-

Bill’s Commentary:

“The chart on lease rates is a day old… they closed out on Friday at 200% to borrow silver. Also, you will notice the futures in NY are now $3 below spot in London. Jim used to always ask the question; ‘what is the value of a contract that cannot perform’. Are futures just now beginning to display what they are actually worth? Think about that…!”

Silver Traders Rush Bars to London as Historic Squeeze Rocks Market

(Bloomberg) — The London silver market has been thrown into turmoil by a massive short squeeze, driving prices above $50 an ounce for only the second time in history and stirring memories of the billionaire Hunt brothers’ notorious attempt to corner the market in 1980.

Benchmark prices in London have soared to near-unprecedented levels over New York. Traders described a market where liquidity has almost entirely dried up, leaving anyone short spot silver struggling to source metal and forced to pay crippling borrowing costs to roll their positions to a later date.

The latest from USA Watchdog –

-

Bill’s Commentary:

“This is SO BAD… failure to deliver from here is a very real possibility! “

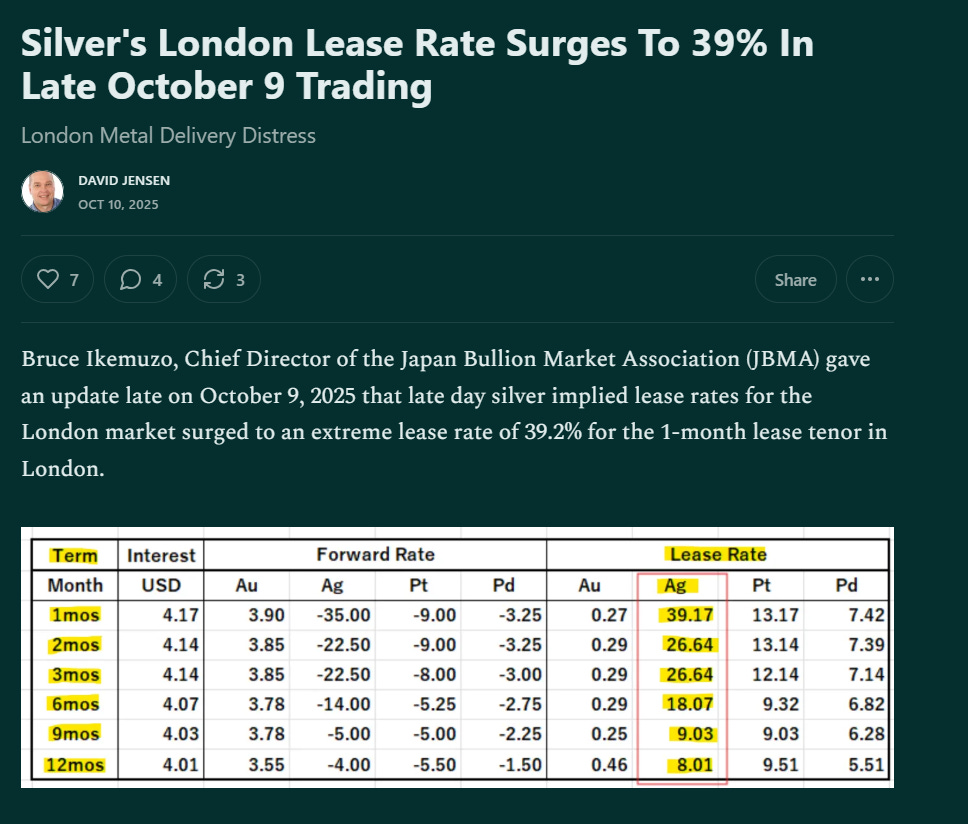

Physical Panic: Lease Rate Hits 39%–London in Crisis

The silver market just witnessed a seismic event: On the evening of October 9, Bruce Ikemizu, Chief Director of the Japan Bullion Market Association (JBMA), confirmed that the 1-month implied lease rate for physical silver in London erupted to a jaw-dropping 39.2%. This extraordinary spike, captured in recent market data, signals acute physical supply distress—metal in the vaults is running out, and lenders are demanding a premium for any silver that remains.

Bill’s Commentary:

“For those who say Trump has not done one single good thing…”

Putin Praises Trump’s ‘Real Efforts’ Toward Peace, Blasts Nobel Committee

President Vladimir Putin on Friday praised U.S. President Donald Trump’s efforts to broker a ceasefire in the Middle East and criticized the Nobel Committee for awarding its peace prize to people he claimed did nothing to deserve it, remarks that appeared aimed at currying favor with Trump, who has grown increasingly cool toward Moscow amid stalled efforts to end the war in Ukraine.

Putin told reporters at a press conference in Tajikistan that Trump “is definitely making an effort and working on these issues — on achieving peace and resolving complex international affairs,” noting that the “clearest example” of those efforts is the recent ceasefire in Gaza.

-

Bill’s Commentary:

“Gold $4,000 and Silver $50… be careful what you wish for!”

Gold and silver finally had explosive runs and have become extremely overbought. They are both due a correction while the dollar gets a relief rally… this would be normal. But, we live in anything but normal times…!

I have said for 10 years now that gold/silver would ultimately fail to deliver and take the global derivative edifice down. I believe we are very close. If you bought gold or silver for asset protection, even if they pull back so what? This, I believe, is “the rally you never sell” as described by my late partner, Jim Sinclair. We are currently living through the biggest global financial change in over 50 years. During every financial upheaval in man’s history, holding gold prior to, and through the tumult turned out to be THE BEST HOLDING.

If the metals do pull back, who cares? The collapse will mathematically come. “Trading” and trying to pick a top and hoping for re-entry is a fool’s game at the end of an empire. The only thing that will financially matter once markets break will be how many ounces you own versus how many assets you have being gobbled up by the system, period! Expect a pullback, even hope for one. Because if the metals fail to deliver and price goes parabolic, it means immediate societal breakdown. I have always cautioned when people talked about gold and silver to the moon, BE CAREFUL WHAT YOU WISH FOR!

Bill is interviewed by Metals and Miners (Also posted under Interviews)

Bill’s Commentary:

“Hi Ho Silver!”

Bill’s Commentary:

“Is silver (and gold) due a pullback? Of course they are and in normal times the pullback could be 10% or even more. The state of the silver market today does not resemble normal under any definition. If lease rates are 19% in London, that tells you the market is thoroughly broken, price will ultimately reflect this… “

East Meets West: Silver Spike Shatters Records—$59 on JD.com, London Lease Rate Explodes to 19%

JD.com has silver listed at $59 per ounce. With 1 kilogram equaling 32.1507 troy ounces, that works out to about $1,900 per kilogram. This highlights soaring premiums in China and the desperate scramble for physical metal.

Now we interrupt this news article to pivot to the WestThe 19% Lease Rate Shock: China’s Secret Silver Empire and a Global Market on the Brink

This is not just another price spike. The world is witnessing an unprecedented unraveling of the silver market—one that pundits, economists, and policymakers everywhere will remember as the point at which physical reality overwhelmed financial illusion.

-

Bill”s Commentary:

“Ya think? Actually, whenever asked how much gold and silver you should have as a portfolio percentage… my standard answer is ‘whatever you don’t want to lose.’”

Ray Dalio says today is like the early 1970s and investors should hold more gold than usual

Bridgewater Associates founder Ray Dalio said investors should allocate as much as 15% of their portfolios to gold even as the precious metal surged to an all-time high above $4,000 an ounce.

“Gold is a very excellent diversifier in the portfolio,” Dalio said Tuesday at the Greenwich Economic Forum in Greenwich, Connecticut. “If you look at it just from a strategic asset allocation perspective, you would probably have something like 15% of your portfolio in gold … because it is one asset that does very well when the typical parts of the portfolio go down.”

Read more here…

The latest from USA Watchdog –

Bill’s Commentary:

“Gold is not “going up”, it is the fiat currencies losing value that you witness…”

Gold: The US Dollar Bank Run Is Speeding Up

Previously, I have shown how the US dollar banking system is in the midst of a bank run. We have entered the critical part of this bank run. The US dollar banking system has become too debased, and nations are running to an asset like gold as a reserve asset instead.

It can be described as very similar to the events since Nixon ended the direct convertibility to gold in 1971. In the Gold/Monetary Base chart (below) you can see currently how a similar pattern has developed to the 1971 end of convertibility.

Bill’s Commentary:

“Things are getting SQUEEZY out there!”

SLV Borrow Fee Surges Again

One other quick note that I came across right after sending out today’s column is that the SLV borrow fee has surged again.

-

Bill’s Commentary:

“In case you are wondering what “passed the fiscal event horizon” means, it means that mathematically the debt cannot be repaid in current values of fiat currency. Fiats MUST devalue in order to make the debt payable… gold is screaming this loud and clear to those who will listen!”

Rabobank: Gold Confirms The World Has Passed The Fiscal Event Horizon

France is once again engulfed in political crisis following the resignation of Prime Minister Lecornu just hours after his cabinet was sworn in. Lecornu lasted less than a month in the job, a tenure that makes Liz Truss look like Lord Liverpool. Jordan Bardella, President of the right-wing National Rally, has urged President Macron to dissolve the National Assembly and call fresh elections.

Lecornu’s is the third French government to collapse in the last 12 months. Former EU Brexit negotiator Michel Barnier lost the Premiership in December following failed attempts to pass budget measures and Francois Bayrou similarly lost a no-confidence vote last month after his attempts to rein in France’s runaway deficit were rejected by parties on the left and right.

Bill’s Commentary:

“We get an update on TRX from CEO Stephen Mullowney toward the end of this interview.”

Bill Holter: Silver Tightness In London Worsens (Also posted under Interviews)

-

Bill’s Commentary:

“Just to be clear, I was trying to say that the only police working will be the “Barney Fifes” of the world…”

The latest from Erik –

Bill’s Commentary:

“Is AI just another fiat incinerator?”

Sam Altman Warns That AI Industry Is Due for a Spectacular Implosion

OpenAI CEO Sam Altman is doing what he does best: warning of AI-related doom that he doesn’t sound all that pressed about.

Last week, while touring one of OpenAI’s mammoth data centers being built in Abilene, Texas, Altman had a pretty casual outlook when he was asked about a bubble that could financially decimate the entire industry.

“Between the ten years we’ve already been operating and the many decades ahead of us, there will be booms and busts,” Altman ruminated, as quoted by The Associated Press. “People will overinvest and lose money, and underinvest and lose a lot of revenue.”

-

Bill is interviewed by The Market Sniper (Also posted under Interviews)

The latest from USA Watchdog –

Bill’s Commentary:

“When you pay something for nothing, why would you expect to get anything more than “nothing” back? “

What the hell happened to NFTs?

https://www.telegraph.co.uk/art/artists/rise-and-fall-of-nfts/

Bill’s Commentary:

“The real economy stops dead in its tracks when credit seizes up…”

Race To The Financial Dung Heap

As I wrote just weeks ago, I believed (and still do) that any new market collapse could come at the hands of crypto and/or stablecoins, which have in many ways become an essentially unregulated $4 trillion slush-y money market fund reminiscent of 2008.

But watching the headlines coming out of commercial real estate, private credit and subprime auto over the last week or two — and I’m not certain we don’t have a new leader, or leaders, in the nationally televised Race To The Financial Dung Heap™.

Let’s try to make this case as clear and as simple as possible, with examples and charts for people with very short attention spans, like myself.

-

Bill’s Commentary:

“Surprise!!!“

Shocker: Soros-Backed Tides Foundation Funding Wikipedia

X user DataRepublican, also known as Jennica Pounds, who leads DOGE-adjacent efforts in an open-source capacity, has delved deeper into the dark-money-funded NGO world. Her latest target: George Soros and one of the largest soft-power projects of the 1990s, called the Muskie Fellowship program.

But the focus here is not the Muskie Fellowship program, but rather her question: “This is straight off the Federal Register. Now ask yourself why Wikipedia doesn’t mention the Soros Foundation.”

She added, “And fun fact — Soros had further grants for these graduates of the Muskie fellowship program. Hard to interpret this as something other than using our taxpayer funds to educate his minions.”

Bill’s Commentary:

“How is your blood pressure these days?”

Bill’s Commentary:

“Is this true?”

MIT study on AI profits rattles tech investors

Wall Street’s biggest fear was validated by a recent MIT study indicating that 95% of organizations studied get zero return on their AI investment.

Why it matters: Investors have put up with record AI spend from tech companies because they expect record returns, eventually. This study calls those returns into question, which could be an existential risk for a market that’s overly tied to the AI narrative.

Driving the news: MIT researchers studied 300 public AI initiatives to try and suss out the “no hype reality” of AI’s impact on business, Aditya Challapally, research contributor to project NANDA at MIT, tells Axios.

-

Bill’s Commentary:

“Grace defined!”

Mormons raise $200,000 for family of gunman who attacked their church

Members of the Church of Jesus Christ of Latter-day Saints were in deep grief after a gunman ambushed a worship service in Michigan on Sunday, killing four people and wounding eight others.

They started fundraisers for the victims. Then they did something remarkable: They began donating money to the wife and son of Thomas Jacob Sanford, the man who police say carried out the attack.

That fundraiser, which has raised close to $200,000, has collected donations from more than 5,000 people, many of them Latter-day Saints.

Bill’s Commentary:

“Some in your face reality from Erik”

The latest from Erik –

-

Bill’s Commentary:

“Is this even legal? If so, it should be MADE ILLEGAL!”

Israel Paying US Social Media Influencers $7,000 Per Post As Right-Wing Support Craters

Following Israeli Prime Minister Benjamin Netanyahu’s meeting in New York on Friday with a group of pro-Israel influencers, we learn that Israel is likely paying them a whopping $7,000 per pro-Israel social-media post in a desperate drive to bolster plummeting support of Israel among America’s young conservatives.

That’s the conclusion of Responsible Statecraft’s Nick Cleveland-Stout, based on analysis of a disclosure filed with the US Department of Justice as required by the Foreign Agents Registration Act (FARA). While pro-Israel lobbying heavyweight AIPAC is notoriously exempt from FARA registration, the social media operation comes under the transparency law’s provisions because Israel’s Ministry of Foreign Affairs is paying for it.

The latest from USA Watchdog –

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.