-

Bill’s Commentary:

“2008 on steroids all over again?”

Trump administration prepares to ease big bank rules

The Trump administration is gearing up to deliver a major win to Wall Street banks: Easing rules imposed on megabanks in response to the 2008 financial crisis.

Trump-appointed regulators are nearing completion of a proposal that would relax rules on how much of a capital cushion the nation’s largest banks must have to absorb potential losses and remain solvent during periods of economic stress.

Bill’s Commentary:

“You mean God, guns, and grub really is a good idea after all?”

Big Bank Boss Urges America To ‘Stockpile Bullets, Not Bitcoin’

JPMorgan Chase CEO Jamie Dimon argued at the inaugural Reagan National Economic Forum in California that the U.S. should should stockpile guns, ammunition and drones rather than Bitcoin.

“We should stockpiling guns, bullets, tanks, planes, drones, you know, rare earths. We know we need to do it. It’s not a mystery,” Dimon said, referencing President Donald Trump’s executive order in March that established a Bitcoin reserve.

Dimon is by now well known for his dislike/disapproval of cryptocurrencies (even though his own bank now allows clients to trade them); which should come as no surprise since the concept of sovereignty and democratizing finance is the nemesis of the established ‘trust us with your cash’ regime of banking rent-seekers.

Bill’s Commentary:

“The day prior to peace talks? Maybe we will soon see whether US Treasuries et al are the safe haven or…rather gold? If Russia retaliates with equal or greater force, is that THE dollar collapse?”

Swarms of drones from parked trucks destroy Putin’s bombers

https://www.telegraph.co.uk/world-news/2025/06/01/bridge-collapses-onto-train-russi

-

Bill’s latest Coffee and a Mike interview – (Also posted under Interviews)

Bill’s Commentary:

“As I have said for years, the “implosion” will be a credit event…”

Bill’s Commentary:

“This is so bad”

The Kingston Report cross-posted a post from FOCAL POINTS (Courageous Discourse)

Karen KingstonMay 31 · The Kingston Report The FDA, CDC, and HHS are aggressively violating human clinical safety standards and their promises by approving a next-generation Moderna mRNA C19 shot, mNEXSPIKE – no placebo, no blinding.

The observer-blinded term is nonsense. The patients and study investigators were unblinded, so that damning data can easily be distorted or discarded.

Thank you Nicolas Hulscher for this excellent article.BREAKING: FDA Goes Rogue — Approves Moderna’s Next-Gen COVID-19 mRNA Injection Without Placebo-Controlled Trial

This move directly contradicts a recent HHS statement: “All new vaccines will undergo safety testing in placebo-controlled trials prior to licensure — a radical departure from past practices.”

Nicolas Hulscher, MPHMay 31 The FDA has officially gone rogue.

It just approved Moderna’s newest COVID-19 mRNA shot—mNEXSPIKE—without a single placebo-controlled trial, directly contradicting recent public assurances from HHS that “all new vaccines will undergo safety testing in placebo-controlled trials prior to licensure.”

However, this authorization appears to align with their so-called “evidence-based approach to COVID-19 vaccination” published in NEJM —a policy that permits the continuation of mass experimentation on many Americans without clinical proof of benefit:

FDA Unveils New Plan to Limit COVID-19 Vaccine Use — Keeps Deadly Program Alive Nicolas Hulscher, MPH·May 20 by Nicolas Hulscher, MPH Read full story According to Moderna:

The U.S. Food and Drug Administration (FDA) has approved mNEXSPIKE® (mRNA-1283), a new vaccine against COVID-19, for use in all adults 65 and older, as well as individuals aged 12-64 years with at least one or more underlying risk factor as defined by the Centers for Disease Control and Prevention (CDC).

The FDA’s approval of mNEXSPIKE is based on results from a randomized, observer-blind, active-controlled Phase 3 clinical trial (ClinicalTrials.gov Identifier: NCT05815498), which enrolled approximately 11,400 participants aged 12 years and older. The primary efficacy objective in this study was to demonstrate the non-inferior vaccine efficacy against COVID-19 starting 14 days after mNEXSPIKE compared to that after the comparator vaccine, mRNA-1273 (Spikevax®), Moderna’s original COVID-19 vaccine.

Moderna expects to have mNEXSPIKE available for eligible populations in the U.S. for the 2025-2026 respiratory virus season, alongside Spikevax and mRESVIA®, the Company’s approved respiratory syncytial virus (RSV) vaccine.

mRNA-1283 is Moderna’s next-generation COVID-19 mRNA vaccine, designed to encode the receptor-binding domain (RBD) and N-terminal domain (NTD) of the SARS-CoV-2 spike protein—unlike the original mRNA-1273 vaccine, which encodes the full-length spike protein.

But buried in the FDA’s May 30 approval letter is a concerning admission: the critical placebo-controlled trial that would actually assess the safety and efficacy of this new mRNA injection hasn’t even started yet.

According to the FDA, Moderna is only planning to begin a Phase 4, randomized, observer-blind, placebo-controlled study in adults aged 50–64 years without high-risk conditions on November 30, 2025—with final results not expected until January 2027.

Meanwhile, the trial used to justify this approval—NCT05815498—was not placebo-controlled. Instead, it merely compared mNEXSPIKE to Moderna’s previous COVID-19 shot (mRNA-1273/Spikevax)—a product already linked to serious adverse events and mass death.

This means the FDA fully licensed mNEXSPIKE for broad use without ever having seen placebo-controlled safety data in the exact population now being targeted.

This approval directly contradicts a recent public statement by an HHS spokesperson, who told The Washington Post:

“All new vaccines will undergo safety testing in placebo-controlled trials prior to licensure — a radical departure from past practices.”

BREAKING — RFK Jr. to Require Placebo-Controlled Trials for New Vaccines as FDA Admits “Void of Data” on COVID BoostersNicolas Hulscher, MPH·May 2Read full story Based on this extremely disappointing and dangerous development, it can be assumed that the Bio-Pharmaceutical Complex still exerts majority control over our regulatory agencies:

If we truly want to Make America Healthy Again, this global syndicate has to be properly dealt with.

Epidemiologist and Foundation Administrator, McCullough Foundation

Please consider following both the McCullough Foundation and my personal account on X (formerly Twitter) for further content.

Originally posted on FOCAL POINTS (Courageous Discourse)Peter A. McCullough, MD, MPHSubscribe Investigative scholarship and reporting of public policy, health, justice, and current affairs. © 2025 Karen Kingston

Karen Kingston, miFight Inc, 1700 Aviara Parkway #130063

Carlsbad, CA 92013

Bill’s Commentary:

“Hopefully he is convicted in a state with the death penalty?”

https://www.facebook.com/watch/?mibextid=wwXIfr&v=1149585699658044&rdid=6E715XkMcFaAFe8J

The latest from USA Watchdog –

The latest from Erik –

-

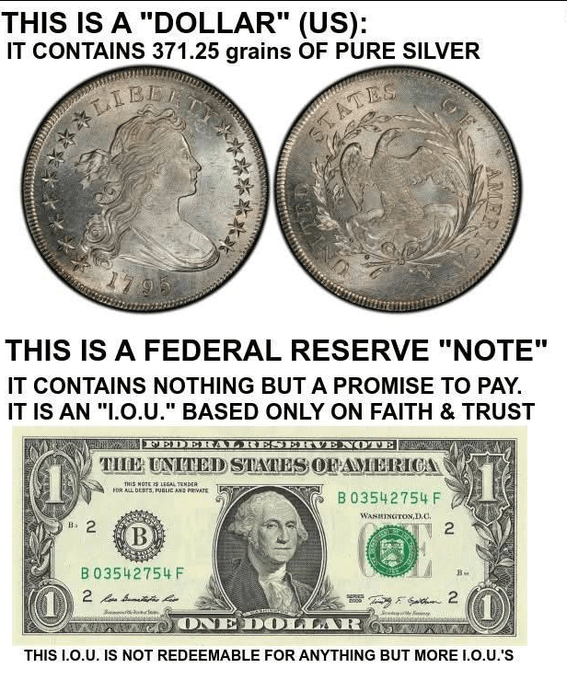

Bill’s Commentary:

“A good read on the coming monetary reset.”

Trump’s Monetary Reset: Is a Gold-Backed Dollar on the Horizon?

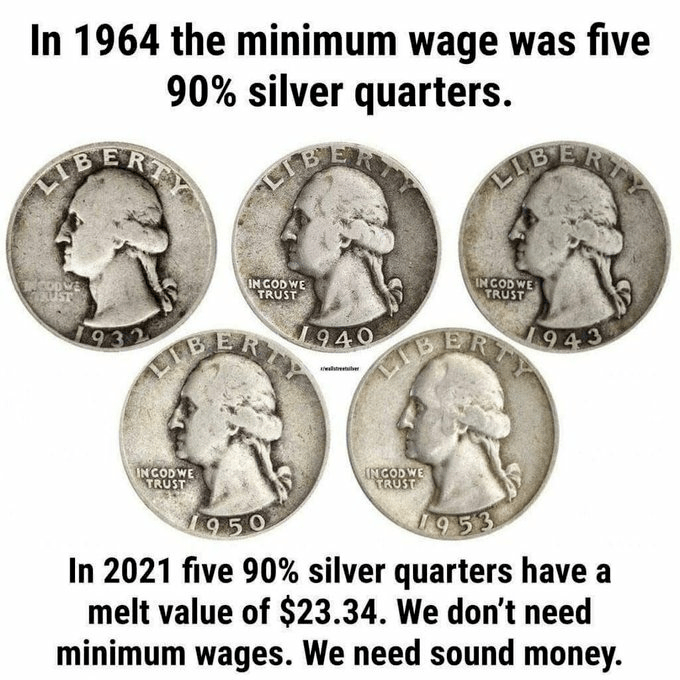

“More and more people are asking if a gold standard will end the financial crisis in which we find ourselves. The question is not so much if it will help or if we will resort to gold, but when.

All great inflations end with the acceptance of real money—gold—and the rejection of political money—paper.” – Ron Paul

Two powerful catalysts are driving the coming monetary reset.

First, the federal debt crisis has reached a breaking point, with skyrocketing interest payments now surpassing defense spending and on track to become the largest single budget item. This trajectory is unsustainable, signaling that a major financial reckoning is imminent.

Bill’s Commentary:

“A bleak report from Erik with the last paragraph summing it up for you.”

The latest from Erik –

-

Bill’s Commentary:

“$22 trillion in 10 years… but we don’t have 10 years”

The latest from USA Watchdog –

Bill’s Commentary:

“What does this say about Trump’s opinion of the dollar?”

Trump Media Raises Money to Buy $2.5 Billion in Bitcoin

Trump Media & Technology Group, the parent company of Truth Social, said on Tuesday that it would raise $2.5 billion from institutional investors to invest in Bitcoin, continuing its transformation from a social media company into a financial services and crypto play.

Trump Media, whose largest shareholder is President Trump, said it would raise $1.5 billion from about 50 institutional investors by selling roughly 58 million shares. The company is planning to raise an additional $1 billion from the sale of bonds that can also be converted into shares at a later date.

Bill’s Commentary:

“So, the US Treasury defaults, and these morons who buy CDS (credit default swaps) on US Treasuries believe they will actually get paid? In what medium may I ask? And what bank or broker will still be open? …Gold instead maybe?”

Credit default swaps are back in fashion — even if the panic might be overblown

Investors are getting nervous the U.S. government might struggle to pay its debt — and they are snapping up insurance in case it defaults.

The cost of insuring exposure to U.S. government debt has been rising steadily and is hovering near its highest level in two years, according to LSEG data.

Spreads or premiums on U.S. 1-year credit default swaps were up at 52 basis points as of Wednesday from 16 basis points at the start of this year, LSEG data showed.

-

Bill’s Commentary:

“I just interviewed with my good friend and business partner Andy Schectman. He thought it would be a neat idea to interview me… about me. I agreed as I have truly been blessed and have had a life of wild adventures both good and bad. We plan to do another interview in the near future as we really did not even touch on the last 10-15 years. I hope you enjoy this!”

Bill’s Commentary:

“It was a problem then, and a bigger problem now… the math only gets worse.”

Why Obama’s former budget director is now sounding alarms about debt

A rally is underway for stocks after the long holiday weekend, thanks to another tariff reversal from President Trump.

And bond yields continue to ease. That’s a sore point for Deutsche Bank, where strategist Henry Allen points out the 10-year Treasury yield at around 4.5% is at a level seen before the global financial crisis “even though U.S. public debt is more than double what it was then.”

On that note, our call of the day from Peter Orszag, President Barack Obama’s former budget director, warned of “alarmingly elevated” U.S. fiscal risks, in an op-ed for The New York Times.

Bill’s Commentary:

“If you put shit information and cannot compete with truth… just SHUT ’em DOWN!”

“Just Gone. Like It Never Existed”: YouTube Nukes Top Canadian Political Account After State-Funded Media Complains

A Canadian YouTube channel that was dominating the platform during the country’s recent election has vanished, after the state-funded Canadian Broadcasting Corporation reached out to the social media giant, and branded it a ‘content farm’ in a Friday hit-piece.

The channel, “Real Talk Politiks,” had over 300,000 subscribers and more than 70 million views in the month of April, according to ViewStats.com – making it the third-most viewed Canadian news and politics channel over the past three months.

Bill’s Commentary:

“LaGarde wants the Euro to replace the dollar as the world’s reserve currency? Maybe they need some commonsense classes first?”

Sovereignty Under Siege: Hungary Faces Mounting Pressure Over Pride Ban

Several EU member states have once again placed Hungary at the center of the European political debate. Seventeen countries—including Germany, France, the Netherlands, and the Nordic nations—have formally urged the European Commission to take “immediate action” against Hungarian Prime Minister Viktor Orbán’s government for banning LGBT events in public spaces.

In a letter coordinated by the Dutch ministry of foreign affairs, the signatories of the statement called on Brussels to deploy the full “rule of law toolkit” to compel Budapest to reverse the measure. Among the possible responses is activating Article 7 of the EU Treaty, which could lead to suspending Hungary’s voting rights in the European Council.

Bill’s Commentary:

“Gold coming into the system, not away from it!”

Bill’s Commentary:

“470,000-600,000 deaths? Probably less than hoped for?”

Joe Rogan and Aaron Rodgers Perform an Autopsy on the Vaccine Narrative

When Joe Rogan sat down with Aaron Rodgers, the conversation quickly turned to one of the most polarizing topics in modern medicine: vaccines.

But instead of retreading old ground, they zeroed in on one of the most overlooked—and deeply disturbing—double standards of the pandemic.

Rogan opened the door with a brutally simple observation.

“You’re not even supposed to eat sushi while you’re breastfeeding,” he said.

“Because you could get some sort of a parasite. And yet, you’re going to take pregnant women and dose them up with this experimental vaccine.”

He didn’t stop there.

-

Bill’s Commentary:

“I just interviewed with my good friend and business partner Andy Schectman. He thought it would be a neat idea to interview me…about me. I agreed as I have truly been blessed and have had a life of wild adventures both good and bad. We plan to do another interview in the near future as we really did not even touch on the last 10-15 years. I hope you enjoy this!”

Bill’s Commentary:

“Trump so far has done some very good things and some bad things. Publicly saying your opponent is “CRAZY” while negotiations are taking place is the definition of BATSHIT CRAZY!”

https://truthsocial.com/@realDonaldTrump/posts/114571369956761390

Bill’s Commentary:

“The man is not wrong. The only problem is he is too late as the math is now irreversible…”

-

Bill’s Commentary:

“I just interviewed with my good friend and business partner Andy Schectman. He thought it would be a neat idea to interview me…about me. I agreed as I have truly been blessed and have had a life of wild adventures both good and bad. We plan to do another interview in the near future as we really did not even touch on the last 10-15 years. I hope you enjoy this!”

Bill’s Commentary:

“Erik on Oligarchy”

The latest from Erik –

Bill’s Commentary:

“And you wonder if you live in a Nanny state?”

Come July, Keys Will Be De Facto Illegal In Minnesota

Come July, common keys for houses, cars, boats, and motorcycles will be illegal in Minnesota, save for uncertain intervention from the state Legislature.

That’s when the state’s ban on the manufacture, sale, or import of keys, toys, dishes, and other common items containing more than a tiny percentage of lead or cadmium goes into effect.

The purpose of that law was to remove dangerous heavy metals from products that come into contact with children. The trouble is that almost all keys sold today have more lead than the new law’s 0.09 percent limit on lead content.

-

Bill’s Commentary:

“I just interviewed with my good friend and business partner Andy Schectman. He thought it would be a neat idea to interview me…about me. I agreed as I have truly been blessed and have had a life of wild adventures both good and bad. We plan to do another interview in the near future as we really did not even touch on the last 10-15 years. I hope you enjoy this!”

Bill’s Commentary:

“Re think? This is the foundation to the entire global financial system and ALL the options are bad ones!”

U.S. Treasury yield spike has investors rethinking the rest of the world

A U.S. Treasury selloff is prompting some market watchers to reassess their stance on fixed income allocation, after “relentless” action from yields on long-dated Treasurys saw those bonds surpass a key 5% threshold.

Yields on 20- and 30-year Treasurys were marginally higher on Thursday, trading at 5.136% and 5.128%, respectively. Both notes were up as much as 5 basis points earlier the session, before paring gains.

Bill’s Commentary:

“This is a new name for me…!”

Declassified: Biden Admin Labeled COVID Dissenters ‘Domestic Violent Extremists’

Newly declassified intelligence records have revealed that the Biden administration labeled Americans who opposed the COVID-19 vaccination and mask mandates as “Domestic Violent Extremists.”

The documents, which were declassified by DNI Tulsi Gabbard, show that they cutely abbreviated the term to ‘DVEs’.

Bill’s Commentary:

“How is it possible the President of the United States goes from totally healthy as per the WH physician to stage 4 cancer in just a few months? Is this the new “turbo cancer” from the jab?”

Bill’s latest with Liberty and Finance (Also posted under Interviews)

The latest from USA Watchdog –

Bill’s Commentary:

“Good stuff from Alisdair Mcleod.”

It’s Been A Wild Week In Global Markets, But Look At This…

May 23 (King World News) – Alasdair Macleod: It’s the best of times for gold; the worst of times for dollars. Led by long-dated JGBs, global government bond markets are wobbling. We can see where this is going…

This week saw moderately firmer prices for gold and silver following a near-four-week consolidation. In European trade this morning, gold was $3328, up $27 from last Friday’s close. And silver was $33.10, up 83 cents. Futures volumes on Comex remained low-to-moderate, though picking up slightly as the week progressed.

Bill’s Commentary:

“As I have always said, a failure to deliver either gold or silver will be the END of the current financial system.”

The ECB’s Limited Hangout Warning About Gold Market Instability

David JensenMay 24 “Limited hangout” is intelligence jargon for a form of propaganda in which a selected portion of a scandal, criminal act, sensitive or classified information, etc. is revealed or leaked, without telling the whole story. The intention may be to establish credibility as a critic of something or somebody by engaging in criticism of them while in fact covering up for them by omitting many details; to distance oneself publicly from something using innocuous or vague criticism even when one’s own sympathies are privately with them; or to divert public attention away from a more heinous act by leaking information about something less heinous.

This is a common tactic used by political extremist groups on both ends of the political spectrum, as well as by government intelligence agencies caught in scandals.

The focus of this Substack is and has been 1) to warn of the specific danger to worldwide societal and market stability presented by the Bank of England’s creation of the leveraged gold and silver market in the City of London where claims for non-existent gold and silver have been sold to unwitting cash purchasers and 2) to call for the institution of stable sound money to avert the coming disruptions.

The suppression of gold and silver’s monetary policy inflation warning signals, coordinated through Bank for International Settlements (BIS), has compounded global currency and debt market disorder created by central bankers over decades.

This week, BIS member the European Central Bank (ECB) revealed that it appears to have gotten the memo in terms of the imminent danger posed by the leveraged claims in the world’s gold (and silver) markets.

However, the challenge for the ECB and other central banks is how do you now offload blame by warning of the imminent disintegration of this decades-old metals Ponzi scheme without implicating your own institution?

The Limited Hangout

In the its May 21, 2025 Financial Stability Review, the ECB gingerly begins the entire discussion on page 39 in a 5 page section titled “What does the record price of gold tell us about risk perceptions in financial markets?” by Maurizio Michael Habib, Oscar Schwartz Blicke, Emilio Siciliano and Jonas Wendelborn.

In what appears to be the ECB’s ‘limited hangout’, the ECB discusses gold and how physical gold delivery in the US against derivatives in the COMEX market highlight the risk gold delivery default destabilizing the Euro area where a notional value of $1 trillion (T) of gold derivatives are held.

Figure 1 – COMEX Gold Market Statistics and EU Gold Derivative Exposure; source: ECB May 21, 2025 Financial Stability Review

On pg. 42, the ECB report notes: “While gold prices are driven by many factors, investors showed high demand for gold as a safe-haven asset and, at the beginning of 2025, a notable preference for gold futures contracts to be settled physically. These dynamics hint at investors’ expectations that geopolitical risks and policy uncertainty could remain elevated or even intensify in the foreseeable future. Should extreme events materialise, there could be adverse effects on financial stability arising from gold markets. This could occur even though the aggregate exposure of the euro area financial sector appears limited compared with other asset classes, given that commodity markets exhibit a number of vulnerabilities.34 Such vulnerabilities have arisen because commodity markets tend to be concentrated among a few large firms, often involve leverage and have a high degree of opacity deriving from the use of OTC derivatives. Margin calls and the unwinding of leveraged positions could lead to liquidity stress among market participants, potentially propagating the shock through the wider financial system. Additionally, disruptions in the physical gold market could increase the risk of a squeeze. In this case, market participants could be subject to significant margin calls and/or have trouble sourcing and transporting appropriate physical gold for delivery in derivatives contracts, leaving themselves exposed to potentially large losses.”

We see in the quote above the ECB use key words “gold”, “vulnerability”, “concentrated”, “leverage”, “opacity” and, most importantly, “OTC derivatives” where OTC is Over-the-Counter (or private party-to-party) derivative contracts.

However, the report only obliquely mentions the London Gold Market despite the fact that London is the world’s largest gold and silver market, trades exclusively in OTC contracts, and is ‘ground zero’ for the global leveraged silver and gold price fixing scheme created by the Bank of England.

The London Bullion Market Association (LBMA) itself tells us that trading of derivatives is less than 10% of daily trading volume while the remainder is in the form of trading of unallocated (leveraged) cash/spot claims for immediate delivery of gold.

Standing claims for cash/spot gold in London are leveraged hundreds of times against physical gold available for immediate delivery with the Bank of England having to lease gold into the market to cover the nature of the leveraged market when physical delivery was demanded earlier this year.

With an estimated 400M to 600M oz. of cash/spot gold claims and 5B to 8B oz. of cash/spot silver claims standing in London, the real risk to global stability is the leveraged CASH/SPOT market for immediate delivery physical gold and silver in London and not derivative gold claims in an unnamed OTC market.

The ECB does not mention this however, as that would highlight the problem that has been created by these central planners.

While the ECB’s May 2025 Financial Stability Review has very little value in identifying the central issue in the gold and silver markets that we face today, it does serve as an excellent example of a ‘limited hangout’.

Best regards,

David Jensen

This post is public so share it with your contacts.

-

Bill’s Commentary:

“I just interviewed with my good friend and business partner Andy Schectman. He thought it would be a neat idea to interview me…about me. I agreed as I have truly been blessed and have had a life of wild adventures both good and bad. We plan to do another interview in the near future as we really did not even touch on the last 10-15 years. I hope you enjoy this!”

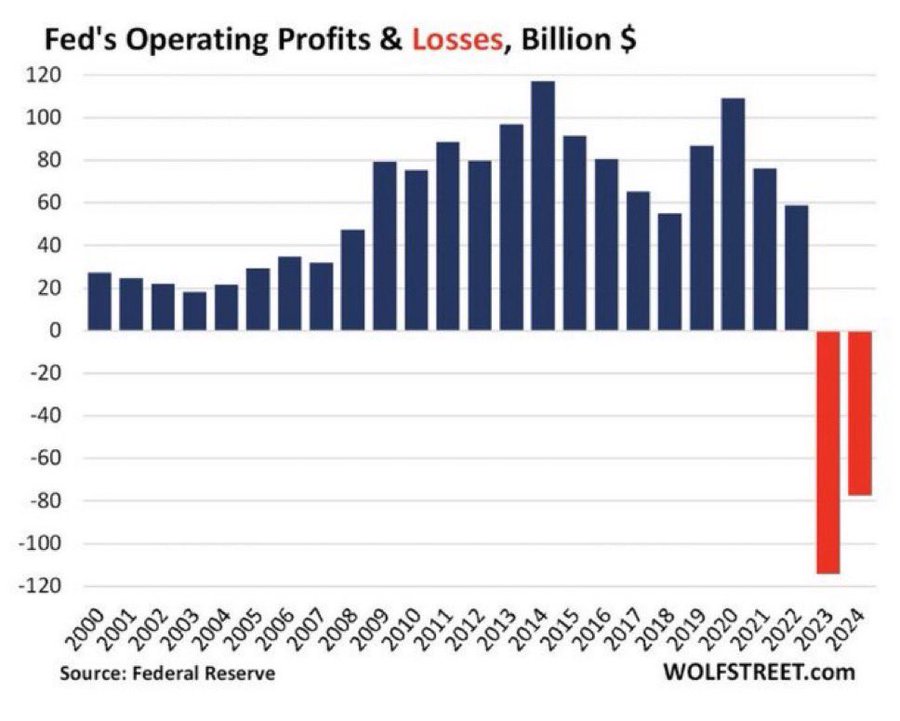

Bill’s Commentary:

“Creative accounting?”

@DarioCpx

How would you define a bank which had ~50bn$ of capital 2 years ago, lost 192bn$ from then till today, but still reports ~50bn$ of capital in its balance sheet when nobody injected 242bn$ of cash into it?

The bank I am describing is not a myth, but the US Federal Reserve

-

Bill’s Commentary:

“I just interviewed with my good friend and business partner Andy Schectman. He thought it would be a neat idea to interview me… about me. I agreed as I have truly been blessed and have had a life of wild adventures both good and bad. We plan to do another interview in the near future as we really did not even touch on the last 10-15 years. I hope you enjoy this!”

The latest from USA Watchdog –

Bill’s Commentary:

“Who could ever believe this is even a “thing”?”

Bill’s Commentary:

“A travesty!”

Massive Scandal Unfolds in Colorado Alleging Elections are Rigged, and the Cover Up is Real – Free Tina Peters Now

Former Mesa County Clerk and Gold Star Mother, Tina Peters, is sitting in prison right now for preserving her own election records following the 2020 election before Dominion Voting Systems and Colorado Secretary of State, Jenna Griswold, could come in and erase them. Peters was following state and federal law to preserve those records, while Dominion and SOS Griswold are more likely the criminals unlawfully erasing them. This persecution of the innocent and promotion of criminality was a hallmark of the Biden era.

Trump’s DOJ has filed a statement of interest in Peter’s case, and President Trump himself has called attention to the fact that the persecution of Tina Peters is nothing more than Democrats covering up their own election crimes:

Bill’s Commentary:

“Interest rate shooting up all over the world threatens the biggest debt bubble (by any metric) the world has ever seen… Pooh pooh this at your own risk and lifetime peril!”

‘Worse than Greece’: The debt crisis threatening to blow up the global economy

When Lisa Nandy attends the World Expo in Osaka on Thursday, she will launch an initiative aimed at increasing ties between Britain and Japan.

However, there is a potential link between the two countries that the Culture Secretary and her ministerial colleagues will be much less keen on.

A dramatic lurch in the Japanese bond market has heightened fears that debt-heavy Western governments such as the UK and even the US could be in line for a budget-busting financial crunch.

Bill’s Commentary:

“Please go back 8 days and read what Pastor Stanley wrote for us? Kudos sir!”

Bill:

I just wanted to say ‘Thank you’ for putting up my ‘ Japanese 40 Year Gov’t Bond at Record High Yield Signals Trouble in One of the Largest Bond Markets’ article 8 days ago as we were out information of yesterday’s story…I’m sure you saw the Japanese PM say yesterday : “The government is not in a position to comment on interest rates, but the reality is we’re facing a world with them. Our country’s fiscal situation is undoubtedly extremely poor, worse than Greece’s.”…

It’s a bad world economic situation-but as a writer it’s nice to be vindicated once in a while. Thanks again for posting my writing.

Stan Szymanski

encouragingangels@icloud.com

“My pleasure Stan!”

From J. Johnson

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.