-

Bill’s Commentary:

“I have told you for many years that the “end” would be a credit event. I have also told you to keep a sharp eye on Japanese yields coming off the “0%” bottom. JGB’s are cratering, your credit event is arriving right before your own eyes! Got gold? Got silver?”

JGBs Implode, Gold Soars: The Trade CNBC Ridiculed Is Crushing Everything

As I first noted back in 2023, my disdain, distrust and general disgust for financial media reached a peak in 2016 when CNBC’s Fast Money invited Bill Fleckenstein on the air to offer up his take on the economy and why the Fed-fueled market was “un-shortable”.

Bill is a well-known advocate for the Austrian school of economics and has been highly critical of the Fed and central banking policies for decades.

In this interview, he made two key points: 1) he thought Japan would probably be the first bond market to blow up and 2) he was buying gold and miners and thought the broader market was “un-shortable”.

Bill’s Commentary:

“Doing publicly what other nations are doing quietly…”

Danish pension fund to sell $100 million in Treasurys, citing ‘poor’ U.S. government finances

Danish pension operator AkademikerPension said it is exiting U.S. Treasurys because of finance concerns as Denmark spars with President Donald Trump over his threats to take over Greenland.

Anders Schelde, AkademikerPension’s investing chief, said the decision was driven by what it sees as “poor [U.S.] government finances” amid America’s debt crisis. But it also comes as tensions escalate between the U.S. and Denmark after Trump’s latest threats to tariff European countries if Greenland, an arctic territory of Denmark, isn’t sold to the U.S.

“It is not directly related to the ongoing rift between the [U.S.] and Europe, but of course that didn’t make it more difficult to take the decision,” Schelde said in a statement to CNBC.

Bill’s Commentary:

“Here it is, the unwinding of the yen carry trade… this is bad beyond words!”

Sudden Japan Bond Crash Unleashes Turmoil Across Trading Floors

The selling in Japan’s $7.6 trillion bond market began slowly, then seemed to hit all at once.

What started as an unremarkable day on Tokyo trading desks quickly morphed into what several market participants described as the most chaotic session in recent memory. While concerns about Japan‘s fiscal position had been simmering for weeks, they suddenly boiled over on Tuesday afternoon with little warning — sending yields on some bonds to all-time highs.

The rout left some hedge funds rushing to unwind losing trades, pushed life insurers to dump bonds and caused at least one corporate bond investor to pull out of a multi-million dollar trade. Even as traders struggled to pinpoint an immediate catalyst for the selloff, the overriding worry was clear: Prime Minister Sanae Takaichi’s plans to cut taxes and boost spending are raising doubts about the financial health of one of the world’s most indebted governments.

Bill’s Commentary:

“Idiots, and they don’t even know they are idiots. These things have consequences; the state will empty out!”

Bill’s Commentary:

“Look at the date on this article. Spot on in the rear view mirror. Oh, and a 40 year bull market will not unwind in an orderly fashion because cheap credit brought forth abundant credit that now needs to be paid back or rolled… but cannot. The biggest bubble in human history is bursting now!”

A 40-year bull run in the bond market is under pressure as Treasury yields touch the ‘most important trend line of all time’

The 40-year trend of declining interest rates could be on its last legs as the 10-year US Treasury yield tests resistance against “the most important trend line of all time,” according to technical analyst Carter Worth of Worth Charting.

Bond prices rise as interest rates fall, but amid a period of record inflation and an expanding economy, the Federal Reserve is raising interest rates to help cool down demand and tame inflation.

Now the widely-followed 10-year US Treasury yield is pushing against its 40-year downtrend line that starts with the 1981 peak in interest rates of 15.81%.

Bill’s Commentary:

“Good question!”

Bill’s Commentary:

“This is going to be some good stuff. If there still is a financial system and a real economy, get ya some popcorn!”

@BGatesIsaPyscho

6h

🚨🌎 James O’Keefe @JamesOKeefeIII

just infiltrated The WEF in Davos & proved that Blackrock are also behind the Global Weather Manipulation we all see each & every day‼️

RFK Jnr was also right – it is DARPA!

Multiple Conspiracies Confirmed ✅

-

Bill’s Commentary:

“Pastor Stanley checks in with natural gas.”

Bill:

I put together a small article on this for your consideration: US Natural Gas Prices Extend Gains to +19% on the Day https://www.encouragingangels.org/new-blog/2026/1/19/us-natural-gas-prices-extend-gains-to-19-on-the-day

Thank you,

Stan Szymanski

encouragingangels@icloud.com

Bill’s Commentary:

“It is a disease of the mind…!”

-

Bill’s Commentary:

“Whitney Webb never ever says anything she hasn’t vetted 100%. She has an earful for you here!”

The latest from USA Watchdog –

Bill’s Commentary:

“And you wonder whether or not you should at least have some mining shares?”

-

Bill’s Commentary:

“Anybody remember this gem?”

Bill’s Commentary:

“Oops!”

Please take all the time you need…..

Bill’s Commentary:

“But Wolfgang, they keep telling me you cannot eat gold or silver? Bill”

Bill,

If people just understood one simple fact, they’d be lining up out the door to purchase physical silver and gold.

That fact is that precious metals are fungible.

We live in, and have always lived in, an inflationary environment. America can’t live without inflation (case in point: the Fed is looking to achieve 2% inflation. Not zero % but 2%.) So anyone with cash will always lose money.

Now we can protect ourselves by purchasing things now instead of later. However, many of our daily needs are perishable. You can’t load up and store meats, produce, dairy products, etc. So what can you do?

Buy gold and silver. They keep up with inflation and can always be traded for perishable goods. You’ll never be at the mercy of having to pay higher and higher prices. Even for non perishable items like car insurance, home insurance, medical insurance, autos, etc.

There’s an old story that, throughout history, an ounce of gold could always dress a man in the finest garments from head to toe. The same applies for perishable foodstuffs.

Now I understand why people like Jim Rogers, when questioned as to when he’ll sell his precious metals, says NEVER!

Wolfgang

-

Bill’s Commentary:

“This is ridiculous W, a cash settled contract on silver “price” without any silver… Brilliant!”

Bill,

The reason for Silver’s pop above $90 this morning is Panic in the Pits.

The “Delivery Demand Dam” is about to burst and they are trying to divert demand to a non deliverable product.

Wolfgang

CME Group will launch its 100-ounce silver futures contract on February 9, 2026, pending regulatory review. This new offering aims to provide retail investors with a more accessible and cost-effective way to trade silver futures with less capital.

Bill’s Commentary:

“Just wait a few months when commercial real estate loans cannot rollover… those will be some BIG CRACKS!”

Cracks Begin to Appear at the Nation’s Biggest Banks

For a year, Wall Street’s dominant theme has been the so-called K-shaped economy, in which the well-to-do have powered financial activity despite lower earners’ struggles.

This week, the nation’s largest banks reported a broadly disappointing set of quarterly earnings, the first stumble after a yearlong spree of rising markets and softening regulations paid off handsomely for the finance set.

Results at Bank of America, Citi, JPMorgan Chase and Wells Fargo all fell short of expectations, and their shares fell. Troubles ranged from delayed merger deals (JPMorgan) to stubborn expenses (Citi) to questions about the efficacy of artificial intelligence tools (Bank of America). Banks that do business largely with rich individuals and corporations, such as Goldman Sachs and Morgan Stanley, fared comparatively better.

-

Bill’s Commentary:

“Which market is correct? COMEX at $92 or Shanghai cash market over $100? It’s OK to say it, you know the answer!”

Shanghai Silver Price in Dollars

The Shanghai Silver Price premium reflects the difference between the price of silver traded in Shanghai and that in other major global markets, such as London. This premium or discount can be influenced by regional factors like industrial demand, which is significant given silver’s extensive use in electronics, solar panels, and other technologies. Additionally, investor sentiment and fluctuations in the Chinese Yuan also play a role. A higher premium often indicates strong local demand or limited supply, while a discount may suggest a softer local market.

Bill’s Commentary:

“Who is on 1st base?”

Bill’s Commentary:

“Bill gets a bit irritated…”

Bill’s Commentary:

“A good one from Erik!”

The latest from Erik –

-

Bill’s Commentary:

“Just relax, we saw this all the time when we were kids… right?”

The latest from USA Watchdog –

-

Bill’s Commentary:

“The “naked shorts” conspiracy theory now has a smoking gun. Add this to conspiracy FACT!”

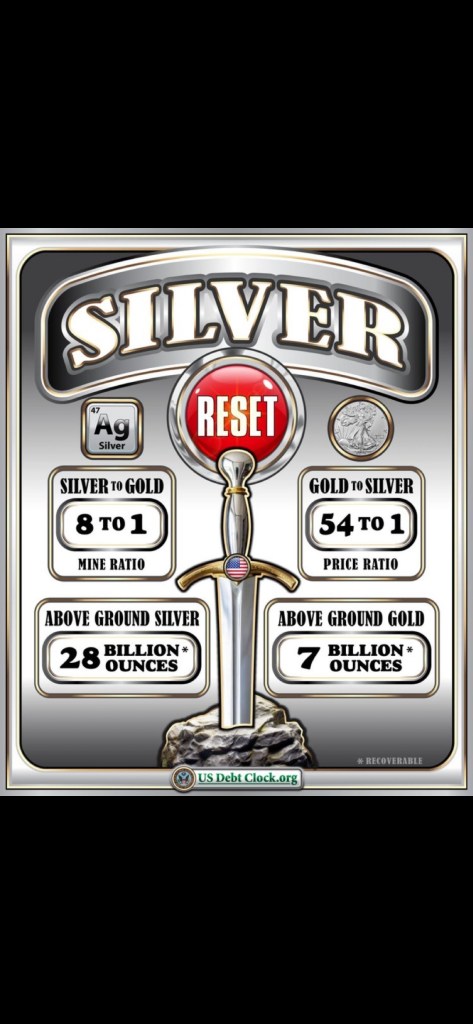

Bill’s Commentary:

“Yes W, 54 to1 is still wrong, a MUCH lower ratio is coming!”

Bill,

Toy with the numbers.

If there’s 4x as much aboveground silver as gold, then silver should be a quarter of the price of gold: a tad over $1,000.

Instead, the gold price to silver ratio stands at 54 to 1. (Should be 4 to 1).

Wolfgang

Bill’s Commentary:

“Therein lies the question: Can the Global South remain intact until the Empire implodes?”

The latest from Erik –

-

The latest from USA Watchdog –

Bill’s Commentary:

“Put this one in the plus category for President Trump”

The UN Goes Ballistic, Demands America Continue to Fund Globalist Agencies in Wake of Trump Pulling America Out of More than 30 UN-Connected Globalist Orgs

Freaking out, the U.N. responded to the Trump administration’s withdrawal of U.S. funding and participation from 66 globalist organizations, of which nearly half are U.N.-affiliated, including UNFCCC for climate, UNRWA, UNESCO, and other murky organizations.

The unaccountable bureaucrats insist the U.S. remains legally bound to pay dues to the U.N. regular and peacekeeping budgets under the U.N. Charter. Despondent, Secretary-General Antonio Guterres expressed regret over the decision, while spokesperson Stephane Dujarric emphasized that assessed contributions are a mandatory obligation for all member states, including the U.S., and that U.N. entities will continue their missions either way.

Bill’s Commentary:

“A good metals discussion from Michael Olliver. Michael has an excellent track record Jim held him in high regard!”

-

Bill’s Commentary:

“Where the world’s silver reserves are”

All of the World’s Silver Reserves by Country, in One Visualization

Silver prices surged to new all-time highs in December, extending a powerful end-of-year rally supported by geopolitical uncertainty and a weaker U.S. dollar.

Silver futures briefly touched around $80, marking an unprecedented 160% rally in 2025 that outpaced even gold. Against this backdrop, understanding where the world’s silver reserves are concentrated provides crucial context for future supply dynamics.

Bill is interviewed by Stacking Surfer (Also posted under Interviews)

Bill’s Commentary:

“Erik’s latest…”

The latest from Erik –

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.