The latest from USA Watchdog –

Bill’s Commentary:

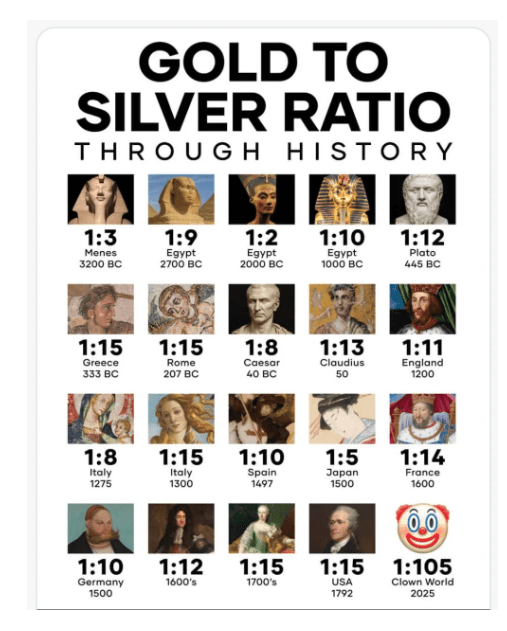

“Some ancient silver history for you and the gold silver ratio chart going back to 1720.”

Life of the Silver Pharaoh named Psusennes

PBS, National Geographic and Popular Archaeology are presenting programs concerning this important time in Egyptian history as it relates to 21st dynasty Pharaoh by the name of Psusennes I. But what do we know about the man, the time in which he lived and his relationship to the history of Egypt in 1047 BC?

Bill’s Commentary:

“On housing…”

The Real Estate Recession You Haven’t Heard About (Yet)

Real estate and construction are considered bellwethers of the overall economy. Recently they’re not looking good – and this isn’t an isolated issue. It’s a warning sign of a crisis that could ripple through the entire economy…

The housing market is a massive portion (about 1/6th!) of the entire U.S. economy. About two-thirds of American families own their home – and for most, it’s their single biggest financial asset (as well as where they sleep). Home equity represents a tremendous share of household net worth – about half for the typical family! More of our national wealth is tied up in housing than any other single asset class.

So any unusual or unexpected developments in the real estate market get attention. Because they’re extremely important for the majority of Americans – far more important than abstractions like GDP or unemployment.

Bill’s Commentary:

“Here is a big “UH-OH”! And it stands to reason, after watching what the US did to Russia with their $300 billion in Treasury reserves, is it any wonder that the world looks at the US with a skeptical eye?”

Growing Calls for Germany and Italy to Pull $245 Billion Out of US

FRANKFURT/ROME — Recall back in April of this year when GoldFix raised reader awareness by breaking the news that Germany had a nascent but growing movement to repatriate its Gold from the US. Of chief importance was the longstanding assumption that Germany’s gold reserves were safe in New York is no longer taken for granted. Political shifts in Washington, public calls for increased transparency, and broader concerns about U.S. reserve integrity are prompting parts of Berlin’s political establishment to reassess the wisdom of maintaining large-scale gold holdings abroad.

Turns out this is now a growing risk to global bullion markets spreading both internally in Germany and externally into Italy.

Bill’s Commentary:

“But here’s the problem: bonds are on track to become a graveyard for capital.”

The Great Bond Scam: Wall Street’s Biggest Myth Exposed

There’s a ridiculous and pervasive notion in finance that US Treasuries are “risk free.”

People repeat it without thinking. Financial institutions build portfolios around it. And for decades, the world has blindly accepted this trope as gospel.

As a result, bonds—especially US Treasuries—became the de facto savings account for many in the post-1971 fiat currency era. Widely regarded as a safe, conservative place to park capital, US Treasuries are the foundation of the massive global bond market.

The global bond market is now estimated to be worth more than $300 trillion. Why? Because the masses were told this was the smart, safe thing to do.

TRX ? you and Sinclair destroyed me with TRX stock

>

LikeLike

Thank you pamelamoves@gmail.com

LikeLike

Bill, with options expiry occurring, would like to get your take on how the big shorts fared getting out from under, or is it still a work in progress?

LikeLike