-

The latest from USA Watchdog –

-

Bill’s Commentary:

“Erik with some valid points.”

The latest from Erik –

-

Bill’s Commentary:

“Silver will be gold on steroids!”

Why It’s Silver’s Time to Shine Now

Gold has been soaring all year, while silver has spent the past nine months languishing, leaving long-suffering investors wondering: Will silver always play second fiddle to gold, or is it finally ready to shine? Like many, I’ve been frustrated by silver’s lackluster performance, but in this report, I’ll highlight a growing number of reasons to believe its rough patch may soon be over. Silver may finally step out of gold’s shadow and embark on a sustained bull market of its own.

The first key sign that silver is ready to surge is its decisive move above the $32 to $33 resistance zone, which has acted as a stubborn ceiling for much of the past year. This breakout is an encouraging signal, but the next crucial confirmation will be a strong, high-volume close above the $34 to $35 resistance zone—the same level that halted the late-October rally in its tracks. Once silver clears both barriers, the path should be wide open for the powerful bull market I’ve anticipated since April 2024. However, for this breakout to remain valid, silver must close and hold above both resistance zones; otherwise, all bets are off.

Bill’s Commentary:

“Please tell me this is not even real?”

Bill’s Commentary:

“Good luck with this, on an already crushed commercial real estate market…”

Trump Seeks to Put 443 Federal Properties Up for Sale

The US government is considering selling a sprawling portfolio of properties across 47 states, the District of Columbia and Puerto Rico, part of President Donald Trump’s campaign to shrink the federal workforce — and the buildings it occupies.

An inventory of 443 “non-core” assets posted by the General Services Administration Tuesday included many of the prime commercial buildings that house local and regional offices for federal agencies and provide services for taxpayers, Social Security recipients, farmers and workers.

In total, the structures represent almost 80 million rentable square feet (7.4 million square meters) of usable space — 12 times the size of the Pentagon. The GSA estimates that selling them could save more than $430 million in annual operating costs, a key focus for Trump and his efforts to reduce government spending. The president is expected to address a joint session of Congress later Tuesday.

Bill’s Commentary:

“I have always said I thought the failure to deliver would happen in silver. It is the fuse to the weapon of mass financial destruction…”

What’s This Now? Silver Is Being Drained At LBMA, NOT Gold

Sometimes even I get too distracted by media hype. There was a lot of chatter about how gold is in “shortage” in London and how it’s being shipped to New York and the wait times for physical delivery are now weeks as opposed to days.

That’s all kind of true, sort of, but I now believe it’s hiding the real story. I looked at this accidentally today because I had completely forgotten about it, but this is the LBMA gold and silver vault data current to January 2025:

-

Bill’s Commentary:

“Treasury balances turned into digital air?”

Trump, the ‘Crypto President’, is Serving Up a National Deception with the Proposal of a Bitcoin Strategic Reserve

I like President Trump for all he is doing to right a lot of wrongs in the United States. But regarding him wearing the self-proclaimed mantle of the ‘Crypto President’, he is serving up an unparalleled deception of financial sovereignty with this idea of a national Bitcoin (or Crypto) Reserve for the United States.

…’A U.S. Crypto Reserve will elevate this critical industry after years of corrupt attacks by the Biden Administration, which is why my Executive Order on Digital Assets directed the Presidential Working Group to move forward on a Crypto Strategic Reserve that includes XRP, SOL, and ADA. I will make sure the U.S. is the Crypto Capital of the World. We are MAKING AMERICA GREAT AGAIN!’…(President Donald Trump via TruthSocial)

The President went on to say: …’And, obviously, BTC and ETH, as other valuable Cryptocurrencies, will be the heart of the Reserve. I also love Bitcoin and Ethereum!’…

Bill’s Commentary:

“Follow the money…”

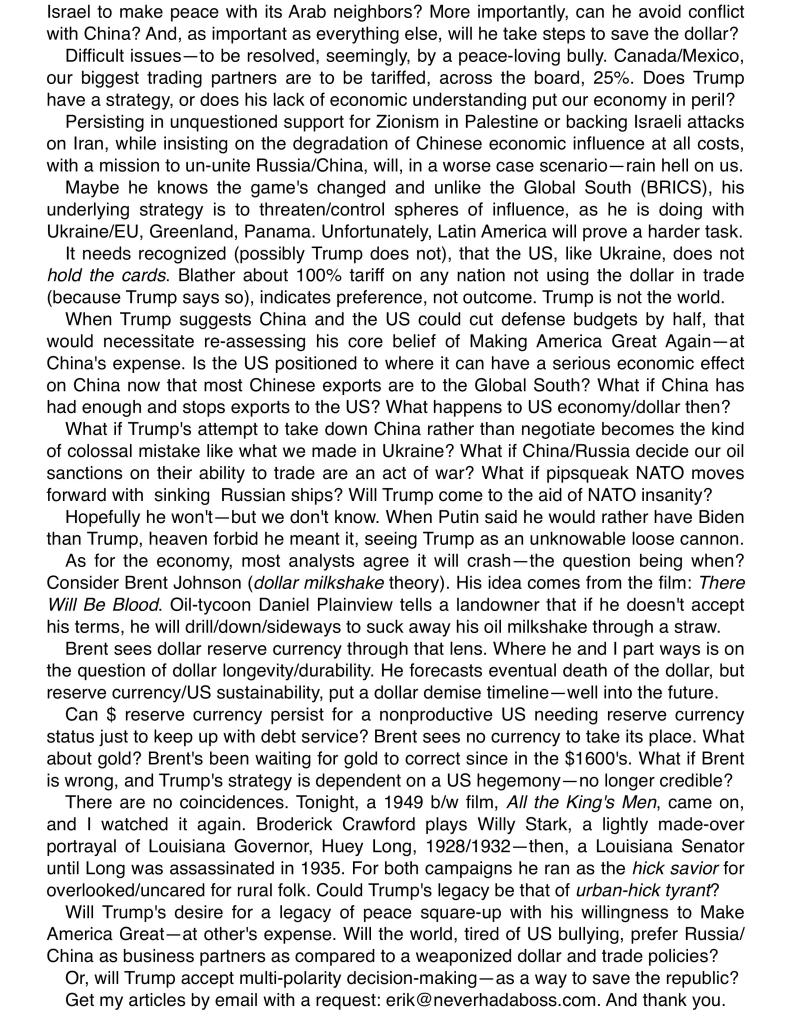

No Bidders, No Safety Net: Is Fed’s Liquidity Lifeline Drying Up? Plus, ETFs To Watch

For the first time since the Great Recession, banks didn’t park a single dollar in the Federal Reserve‘s Reverse Repo Facility overnight. That’s right—zero bids.

The mother ship of the U.S. banking system, which has been the go-to safety net for surplus cash, found no takers.

-

The latest from USA Watchdog –

-

Bill’s Commentary:

“The biggest wipeout of home values is just right around the corner. Many believe renting is pissing money down the drain …the reality today is that renting avoids a wipeout of your capital!”

Homebuilders Have Most Speculative Unsold Inventory Since May of 2008

Homebuilder inventory of started and completed homes is soaring but sales are weak.

New Homes for Sale by Stage of Construction

- Total: 495,000. The most since December 2007.

- Started Plus Completed: 389,000. The most since May 2008.

- Under Construction: 274,000

- Completed: 115,000. The most since August 2009.

- Not Started: 106,000

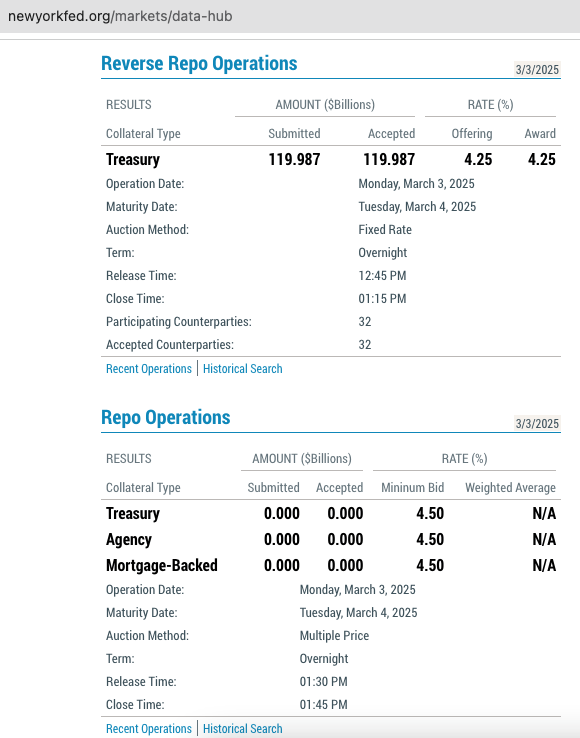

US Pending Home Sales Collapse To Record Lows

Completing the triumvirate of turmoil in the US housing market, pending home sales joined new- and existing-home sales prints with a big decline in January.

Pending home sales tumbled 4.6% MoM in January (after dropping 4.2% MoM in December), dramatically worse than the 0.9% MoM decline expected and dragging YoY sales down 5.2%…

Source: Bloomberg

Bill’s Commentary:

“This is LaLa land.”

The sky’s the limit? Shanahan and Trump demand answers on geoengineering and public health

- Nicole Shanahan and former President Donald Trump have demanded answers about chemical spraying in American skies, reigniting a debate over the ethics and secrecy surrounding geoengineering programs.

- Shanahan’s social media post highlighted visible trails in the sky, questioning whether they were natural contrails or artificial clouds created by chemical spraying, and called for a referendum with full disclosures.

- Trump suggested that rising autism rates among children could be linked to chemicals sprayed in the air, hinting at potential revelations about these practices

Bill’s Commentary:

“Some midweek Erik for you”

The latest from Erik –

-

Bill’s Commentary:

“This is gold coming into the system, not out of it…”

Wyoming Enacts Law to Establish Strategic Gold Reserve

Senate File 96 – also known as the Wyoming Gold Act – requires the Wyoming Treasurer to diversify the state’s holdings by acquiring no less than $10 million in “specie and specie legal tender” as part of the state’s Permanent Mineral Trust Fund.

After the bill passed overwhelmingly through both chambers, Governor Mark Gordon – who once held a position at the anti-gold Federal Reserve and previously served as state treasurer – today begrudgingly allowed SF 96 to become law without his signature and wrote a letter expressing his personal skepticism about protecting taxpayer funds with a gold allocation.

The latest from USA Watchdog –

-

Bill’s Commentary:

“About time!”

Trump Proposes Investigation into Autism and [Chemtrail] “Sprays”

President Trump recently said that 15 years ago, only one in 10,000 or 1 in 20,000 children were diagnosed with autism, but now the rate is one in 34 children have autism. While the numbers vary, the rate of autism rose after drug manufacturers were given legal immunity from lawsuits over vaccine injury in 1986.

Summary by JW Williams

President Trump recently said that 15 years ago, only one in 10,000 or 1 in 20,000 children were diagnosed with autism, but now the rate is one in 34 children have autism. The autism rate rose after drug manufacturers were given legal immunity from lawsuits over vaccine injury in 1986.

The National Childhood Vaccine Injury Act (NCVIA) of 1986 was signed into law by United States President Ronald Reagan as part of a larger health bill that prevents people who have suffered vaccine injuries or death, and their families, from suing drug manufacturers in court. Instead, there is a special federal court that was set up to compensate vaccine victims, however, it is a corrupt system that often denies victims’ claims. After drug companies received immunity from prosecution in 1986, the number of vaccines on the CDC’s vaccine schedule had increased dramatically. Autism has also risen dramatically. There are currently over 70 vaccine doses on the CDC’s Vaccine Schedule. Many of the vaccines are required for children to attend school.

Bill’s Commentary:

“In the not too distant future, real estate by and large will become a liability rather than an asset…”

‘I feel trapped’: how home ownership has become a nightmare for many Americans

“I bought my home in a hurry in 2020,” said Meg, 60, an office manager from Maryland. “It was less expensive to take on a mortgage than to keep paying ever-increasing rents for my college-student daughter and me.”

Now housing costs consume 50% of her income.

Although Meg said she felt “grateful to have our little house”, the purchase has lost its luster. Her aging row home needs various repairs, while other costs associated with home ownership rose continually too.

Bill’s Commentary:

“I agree Wolfgang, but what no one is talking about is what happens when this money no longer hits the streets? Bill”

On Monday, February 24, 2025 at 05:30:21 PM PST, Wolfgang wrote:

Bill,

We need a clawback and get $5 trillion, for starters, back into the Treasury's coffers.

Or give it back to the taxpayers.

Wolfgang

“Give Us Back Our F**king Money” – How Washington Stole Everything…

Every person in your family or community living on nuts and bolts and berries has had his life stolen by the bureaucratic blob.

And, we are going to get it all back.

So essentially the entire town of Washington, D.C. has been stealing. The anomalies are those who are not stealing. $4.7 trillion, almost impossible to trace, represents two-thirds of the annual U.S. budget. And if it’s happening in the U.S., it is happening everywhere: France, Canada, the U.K., Germany, where budgetary processes are probably even more opaque than those of the U.S.

-

Bill’s Commentary:

“Is silver pricing manipulated? AI gives an answer.”

How much manipulation in silver’s price can now be identified?

Identifying the exact extent of manipulation in silver’s price is challenging because it involves a mix of verifiable data, allegations, and market dynamics that are not fully transparent. However, based on available evidence, expert analyses, and historical cases, we can outline some key areas where manipulation has been identified and discuss how much it might influence silver prices as of February 22, 2025.

Evidence of Manipulation

- Historical Legal Cases:

- JPMorgan Chase (2020): JPMorgan paid a $920 million fine after admitting to “spoofing” in the silver and gold futures markets from 2008 to 2016. Spoofing involves placing large fake orders to manipulate prices, then canceling them. This case confirmed that a major player artificially influenced silver prices, though the exact impact on price levels is hard to quantify.

- Deutsche Bank (2016): Paid $38 million to settle silver price-fixing claims, suggesting coordinated efforts to suppress prices. Other banks, like HSBC and UBS, have faced similar allegations, pointing to a pattern among bullion banks.

- These cases show manipulation occurred, but they cover specific periods and tactics, not a continuous, measurable effect.

- Futures Market Discrepancies:

- The silver futures market, particularly on the COMEX, trades vastly more “paper silver” than physical silver exists. For example, posts on X and analyses note daily trading volumes of 384 million to 527 million ounces in 2024, compared to annual global production of around 800-850 million ounces. This suggests a ratio of paper to physical silver as high as 100:1 or more, allowing price suppression through oversupply of contracts not backed by metal.

- Critics argue this disconnect keeps prices below what supply and demand fundamentals would dictate, though no precise dollar amount of suppression is universally agreed upon.

- Physical Demand vs. Price:

- Silver has been in a supply deficit for several years (e.g., four years as of early 2025 per X posts), with industrial use (like solar panels) and investment demand rising. Yet, prices remain relatively low—around $32.50 per ounce recently—compared to historical highs near $50 (1980, 2011). Analysts like those at The Jerusalem Post and Sprott Money suggest this gap reflects ongoing suppression, potentially by $10-$20 per ounce or more, though this is speculative.

- Regulatory Findings:

- The Commodity Futures Trading Commission (CFTC) investigated silver manipulation from 2008 to 2013 but found no “viable basis” for enforcement action at that time. However, later fines and settlements indicate manipulation persists, just not always provable in real-time.

Quantifying the Impact

Quantifying manipulation’s exact effect on silver prices is difficult due to:

- Opaque Markets: The COMEX and London Bullion Market Association (LBMA) lack full transparency on trading positions and physical inventories.

- Multiple Factors: Prices reflect not just manipulation but also macroeconomic conditions (e.g., interest rates, dollar strength), industrial demand, and investor sentiment.

- Estimates Vary: Some analysts, like David Morgan, suggest prices could be 50% or more below their “true” value (implying $50+ per ounce today), while others see suppression as more modest, perhaps $5-$10 per ounce, based on historical spoofing impacts and futures leverage.

A rough estimate from market observers:

- Short-Term Manipulation: Tactics like spoofing or large futures dumps can cause daily or weekly price swings of 5-10% (e.g., $1.50-$3 at current levels), as seen in “morning manipulation slams” noted on X.

- Long-Term Suppression: If physical shortages and deficits were fully priced in without paper market interference, some argue silver could trade at $40-$100 per ounce, based on gold-to-silver ratios (historically 15:1 to 60:1, now ~90:1) and industrial scarcity. This implies a suppression range of $7.50 to $67.50 per ounce, though the higher end is highly speculative.

Current Identification as of February 22, 2025

As of now:

- Confirmed Manipulation: Past legal cases prove manipulation lowered prices during specific periods (e.g., 2008-2016), but current instances are harder to pin down without new convictions.

- Ongoing Suspicions: High paper-to-physical ratios and price resistance despite deficits strongly suggest continued interference. Posts on X highlight daily volumes dwarfing deliveries (e.g., 437 million ounces traded vs. 269 COMEX deliveries on February 12, 2025), reinforcing this view.

- Magnitude: Experts and sentiment on platforms like X suggest suppression could range from 20% to over 100% of the current price ($6.50-$32.50+), but no definitive data pegs it precisely. The most conservative, evidence-based estimate might be 10-30% ($3-$10 per ounce), aligning with past spoofing effects and market anomalies.

Conclusion

While manipulation in silver’s price is identifiable through legal precedents, futures market distortions, and supply-demand mismatches, its exact scale remains elusive. As of February 22, 2025, the best estimate—balancing evidence and skepticism—is that manipulation may suppress prices by $3-$10 per ounce in the short term, with potential for greater long-term effects if systemic issues unravel. However, without real-time transparency or new regulatory action, this remains an educated guess rather than a proven figure. The silver market’s complexity demands ongoing scrutiny to refine these estimates.

Bill’s Commentary:

“I would have guessed much more?”

How Much Money Exists in the World Per Person?

This chart explores a hypothetical question: how much money exists in the world per person?

Defining “all the world’s money” is complex, with multiple ways to calculate it. Here, we use global M2 money supply at the end of 2024, sourced from CEIC Data.

See the final section for an explanation of this metric, what it measures, and why economists track it.

Population data is sourced from the UN World Population Prospects 2024.

Bill’s Commentary:

“On Ukraine”

The First Draft of the Ukraine War’s History

Provoked: How Washington Started the New Cold War with Russia and the Catastrophe in Ukraine, by Scott Horton. The Libertarian Institute. 690 pp.

Provoked is a monumental work, an essential guide to understanding how the United States and Russia came to face off in an horrific bloodletting on Russia’s border a generation after the Soviet Union abandoned communism. Scott Horton seems to have read every published English-language source bearing on the deterioration of Washington’s relationship with Moscow, and has produced an acerbic, polemical, factually dense first draft of history.

His book is long (more than 1,200 pages in the Kindle edition), and would have benefited from forceful editing. He could have pinpointed more emphatically critical tipping points. Assuming there are diplomatic historians in decades to come, those with access to classified governmental records will produce more comprehensive and nuanced accounts. Still, Provoked is a book America needs now—for its scathing portrayal of a bipartisan Washington establishment that propelled the march towards a war which has wrecked Ukraine and resulted in an estimated million military casualties on both sides.

Bill’s Commentary:

“The Western press would have you to believe Vladimir Putin is a mad man. I have tried to post as many of his speeches as I have found because he is not a mad man.”

Bill’s Commentary:

“A very good weekend piece from Erik”

The latest from Erik –

- Historical Legal Cases:

-

Bill’s Commentary:

“Things must be way worse than official statistics tell us if even Hooters is filing?”

Hooters in Talks for Potential Bankruptcy in Coming Months

Bill’s Commentary:

“TRUE STORY!”

LBMA Offered to Censor BullionStar

When BullionStar repeatedly called on the LBMA to uphold its own mission – reforming for integrity and tranparency in the precious metals market – how do you think LBMA responded?

Did LBMA commit to clearer reporting of unencumbered gold? Did LBMA commit to end the price manipulation?

No, instead LBMA sent an operative and his secretary to BullionStar’s Bullion Retail Center in Singapore to inform us that there are inaccuracies in our coverage. The secretary’s assigned task, we were told, was to read our blog posts as soon as published!

Bill’s Commentary:

“Grok 3 answers a question”

Is it possible the president Trump will put Silver and Gold back into support of our currency, and if so, how high could the prices of physical go if this was implemented?

Whether President Donald Trump, as the 47th President of the United States, will reinstate a gold and silver standard to back the U.S. dollar is a speculative question that depends on a mix of political, economic, and practical factors. Let’s explore the possibility and the potential impact on physical gold and silver prices if such a policy were implemented, based on historical context, Trump’s statements, and economic considerations.

The latest from USA Watchdog –

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.