-

The latest from USA Watchdog –

-

Bill’s Commentary:

“A TRAVESTY no matter what angle it’s viewed from…”

Bill’s Commentary:

“You “spend” your bad cash first and hold on to your real monies…that said, this is a nice gesture and a step in the right direction but does not change very much in my opinion.”

Texas authorizes use of gold and silver as legal tender for day-to-day transactions

Texas Governor Greg Abbott said Sunday he signed a bill into law that designates gold and silver as legal tender for everyday financial transactions within the state.

The bill, expected to take effect in May 2027, amends the state government code to recognize the precious metals as legal tender and for residents to use them in everyday transactions based on the state comptroller’s determined value at the time.

Bill’s Commentary:

“In case you were not aware, it certainly DOES MATTER “where” you live!”

-

“And there you have it from the “Madman” himself!”

“Seize The Means Of Production”: Mamdani Lays Bare His Agenda

Zohran Mamdani’s run for mayor of New York City is a clear and present danger to the stability, economic health, and democratic foundation of both the city and the nation.

His platform is rooted in a radical socialist ideology that has, time and time again, led to failure, repression, and suffering wherever it has been tried.

And thanks to a clip surfacing on social media today, we see that Mamdani is not hiding this. In fact, he has been strikingly open about what he believes and what he plans to do. You can listen to his comments for yourself here.

-

Bill’s Commentary:

“Talking his book, or from the gut?”

Elon Musk is once again bashing the Republican megabill.

Weeks after an initial tirade against the legislation, the former top White House staffer and current richest man in the world wrote Saturday on X that the “latest Senate draft bill will destroy millions of jobs in America and cause immense strategic harm to our country!”

The latest from USA Watchdog –

-

Bill’s Commentary:

“You didn’t think he (or the rest of the world) forgot about this, did you?”

Putin: ‘Theft’ Of $300BN in Frozen Assets A ‘Price Worth Paying’ To Break West’s Grip On Global Finance

In somewhat surprising statements and what can be viewed as a very frank ‘concession’, President Vladimir Putin has said Russia is “ready” to part with its $300 billion in frozen assets, framing it as a another way which accelerates Russia’s and its allies’ shift away from Western-dominated financial systems.

“A significant amount of Russian gold and currency assets is frozen in Western banks. They keep telling us they intend to steal our money,” Putin said before the Eurasian Economic Union (EEU) summit in Minsk on Thursday.

If the West does simply take the funds in the end, it would create an “irreversible trend toward the regionalization of payment systems” – and this in the long run would benefit the global economy. “I think it is probably worth paying for,” Putin mused, while further describing the Moscow aims to strengthen its own financial settlement systems with “friendly states.”

Bill’s Commentary:

“I searched a dictionary for “Karens wearing burqas” and to my astonishment, this came up! I am not sure that these flashy colors are acceptable? I am sure that the Karens, once under Sharia law, will see their human rights blasted back to Medieval times!”

White Women in New York City Embrace Burqas Ahead of Mamdani Administration

Across New York City, white liberal women are donning colorful burqas in anticipation of what they believe will be a transformative era under the administration of Zohran Mamdani, the progressive Democratic Socialist poised to lead the city.

The trend, which has swept through neighborhoods like Williamsburg and Park Slope, is being hailed as a bold statement of solidarity with the incoming leadership’s vision, which many expect will usher in policies rooted in equity and cultural inclusivity.

The burqa, a full-body covering traditionally associated with certain Islamic practices, has been reimagined in vibrant hues like magenta, teal, and sunflower yellow, with some featuring patterns inspired by local street art.

Bill’s Commentary:

“”Dog and pony show” is an understatement!”

-

Bill’s Commentary:

“Holy shit!”

Bill’s Commentary:

“And thus the timing of the attack?”

HISTORIC! First Freight Train From China Wheels Into Iran, Flying In The Face Of American Sanctions

In what could only be termed as a geopolitical coup, the first freight train from China rolled into Iran this week. Flying in the face of the US sanctions aimed at crippling Tehran’s oil trade and isolating Beijing, the rail line will not only boost trade between the two countries, but would also undermine America’s influence in the region.

The project has its genesis in the USD 400 billion economic agreement inked between China and Iran in 2021 as part of Beijing’s Belt and Road initiative. It is a testament to the China-Iran nexus that is getting stronger after strategically trapping the US Navy in the Red Sea. The new rail route shortens the delivery times for Iranian oil exports and helps China evade the Malacca Strait choke point.

Bill’s Commentary:

“A very good article re the “plumbing” of markets. I have always told you what comes will be a credit/currency event, a lack of liquidity will certainly do the trick…”

The Great Illiquidity Crisis Nobody’s Talking About

On the surface, markets may currently appear to be calm, almost suspiciously so. While the S&P 500 continues to push higher, volatility has decreased to near post-pandemic lows, and capital is trickling back into risk assets that were recently under pressure. To the casual observer, it feels like stability has returned. But that calm is deceiving.

Beneath the headlines, market liquidity is quietly deteriorating. Bid-ask spreads are widening in places that used to be tight. Treasury auctions are growing more volatile and trading volumes in key segments are thinning out. It has not yet shown up in the VIX or mainstream coverage, however, the structural cracks are there.

-

The latest from USA Watchdog –

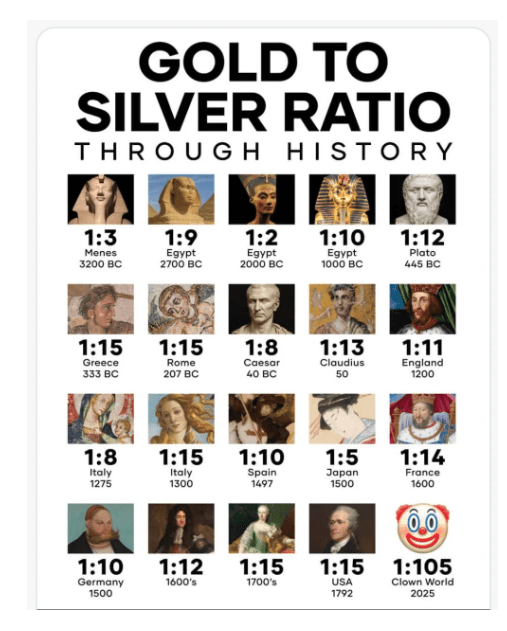

Bill’s Commentary:

“Some ancient silver history for you and the gold silver ratio chart going back to 1720.”

Life of the Silver Pharaoh named Psusennes

PBS, National Geographic and Popular Archaeology are presenting programs concerning this important time in Egyptian history as it relates to 21st dynasty Pharaoh by the name of Psusennes I. But what do we know about the man, the time in which he lived and his relationship to the history of Egypt in 1047 BC?

Bill’s Commentary:

“On housing…”

The Real Estate Recession You Haven’t Heard About (Yet)

Real estate and construction are considered bellwethers of the overall economy. Recently they’re not looking good – and this isn’t an isolated issue. It’s a warning sign of a crisis that could ripple through the entire economy…

The housing market is a massive portion (about 1/6th!) of the entire U.S. economy. About two-thirds of American families own their home – and for most, it’s their single biggest financial asset (as well as where they sleep). Home equity represents a tremendous share of household net worth – about half for the typical family! More of our national wealth is tied up in housing than any other single asset class.

So any unusual or unexpected developments in the real estate market get attention. Because they’re extremely important for the majority of Americans – far more important than abstractions like GDP or unemployment.

Bill’s Commentary:

“Here is a big “UH-OH”! And it stands to reason, after watching what the US did to Russia with their $300 billion in Treasury reserves, is it any wonder that the world looks at the US with a skeptical eye?”

Growing Calls for Germany and Italy to Pull $245 Billion Out of US

FRANKFURT/ROME — Recall back in April of this year when GoldFix raised reader awareness by breaking the news that Germany had a nascent but growing movement to repatriate its Gold from the US. Of chief importance was the longstanding assumption that Germany’s gold reserves were safe in New York is no longer taken for granted. Political shifts in Washington, public calls for increased transparency, and broader concerns about U.S. reserve integrity are prompting parts of Berlin’s political establishment to reassess the wisdom of maintaining large-scale gold holdings abroad.

Turns out this is now a growing risk to global bullion markets spreading both internally in Germany and externally into Italy.

Bill’s Commentary:

“But here’s the problem: bonds are on track to become a graveyard for capital.”

The Great Bond Scam: Wall Street’s Biggest Myth Exposed

There’s a ridiculous and pervasive notion in finance that US Treasuries are “risk free.”

People repeat it without thinking. Financial institutions build portfolios around it. And for decades, the world has blindly accepted this trope as gospel.

As a result, bonds—especially US Treasuries—became the de facto savings account for many in the post-1971 fiat currency era. Widely regarded as a safe, conservative place to park capital, US Treasuries are the foundation of the massive global bond market.

The global bond market is now estimated to be worth more than $300 trillion. Why? Because the masses were told this was the smart, safe thing to do.

-

Bill’s Commentary:

“You do understand what happens next, right?”

Home price hikes are slowing more than expected

Rising supply and slowing demand in the housing market are finally causing prices to cool off, and the weakness is accelerating.

Home prices nationally rose just 2.7% in April compared with the previous year, according to the S&P CoreLogic Case-Shiller Index released Tuesday. That is down from a 3.4% annual increase in March and is the smallest gain in nearly two years.

The report is slightly backdated, as it is a three-month running average of prices ended in April. Other more current readings of the market, such as one from Parcl Labs, shows prices nationally are now flat compared with a year ago.

Bill’s Commentary:

“Some will think “all is well”, I believe you are watching the narrative being “painted”… until it is not…?”

Oil tumbles for a second day, loses 6% as Iran-Israel ceasefire eases supply concerns

Oil prices tumbled for a second day Tuesday, as the market bet that a ceasefire between Israel and Iran would hold and the risk of a major crude supply disruption had faded.

U.S. crude oil settled down 6% at $64.37 a barrel, while the global benchmark Brent fell 6.1%, to $67.14. Prices closed 7% lower on Monday after Iran did not target energy infrastructure in response to the U.S. bombing its key nuclear sites.

Earlier Tuesday, President Donald Trump said China can keep buying oil from Iran, in what seemed like a sign that the U.S. may soften its maximum pressure campaign against the Islamic Republic.

Bill’s Commentary:

“We will file this one under “delusional”…”

-

Bill’s latest interview with Operation Freedom (Also posted under Interviews)

-

Bill’s Commentary:

“I did not realize the railway from China to Tehran had been completed last week. Did the completion of the Silk Road necessitate the attack on Iran?”

The latest from Erik –

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.