Bill’s commentary:

“‘Discovered’? You mean someone actually looked? Imagine what they would find in the US?”

“Amidst market turmoil, we’ve discovered massive illegal naked short-selling by global investment banks and circumstances of additional illegal activities,” Financial Services Commission Chairman Kim Joo-hyun told a briefing. “It’s a grave situation where illegal short-selling undermines fair price formation and hurts market confidence.”

Bill’s commentary:

“Must be some of real substance to have a ‘news blackout’?”

There are extremely strange things happening in a very high-profile federal court case in Manhattan where the largest bank in the United States, JPMorgan Chase, stands accused by victims of facilitating Jeffrey Epstein’s sex-trafficking ring that sexually abused minors as the bank doled out $40,000 to $80,000 a month in hard cash for more than a decade without filing the legally required Suspicious Activity Reports.

Bill’s commentary:

“It’s what they do …and why you have them!”

Bill’s commentary:

“It is only a matter of time …”

By Joe Sullivan, a senior advisor at the Lindsey Group and a former special advisor and staff economist at the White House Council of Economic Advisers during the Trump administration.

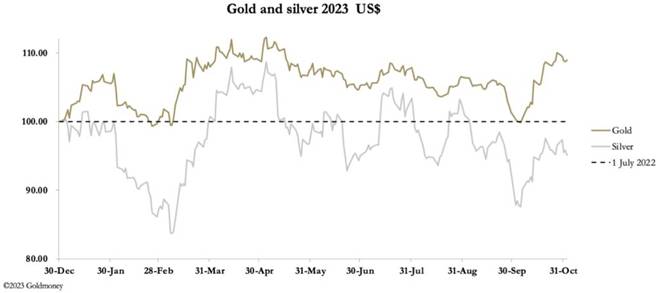

The wake of the BRICS summit splashes into a world much riper for de-dollarization now than it was even six months ago. BRICS, now BRICS+ due to the admission of new members, deserves only partial credit. In the last six months, tectonic shifts in China’s economy and in Washington have cleared the path for de-dollarization—an open route that BRICS+ can now step into.

Bill’s commentary:

“Some more ugliness from our pal Dismal Dave.”

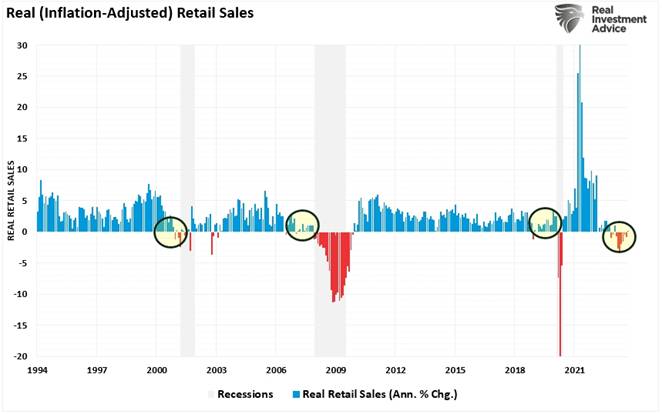

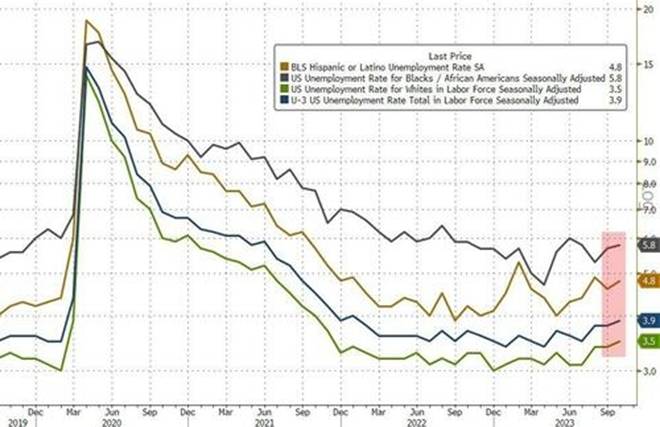

“How does a recession happen?” “Slowly, and then all at once.”

“Bill, who could have seen this coming? I only said every Saturday it was going to go bust.

The firm signed office leases for 10 to 20 years, freshened up the space and generated buzz with perks such as free beer on tap to attract younger workers. As of June, WeWork was paying over $2.7 billion a year in rent and interest—more than 80% of its entire revenue, according to company filings. Its total losses since founding topped $16 billion as of June, as it churned through all the money it raised from top investors and lenders over the past decade.

So what does this say about how stupid these top investors are, very stupid?

Wall street is a ponzi!”

– Dave

Bill’s commentary:

“David, you have been spot on since we met in 1999, you will soon get paid very handsomely for being the quintessential ‘My cousin Vinny’. People who have never listened to you do not know what they missed!”

WeWork rode the wave of the venture-capital frenzy, building a global real-estate empire worth more than any other U.S. startup before buckling and laying off thousands when funding ran dry under its turbulent co-founder and former chief executive Adam Neumann.

Ultimately, though, it was a historic office market bust that doomed the desk-rental giant.