Bill’s commentary:

“Charts from our pal down under.”

‘Most successful investors, in fact, do nothing most of the time.’ Jim Rogers. (read much, Jim?)

Bill’s commentary:

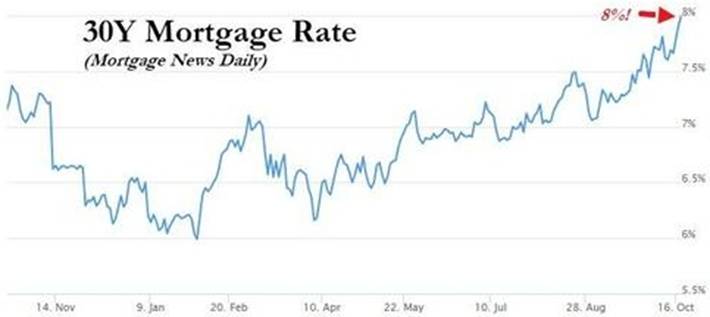

“The commercial real estate market has already crashed and the housing market has frozen solid. Your 401k/brokerage statements don’t show this …yet, just wait a short time!”

Soaring interest rates and a slide in bank lending following March’s regional banking meltdown have pressured the commercial real estate sector, especially office towers nationwide. But the stress might be spreading as a new report warns one of San Francisco’s largest apartment buildings has sustained a near 50% collapse in valuation in just five years, with risks of imminent default.

Bill’s commentary:

“And you thought banking problems were over? Naw, just temporarily swept under the rug…”

As the chart above indicates, Friday was not a good day to own regional bank stocks. The percentage declines are just for the one day of trading on Friday — not the year-to-date percentage losses. After the bank runs this past spring at regional banks brought on the second, third and fourth largest bank failures in U.S. history, things had quieted down in recent months. Then, along came earnings announcements last week, showing renewed struggles among the regional banks.