Bill is interviewed at Coffee and a Mike (also posted under Interviews)

Bill’s Commentary:

“So not only is The Fed sitting on huge unrealized losses, they also have a cash operating loss since 2022? And this is the entity that issues the world’s reserve currency? At least now you know why the world has formed a competitive bloc called the “BRICS”!”

The Fed Posts Historic Operating Losses As It Pays Out 5.40 Percent Interest to Banks

According to Federal Reserve data, for the first time in its history, the Fed has been losing money on a consistent monthly basis since September 28, 2022. As of the last reporting date of June 19, 2024, those losses add up to a cumulative $176 billion. As the chart above using Fed data shows, the losses thus far in 2024 have ranged from a monthly high of $11.076 billion in February to a low of $5.674 billion in May.

These losses are separate and distinct from the unrealized losses the Fed is experiencing on the debt securities it holds on its balance sheet. It does not mark those losses to market since it intends to hold the securities to maturity and their principal is guaranteed at maturity by the U.S. government.

Bill’s Commentary:

“Price always follows volume! Are you paying attention?”

US Pending Home Sales Unexpectedly Plunged In May To A New Record Low

After crashing in April, analysts expected a small rebound in pending home sales in May, but they didn’t.

That dragged the YoY change down 6.6% to a new record low…

“The market is at an interesting point with rising inventory and lower demand,” NAR Chief Economist Lawrence Yun said in a statement.

“Supply and demand movements suggest easing home price appreciation in upcoming months. Inevitably, more inventory in a job-creating economy will lead to greater home buying, especially when mortgage rates descend.”

Bill’s Commentary:

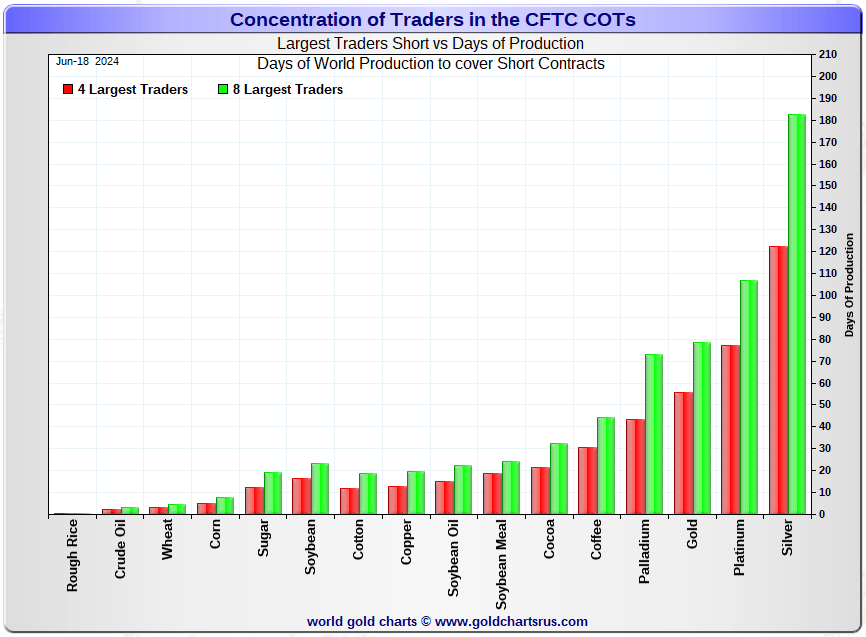

“Based on this chart, which asset will have THE greatest short squeeze rallies when the financial system goes south? To put this in easy terms to understand, based on current volume levels, the shorts would need to purchase (cover) an amount equal to 6 months worth of normal daily volume. This of course does not include “normal buying” which will be anything but normal …have you ever seen sharks in bloodied water before?! I promise you, the “cover” and resulting explosion will be unlike anything you have ever seen in any asset class in ALL OF HISTORY!”

Bill’s Commentary:

“Well, at least they have now given a timeline of 3 years. Do you really believe there will be no frontrunning?”

Brics Announces Plans to Completely Abandon the US Dollar

The Brics is a group of countries interested in the prevalence of international justice, while the West seeks in all ways to stop the multilateralization of the international community to prolong its hegemony.

The new development bank of the economic alliance Brics announced on Wednesday its plans to abandon completely the US dollar in the next 3 years.

Thank you pamelamoves@gmail.com

LikeLike