-

Bill’s Commentary:

“This is so bad on so many levels…”

The Foreboding UN Convention On Cybercrime

The UN committee approved the text of the Convention on Combating Cybercrime. Human rights organizations and information technology experts have called it a threat to democracy and the free world.

“One of the world’s most dangerous surveillance treaties was approved with a standing ovation,” wrote Austrian digital rights group Epicenter Works.

The UN General Assembly is now due to vote on the adoption of the Convention in September.

“It can be assumed that the treaty will be accepted without difficulty at the UN General Assembly in September, and will thus be officially considered a UN convention. After that, it will be available for signature and subsequently it can be ratified,” said political advisor Tanja Fachathalerová.

“It can be assumed that it will not be a big problem to achieve the necessary forty ratifications, which are necessary for the treaty to enter into force.”

Bill’s Commentary:

“You’ve been duped!”

The latest from Erik –

-

Pepe Escobar

From 11 September to 7 October: The fake ‘War on Terror’ collapses

The events of 11 September 2001 were intended to impose and enshrine a new Exceptionalist paradigm on the young 21st century. History, though, ruled otherwise.

Cast as an attack on the US Homeland, 11 September 2001, immediately generated the Global War on Terror (GWOT), launched at 11 pm on the same day. Initially christened “The Long War” by the Pentagon, the term was later sanitized by the administration of Barack Obama as “Overseas Contingency Operations (OCO).”

The US-manufactured War on Terror spent a notoriously un-trackable eight trillion dollars defeating a phantom enemy, killed over half a million people – overwhelmingly Muslims – and branched out into illegal wars against seven Muslim-majority states. All of this was relentlessly justified on “humanitarian grounds” and allegedly supported by the “international community” – before that term, too, was renamed as the “rules-based international order.”

Bill’s Commentary:

“Has Tucker been watching my interviews on the sly since last November? Wait until he uses the phrase “Mad Max.” Then I will really become “mainstream”!”

“Throw Society Into Chaos” – Tucker Outlines Dem Plan As Harris ‘Honeymoon’ Fades

Tucker Carlson said the quiet part out loud in a brief comment last last week. Uncomfortable truths about the “party of democracy”…

“If they think that there’s a chance that Trump could win decisively enough in November that they can’t steal it, then I think their only option there is to in some way throw the society into chaos as they did during COVID which was the pretext for changing the way we vote and letting people vote anonymously without IDs and drop boxes and a month before the election.”

We all know what happened then (and we, the people, acquiesced so quickly):

-

The latest from USA Watchdog –

Bill’s Commentary:

“Erik on the dreadful prospects of the election.”

The latest from Erik –

Bill’s Commentary:“Why “secret”?”

Saudi Central Bank Caught Secretly Buying 160 Tonnes Of Gold In Switzerland

The Saudis have joined other Asian countries in ditching their long-term sensitivity to the gold price. Evidence suggests the Saudi central bank has been covertly buying 160 tonnes of gold in Switzerland since early 2022, contributing to the current gold bull market.

Until recently, Saudi Arabia’s gold demand would decline when the gold price went up and strengthen when the price went south. This dampened volatility in the gold market, which for many decades was ruled by the West.

Ever since the West immobilized Russia’s dollar assets in February 2022, those with diplomatic disagreements with the West are increasingly exchanging their dollars for physical gold. Saudi Arabia is the latest country—after China and Thailand—of which I have found cross-border trade statistics showing it has shifted from being price sensitive to a price driver.

-

Bill’s latest interview with Liberty and Finance (Also posted under Interviews)

Bill’s Commentary:

“Here is a fact check for you!”

-

Bill’s Commentary:

“Have you been “feeling dumb” lately? Watch this!”

USAF Pilot Exposes Top Secret Chemtrails ‘Mind Control’ Program To ‘Destroy Civilization’

Bill’s Commentary:

“Personally… I hope they AND the rest of big pharma bankrupts into oblivion, but that’s just my opinion!”

Moderna scales back vaccine ambitions as COVID shot revenue plunges

Moderna is dialing back its plans for new vaccines, shelving several key projects as it grapples with a sharp slowdown in COVID shot sales.

Why it matters: The company came to the world’s rescue during the pandemic, but the pharmaceutical industry is still a what-have-you-done-for-me-lately business.

Between the lines: Moderna plans to “slow down the pace of new R&D investment, and build our commercial business,” CEO Stéphane Bancel said in a statement.

-

Bill’s Commentary:

“The man does not bluff…”

Bill’s Commentary:

“Afghanistan was the single most embarrassing event in US history …but “they” apparently do not see it this way?”

White House Adviser John Kirby Accidentally Sends Fox News an Insulting Message About a ‘Handful of Veterans’

A basic summary of Americans’ contempt for their repellent ruling class boils down to three sentences:

Establishment politicians and other regime operatives view everything through the lens of power. They never assume any responsibility. They never suffer any consequences for their failures.

On Wednesday — the 23rd anniversary of the Sept. 11, 2001, terrorist attacks against the United States — White House National Security Council communications adviser John Kirby demonstrated the mind of a well-placed regime toady when he accidentally included Fox News in a “reply all” email chain that featured a message dismissive of what he called “a ‘handful’ of vets” critical of President Joe Biden’s botched 2021 Afghanistan withdrawal.

Bill’s Commentary:

“Regarding ‘weapons of mass financial destruction’…”

The Fed Just Kicked the Capital Increases for the Dangerous Megabanks and their Derivatives Down the Road for Years

When the next megabank blows up from its derivative exposure, you can add the names Jamie Dimon and Patick McHenry to former Republican Congressmen Randy Hultgren and Kevin Yoder as four of the men who greased the skids for another derivatives banking crisis. (For our report on the role played by Hultgren and Yoder, see our 2021 report here.)

Dimon and McHenry are the latest lead players in the disastrous history of derivative regulation in the U.S.

-

Bill’s Commentary:

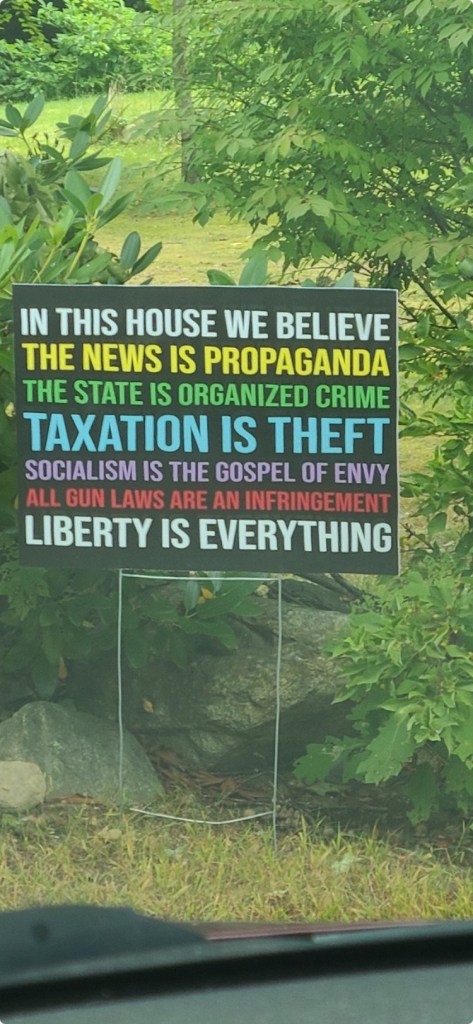

“Good guys with a gun!”

-

Bill’s Commentary:

“Erik on taxes, more taxes, and even more taxes!”

The latest from Erik –

-

Bill’s Commentary:

“This barely scratches the surface. There will be a short squeeze that makes market history!”

Silver: The Unsung Hero Of The New Economy

Silver demand continues to surge, driven by technologies like solar power and AI.

In 2023 alone, the silver market experienced a 15% supply deficit. Furthermore, the market is expected to reach a cumulative deficit of 1,093.4 million ounces from 2020 to 2024.

In this graphic by Outcrop Silver, Visual Capitalist’s Bruno Venditti discusses how new mines are necessary to meet the high demand for the metal.

Bill’s Commentary:

“This Romanian kid is a legend! Have a good weekend, a couple days off for me…”

-

Bill’s Commentary:

“What do you mean my retirement plan is broke?”

Social Security Facing $63 Trillion in Unfunded Liabilities

Social Security is facing $63 trillion in long-term unfunded liabilities, according to the 2024 Old-Age, Survivors, Disability Insurance (OASDI) trustees report.

The report looked at two things: how much money will be missing indefinitely and how much will be missing in the next 75 years. The report determined that there will be a permanent $62.8 trillion deficit and about a $23 trillion shortage for the next 75 years.

Officials explained that these numbers show how much less money they will have after the money saved up in trust funds runs out.

Bill’s Commentary:

“2,000 plants? How about the COVID vaccine, what “inspection” was done with these?”

Nearly 2,000 drug plants are overdue for FDA checks after COVID delays, AP finds

WASHINGTON (AP) — Federal regulators responsible for the safety of the U.S. drug supply are still struggling to get back to where they were in 2019, before the COVID-19 pandemic upended factory inspections in the U.S. and across the world, The Associated Press has found.

An AP analysis of Food and Drug Administration data shows that agency staffers have not returned to roughly 2,000 pharmaceutical manufacturing firms to conduct surveillance inspections since before the pandemic, raising the risks of contamination and other issues in drugs used by millions of Americans.

Bill’s Commentary:

“Or, you could JUST SAY NO!”

World Economic Forum Finally Tells the Truth About Covid: It Was a ‘Test’ of Our Obedience to Rapidly Forming New World Order

They wanted to know how many people would comply with a complete re-ordering of their lives based on no science at all, just random orders, some of which bordered on absurdity.

I have long said that Covid 19 was launched by design by a small number of people in the globalist predator class for one reason and one reason only — as a beta test for the coming technocratic new world order.

Now, we’ve got the World Economic Forum coming out and all but admitting that was exactly why the Covid-19 “pandemic” had to happen.

Bill’s Commentary:

“Why would they understate margin debt? Because it is very dangerous and us peons don’t need to know!”

A Wall Street Regulator Is Understating Margin Debt by More than $4 Trillion – Because It’s Not Counting Giant Banks Making Loans to Hedge Funds

Most market watchers rely on the monthly margin debt figures published by Wall Street’s self-regulator, FINRA, as the reliable gauge in determining how much of securities trading on Wall Street is being done with borrowed money, known as margin debt.

According to the FINRA data, as of March 31, 2024, margin debt stood at $784.136 billion.

Bill’s Commentary:

“Why do you think they call it “history”? Because it is HIS STORY!”

The latest from Erik –

The latest from USA Watchdog –

Bill’s Commentary:

“Yeah, pretty much over the targets!”

Bill’s Commentary:

“Very soon, these people will become irrelevant…”

Fed Must Decide If Quarter-Point Cut Will Be Enough for Workers

(Bloomberg) — The Federal Reserve is set to begin unwinding its tightening campaign this month as inflation cools and the labor market slows. The big question policymakers now face is whether a small interest-rate cut will be enough to keep the economy in expansion mode.

The monthly jobs report Friday showed the pace of hiring in the US moderated over the last three months to the slowest since the onset of the pandemic in 2020. Even so, the numbers left investors skeptical as to whether Fed officials would opt for an outsize rate cut at their Sept. 17-18 meeting.

The release sets the table for a heated debate between those like Fed Chair Jerome Powell, who is open to a larger cut to ensure the central bank doesn’t fall behind the curve, and other officials who “are still waffling on a quarter point,” according to Diane Swonk, chief economist at KPMG.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.