Bill’s Commentary:

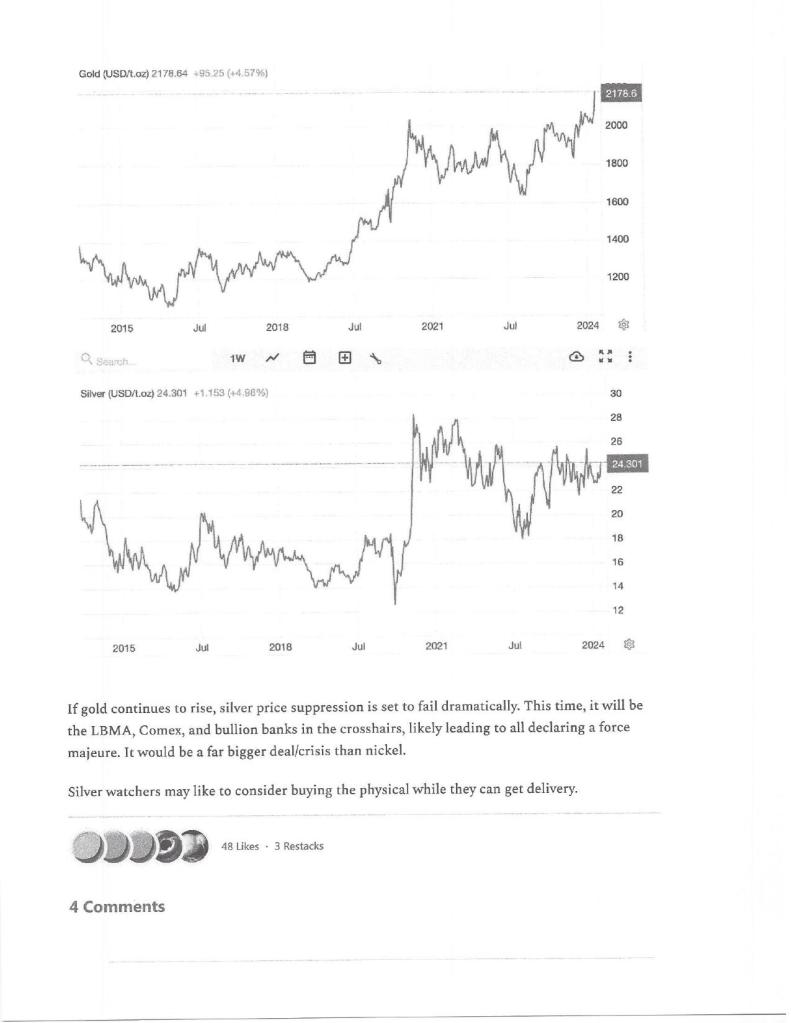

“From Alasdair Macleod. The answer to the title is ‘Yes, and on anabolic steroids’. The crackup two years ago in the Nickel market will pale in comparison to the upcoming silver fiasco!”

Bill’s Commentary:

“Don’t worry, the CRASH will be “transitory”!”

“According to data released by the Federal Home Loan Banks for the quarter ending December 31, 2023, it is not just small or medium size banks that are tapping advances from the FHLBs. As of that date, the top three borrowers were the following: JPMorgan Chase, the largest bank in the U.S., had outstanding FHLB advances of $41.7 billion. Wells Fargo and PNC Bank each took second place with advances of $38 billion each.”

During Spring Bank Panic of 2023, Liquidity Advances From FHLBs Topped Those of Q4 2008, When Wall Street was in Collapse

According to data from the Federal Deposit Insurance Corporation, and using a graph from the St. Louis Fed above, the liquidity crisis among banks in the spring of last year was far more dramatic than has been acknowledged by banking regulators.

According to the data, during the worst financial crisis since the Great Depression (at the end of the fourth quarter of 2008 when Wall Street was in a state of collapse), banks had borrowed a total of $790 billion in advances from Federal Home Loan Banks (FHLBs). But during the bank panic in the spring of last year, those FHLB advances topped the Q4 2008 number, registering $804 billion as of March 31, 2023.

Thank you pamelamoves@gmail.com

LikeLike

Let’s hope Bill as I just acquired another 150 1oz silver Britanias last week to top my silver stack, with the hope and analysis that silver will go silly in the next few months!

Sent from Outlook for Androidhttps://aka.ms/AAb9ysg ________________________________

LikeLike

Gold made a second attempt yesterday to break through $2,200. I can’t see the third and final attempt being that far away

LikeLike