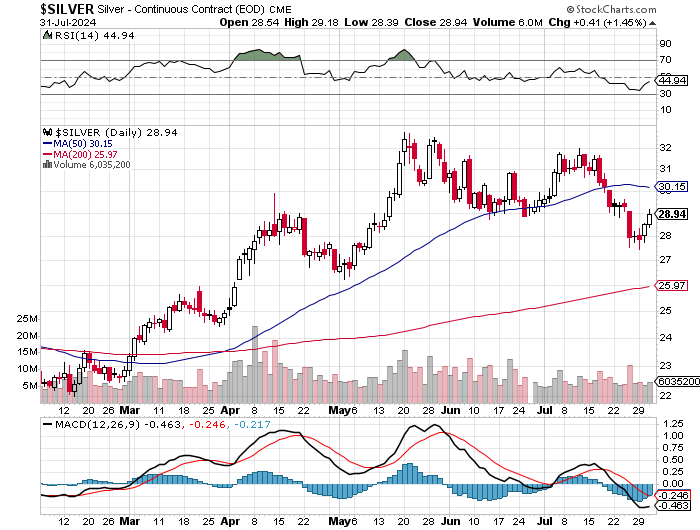

“Another push higher?

Here we go again, with another try! I posted these 3 charts back on May 11, I suggested we were about to move sharply higher in all 3 markets. We did, silver moved better than 20% in roughly 3 weeks. I posted them again at the beginning of July suggesting another move higher. Gold and the HUI index made new highs (the HUI is a new high since 2016, Gold is all time high). Silver got whacked at $32, so did not quite make a new high for this move. After a healthy pullback, here we are again! Gold and the HUI have MACD’s (bottom and right on each chart) in the process of crossing over again to the upside, silver is working on it and needs another 2-5 days to resolve. We got as low as a 74-1 gold to silver ratio at one point, we are now back up to 84-1. Silver is only 10 times more plentiful than gold, to see this ratio come down to 40-1 or lower should be expected. From here, a 40-1 ratio would mean that silver outperforms gold in purchasing power by better than 2-1. Be careful what you wish for however. Exploding metals, especially silver will create huge margin calls for the shorts, this will coincide with customers demanding delivery. At some point, a failure to deliver will occur. Does it happen in the immediate future? I do not know, I do know that the current global geopolitical scene is a disaster …with a backdrop of insolvent and bankrupt central banks and treasuries. Be shocked at nothing, anything can happen at any time to pull this curtain down. The financial situation is pure math, we know it, and they know it. They will kick this table over because the collapse must be to their timing, stay alert and skeptical!”

Standing watch,

Bill Holter

-

Bill’s Commentary:

“Please keep in mind, the author, James Howard Kunstler was a registered Democrat (I do not know if he still is?), and a liberal for most of his life. He says the “wokery” tide is now going out. While I would tend to agree, the problem is this, the asshats currently “in charge” will NEVER willingly relinquish power. I fully expect to see some sort of super crazy false flag prior to the election …so that “we the people” cannot have an election because that would be an attack on their DEMOCRACY! Mr. Kunstler is pretty spot on with this writing…so sad that it all has happened on our watch.”

You’ll Never Work in This Town Again!

Did we just witness the suicide of Wokery? I think you saw what’s called, in the argot of progressive thinking, the “queering” of the Olympics. That was some spectacle. First, Death on a Pale Horse came galloping down the Seine River so that no one would miss the point of the symbolism to follow: the beheaded Marie Antoinette portrayed singing in the window of a flaming palais (revolution anyone?). . . . Then, a tableau vivant of DaVinci’s The Last Supper “queered” to-the-max with a tattooed land-whale in the Jesus seat offering a Satan hand-signal among the swaying drag queens, plus one child ostentatiously in the mix (say, whu?). . . followed by a blue Dionysus crooning about nudity (“Nu”) on a giant fruit platter, with his ball-sack clearly on display among the cherries and nectarines. . . . It rained. . .tant pis. . . . The power went out and Paris ceased to be the City of Light. Finis. . . .

Bill’s Commentary:

“Nothing is ever official …until it is “officially denied”.”

CIA Denies Conspiracy Theory That It Used MKUltra on Trump Shooter

Was the attempted assassination of former president Donald Trump earlier this month part of a secret CIA program involving brainwashed killers? That’s the claim being made by some far-right accounts on X, but the U.S. intelligence agency is taking the unusual step of directly and forcefully denying the claims.

When it was revealed in the 1970s that the CIA had tried to develop a mind-manipulation program called MKUltra, it sounded like the most absurd conspiracy theory around. Unfortunately, it turned out to be true, even if the suggestive results of the program–and potential for creating Manchurian Candidate-like killers–have been exaggerated in the subsequent decades.

Bill’s Commentary:

“Without doubt, the West is at an inflection point…”

The latest from Erik –

-

Bill’s Commentary:

“They also promote wearing a mask while alone in your car. You know, just in case?”

San Francisco officials recommend wearing masks in some indoor spaces

SAN FRANCISCO (KRON) — The San Francisco Department of Public Health is recommending that people begin wearing masks again in some indoor settings. In a post published to X, formerly Twitter, on Friday, the department recommended people “consider” wearing masks in crowded indoor spaces.

“Make this summer a healthy one for yourself and others,” the department tweeted. “With COVID-19 circulating, please consider wearing a well-fitted mask in crowded indoor spaces.”

Bill’s Commentary:

“Did you not see this one coming? Maybe you should “double booster up” for this one?”

Pandemic 2.0 ready to go: FDA to grant emergency use authorization (EUA) to mRNA bird flu shots, just like what happened with COVID

The medical establishment is teeing up for the launch of another “pandemic,” this one centering around H5N8 Influenza, also known as avian influenza or bird flu.

The American Medical Association (AMA) made a few changes this past week to its Current Procedural Terminology (CPT) system, described as “the leading medical terminology code set for describing health care procedures and services.” One change is the creation of a new CPT code for H5N8 Influenza virus “vaccine” candidates that “receive emergency use authorization (EUA) from the U.S. Food and Drug Administration (FDA).”

You may recall that during the Wuhan coronavirus (COVID-19) “pandemic,” the FDA granted EUA to the lineup of injections unleashed through Operation Warp Speed. Now, for the first time since COVID, the medical establishment is readying itself for what appears to be the next scamdemic: bird flu.

Bill’s Commentary:

“This man never bluffs, the West does not seem to have learned this yet.”

Putin warns US against deploying long-range missiles in Germany

Vladimir Putin has warned the US that if Washington deploys long-range missiles in Germany from 2026, Russia will station similar missiles within striking distance of the west.

The US would start deploying long-range fire capabilities in Germany in 2026 in an effort to demonstrate its commitment to Nato and European defence, Washington and Germany said earlier this month.

The US’s “episodic deployments” are in preparation for longer-term stationing of such capabilities that will include SM-6 and Tomahawk cruise missiles and developmental hypersonic weapons that have a longer range than current capabilities in Europe, Washington and Berlin said.

Bill’s Commentary:

“Doesn’t this sound like the exact playbook of the 2020 US election? And all if it to save “their” demoncracy!”

Bill’s Commentary:

“He should be fine as long as last rights were already performed?”

Rebel Archbishop Slams Olympics As “Vile Attack On God”, Says Macron Married A Tranny, Obama “Accompanied By Muscular Man In Wig”

As we noted on Sunday, French bishops were outraged at the Olympics’ opening ceremony over its blatant mockery of Christianity – in which transgender men and a child reenacted Leonardo da Vinci’s “The Last Supper” – along with many other sexualized scenes that included a man with his testicles exposed and hanging out of his outfit. The display has led to worldwide outrage, including several corporate sponsors ditching the Olympics.

Bill’s Commentary:

Bill,

An ounce of gold in hand is worth 2 Bitcoins in bush.

No cables or internet outages to affect gold.

Gold= the ultimate in no counterparty risk AND not contingent upon electronic operating consistency.

Wolfgang Rech

“You are correct Wolfgang. Bill”

Second Sabotage? French Internet Fiber Cables Severed, Causing Widespread Disruptions

France has experienced the second sabotage of critical infrastructure in just a few days.

Outage tracking website Netblocks confirmed on X, “Network data show disruptions to multiple internet providers in France amid reports of a fibre sabotage campaign targeting telecoms infrastructure during the Paris 2024 Olympics.”

-

Bill’s Commentary:

“Mathematically a banana republic without even looking at the social and judicial aspects!”

US National Debt Hits $35 Trillion. Debt-to-GDP Ratio, at Scary Levels, Dips a Tad. And T-Bills’ Share of this Debt

The US national debt – the total amount of Treasury securities – rose to $35.00 trillion, according to the Treasury Department on Friday (rounded to the nearest billion: $34.998 trillion). Since the beginning of the year, in less than seven months, the debt has jumped by $1.0 trillion. Since January 2020, the debt has ballooned by 50%.

The economy has been growing rapidly since the trough in 2020. Yet trillions in new debt were whizzing by so fast they were hard to see, like, “Oh wow, there went another one I think.” We don’t even want to know what this situation will look like during the next recession. But we know one thing for sure, this is nuts:

Bill’s Commentary:

“Chris Powell of GATA on silver manipulation.”

Suppressing Silver Prices Has Been Official US Policy Since 1965

In the July 18 edition of Gold Newsletter, editor and publisher Brien Lundin wrote about the failure of silver prices to keep up with gold prices.

“I’m not the kind of conspiracy buff that many of my friends in the industry are,” Lundin wrote, “but it’s hard to look at silver and not see some hidden hands at work (especially considering who holds so much of the metal in both physical and paper forms while acting as custodian for the biggest silver exchange-traded fund).”

Of course, Lundin meant investment bank JPMorgan Chase and silver ETF SLV.

Bill’s Commentary:

“Turning up the heat on a post that’s already boiling?”

Putin warns US against deploying long-range missiles in Germany

Vladimir Putin has warned the US that if Washington deploys long-range missiles in Germany from 2026, Russia will station similar missiles within striking distance of the west.

The US would start deploying long-range fire capabilities in Germany in 2026 in an effort to demonstrate its commitment to Nato and European defence, the Washington and Germany said earlier this month.

The US’s “episodic deployments” are in preparation for longer-term stationing of such capabilities that will include SM-6 and Tomahawk cruise missiles and developmental hypersonic weapons that have a longer range than current capabilities in Europe, Washington and Berlin said.

Bill’s Commentary:

“Filed under the category of full of shit! If you believe this, please put your mask back on…”

4 hottest days ever observed raise fears of a planet nearing ‘tipping points’

As global temperatures spiked to their highest levels in recorded history on Monday, ambulances were screaming through the streets of Tokyo, carrying scores of people who had collapsed amid an unrelenting heat wave. A monster typhoon was emerging from the scorching waters of the Pacific Ocean, which were several degrees warmer than normal. Thousands of vacationers fled the idyllic mountain town of Jasper, Canada ahead of a fast-moving wall of wildfire flames.

By the end of the week — which saw the four hottest days ever observed by scientists — dozens had been killed in the raging floodwaters and massive mudslides triggered by Typhoon Gaemi. Half of Jasper was reduced to ash. And about 3.6 billion people around the planet had endured temperatures that would have been exceedingly rare in a world without burning fossil fuels and other human activities, according to an analysis by scientists at the group Climate Central.

-

Bill’s Commentary:

“I guess the question at this point is WHY?”

Good Morning and welcome to part 2 of the September Silver $200 Calls of confusion.

Yesterday, I had witnessed a large scale purchase of this said option, within a 40 minute time period before the S&P close, within a trading range between .001 and .002, going from a Volume of 134 all the way up to a total of 1,080 swaps at the ICE close (International Commodity Exchange). By all measure, one would have expected to see a change in the Open Interest which was recorded at 4,812 (buyers/sellers combined). The option value closed at 0.001 cent = $5. As of this morning, even after shutting down my trading platform and restarting, the Open Interest has not changed. It remains at 4,812. To add, the is an “ask” price of 1.5 cents and no bids up on the board so far this morning.

Since this trade was done after the Comex close, 1:25 PM Est, it may be that the Open Interest won’t change until the next trading day (Monday).

Admittedly I have no idea what this means. I do see $125/$150/$175/$200 Calls spread out till March 2025 (excluding the Jan/Feb serial months, for now). It could be a form of what is called a Calendar Spread, but is way super overweighted in Sept.

If anything else noteworthy happens on Monday, I’ll send out another note. Have a great weekend and as always

Stay Long!

Jeremiah Johnson

-

Bill’s Commentary:

“Drugged up athletes and drag queens, I think I will totally pass on this Olympics …”

Bill’s Commentary:

“Did he really say “after the GOVERNMENT tried to kill former President Trump?”

Bill’s Commentary:

“Our pal J. Johnson checks in with something quite interesting! Who in the world would pay money for October silver $200 calls? And for those who wrote these calls, could they end up being similar to the counterparties of “The Big Short”?”

To all; I saw something absolutely crazy today and have to tell you. Today is options expiration for August Options in Silver and Gold. I only watch Silver at present and have noticed someone had become a market maker in the $100/$125/$150/$200 Calls going out to March 2025 (maybe about a week ago). Today, about ½ hour before the S&P close I watch the Volume in the $200 Calls (September) go from 134 to now 861, and climbing, paying $5 each for them plus the commissions. Not sure what I am seeing here. Brokering for over 30 years and have never seen anything like before.

Hope it means something. Have a nice day, and as always ..

Stay Strong!

Jeremiah Johnson

An addendum from J. Johnson –

For the $200 Calls in September at 1,080. No other months have this kind of Volume that high at all. Truly an odd purchase.

-

Bill’s Commentary:

”Homeschooling is the answer to this!”

California teachers were right to severely punish girl, 7, for writing these words under Black Lives Matter drawing she gave to friend, judge rules

A California judge has ruled that teachers were right to punish a seven-year-old girl over a Black Lives Matter drawing because ‘she’s too young to have First Amendment rights.’

The first grader was banned from recess and drawing pictures at Viejo Elementary in Orange County after she added the words ‘any life’ below Black Lives Matter on a picture she drew and and gave to a black friend.

The picture showed the words ‘Black Lives Matter’ with four round shapes in various different tones of brown, beige and yellow, which was intended to ‘represent her friends’ who were ‘racially-mixed’.

Bill’s Commentary:

“Filed under the category of complete bullshit!”

Monday was the world’s hottest day ever recorded — breaking Sunday’s short-lived record

Sunday’s record as the hottest day ever recorded on Earth lasted only one day.

According to preliminary data from the European Union’s Copernicus Climate Change Service, the global average temperature reached 17.15 degrees Celsius (62.87 degrees Fahrenheit) on Monday, toppling the prior day’s record of 17.09 C.

In other words, the planet had its two warmest days back-to-back this week. “For those of you who are bent out of shape that silver stopped at $32, here is Michael Oliver to help your weak knees!”

Bill’s Commentary:

“For those of you who are bent out of shape that silver stopped at $32, here is Michael Oliver to help your weak knees!“

Michael Oliver: $50 Silver? No Problem.

This is an excellent interview conducted by Chris in which he and Michael discuss price and momentum as indicators of future price using historical context.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.