Bill’s Commentary:

“What do you mean my retirement plan is broke?”

Social Security Facing $63 Trillion in Unfunded Liabilities

Social Security is facing $63 trillion in long-term unfunded liabilities, according to the 2024 Old-Age, Survivors, Disability Insurance (OASDI) trustees report.

The report looked at two things: how much money will be missing indefinitely and how much will be missing in the next 75 years. The report determined that there will be a permanent $62.8 trillion deficit and about a $23 trillion shortage for the next 75 years.

Officials explained that these numbers show how much less money they will have after the money saved up in trust funds runs out.

Bill’s Commentary:

“2,000 plants? How about the COVID vaccine, what “inspection” was done with these?”

Nearly 2,000 drug plants are overdue for FDA checks after COVID delays, AP finds

WASHINGTON (AP) — Federal regulators responsible for the safety of the U.S. drug supply are still struggling to get back to where they were in 2019, before the COVID-19 pandemic upended factory inspections in the U.S. and across the world, The Associated Press has found.

An AP analysis of Food and Drug Administration data shows that agency staffers have not returned to roughly 2,000 pharmaceutical manufacturing firms to conduct surveillance inspections since before the pandemic, raising the risks of contamination and other issues in drugs used by millions of Americans.

Bill’s Commentary:

“Or, you could JUST SAY NO!”

World Economic Forum Finally Tells the Truth About Covid: It Was a ‘Test’ of Our Obedience to Rapidly Forming New World Order

They wanted to know how many people would comply with a complete re-ordering of their lives based on no science at all, just random orders, some of which bordered on absurdity.

I have long said that Covid 19 was launched by design by a small number of people in the globalist predator class for one reason and one reason only — as a beta test for the coming technocratic new world order.

Now, we’ve got the World Economic Forum coming out and all but admitting that was exactly why the Covid-19 “pandemic” had to happen.

Bill’s Commentary:

“Why would they understate margin debt? Because it is very dangerous and us peons don’t need to know!”

A Wall Street Regulator Is Understating Margin Debt by More than $4 Trillion – Because It’s Not Counting Giant Banks Making Loans to Hedge Funds

Most market watchers rely on the monthly margin debt figures published by Wall Street’s self-regulator, FINRA, as the reliable gauge in determining how much of securities trading on Wall Street is being done with borrowed money, known as margin debt.

According to the FINRA data, as of March 31, 2024, margin debt stood at $784.136 billion.

Bill’s Commentary:

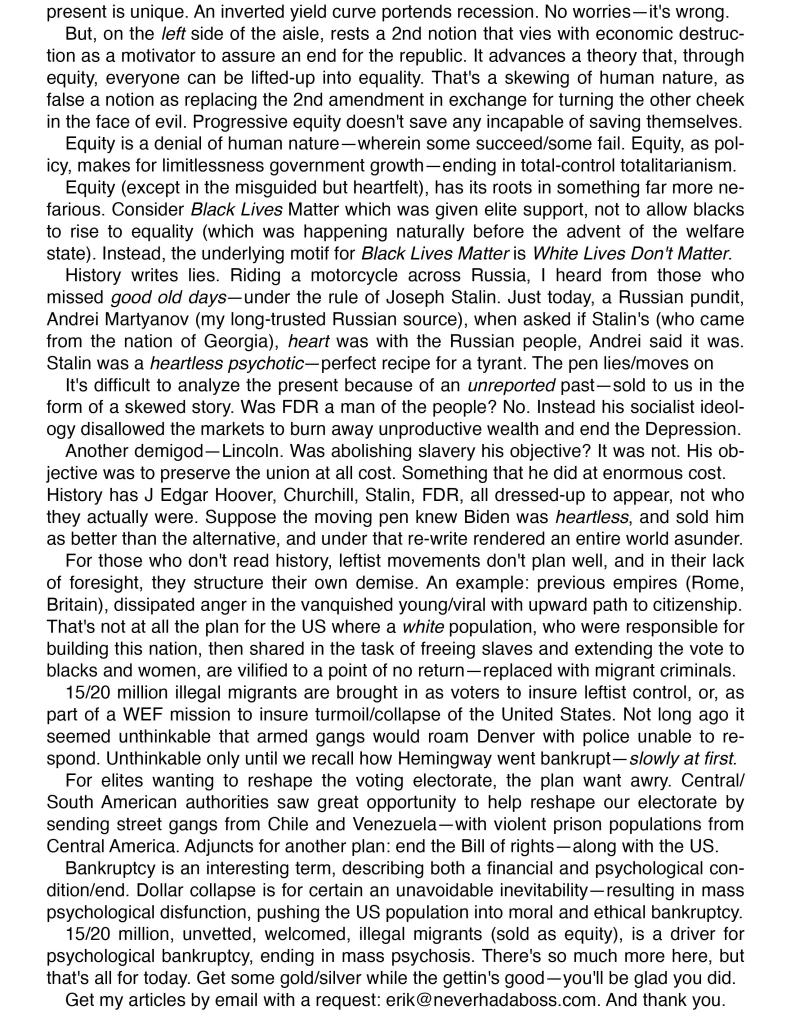

“Why do you think they call it “history”? Because it is HIS STORY!”

The latest from Erik –

The latest from USA Watchdog –

Bill’s Commentary:

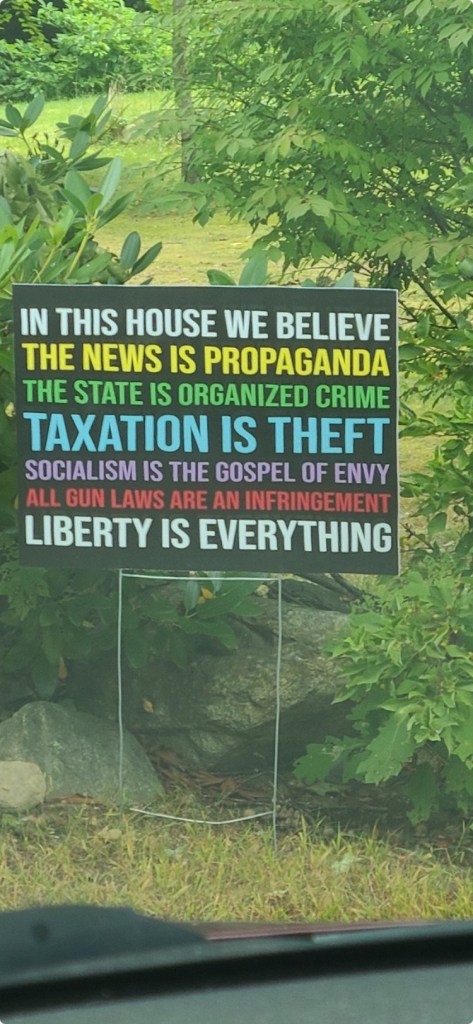

“Yeah, pretty much over the targets!”

Bill’s Commentary:

“Very soon, these people will become irrelevant…”

Fed Must Decide If Quarter-Point Cut Will Be Enough for Workers

(Bloomberg) — The Federal Reserve is set to begin unwinding its tightening campaign this month as inflation cools and the labor market slows. The big question policymakers now face is whether a small interest-rate cut will be enough to keep the economy in expansion mode.

The monthly jobs report Friday showed the pace of hiring in the US moderated over the last three months to the slowest since the onset of the pandemic in 2020. Even so, the numbers left investors skeptical as to whether Fed officials would opt for an outsize rate cut at their Sept. 17-18 meeting.

The release sets the table for a heated debate between those like Fed Chair Jerome Powell, who is open to a larger cut to ensure the central bank doesn’t fall behind the curve, and other officials who “are still waffling on a quarter point,” according to Diane Swonk, chief economist at KPMG.

Thank you pamelamoves@gmail.com

LikeLike