Bill’s commentary:

“Who cares as long as the stock market is up …right?”

Total outstanding loans in the Federal Reserve’s bank bailout program jumped by just over $5 billion in November.

There was a sudden spike in banks tapping into the bailout program during the first week of the month with financial institutions borrowing $3.87 billion from the Bank Term Funding Program (BTFP). There was another surge in borrowing between Nov. 15 and Nov. 22, according to Fed data.

As of Nov. 22, there was $114.1 billion in outstanding loans in the BTFP bank bailout program.

Bill’s commentary:

“Two from Erik on the weekend!”

Bill’s commentary:

“If this is true, and I believe it is pretty close, what does it men for the loser of hegemon and thus it’s currency?”

The Eviction Notice is being written. And it will come in four languages. Russian. Farsi. Mandarin. And last but not least, English.

A much-cherished pleasure of professional writing is to always be enriched by informed readers. This “eviction” insight – worth a thousand geopolitical treatises – was offered by one of my sharpest readers commenting on a column.

Concisely, what we have here expresses a deeply felt consensus across the spectrum not only in West Asia but also in most latitudes across the Global South/Global Majority.

Bill’s commentary:

“This is very interesting! Maybe we will get a glimpse or preview to events for when the Fed is finally abolished? Though, abolishing the Fed will be 1,000 times more chaotic …”

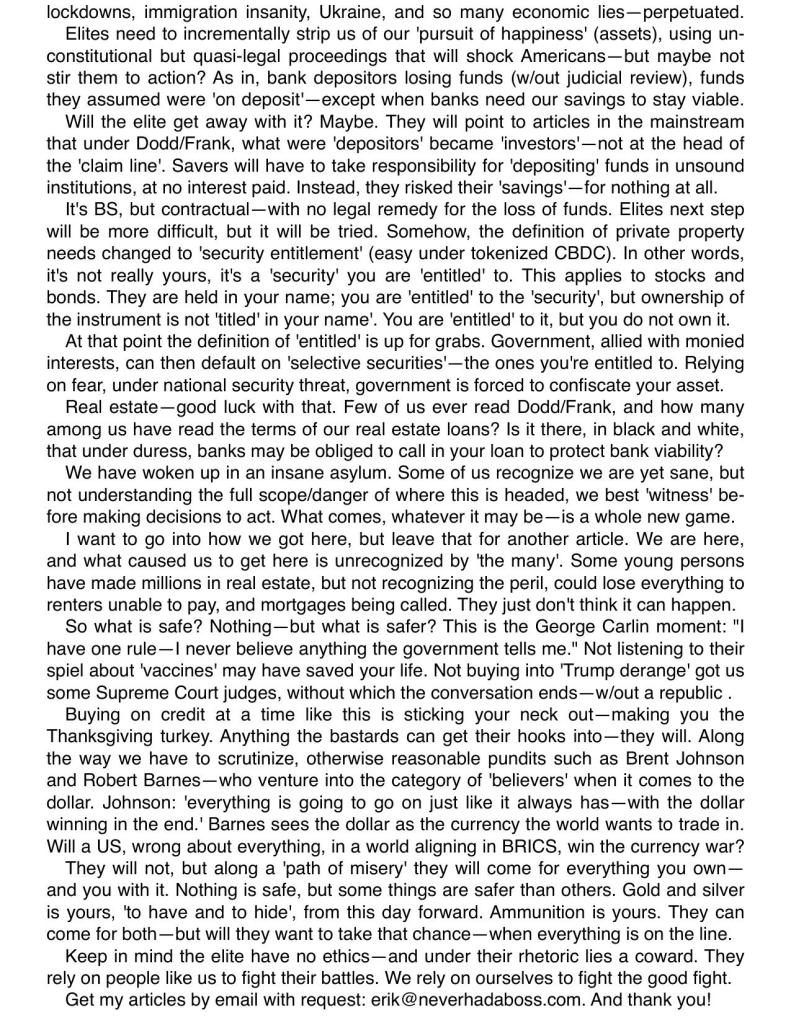

President-elect Milei to close the Argentine central bank. “It’s not negotiable.” See the official release and translation below.

PRESS RELEASE

Buenos Aires City, November 24, 2023 –

“…On the other hand, in the face of false rumors spread, we wish to clarify that the closure of the Central Bank of the Argentine Republic (BCRA) is not a negotiable issue.”

We don’t negotiate with terrorists!!!

Give them nothing!

Bill’s commentary:

“This is very sad, but also very true!”

#1 Banks by Statute are not required to hold any of your money in the bank. This is what is called the recently passed 0% reserve requirement.

Yes, the reserve requirement in the United States has been reduced to zero percent. The Federal Reserve announced on March 15, 2020, that reserve requirement ratios would be set to 0%, effective March 26, 2020, eliminating reserve requirements for all depository institutions[1][2][3]. This action was taken in response to the COVID-19 pandemic to jump-start the economy by allowing banks to use additional liquidity to lend[2]. As a result, depository institutions are no longer required to maintain deposits in a Reserve Bank account to satisfy reserve requirements[4]. This change has been in effect since March 26, 2020, and there are currently no plans to reinstate the reserve requirement[4].

Citations:

[1] https://www.federalreserve.gov/monetarypolicy/reservereq.htm

[2] https://www.investopedia.com/terms/r/requiredreserves.asp

[4] https://www.eidebailly.com/insights/articles/2020/4/federal-reserve-eliminates-reserve-requirements

[5] https://cointelegraph.com/news/why-isn-t-the-federal-reserve-requiring-banks-to-hold-depositors-cash

The reserve requirement for banks, also known as the reserve ratio, is the minimum amount of funds that banks must hold in reserves. Before March 2020, the U.S. central bank, the Federal Reserve, required banks to have a percentage of funds tied up in reserves. The percentage was 3% or 10% of money held in transaction accounts, such as checking accounts, and the percentage depended on a bank’s size. However, in March 2020, the Fed lowered the reserve requirement ratio to 0%, meaning there is no longer a reserve requirement for banks.

This change was made to stimulate the economy, and the 0% reserve ratio has remained in place since late March 2020

Remember, By Law Banks are held to the High Bar of Having a 0% reserve requirement meaning that if you put 1,000.00 in the bank you just made a $1000 unsecured loan to the bank.

#2 – 2023 Bank Failure Watch here in USA

As of today there have been 5 bank failures in 2023 that have been put into FDIC receivership.

These failures include :

1. First Republic Bank, San Francisco, CA

2. Silicon Valley Bank, Santa Clara, CA

3. Heartland Tri-State Bank, Elkhart, KS

4. Citizens Bank, Sac City, IA

5. Signature Bank, New York, NY

The total assets of these failed banks in 2023 amount to billions of dollars

The FDIC has taken various measures to protect depositors, such as entering into purchase and assumption agreements with other banks to assume the deposits and assets of the failed banks.

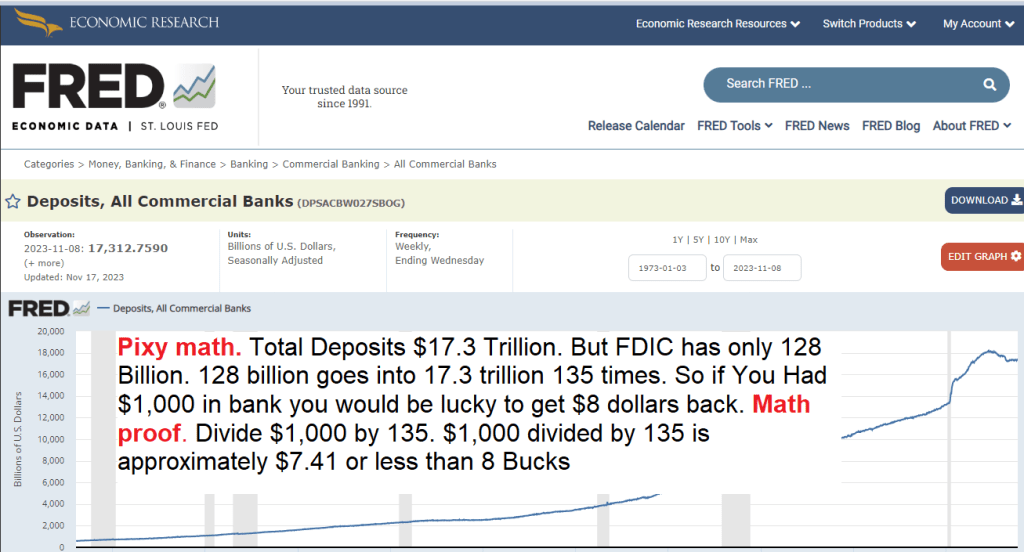

But look at the table below where you can plainly see The FDIC has less than 1% of deposits in their fund.

#3 When you make a Deposit in the Bank it is no longer your money but you are making an unsecured loan to the bank

Exploring Banking Realities: Rethinking the Notion of Deposits as Unsecured Loans

In the realm of banking, the commonly held belief portrays these financial institutions as deposit-taking entities, entrusted with safeguarding funds and facilitating loans. However You are not making a Deposit. By Law you are handing the bank an unsecured loan and they have no legal responsibility to keep any of your money in reserves. ZERO

In the extensive 5,000-year history of banking, studies have been conducted to substantiate the prevailing perception that banks function as deposit-taking institutions while also engaging in lending activities. However, a closer examination of the legal framework reveals a striking contrast to this common belief. The legal reality challenges the notion that banks take deposits and lend money, asserting that they do neither.

The term “deposit,” traditionally associated with a secure placement of funds within a bank, is debunked by legal intricacies. Contrary to the conventional understanding, a deposit is not a bailment and is not held in custody at law.

Legal authorities, including courts and various judgments, unequivocally declare that when individuals provide money to a bank under the label of a deposit, it essentially constitutes a loan to the bank. This legal perspective renders the term “deposit” devoid of substantive meaning.

Deposit Clarification: The term “deposit” is deemed meaningless in legal terms. Courts and judgments emphasize that money given to a bank is essentially a loan.

Deposit as Record of Debt: What is commonly called a “deposit” is revealed to be the bank’s record of debt to the public, challenging traditional understanding.

explained by Professor Richard Werner who is blacklisted by The Parasitic Class

#4 Smoke and Mirrors. Banks are Insolvent. FDIC Receivership is a SCAM. Here’s Why?

Look at the graphic below.

- It shows total deposits in typical US commercial banks at $17.34 Trillion.

- Yet there is only $128 Billion in the FDIC Fund.

- This means US government and banking deposits are insolvent because funds in FDIC cover .74% of our collective deposits. That’s far less than 1%

- Given the simple math (ratio), this means if you have $1,000 in the bank, all of it is wiped out, but you may be able to recover $7.41 out of your $1,000

- Math formula below

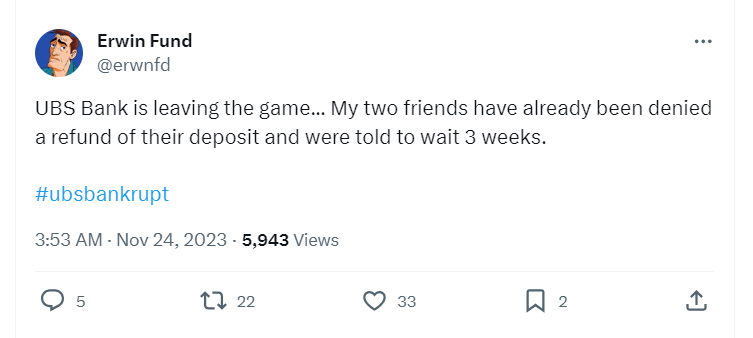

#5 – Japan, Euro and USA Banks on Brink of Collapse

- UBS circling the drain

- HSBS insolvent

- Credit Suisse on the Brink of Collapse

- Dominoes falling in Japan, Europe, USA

Today on Reuters

Bill’s commentary:

“Our pal Pastor Stanley has written a short book that you can give to those who do not understand that ‘fiat’ is ultimately worthless. This could be a very inexpensive Christmas gift to those you love but think you are nuts? I believe it is basic enough that even the most moronic will understand. I hope his book gains traction!”

Bill:

Please find below the ‘Book Overview’, the cover and the Amazon link of the book for posting on your site. This is very kind of you to consider sharing with with your readers. It’s a short read of about ten minutes and $2.99 on Amazon my hope is that it will wake up those who are sleeping before it’s too late (bad rumblings with UBS yesterday/this morning). Also, people can send this as a gift to as many people as they like by clicking the ‘Buy for Others’ button on the product page.

Thanks and God bless,

Stan S

Book Overview

The Cautionary Tale of the Golden Bones by Stanley Szymanski is a modern fable which was written to warn savers and investors of the dangers of fiat (‘by decree’) currency and to laud the freedom and relative security of real money.

The Cautionary Tale of the Golden Bones uses the fanciful universe of Doglandia to spin a folksy narrative of a financial situation right out of current world geopolitics but explains it in the adversarial relationships between dogs and cats.

Plentifully purposed profitable puns litter the landscape of The Cautionary Tale of the Golden Bones to impress the real meaning of what is being said to the reader.

This short, inexpensive and profound parable is perfect for gaining understanding of real money and for sharing with those you care about so that they don’t become victims of having all their bones in fiat! (This is not financial advice.)

Thank you pamelamoves@gmail.com

LikeLike