-

Bill is interviewed by Texas Silver -Part 3 of 3 (Also posted under Interviews)

Bill is interviewed by Liberty and Finance (Also posted under Interviews)

How To Use SILVER When Credit Fails | Bill Holter

Bill Holter (https://billholter.com) warns of a collapse of the credit system and emphasizes the vital role of precious metals. He predicts that as the credit-based financial system fails, only tangible assets like gold and silver will retain value. Holter advises focusing on easily recognizable and hard-to-counterfeit forms of silver, such as constitutional silver, and cautions against relying on ETFs that may not hold physical metals. His message underscores the need to secure physical precious metals in preparation for a potential systemic collapse.

-

Bill’s Commentary:

“Sadly, this is NOT The Onion or Babylon Bee…”

Secret Service Agent Abandoned Post Guarding Trump To Breastfeed: REPORT

A female Secret Service agent abandoned her post to breastfeed a child right before former President Trump’s North Carolina rally Wednesday, Real Clear Politics’ Susan Crabtree reported.

The site agent, in charge of security for the entire event, found her breastfeeding her child in a room that was supposed to be set aside for Secret Service “official work,” five minutes before Trump’s motorcade arrived, according to Crabtree.

The woman, who came from the Atlanta Field Office, was in the room with two other family members, Crabtree reported.Bill’s Commentary:

“Please understand that the fears back in 1980 are the reality today… times 1,000 or more. This clip from the movie Rollover portrays exactly where we are, but even more so because of the advent and orgy of financial derivatives. I am taking a couple of days off and leave you with this trailer to contemplate.”

Bill’s Commentary:

“For your review, the White Paper on “the Unit”, the proposed currency to come forth from the BRICS.”

The UNIT white paper

The UNIT fractal monetary ecosystem introduces a practical approach to creating essentially “apolitical money” that can be freely used as a storage of value or currency for payments via any open payment and clearing system, while providing long-term purchasing power stability. The UNIT ecosystem is proposed as a solution to the basic lack of trust problem stemming from the politicization of the use of a single global currency and constraints on its use for valuation and settlement of trade and capital flows.

We introduce the fractal monetary framework, which allows global financial system to function without directly using any national currencies for international trade and reserves. The UNIT is designed to serve as a convenient and stable global currency alternative within the existing financial infrastructure. It is also expected to be more resilient than any national currency to political exigences of the day.

-

Bill’s Commentary:

“No matter what you think of Trump, this is plain wrong!”

Judge Merchan’s Daughter Raked in $12.7 Million in First Six Months of 2024

Loren Merchan, owner of Authentic Campaigns, nearly doubled her business from this same time two years ago. Having daddy preside over the New York trial of Donald Trump sure does help!

Democrats have paid the company owned by the politically active daughter of compromised Judge Juan Merchan at least $12.7 million in the first half of this year.

Federal election reports show Authentic Campaigns, the consulting firm owned by Loren Merchan, raked in the windfall between January 1 and July 1, 2024. Her father currently presides over Manhattan District Attorney Alvin Bragg’s case against Donald Trump in New York City.

Bill’s Commentary:

“This would fall under the category of seeing with your own eyes. This is a statistic the government cannot bullshit you about because the stores are either open, or as in today’s reality …CLOSED! If everything was just fine and retail sales humming along with a strong consumer, this would not be happening, but it is. Why is that? If you tell me that online sales are the reason, then I would ask about the underlying real estate of these brick and mortar stores, who will eat that disaster? Our national credit card will be cancelled very shortly!”

A “Retail Apocalypse” Is Gaining Momentum All Over America. Is Your Favorite Chain Closing Stores?

Why are retailers closing thousands of stores if the U.S. economy is in good shape? Of course the truth is that the U.S. economy is not in good shape at all. The cost of living crisis is absolutely crushing working families all over the nation, and U.S. consumers simply don’t have as much discretionary income as they once did. Needless to say, our retailers are highly dependent on discretionary spending, and many of them have been reporting very disappointing sales numbers recently. Sadly, the problems that our retailers are experiencing are only going to intensify as U.S. economic activity continues to slow down.

According to CBS News, U.S. retailers have announced the closing of more than 3,000 locations in 2024…

Bill’s Commentary:

“JJ checks in with the crazy short term, super high strike price calls on silver. My only guess is that the sellers are using these so their “sales” of futures are not naked. As for who the buyers are, I have not a clue?”

Great and Wonderful Wednesday Morning Folks,

We’re 13 days away from seeing the September Options in Silver come off the board. Those $200 Calls finally had some activity during yesterday’s trade, which lead to something else equally as crazy. That is unless this is something that is being done in preparation, maybe? I have posted below the Sept Silver Call options, the first picture is yesterday’s activities at the close, with this mornings (2nd picture) showing the changes in Open Interest. First our $200 Calls had a Volume of 186 trades between 0.002 and 0.003 ($10 – $15 in value respectively) the second picture shows the $200 Calls had no change in OI at all. Still a very stupid trade based on the short term.

However, the $60 Calls and the Volume made inside the first picture showing 1,223 purchases (Volume) when its Open Interest read 606. Picture 2 now shows the Open Interest on that $60 Call to be at 1,734 in OI. Almost a 2/3rds jump in open interest with only 13 Days to go.

Your guess is as good as mine as to what this may mean, It could also be part of an elaborate Iron Butterfly or Condor spread if one looks at all the option OI in between the $60 on up. We have 2 Tuesdays to go before we find out if this is a guy who was raised on bad math and thinking he bought $20 Calls instead of $200’s or if there is something else?

Regardless, have a great day, and as always …

Stay Strong!

Jeremiah Johnson

Bill is Interviewed by Texas Silver (Also posted under Interviews)

Episode 2 with Aaron at Texas Silver

Bill’s Commentary:

“Bravo, he names names!”

“The Council” – Who is Running the United States of America?

“The Council” and everyone and everything that emanates from them, has controlled the United States for the past fifty years for the purpose of extracting our nation’s wealth. Our constitutional government and the federal workforce’s purpose is to protect our wealth, and the “public good” of the American people. “The Council’s” purpose is to crush and destroy it.

They use the tools of indictments, obstruction, and government agencies they have weaponized to attack their enemies under false color of law. They alone select who will be winners and losers in politics, business, the economy, media, elections, education, and do so with complete amorality.

Bill’s Commentary:

“Erik on steroids!”

The latest from Erik –

-

Bill’s Commentary:

“When was the last time you went to a mall?”

Apartments, hockey rinks and Amazon warehouses: Macy’s closures will set off a wave of change at shopping malls

Macy’s decision to close nearly a third of its stores will spark change in malls and communities across the U.S.

Some of those transformations may catch shoppers by surprise.

The retailer said in late February that it plans to close about 150 of its namesake locations by early 2027. Macy’s has not yet revealed which stores it will shutter. When CEO Tony Spring announced the move, he said the stores that Macy’s will close account for 25% of the company’s gross square footage but less than 10% of its sales.

Bill’s Commentary:

“The best place to get real news is on comedy channels…”

Bill’s Commentary:

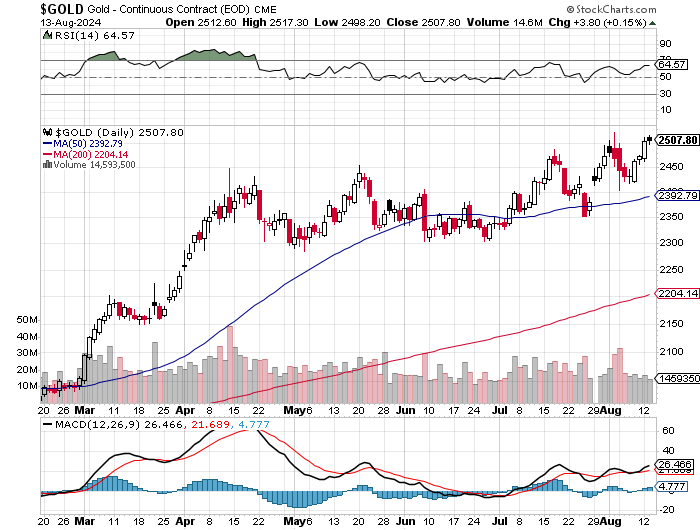

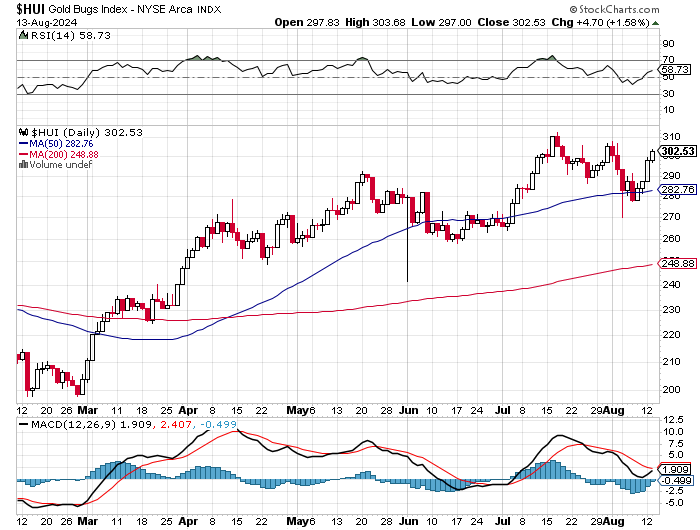

“Here we are again!

I posted these three charts back on July 31 positing a move higher was imminent. It looked to be working well for a few days until the Japanese meltdown occurred and the moves were aborted. But here we are again in a very short period of time. Gold has already broken to new highs with the MACD crossing over to the upside. Both silver and the HUI have MACD lines touching and poised to cross to the upside. We have been watching the famed “Swiss stairstep” upwards since last October, it appears another step higher is imminent. I should also mention, when the system itself begins to break down, the step(s) higher will shock everyone!”

-

Bill’s Commentary:

“No, this is not the Onion or Babylon Bee, but it is insanity! This too will change abruptly in the coming Great Reset…”

Gay trans ‘man’ to vote Kamala so ‘he’ can have more abortions

Tenet Media’s Tayler Hanson was out in Arizona ahead of a rally for the Kamala Harris, Tim Walz campaign and spoke to attendees about why they have decided to support the progressive presidential hopeful.

“Why are y’all voting for Kamala Harris?” Hansen asked to young women at the arena.

“I don’t wanna lose my rights,” one woman in a black Camp Half-Blood shirt said, referencing a fiction series by Rick Riordan.

Bill’s Commentary:

“In today’s world of fake news and bullshit, this may be bullshit? But, if this is proven true, the gates to hell have just been opened in my opinion.”

Japan Declares State of Emergency After ‘Nanobots’ Found in 96 Million Citizens

The globalist elite and Big Pharma are panicking, terrified of what the Japanese are finding, and they are doing everything they can to discredit these investigations, including ordering the mainstream media to initiate a total media blackout of any news coming out of Japan.

But we are not going to allow the elite to succeed in gaslighting the public any longer. Japan are uncovering crimes against humanity and the whole world needs to hear this information.

Bill’s Commentary:

“Nothing to worry about here!”

Exposure at Hedge Funds Has Skyrocketed to Over $28 Trillion; Goldman Sachs, Morgan Stanley and JPMorgan Are at Risk

According to a report at the U.S. Treasury’s Office of Financial Research (OFR), the Gross Notional Exposure at hedge funds has skyrocketed by 24.5 percent in the span of one year: from $22.946 trillion on March 31, 2023 to $28.579 trillion on March 31, 2024. (Run your cursor along the top green line at this link to observe the stunning growth in hedge fund exposures despite the banking crisis in the spring of 2023 when the second, third and fourth largest banks blew up.)

Gross Notional Exposure (GNE) is defined by OFR as “the sum of the absolute value of long and short exposures, including those on and off the balance sheet.”

The OFR was created under the Dodd-Frank financial reform legislation of 2010 to keep bank and market regulators informed of growing risks, in the hope of preventing another financial crisis like that of 2007-2010 from occurring.

From Wolfgang Rech –

Bill,"Discretionary" is in the eye of the beholder. Or should I say the beholden.

I could already feel Hyman Minsky breathing down my neck.

Wolfgang Rech

Correct Wolfgang, we are already paying 25%+ of tax revenues to interest alone. Bill

"How can the US, which is now $35 trillion in the hole justify this kind of irresponsible, profligate spending? The only possible answer for why this level of explosive deficit (and debt) growth continues, is the admin's ongoing attempts to buy as many votes as possible, as well as the relentless increase in interest on the US debt.And it only goes downhill from there, because as we have noted previously, the biggest risk factor is not so much spending on such discretionary items as social security, health and national defense ("how dare you say these are discretionary! these are mandatory, untouchable outlays" some will scream, but if and when the taxes dry up and the dollar loses its reserve status you will see just how discretionary they are), but on interest, and here recall what we said back in April: "interest on US debt - currently the second biggest government outlay at $1.2 trillion - will surpass social security and become the single biggest US expense before the end of 2024 at $1.6 trillion."..." Read more here...Bill is interviewed by Texas Silver (also posted under Interviews)

-

From Wolfgang Rech –

Bill,

Now, I'm not taking a political stance here, but the rationale of the Democratic Party is amiss.

Forcing Biden out of the Presidential race because they feel he would be incapable of running the country, is one thing. Understandable as it would affect our nation and its citizens.

But to oust him, because these career politicians fear losing their jobs, is just wrong. It shows no allegiance to the great nation of the United States. Only to their self interests. Wolfgang

W, this is exactly why I have said to look for a false flag and cancelled election in Nov. if they believe they cannot cheat enough to win. Time will tell ... Best, Bill

"A number of my Democratic colleagues in the House and Senate thought that I was going to hurt them in the races." Biden.

As modernity.news reported last week, it was widely reported that Pelosi told Biden that he could either step down "the easy way" or be removed "the hard way." Biden is apparently furious with her, as mentioned by interviewer Lesley Stahl in this clip.

Wolfgang

“It Didn’t Sound Like Joe Biden”: Pelosi Questions Dropout Letter As Biden Fingers Her In Ouster

In his first interview since he was very clearly ousted from the 2024 race, President Biden specifically mentioned former House Speaker Nancy Pelosi (D-CA) – telling CBS News Sunday Morning that Democrats in the House and Senate thought he would drag down the entire party’s chances of reelection.

“A number of my Democratic colleagues in the House and Senate thought that I was going to hurt them in the races. And I was concerned if I stayed in the race, that would be the topic — you’d be interviewing me about why did Nancy Pelosi say [something] … and I thought it’d be a real distraction,” said Biden.

Bill’s Commentary:

“Layoffs. Who cares? We don’t need no stinkin’ real economy… as long as we have the Dow Jones!”

Tech and media layoffs August 2024 update: Paramount Global, Dell, LegalZoom, Axios cut jobs

It hasn’t been a good month for job security in the media and tech industries as numerous companies have announced layoffs since the beginning of August. Intel was the first big name to announce job cuts when the chip giant on August 1 said it would lay off around 15,000 of its staff—or about 15% of its total workforce.

But since then, more companies in both tech and media have announced layoffs. Here are some of the latest ones to have done so.

-

Bill’s Commentary:

“For those of you who do not know about, nor seen “The Great Taking”, I post it here again. This is NOT speculation, the laws are already on the books. Please PAY ATTENTION!”

Bill’s Commentary:

“This is truly scary and probably just the beginning…”

Bill’s Commentary:

“A $trillion platinum coin? Is this similar to thinking they can borrow roughly $500 billion off the Ft. Knox gold (does it even exist?) to purchase Bitcoin …to cover our $35 trillion in debt? Dreamers dream, lenders lend, and borrowers default!”

The Trillion Dollar Legal Memo

Ahhhhh, the trillion-dollar-coin. It’s the bête noir of some economists who see such a thing as, at best, a harebrained thought experiment. It’s an economic elixir for others who view it as a way to circumvent the unhealthy cycle of national debt crises.

It’s also a topic that’s near and dear to me, not least because I’ve spent more than a decade trying to pry loose details about it. Now, I finally have something to share from behind the platinum curtain. But — spoiler alert — what I’m able to share with you is pretty barebones, due to heavy redactions.

Bill’s Commentary:

“After the longest yield curve inversion of all time, the Depression cake is not only baked, it is on fire!”

“Japan Mixed The Batter, The Fed Will Bake The Cake…”

Americans are already struggling to feed their families and pay their bills, but having predicted every US recession since 1960, the steepening bond yield curve is speaking loud and clear that an “official” downturn is nearly inevitable. With bond prices on the rise as the Fed looks increasingly likely to cut rates in September, the yields are going down and the inverted curve is finally leveling out after an epic two-year inversion.

And with stocks now crashing around the world, global uncertainty is rocketing upward in a “Black Monday” event, especially as dizzyingly volatile Japan struggles to contain its post-ZIRP doom loop. In other words, the storm may be arriving in earnest.

-

Bill’s Commentary:

“Safe and effective!”

620% Increased Risk of Myocarditis: Another Peer-Reviewed Study Confirms Destruction Caused by mRNA COVID-19 Jabs

Yet another recent peer-reviewed study has been published, amplifying the incredible dangers of the experimental mRNA COVID jabs. We recently reported on a groundbreaking new study proving that the tyrannical public response—including lockdowns, the mandated deadly jabs, drastic medical interventions, and so on—to COVID-19 caused more deaths than COVID-19 itself. And now, a study of 9.2 million South Koreans published in Nature Communications exposes an unprecedented increased risk of myocarditis and pericarditis after receiving the gene-damaging mRNA jabs. Specifically, the study reveals a 620 percent increased risk of myocarditis and a 175 percent higher risk of pericarditis after the shots. But it doesn’t end there. Researchers also discovered an increased risk of neurological disorders—including Alzheimer’s—and increased risks of numerous autoimmune conditions, especially after booster shots.

Bill’s Commentary:

A perfect illustration of what’s taking place in the UK today.

Bill’s Commentary:

“An American travesty!”

A little-known law has forced over 120,000 veterans to return the money they got to leave the military, new data shows

A federal law has forced nearly 122,000 disabled veterans in the last 12 years to return payouts — some totaling tens of thousands of dollars — they received to leave the military when it needed to downsize, according to new data obtained by NBC News.

The statistics come amid renewed calls to change the little-known law, which prohibits veterans from receiving both disability and special separation pay, which are one-time, lump-sum incentives offered to service members when the U.S. had to reduce its active-duty force.

“Nobody realizes that they are doing this to so many people,” said Vernon Reffitt, who was recently told to repay the $30,000 he got to leave the Army more than 30 years ago.

Bill’s Commentary:

“Erik on “Wokeworld”…”

The latest from Erik –

-

Bill’s Commentary:

“A weak consumer is certainly plausible, so is GET WOKE GO BROKE!”

Disney CFO Admits Lower-Income Consumers Are “Stressed & Shaving Time Off At Parks”

Shares of Walt Disney Co. are lower in premarket trading following mixed third-quarter results on Wednesday. Disney’s streaming and movie businesses reported their first-ever profitability—one quarter ahead of schedule. However, a worsening consumer downturn has pressured the entertainment giant’s park attendance numbers and per-visitor spending.

Goldman’s Michael Ng provided clients this AM with a breakdown of third-quarter earnings, highlighting streaming and movie businesses kicking into high gear but sliding park demand and “moderation of consumer demand” should weigh on experiences in the coming quarters.

Bill’s Commentary:

“These fine young men were probably just lost …but Tulsi Gabbard is a terrorist!”

Illegal immigrants arrested on military base for trespassing walk free after posting five-figure bail

Two Jordanian nationals in the country illegally and who were arrested for trespassing on a Marine Corps base in Virginia have been released from federal custody after posting bond, federal officials confirmed to Fox News Digital.

An Immigration and Customs Enforcement (ICE) official confirmed to Fox News Digital that Hasan Yousef Hamdan and Mohammad Khair Dabous were allowed to bond out by an immigration judge in June.

The bonds were $15,000 and $10,000 for Hamdan and Dabous, respectively. Conditions of their release include showing up for immigration proceedings and staying away from Quantico or other military installations.

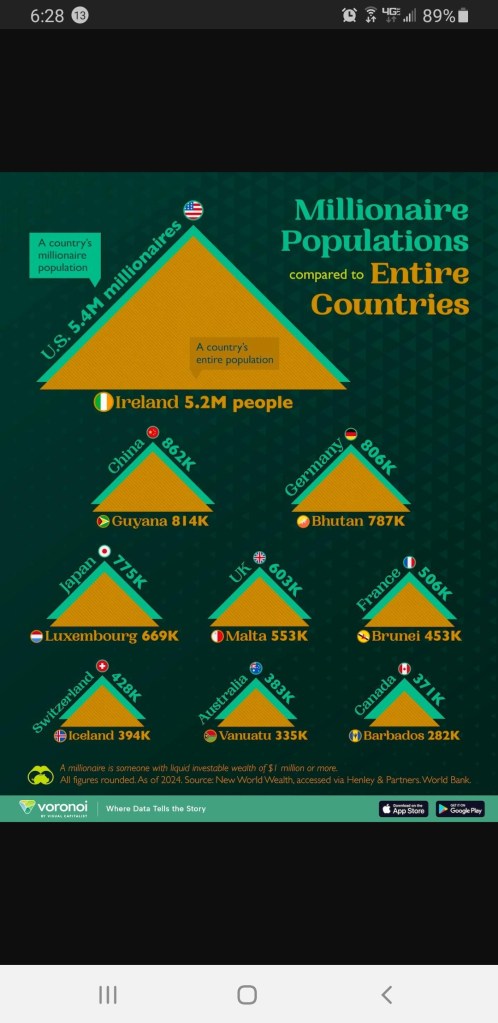

From Wolfgang Rech –

Bill,

Lest we get ahead of ourselves here and become too proud, a few years ago EVERYBODY in Zimbabwe was a millionaire...no wait,.make that a billionaire....no wait, make that a trillionaire.

"Q: How many US dollars is 100 trillion Zimbabwe dollars?A: 100 trillion Zimbabwe dollars = $0.40 USor stated another way:$1.00 USD = $250,000,000,000,000 ZimbabThe country of Zimbabwe has more trillionaires than any other country on earth. Of course a trillion dollars there doesn't go as far as it used to."

Everything is relative. Never forget that.Wolfgang Rech

Bill’s Commentary:

“”Action”? Why not just take all of the “depositors” (legally lenders) money? That’s the plan anyway, right?”

Bank of England seeks action from Britain’s biggest banks on crisis plans

Five of Britain’s biggest banks were today instructed to improve their readiness for failure after the sudden demise of major financial institutions last year highlighted the speed with which they can collapse. The Bank of England today named Barclays, HSBC and Lloyds among firms that needed to strengthen their preparedness for failure, warning they must be “sufficiently flexible and able to produce timely and robust estimations of their liquidity needs in a resolution, given the speed at which events can evolve, for example due to rapid deposit outflows.”

The scale of the risks latent within the banking sector was revealed last year by the rapid collapse of Credit Suisse and Silicon Valley Bank (SVB), which sent shockwaves through financial markets. Within a day of SVB’s warning that it needed a capital raise, the firm’s share price sunk 60% and as much as $40 billion or nearly a third of its deposits had been withdrawn, with a further $100 billion on course to leave. The UK arm of SVB was acquired shortly thereafter in a last-minute rescue deal by HSBC, while Credit Suisse was merged with UBS.

Bill’s Commentary:

“Another “get woke …go broke”!”

CNN Effectively Worthless After Parent Warner Bros Takes $9.1 Billion Writedown

What had been obvious “to the rest of us” for years, is finally official: late last night, shares of Warner Bros. Discovery, the parent of CNN and TNT, crashed 10% to the lowest level on record after it reported dire results, which missed across the board and plunged across every income statement category…

… but the biggest hit – and surprise – was the company’s stunning $9.1 billion charge taken to write down the value of its traditional TV networks, such as CNN and TNT, which were acquired in 2022 when Warner Bros Discovery was created as part of its acquisition of WarnerMedia. The write down confirmed that legacy cable channels like CNN and TNT are no longer worth what they were when the $42 billion merger was completed. In fact, judging by the ongoing mass layoffs at the former, one can argue that CNN’s value is now negative and will continue to be so until it stops hemorrhaging cash.

Bill’s Commentary:

“Father God did bless Texas!”

-

Bill’s Commentary:

“Piss on you Mr.? (not sure if this person goes by he/him, she/her, or it?) Stephen Parkinson, mass migration (mostly by illegal means) is a travesty for the ages! There, I said it and disparaged your ridiculous stance publicly, now, come and get me… Or, you will not because unlike your asshat country, we have guns here in the US to make sure pussy tyrannists like you cannot bully us. I cannot believe the British empire has sunk to such a low IQ level!”

UK Threatens to Extradite Overseas Social Media Users Who Criticize Mass Migration, Two-Tier Policing.

The United Kingdom’s Director of Public Prosecutions, Stephen Parkinson, has threatened to extradite overseas social media users who have supported or spoken out on the anti-mass migration protests and riots gripping the country. Prime Minister Sir Keir Starmer has promised draconian action against those protesting against the deadly stabbing of multiple young girls by a migration-background teenager in Southport, England last week.

Parkinson said that overseas social media posters should be aware that “they are not safe and there is nowhere to hide.”

Bill’s Commentary:

“I never liked British humor, but here is more of it…”

Transgender civil servant sparks uproar after colleagues complain that she wears ‘fetish gear’ including fishnet tights, low-cut corsets and chokers into the office

A government department is embroiled in a peculiar row over whether staff can wear ‘fetish gear’ to work following complaints from civil servants about a transgender colleague, The Mail on Sunday can reveal.

Employees in the Department for Work and Pensions are objecting to the ‘highly inappropriate’ workwear of a fellow official which last week prompted a Tory peer to ask the Government about its ‘policy on civil servants wearing fetish clothing in the workplace’.

It is understood that Baroness Jenkin of Kennington tabled the unusual question to reflect her general concerns about the dress code and also in response to the specific issues raised by civil servants about one Whitehall diversity ambassador.

Bill’s Commentary:

“Keeping American skies safe? Maybe they should start with chemtrails first?”

Empower Oversight: Homeland Security Has Done Nothing to Stop Abuse of Quiet Skies Surveillance Program

For two-plus years, Empower Oversight has tried to get answers from Joseph Cuffari about the abuses of TSA’s Quiet Skies surveillance program. The alleged targeting of Tulsi Gabbard by the TSA’s Quiet Skies program has prompted Tristan Leavitt with Empower Oversight to send yet another letter to Inspector General Joseph V. Cuffari in the U.S. Department of Homeland Security to ask why the TSA continues to “waste taxpayer resources and abuse its authority.” While it is incredible that an active U.S. Army Reserve officer, former congresswoman, and presidential candidate would be targeted, it is true. Screenshots of the Target Package being used to surveil Gabbard prove Gabbard is enrolled in the program. The screenshots were provided to UncoverDC by Sonya LaBosco, Executive Director of the Air Marshal National Council (AMNC).

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.