Bill’s commentary:

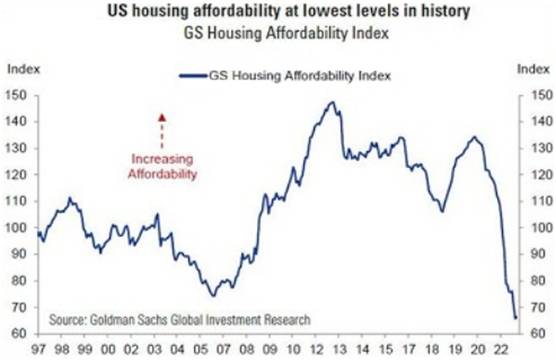

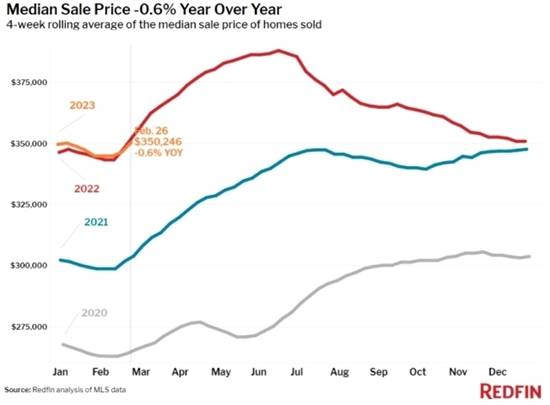

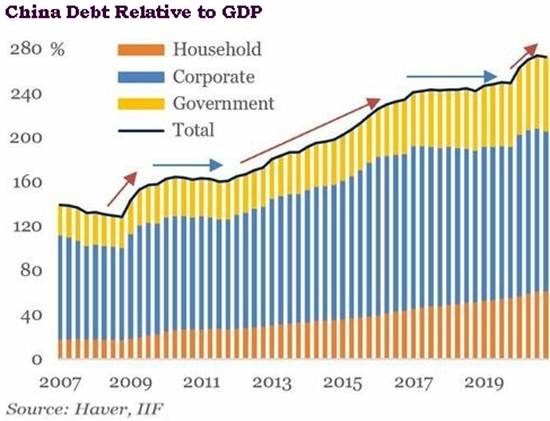

“Some truly ugly charts fro our pal down under, Dismal Dave.”

‘If you don’t read the newspaper you are uninformed, if you do read the newspaper, you are misinformed.’ Mark Twain. (1835-1910).

Bill’s commentary:

“Pastor Stanely with more for us. I would simply ask why there is ANY need for FDIC since the Treasury now says they back EVERYTHING???”

Last night, just after the futures markets opened, the Treasury, the Federal Reserve and the FDIC issued a ‘joint press release’ to inform the world of their method of salvation for the banking system:

…’the Federal Reserve Board on Sunday announced it will make available additional funding to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors.’…

Bill’s commentary:

“Is this true? If so, I guess the question is, how do you catch a hypersonic missile …if you are not yet hypersonic?”

In the last several days, multiple sources have published information regarding the Kiev regime’s usage of a number of NATO weapons and munitions, including the JDAM (Joint Direct Attack Munition) bombs. JDAMs are standard unguided freefall/gravity bombs (so-called “dumb bombs”) equipped with a guidance kit that converts them into all-weather PGMs (precision-guided munitions). Guided by an integrated inertial guidance system combined with a GPS receiver, JDAMs have a declared range of up to 30 km, although this has been extended with newer versions, such as the JDAM-ER (up to 70 km). Precisely this type was given to the Neo-Nazi junta in recent weeks, according to the US Air Force Europe (USAFE) command.

Bill’s commentary:

“I have never had a high opinion of Cramer, and he does not disappoint with his “solution”. If I read this correctly, he is suggesting the solution to bank runs is to prevent money, ALL money from moving? Would it really be YOUR money, if you could not “move it” and thus use it? Am I missing something?”

CNBC’s Jim Cramer treaded lightly before the Wall Street opening bell with his commentary on what might be in store for the market Monday after the collapse of Silicon Valley Bank in California and Signature Bank in New York.

Cramer, who has come under scrutiny for hyping SVB before it failed, was on Squawk on the Street to talk about the bank run that caused its collapse. Financial observers have been concerned that the bank’s failure could spark runs on other smaller regional banks, which could send the economy into a freefall.

After suggesting that Silicon Valley Bank’s examiners should be called into question, Cramer said that “what I’m concerned about is that when you see where all these banks are trading, you may need to have more assurance than we’re getting right now.

Bill’s commentary:

“I’m not sure, but if she said “I apologize for acting like a tyrant” might have better?”

Michigan Gov. Gretchen Whitmer (D) admitted on Sunday that her administration’s pandemic-era lockdown policies went too far, such as her April 2020 executive order barring most stores from selling gardening supplies, including seeds and plants, to Americans who anted to grow their own fruits and vegetables.

Bill’s commentary:

“Dave sends us the scoop by Wall St. on Parade”

If you want to genuinely understand why Silicon Valley Bank (SVB) failed and why Jerome Powell’s Fed led the effort yesterday to make sure $150 billion of the bank’s uninsured depositors’ money would be treated as FDIC insured and available today, you need to take a look at how the bank defined itself right up until it blew up on Friday. (That history is still available at the Internet Archives’ Wayback Machine at this link. Give the page time to load.)

This was a financial institution deployed to facilitate the goals of powerful venture capital and private equity operators, by financing tech and pharmaceutical startups until they could raise millions or billions of dollars in a Wall Street Initial Public Offering (IPO). The bank was also involved in managing the wealth of those startup millionaires or billionaires once they struck it big in an IPO.