Bill’s Commentary:

”A good history and explanation of silver price manipulation.”

Suppressing silver prices has been official U.S. policy since 1965

In the July 18 edition of Gold Newsletter, editor and publisher Brien Lundin wrote about the failure of silver prices to keep up with gold prices. “I’m not the kind of conspiracy buff that many of my friends in the industry are,” Lundin wrote, “but it’s hard to look at silver and not see some hidden hands at work (especially considering who holds so much of the metal in both physical and paper forms while acting as custodian for the biggest silver exchange-traded fund).”

Of course Lundin meant investment bank JPMorganChase and silver ETF SLV.

Bill’s Commentary:

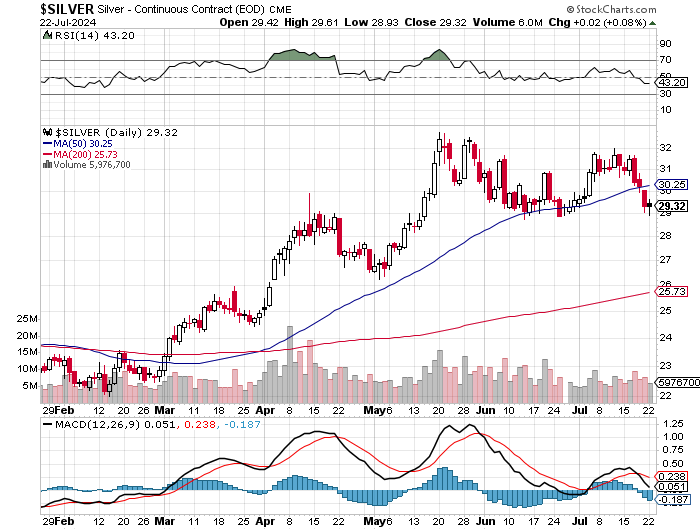

”Update on Silver;

We posted this chart a little over 3 weeks ago. Silver did break higher but was contained at $32. Was it real selling or paper? I believe it was vastly paper but for now it does not matter, price is price. It will certainly matter when failure to deliver finally arrives. So here we are, right back at $29 support. This should hold, if not there is strong support at $25.50-26. If it does hold, it will require a week or two to stabilize but $32.50 should fall. This is all short term technical stuff, the reality is fundamental, not technical. The Western world has gone hyperbolic in its issuance of debt, $2-3 trillion per year just from the US alone, then add the other sovereign treasuries. Silver supply/demand has been in deficit for 3+ years and continues today. Between the supply deficit, Western central banks shortly being forced to ease due to financial stress and the fact that they have reached “debt saturation” levels, once this pullback is done, silver looks to me like we will see a spectacular 2nd half of the year after performing as the best asset in the 1st half. Hold tight and do not be shaken out. The biggest outlying gains always come in compressed timeframes! A great change in “global currency” is about to occur, you must be in place while it happens. You will either be IN, or you will be OUT, likely for the remainder of your financial life!”

Thank you pamelamoves@gmail.com

LikeLike