-

Bill’s Commentary:

“From our pal Chris Marcus. The setup certainly looks “squeezy” to me.”

Gold & Silver Bank COMEX Short Positions Remain Near All-Time Highs, While Silver ‘Free Float’ Is Running Low

After two days of rallying to start the week, both precious metals were pretty quiet on Wednesday.

The gold futures are currently down just under two dollars to $3,432. The silver futures are up a dime on Wednesday to $37.93.

As you might imagine, given the current price levels, the short position held by the banks in both the gold and silver markets remains near the extreme end.

-

Bill’s Commentary:

“The man is correct.”

The Linguistic Kill-Switch: Inside the Modern Propaganda Playbook

The next time someone sneers “conspiracy theorist,” “anti-vaxxer,” “climate denier,” “far right,” “hate speech,” “terrorist,” or the ever-popular “racist,” understand what they are really saying: stop thinking.

These words are a linguistic kill-switch—engineered to short-circuit thought by triggering a reflexive emotional spasm.

If you encounter someone using these words, you can be certain you are not dealing with someone interested in a good faith effort to find the truth.

Bill’s Commentary:

“While reading this post from Erik, please keep in mind that the financial markets AND real economies only run if credit is available. Once credit is interrupted or ceases to flow… everything will also stop!”

The latest from Erik –

-

Bill’s Commentary:

“You will hear much more of this going forward…”

China’s Grip On Critical Minerals Disrupts U.S. Defense Supply Chain

In 2023, Raytheon CEO Greg Hayes warned that Beijing effectively has the US military’s supply chain by the balls, thanks to America’s reliance on rare earths and other materials which either come from, or are processed in, China.

According to Hayes, Raytheon has “several thousand suppliers in China,” because of which “decoupling … is impossible.“

“We can de-risk but not decouple,” he told the Financial Times, adding that he thinks this is the case “for everybody.”

Bill’s Commentary:

“Zacks; TRX undervalued deserves rerating”

TRX: Zacks Company Report Preliminary Economic Assessment supports business plan with strong production growth profile

TRX Gold Corporation (NYSE:TRX) (TSX:TRX.TO) is a junior gold producer operating the Buckreef Gold Mine in Tanzania under a joint venture with the state mining development company.

An investment in the Company gives leverage to a growing production profile based on a sound PEA business plan, capitalizing on higher gold prices and the ability to be self-funded. This plan sees production growth from 27,000 to over 90,000 ounces per year over the next five years. This strong growth profile is expected to attract additional market interest in the Company.

Bill’s Commentary:

“I pledge allegiance to the US flag, not Israeli. I believe this is unConstitutional but what do I know other than there are many MAGAheads out there that are extremely pissed…”

Trump’s Base Fragments Further As He Demands States Support Israel Or Risk Disaster Relief

Reuters reports that President Donald Trump has announced new restrictions barring federal disaster preparedness funds from going to states or cities that boycott Israeli companies, in a move which is sure to further divide Trump’s base, given it’s widely perceived even among many conservatives as flying in the face of America First.

Critics have long argued that Republicans have been placing the foreign nation Israel’s defense and funding needs ahead of American citizens’ well-being. This certainly constitutes more evidence that this is the case. Monday’s controversial order has resulted in an avalanche of online commentary and angry reaction.

-

Financial Apocalypse Now: Dalio, Burry, and Grantham Say the System Will Collapse—Get Ready for the Greatest Wealth Wipeout in History

Financial Judgment Day: Complacency or Catastrophe?

What happens when the world’s most prescient financial minds not only abandon ship, but shout warnings of imminent disaster—signals so dire, they go beyond any cyclical downturn we’ve seen in our lifetime? Are you sitting comfortably, lulled by yesterday’s wins, still clinging to the fantasy that this is just another rough patch? Or will you heed these warnings, as the very pillars of global finance start to tremble beneath our feet?

Bill’s Commentary:

“Who could’ve seen this coming?”

China Is Choking Supply of Critical Minerals to Western Defense Companies

China is limiting the flow of critical minerals to Western defense manufacturers, delaying production and forcing companies to scour the world for stockpiles of the minerals needed to make everything from bullets to jet fighters.

Earlier this year, as U.S.-China trade tensions soared, Beijing tightened the controls it places on the export of rare earths. While Beijing allowed them to start flowing after the Trump administration agreed in June to a series of trade concessions, China has maintained a lock on critical minerals for defense purposes. China supplies around 90% of the world’s rare earths and dominates the production of many other critical minerals.

-

The latest from USA Watchdog –

Bill’s Commentary:

“Unhealthy…”

Bill is interviewed by Dr. Dave Janda (Also posted under Interviews)

Bill’s Commentary:

“Some weekend reading from Erik for you.”

The latest from Erik –

-

Bill’s Commentary:

“This in my opinion is very bad. OK, so if needed you position these subs wherever needed. But, again in my opinion, PUBLICLY announcing this gives a heads up and also sounds like a threat. Someone please turn the heat down!”

https://truthsocial.com/@realDonaldTrump/posts/114954549017557270

-

Bill’s Commentary:

“Economy watch: is it really growing at 3% like they say or are these numbers on the ground telling the real story?”

Another Canary: The Las Vegas Economy Is Tanking Just Like It Did In 2008 And 2009

If you want to get a really good indication of where the U.S. economy is heading, just look at what is happening in Las Vegas. During good times, hotel occupancy rates are very high and lots of money is thrown around in the casinos. But when times are getting tough, less people head to Las Vegas and those that do go tend to be tighter with their money. We saw a perfect example of this during the Great Recession.

Once the global financial crisis hit, gambling revenues in Las Vegas plunged. The following comes from an ABC News article that was published in 2009…

Bill’s Commentary:

“From satire to reality in a decade?”

Bill’s Commentary:

“Diplomacy?”

https://truthsocial.com/@realDonaldTrump/posts/114945847973193713

Bill’s Commentary:

“Japan is only the first of many!”

Bill’s Commentary:

“A grand game of poker where someone is bluffing without much of a hand?”

The latest from Erik –

-

Bill’s Commentary:

“Ivermectin…”

The latest from USA Watchdog –

-

Bill’s Commentary:

“Just like frogs that have been slow boiled… no one noticed while it was happening!”

Bill’s Commentary:

“In your face!”

Bill’s Commentary:

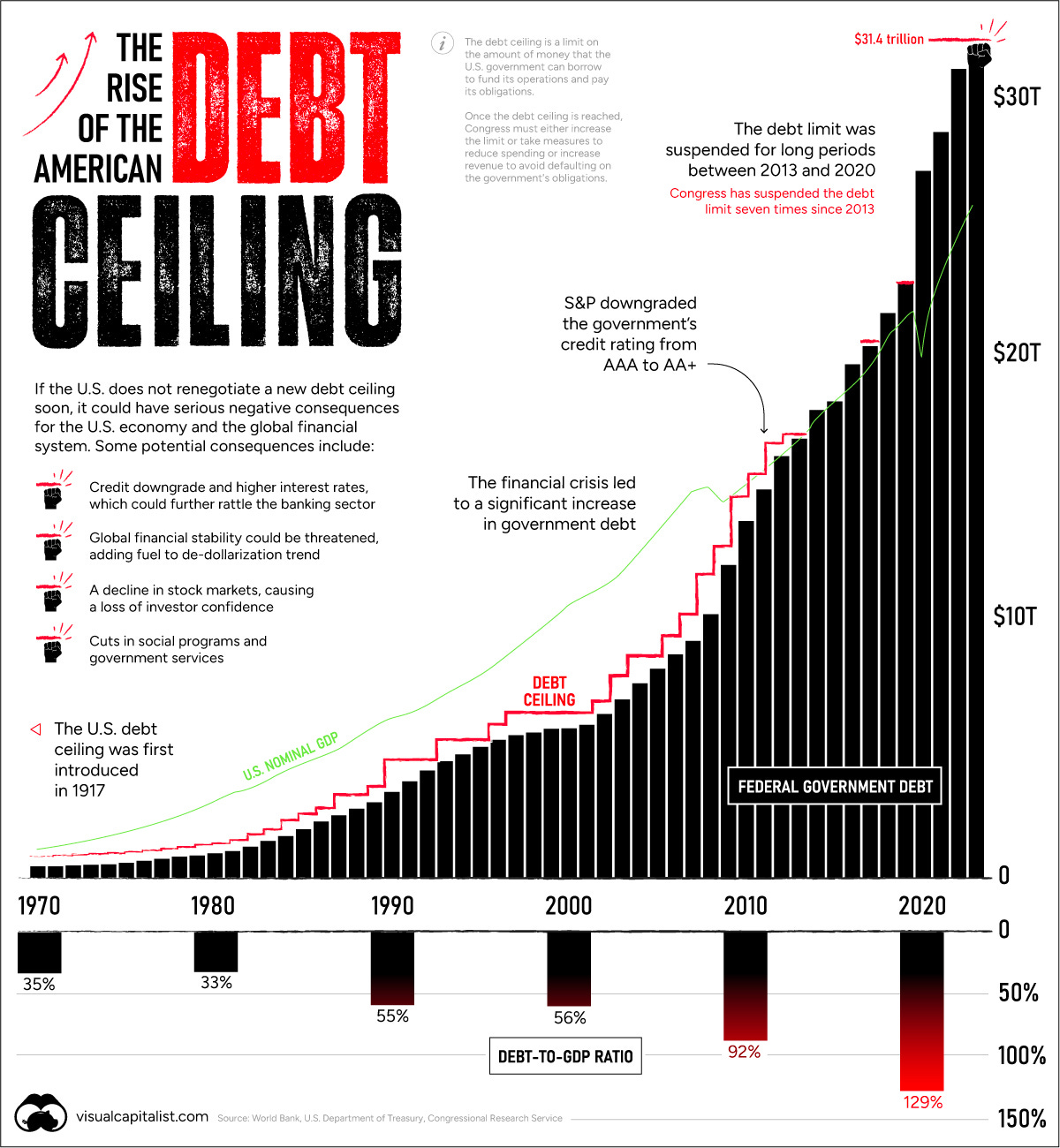

“The problem is this, the US has something like $7 trillion to refinance through the rest of the year. This will be done primarily with short term paper. Short term funding for a VERY long term problem?”

Treasury Boosts Q3 Debt Borrowing Estimate To $1 Trillion From $554 Billion To Replenish Cash Balance

Earlier this afternoon, we wrote in our Treasury refunding preview that the Treasury’s latest borrowing estimate published today (which is also part 1 of the Refunding statement), would show a surge in current quarter funding needs by over $400 billion, from $554 billion to $960 billion.

It was short by almost $50 billion. We found that out moments ago when the Treasury published its estimate for marketable borrowing needs for the July-September 2025 and October-December 2025 quarters.

According to the Treasury, during the current quarter, Treasury now expects to borrow $1.007 trillion in net marketable debt, assuming an end-of-September cash balance of $850 billion. The borrowing estimate is $453 billion higher than announced in April 2025, primarily due to the lower beginning-of-quarter cash balance and projected lower net cash flows.

-

Bill’s Commentary:

“We will know the answer to this only after the smoke clears from the pending credit/currency crisis. I would ask the simple question; which one has stood the 5,000+ year test of time… and which one is an experiment in progress?”

Is True Value in Crypto or Gold?

With the Trump Administration headed down the road to higher inflation and the political chaos that results, it is worth asking why there are “only” $4 trillion in notional crypto tokens, this according to the Financial Times. The rise of bitcoin and other ethereal instruments evidences a strong desire on the part of many Americans to escape a sinking ship, but also confirms the love for creating new games to enable speculation. Are the crypto tokens really a way to avoid the demise of fiat dollars?

As we noted in a recent comment in The Institutional Risk Analyst, the best returns in crypto at present are found investing in the stocks of some of the enablers. The fact that these new companies may or may not be stable businesses long term does not matter in the speculative environment that currently governs Wall Street. We are particularly fascinated by the idea that a crypto firm can generate enough revenue to survive as a bank.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.