-

The latest from USA Watchdog –

-

Bill’s Commentary:

“Some weekend Erik for you”

The latest from Erik –

-

Bill’s Commentary:

“True story”

Bill’s Commentary:

“Grizzly checks in regarding your best power choice options when things go sideways.”

Fuels for Standby Generators (long term)

In order of preference for long term usage and storage.

1. Propane (LPG)

This is by far the best choice for standby generators for “when the lights go out”. Propane has no expiration date; does not lose potency or octane; doesn’t collect water from condensation which in turn can grow algae inside the tank leading to clogged filters and fuel lines; large propane tanks last indefinitely.

Cons:

Less efficient per gallon than diesel, especially in extreme cold.

2. Diesel

Diesel generators will burn less fuel than propane especially in extreme cold so you’ll get more hours of power per gallon.

Typically maintenance could be less frequent in a diesel generator vs propane but that’s very debatable with new diesel engines. What I see is new diesel engines are getting worse, requiring DEF (which has its own storage issues), are very sensitive to slightly dirty fuel, have regeneration issues that come along with all Tier 4 emissions requirements. While propane generators seem to be getting better with longer warranties and service intervals.

Older diesel engines (no Tier 4) are great and will serve you well for long term standby generator needs but the degradation of the fuel should be a major concern. There are numerous products to help preserve the fuel to minimize this degradation (PRI-D, some algaecides, Howe’s conditioner, etc) but when reliable power is needed several years down the road perhaps, or for many months of run time after the lights go out, worrying about the usefulness of what’s in the fuel tank is a chance I’m not willing to take.

3. Gasoline

Gas suffers from many of the same issues as diesel without any of the upsides, like longer run times.

Gasoline degrades even more quickly than diesel. Gasoline also poses a greater risk of fire than diesel because of its lower flash point.

The only upside of a gasoline powered generator is they are cheap and are easy to run for short term use. But any use for more than a few hours or over night, gasoline powered generators aren’t a good choice.

Natural gas is a horrible option because it requires dependence on a third party supplier that will probably not be operating after the lights go out. So we won’t really even go into that.

As always, it’s best to prepare as much as possible for a scenario where all generators will run out of fuel, because in all likelihood, they will. Because of this, try to also continue to store up hand tools and become familiar with the use and care of them; gain knowledge of canning and food preservation to avoid the need for freezers; develop water storage and other water sources to avoid dependence on a well pump; store up kerosene lanterns, fuel and wicks to avoid dependence on electric lighting. Get familiar with wood cookstoves and ovens and store up plenty of wood (which will also give you some experience with some hand tools!), to reduce dependency on electric stoves and ovens.

You’ll notice probably that I’ve not discussed solar. I have several solar generators and use them to charge batteries for power tools (yes I use those often and have a huge supply of batteries but they too will eventually die if the lights are out long enough).

I see these portable solar generators as fantastic renewable power sources for a freezer or two or any number of things to supplement the main standby generator to get more KW’s per gallon by reducing the load.

Full solar power ?

I’m not experienced in that field to want to discuss it, so I won’t. Perhaps it’s a very viable solution and worth looking into.

As always, prepare for the worst and hope for the best. Keep faith in God that He wins in the end and will be with us no matter how dark the days may appear. Develop solid networks of like-minded people to help each other alleviate each others shortcomings. Good communities, neighborhoods or valleys of good people can do way more than any of us realize and I have a suspicion we just might find out how much we will need to do together.

Bill’s Commentary:

“Two things; first, paying less interest on our national debt is not a bad thing. Second and most important, capturing the Fed and driving “official rates” lower does not guarantee lower market rates. The last time the Fed cut rates by 1%, bond market rates WENT UP 1%! If this happens again this time when the Fed cuts, the world will see the US in a VERY different light. Do you remember bond market “vigilantes”? There is no risk premium at all in US Treasuries when in fact there are huge risks…the surprise in credit markets will ultimately be skyrocketing interest rates while financial markets implode.”

Behind Trump’s Bid for Fed Dominance Lies a Dangerous Debt Idea

(Bloomberg) — As Donald Trump ramps up efforts to control the Federal Reserve, investors worry he’ll use central bank tools to fix something that’s not supposed to be a central bank problem: America’s ballooning debt bills.

Trump said Tuesday he’s ready for a legal fight over his attempt to oust Fed Governor Lisa Cook, and looking forward to having a “majority” on the central bank’s board. That could advance the president’s campaign for lower interest rates, which he says will save the country “hundreds of billions.”

Bill’s Commentary:

“Housing turnover is now stuck at the Covid lows… for 2 years running. And by the way, much lower than immediately after the 2008 GFC. But no worries, party on dudes!”

US Pending Home Sales Stick Near Record Lows in July

The choppy performance of the US housing market continued in July with pending home sales falling 0.4% MoM (worse than the 0.2% MoM rise expected). However, this print managed to push sales up a medicore 0.25% YoY (its best annual gain since Nov 2024)…

Source: Bloomberg

Which left the total pending home sales index hovering near record lows…

-

Bill’s Commentary:

“Silver proposed as a critical metal…!”

Silver: Here’s Why The US Government Just Announced Its Critical

When the U.S. government added silver to its Draft List of Critical Minerals for 2025, most missed the significance of this. But for investors, this is no bureaucratic decision.

It is Washington signalling that without silver, the machinery of modern life falters: energy systems, medical technologies, defence, and the digital economy all depend on it.

This shift is historic. Silver is now officially classed alongside lithium, copper, and rare earths, all materials deemed vital to national security and economic stability. The designation paves the way for federal subsidies, strategic stockpiling, and accelerated permitting for miners. And yet, the supply side is already struggling to keep pace with demand.

Bill Holter: Gold & Silver LOVED Powell’s Jackson Hole Speech!

Jerome Powell gave his yearly Jackson Hole speech on Friday, and gold and silver prices shot higher as he was talking.

While the main takeaway was that he let the world know that it’s time for more interest rate cuts, there were some really important unanswered questions left behind.

Fortunately, gold and silver precious metals veteran Bill Holter joined me on the show to talk about some of the wild things that Powell said, that left the precious metals soaring.

Bill also talks about silver as a potential strategic mineral in the US, the reports of Saudi Arabia investing in SLV, and his thoughts on why we haven’t heard more about the Fort Knox gold audit.

So to hear what Bill had to say, click to watch the video now!

Watch here…

Copyright © 2025 Arcadia Economics, All rights reserved.

Our mailing address is:

contact@arcadiaeconomics.com

Want to change how you receive these emails?

You can unsubscribe from this list. -

Bill’s Commentary:

“They used to tell us they were not doing this… now they say they won’t do it anymore?”

Yet Another White House Says It Won’t Fund Engineered Deadly Viruses

In early May, President Donald Trump issued an executive order to restrict dangerous gain-of-function (GOF) research and tighten oversight of DNA synthesis. Unlike past attempts, this one might stick.

In the past, GOF advocates could count on friendly National Institutes of Health leadership to cheer on their experiments, but the new NIH Director Jay Bhattacharya has been clear that GOF research poses real dangers—and that many citizens, intelligence agencies, and scientists blame GOF research at the Wuhan Institute of Virology (WIV) for the COVID-19 pandemic. Will backlash from scientists stop this executive order from being implemented in any meaningful way?

The latest from USA Watchdog –

-

Bill’s Commentary:

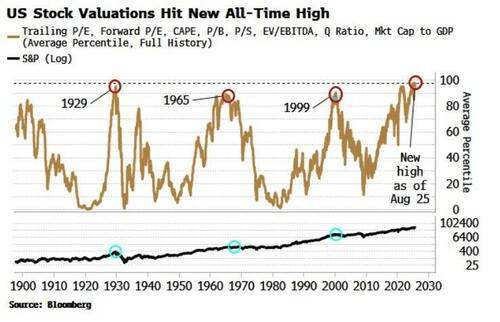

“We have never been this overvalued!”

Market Valuations Don’t Matter…Until They Do

After the market slid lower all week, testing the 20-DMA on Thursday, Jerome Powell’s speech at Jackson Hole turned sentiment on a dime. The S&P 500 returned to record highs, and the Dow surged 900 points. Investors took his tone as confirmation that a September rate cut is in play. Specifically, Powell noted the slowdown in employment as a key reason for the shift in stance, as noted in the key paragraph from his speech.

“In the near term, risks to inflation are tilted to the upside, and risks to employment to the downside—a challenging situation. When our goals are in tension like this, our framework calls for us to balance both sides of our dual mandate.

Our policy rate is now 100 basis points closer to neutral than it was a year ago, and the stability of the unemployment rate and other labor market measures allows us to proceed carefully as we consider changes to our policy stance.

Bill’s Commentary:

“Trump needs to own up to this… the “beautiful vaccine” that has destroyed so many lives and families!”

RFK Jr. May Roll Back Major Achievement Donald Trump Called ‘Monumental’

President Donald Trump and Health and Human Services Secretary Robert F. Kennedy Jr. are allegedly planning to ban the COVID vaccine “within months,” years after Trump labeled the vaccine’s development during the pandemic as a “monumental achievement,” according to an associate of Kennedy’s.

Newsweek reached out to HHS via email for comment.

Trump said in December 2020, during the height of the COVID-19 pandemic, that the development of a vaccine as part of Operation Warp Speed was a “historic” success.

Bill’s Commentary:

“Trump now has a majority on the FRB Board… bye bye dollar!”

Trump says he’s removing Federal Reserve Gov. Lisa Cook, citing his administration’s allegations of mortgage fraud

President Donald Trump is removing Federal Reserve Governor Lisa Cook effective immediately, according to a letter he posted to Truth Social on Monday night.

In the letter, Trump writes: “Pursuant to my authority under Article II of the Constitution of the United States and the Federal Reserve Act of 1913, as amended, you are hereby removed from your position on the Board of Governors of the Federal Reserve, effective immediately.”

Trump cites a “criminal referral” from Federal Housing Finance Agency Director William Pulte, in which Pulte accused Cook of mortgage fraud.

Bill’s Commentary:

“Erik with many uncomfortable facts.”

The latest from Erik –

-

Bill’s Commentary:

“Our pal Grizzly came in from the woods with this one!”

Mornin Bill,

> This should be rolled into silver and other commodities as well. If this isn’t a legitimate RICO case, then all the other bullshit cases should be tossed. Grizzly

Judge Allows Claim That Large Investors Conspired To Drive Up Coal, Energy Costs

A lawsuit by Wyoming and 10 other states can continue against giant investment companies, on claims they conspired to drive up coal and energy costs. They used their pull as coal shareholders to push “a climate activist agenda,” Gov. Mark Gordon has said.

Wyoming and 10 other states’ claims that giant investment companies conspired to drive coal production down and drive prices up — increasing people’s energy costs — are at least plausible enough to keep a lawsuit alive, a judge has ruled.Wyoming filed suit in the U.S. District Court of Eastern Texas in late November against Blackrock Inc., State Street Corp. and Vanguard Group Inc.

-

Bill’s Commentary:

”Yes Erik, you are an idiot in the eyes of those who cannot connect the dots. I know a few guys like you, welcome to the club!”

The latest from Erik –

-

Bill’s Commentary:

”With all the companies that already went woke with disastrous results, WHY would they do this now?”

Cracker Barrel’s Board Should Fire Its CEO Immediately

Cracker Barrel is learning the same lesson Bud Light did: fat, bearded, gun toting middle Americans not only dislike change — especially the “woke” kind — but will also turn on you for taking a staple brand they love and pile-driving it into the ground.

Today Cracker Barrel’s stock cratered more than 10% after the company unveiled a rebrand that scrapped its iconic barrel-and-man logo in favor of a sterile, text-only “woker” design minus the old white guy and the…well, cracker barrel.

-

Bill’s latest interview with Liberty and Finance – (Also posted under Interviews)

Bill Holter: The U.S. Debt Is a Mathematical Death Sentence – Only Gold Will Survive

Bill Holter presents a grim financial diagnosis: the U.S. debt is beyond repair, with default—either explicit or via dollar debasement—the only mathematical outcome. With global confidence in U.S. Treasuries unraveling and central banks pivoting to gold like it’s a post-Bretton Woods fire sale, Holter warns of a domino collapse of credit markets that would leave modern society blinking in the dark—literally. Meanwhile, the irony of the American middle class selling silver to buy groceries underscores a tragic reversal: the very assets meant to preserve wealth are now being liquidated for survival. Holter argues that while the East quietly builds a commodity-based lifeboat, the West may attempt a theatrical gold revaluation—but likely too little, too late. If the system crashes, he suggests, prosperity won’t mean luxury; it’ll mean having food, water, and a working generator—proof that in the empire of IOUs, the man with ounces is king.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.